Australia, Canada, and Colombia are pumping the breaks on plans to launch central bank digital currencies (CBDCs). But the opposition isn’t just coming from citizens on the ground. Rather, this time, it is the central banks that are voicing concerns. Other central banks should take notice and follow suit.

“There is no clear public interest case to issue retail CBDC in Australia yet,” said the Reserve Bank of Australia in a recent report. Similarly, the Banco de la República de Colombia published a report that said, “[T]here are not sufficient reasons for the issuance of [a CBDC] (retail or wholesale) in Colombia.” For its part, the Bank of Canada said it is “scaling down its work on a retail central bank digital currency and shifting its focus to broader payments system research and policy development.”

The central banks described a few reasons for pumping the breaks. First, most officials seem to recognize that people are generally well-served by the existing options in the private sector. Sure, there are problems, but mobile banking, payment apps, cryptocurrency, and the like have offered people an ever-growing suite of options to choose from.

Second — speaking of the available options — the central banks also expressed concern that introducing a CBDC would undermine the traditional financial system. In short, the introduction of a CBDC could increase the chance of bank runs, reduce the number of deposits available to banks, and ultimately destabilize the financial system.

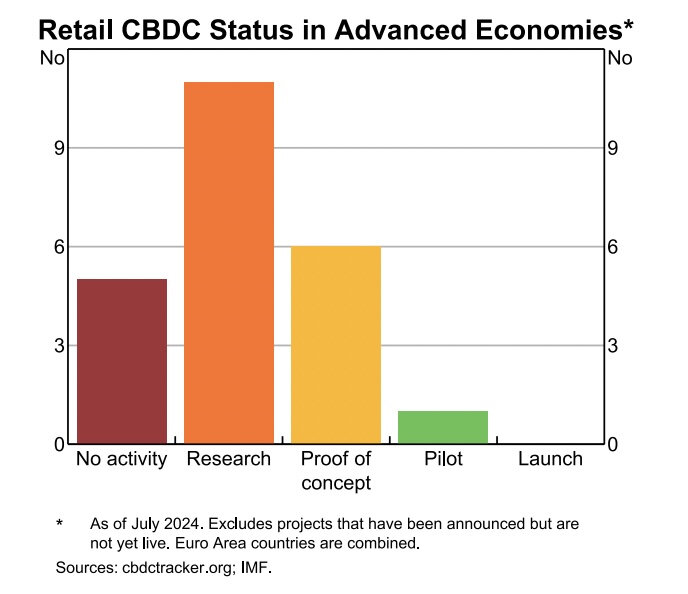

Retail CBDC status in advanced economies. Source: Reserve Bank of Australia

Third, and finally, the potential elimination of cash also came up. While many central banks have argued that CBDCs are needed because cash use is falling, the Reserve Bank of Australia warned that introducing a CBDC would ultimately spell doom for cash.

Regular readers of my work likely recognize some of these concerns — critics of CBDCs have been writing about the risks to financial privacy, freedom, and markets for years.

The Cato Institute’s Norbert Michel has long warned that “A CBDC would give federal officials full control over the money going into — and coming out of — every person’s account.” Elsewhere, Bitcoin Policy Institute’s Natalie Smolenski and Dan Held wrote, “[T]he rationales… for implementing CBDCs are already well covered by bitcoin and stablecoins.” And Circle’s Dante Disparte wrote, “With a CBDC, central banks would have a backdoor directly into your bank account, as well as the means to monitor every digital transaction made.”

When it comes to CBDCs, the costs far outweigh the benefits.

Yet despite the long-standing criticism, it is only relatively recent news that central banks are taking official stances against launching CBDCs. Yes, there have been individual objections at times. However, official stances have been exceedingly rare.

Just consider the activity documented in the Human Rights Foundation’s CBDC Tracker. Out of the 132 jurisdictions currently featured, very few have changed course. In fact, they’ve been explicitly told not to.

Around this time in 2023, International Monetary Fund managing director Kristalina Georgieva described the rise of CBDCs as a “voyage” that calls for “courage and determination” as policymakers “brave the open waters.” She cautioned that “this is not the time to turn back” and said, “If anything, we need to raise another sail to pick up speed.”

However, the news from Australia, Canada, and Colombia shows that not everyone is on board with CBDCs — or the International Monetary Fund’s plans for that matter.

The recent statements from these central banks are by no means the final word on the matter. History has shown crises can quickly lead to radical changes in the way governments operate, and nothing these central banks has said is binding. However, this news is a welcome change of pace. If nothing else, this news shows that maybe CBDCs are less inevitable than some people think.