Dear Capitolisters,

One of the summer’s most widely covered financial phenomena is the global “shipping crisis” and its harms to the U.S. and global economies. Less-covered, however, (if at all) are the long-term, systemic problems—and bad U.S. policy—that have almost certainly made the situation far worse than it could or should have been by exacerbating delays at almost every major U.S. port. Today we’re going to look at those policies, which not only provide needed perspective on the global shipping situation, but also offer some clues as to how we can prevent similar crises in the future.

So What’s the ‘Shipping Crisis’?

As detailed in numerous reports, American ports and rail terminals are struggling to cope with unprecedented surges of imports from Asia, a situation likely to continue into next year and contributing to both U.S. companies’ supply chain woes and broader inflationary pressures. Shipping containers are piling up by the thousands, leading to higher shipping costs (both ocean and inland freight) and U.S. exporters—mainly of agricultural products—lacking the empty containers they need to send their goods abroad. Importers are also reeling. The disruption is so bad that the head of the American Apparel Association recently urged consumers to do their Christmas shopping in the summer.

(Sorry, fellow procrastinators.)

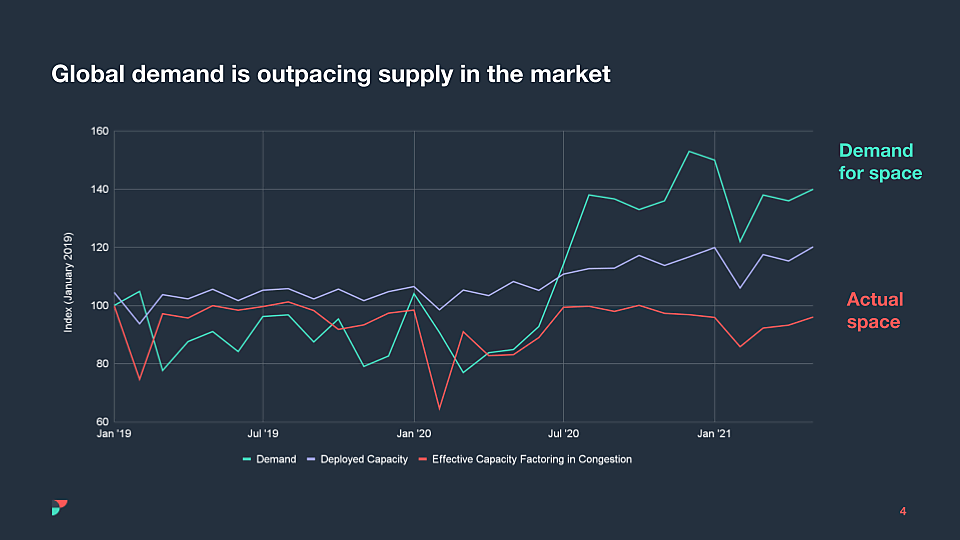

Surely, a lot of the problem here is just the global pandemic doing its thing. In the United States, for example, the summer saw a surge of Asian‐made consumer goods to meet an unexpected spike in U.S. demand but still‐muted demand abroad for certain U.S. products in countries with relatively few vaccinations. (Hence, a big imbalance in shipping container flows to/from the country.) Logistics firm Flexport adds that skyrocketing global shipping prices generally reflect not some big conspiracy by global shipping companies but a basic mismatch between peaking worldwide demand—economies reopening, consumers making up lost time, and companies restocking depleted inventories—and insufficient shipping capacity:

COVID-19 outbreaks closing down several major ports—especially in China a few weeks ago—have also contributed to the current situation. And until the virus is under control around the world and economies get back to “normal,” shipping imbalances, supply chain hiccups, and high prices will persist. Working out a lot of this mess will just take time.

But It’s Not Just the Pandemic—At Least Not Here

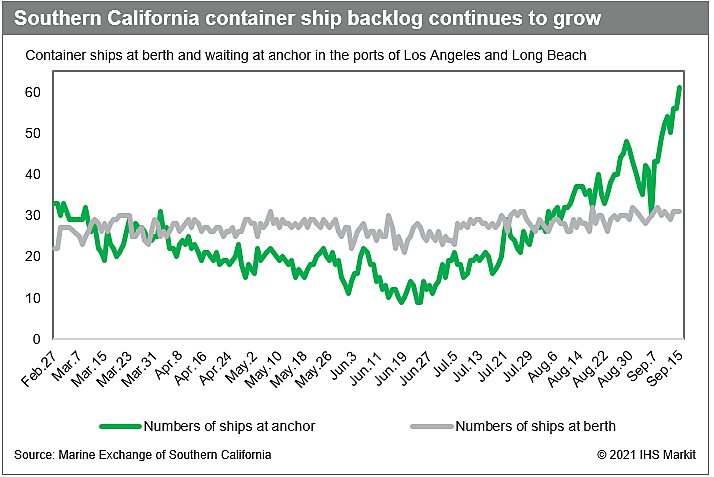

There is, however, another culprit that’s only partially caused by the pandemic — major U.S. port delays that have, per Flexport, exacerbated the global supply-demand imbalance: “Ocean carriers have deployed all available capacity, including ships that are not even designed to carry containers, but the effective capacity is 25 percent less than what’s actually deployed, because so many vessels are caught up in record bottlenecks at ports.” That was back in June, and it’s only gotten worse since then. Backups are particularly a problem at major U.S. ports in California (Los Angeles/Long Beach, Oakland), New York/New Jersey, Georgia (Savannah), and South Carolina (Charleston), each of which has recently seen record numbers of ships parked offshore waiting to unload their containers. Things have gotten so bad at the LA/LB port complex—the busiest one in the United States, handling 30 to40 percent of total export/import volumes each year—that “all of the contingency anchorages set up along the coast are filled, and many ships have been ordered to drift along the coast, something that has never happened before.”

According to Bloomberg, this backlog means thousands of full containers (the boxes “would stretch halfway across the country if lined up end to end”) just sitting offshore waiting days for a spot at the port: “The average wait was 8.7 days compared with 6.2 days in mid-August. … The ship waiting the longest arrived on Aug. 23.” Fewer containers in use means higher prices and more stress on the system. And backlogs at West Coast ports have also pushed shippers to use East Coast ports like Savannah, Virginia, and New York/New Jersey (via the Suez Canal), helping to create backlogs there too.

The LA/LB port, however, remains ground zero for the problem. In response, officials announced last week that they’ll add some night and weekend shifts in “the first step towards a 24/7 supply chain” there. Hopefully, these and other efforts will help speed things up a little, but it’s not like flipping a switch—truckers and others who’d be needed to make these additional shifts effective are already expressing skepticism for various reasons (more on that in a second).

COVID is certainly to blame for some of the ports’ problems: Popular Science notes, for example, that “every shift change for port workers requires new protocols, including the cleaning of crane compartments and equipment, daily health screenings for staff, and other inefficiencies caused by social distancing measures.” And there are undoubtedly still pandemic-related strains in the broader U.S. economy that, for example, limit the number of available truckers or other workers to haul cargo from ship to store, or the amount of free warehouse or railcar space.

The Long-Term Problems at U.S. Ports

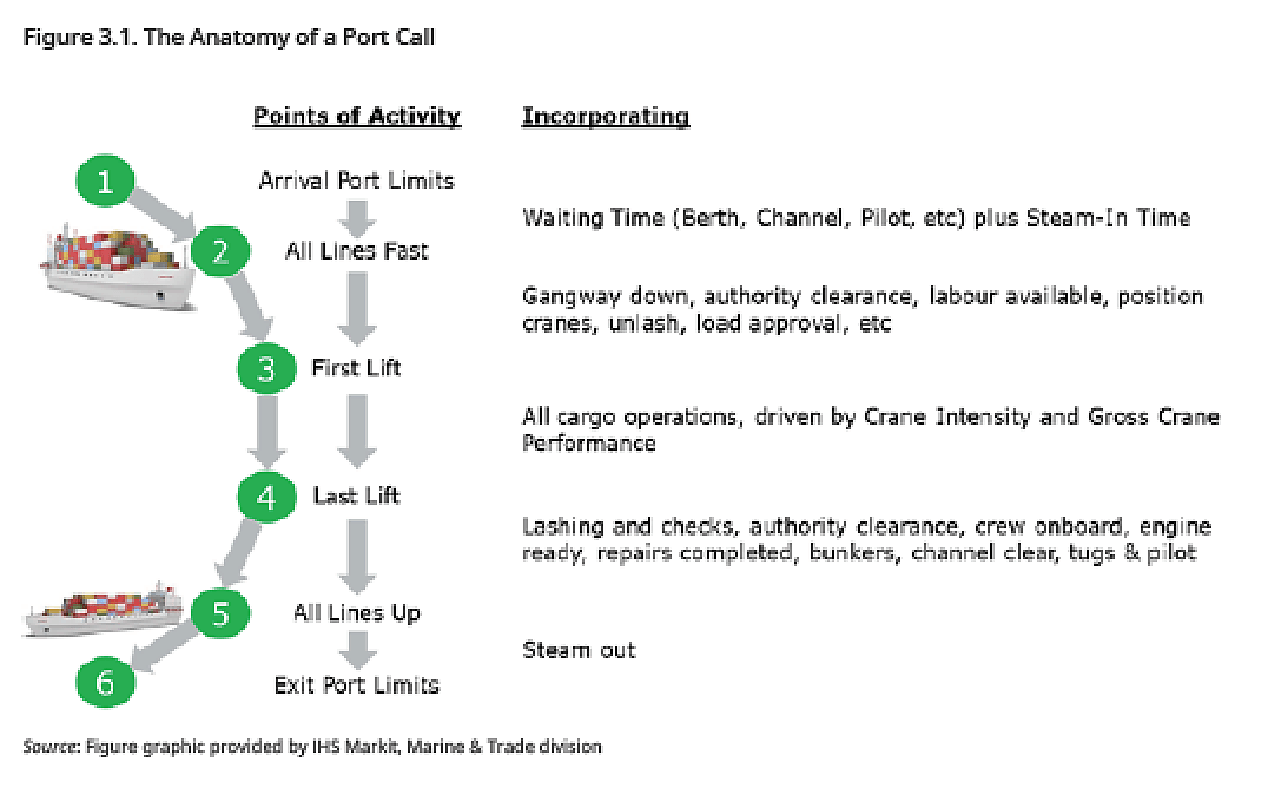

At the same time, however, many of the problems at U.S. ports today result from intentional decisions made years ago—decisions that have caused our port system to badly lag much of the world. According to the 2020 World Bank/IHS Markit “Container Port Performance Index,” for example, not one U.S. port ranked in the top 50 global ports in terms of getting a ship in and out of a port (see flowchart below), using either a “statistical approach” measuring efficiency and finances or an “administrative approach” reflecting expert knowledge and judgment. The highest ranked U.S. port (statistically) was Philadelphia at 83, with Virginia close behind at 85 and NY/NJ at 89. Oakland came in at 332, while LA/LB ranked a dismal 328 and 333, respectively. (Things are even a little worse using the “administrative approach.”)

Overall, these rankings are dominated by Asian ports (Japan’s Yokohama ranks first under both methodologies), but many Western ports also score better than anything in the U.S.: Algeciras in Spain (10th); Mexico’s Lazaro Cardenas (25th); Canada’s Halifax (39th); and Denmark’s Aarhus (44th).

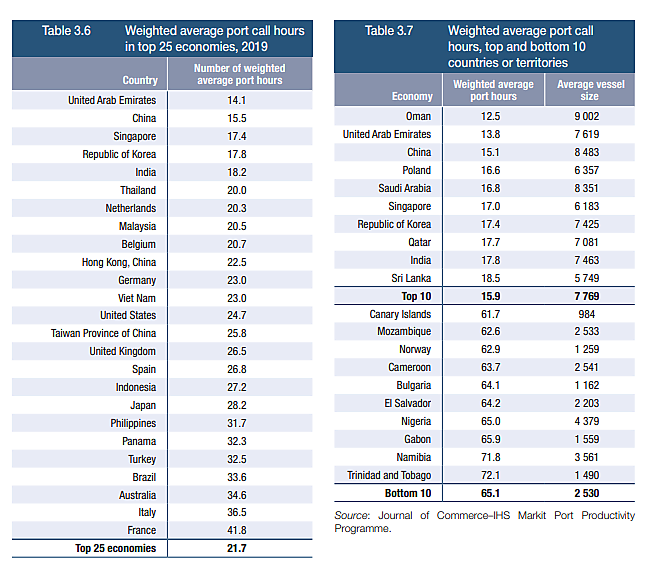

Less sophisticated measures of port efficiency reveal similar concerns. According to UNCTAD, for example, U.S. ports in 2019 ranked in the middle of the pack in terms of the time that container ships spend in port (weighted by ship size) and below the world average of 23.2 hours:

So why do the ports in one of the richest countries in the world — and a major driver of the global economy — rank below those of so many other nations, including ones with far fewer resources?

Start with the Unions

Perhaps most notable is the extreme influence that U.S. longshoreman unions—the International Longshore and Warehouse Union (ILWU) out West and the International Longshoremen’s Association (ILA) basically everywhere else—have on port operations. The ILWU’s impact is particularly strong because it controls essentially all longshore labor for all West Coast ports (thus giving the union extreme leverage—strikes or slowdowns affect every port on the West Coast). Thus, contentious labor negotiations not only lead to occasional, economy-crippling port stoppages (and other non-economic harms), but also longer-term labor contract provisions that intentionally decrease port productivity in several ways:

First, as the Journal of Commerce columnist Peter Tirschwell laid out (and as indicated by last week’s news about additional LA/LB port hours), U.S. ports are open for fewer hours per week than many other ports around the world: “[B]erths in Asia work ships 24/7, or 168 total hours per week. Ships are worked 16 hours per day or only 112 hours per week at LA-Long Beach, and terminal gates only operate 88 hours per week versus 24/7 operations in Asia.” Thus, U.S. ports create a “bottleneck” where “factories are working 24/7; the terminals in Asia are generally working 24/7” but North American ports aren’t. Much of this is dictated by union labor contracts, which expressly limit the number of hours that workers can work (total and per shift) and require overtime pay for unscheduled work, as well as any work on weekends and holidays. Compounding the issue is the fact that many ports’ Customs offices—required to clear and admit goods into the United States—are closed nights and weekends. (Customs at LA/Long Beach is open only Monday through Friday, 8 a.m. to 4:30 p.m.)

Second, the contracts dramatically increase labor costs at port terminals. For example, West Coast terminal operators could—as one union rep recently suggested in the Wall Street Journal—simply hire more unionized workers for an overnight third shift contemplated by the ILWU contract, but that same contract has made doing so outrageously expensive, if not cost-prohibitive:

The ILWU has parlayed its niche, handling ocean cargo worth trillions of dollars, to land lucrative labor contracts with the Pacific Maritime Assn., an employers’ group of shipping lines and terminal operators. Union dockworkers make an average of $171,000 a year plus free healthcare.

Clerks average $194,000, and foremen, or “walking bosses,” $282,000. Their paychecks dwarf those of many white-collar managers in the global economy, let alone other transportation workers, including members of the East Coast longshore union.

Union contracts can be equally painful on the East Coast too. NY/NJ port labor costs, for example, are the “highest in the nation, making consumer goods more expensive and the port less competitive.” ILA contract provisions not only push pay for top earners well in excess of $400,000 per year (the union’s president makes $680,000!), but also a “relief” system for “normal” workers that pays them for time they don’t actually work.

Unions also have actively fought efforts by other port operators, especially in the South, to supplement their unionized labor force with non-union workers—a “hybrid system” that “has underpinned robust container volume growth across the region.” For example, when the port of Charleston and state of South Carolina recently opened a massive new port terminal (the first U.S. container terminal to open since 2009, which is itself telling), the ILA allegedly organized a boycott to dissuade ships from using it because the port hired non-union state employees. (The ILA’s contract requires work at new terminals to be performed by ILA workers, but the new terminal was already under construction when the relevant contract provision was adopted.) After the Trump-era NLRB preliminarily ruled for the port, the ILA then sued the first ship to use the terminal—supposedly to delay a final NLRB ruling until the Biden administration has made it “theoretically more favorable to the ILA.”

Third, and perhaps worst of all, the unions have for years fought efforts to automate ports on both the West and East coasts—just as they fought containerized shipping and computers decades before that. In 2018, for example, the ILA negotiated an agreement for Gulf and East Coast ports (including “right to work” Georgia and South Carolina) that includes both “generous pay increases” for union longshoremen and “landmark protections against job-killing fully automated ports” (essentially prohibiting full automation at covered ports through 2024). As the JOC reported, the ban on fully automated terminals “quash[ed] shipper hopes that some of the East and Gulf coasts’ more expensive ports— among them the Port of New York and New Jersey— might harness automation and technology to cut costs and improve efficiency.” Back on the West Coast, the ILWU has long-resisted port automation efforts and is gearing up to make that a big focus of upcoming contract negotiations in 2022. “Those robots represent hundreds of (lost) jobs,” one ILWU official said. They’re even fighting automated ships too—in solidarity with their unionized brethren on the sea.

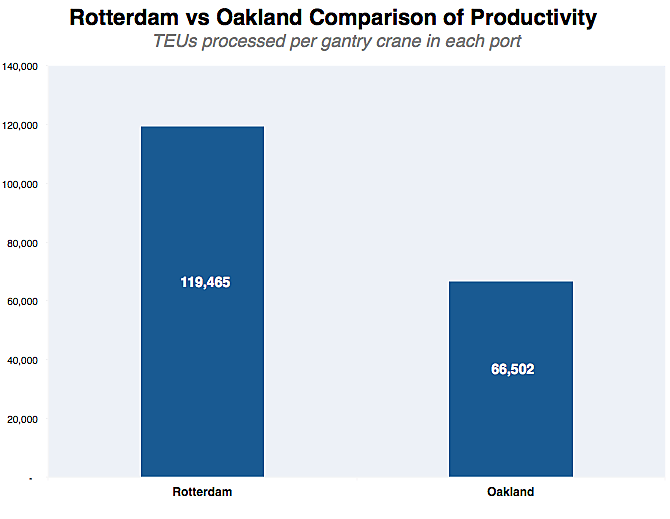

The widespread failure to fully automate major U.S. ports has inevitably hurt their efficiency. One analysis found, for example, that automated cranes in Rotterdam were almost twice productive than the stone-aged ones in Oakland (The industry metric for containers is the “twenty-foot equivalent unit” (TEU)):

That same analysis explained why this is (and why expensive labor compounds the problem):

[H]igh levels of automation make it easier to have multiple shifts per day and better utilize expensive capital assets (cranes, trucks, berths, etc). In Oakland, it’s extremely expensive to run a second shift to quickly unload a ship because it is necessary to pay employees overtime wages in order to do so. In Rotterdam, it’s much more the normal course of business to operate two or three shifts per 24 hour period, especially for container yard deliveries. All terminals in the Port of Oakland still run 1st, 2nd and 3rd shift operations as needed based on volume, it is just at much higher cost to both capital and human assets.

Human-operated and software-operated cranes, can, in theory, move containers at the same rate. However, humans get tired and distracted, and don’t consistently operate at peak performance. Software, on the other hand, operates at the same rate no matter what. Technology can also make workers’ jobs easier and safer, reducing workplace stress which can increase productivity in its own right.

The aforementioned COVID protocols at U.S. ports exacerbate these issues: more workers means more tests, more absences, and more potential delays. And the recent experience of one of the most automated (though still not fully) ports in the country—the Port of Virginia—shows just how much this all matters for the current shipping crisis. There, the semi-automated marine terminal is, unlike other major ports on both coasts, “free of backlogs” despite experiencing similar “record volumes.” As one port representative explained:

“With the automation, you can rework your yard to say, ‘Okay, while I was expecting to be loading Ship A first, I’m now loading Ship B first,′ and can keep import flow fluid.” In that way, the terminal doesn’t have to shift equipment within the yard to manage the ships, as “automation is able to do that for you, whereas in a conventional terminal, they’re managing ships against their yard.”

That, along with investments in data sharing and multiyear refinement of a trucking appointment system, has given Virginia the distinction of being the rare port to keep cargo flowing even though its year-over-year import growth over the past seven months has been second only to Los Angeles.

If every port had even this incomplete level of automation, things wouldn’t be perfect, but they’d undoubtedly be much, much better.

U.S. Maritime Law

Two aspects of U.S. maritime law make matters even worse. First, as a recent Congressional Research Service report explains, the good ol’ Jones Act, which requires U.S.-built, ‑crewed, and ‑flagged ships to move all freight between U.S. ports on supposed “national security” grounds, made those ships incredibly expensive and dramatically reduced the size of the U.S.-flagged fleet. Along with the aforementioned high port handling costs, this has essentially eliminated the coastwise shipping that the Jones Act regulates and, in turn, has worsened the current shipping situation by (1) putting additional pressure on inland transit (i.e., trucks and trains are used instead of ships that could travel between U.S. ports); and (2) causing companies to avoid the Jones Act by “port hopping” up and down U.S. coasts using larger, foreign-flagged ships that take longer to offload and are prohibited from picking up additional cargo while they’re in port.

Second, the combination of the Jones Act and the Foreign Dredge Act (which requires barges transporting dredged material to be Jones Act-compliant) dramatically raises the cost of dredging U.S. ports—dredging that they need to accept more, bigger, and fuller ships. Heritage’s Nick Loris elaborates:

The depth and width of the shipping channels determine what size and how many vessels can travel through a shipping channel. Even a seemingly small amount of additional depth to accommodate the weight of a larger vessel exponentially creates value. Just one inch of water depth results in the ability to import and export millions of dollars’ worth of more cargo. According to the National Oceanic and Atmospheric Administration, “With one more inch of depth in a port, a cargo ship could carry about 50 more tractors, 5,000 televisions, 30,000 laptops, or 770,000 bushels of wheat.”

The lack of depth in many shipping channels also forces bulk carriers to “light load,” or carry less than a full load, because they cannot travel with full loads at existing depths. Because light-loading is inefficient, it increases transportation costs per unit of good transported—and consequently raises prices for U.S. exporters. If a port cannot accommodate a larger, heavier ship, that cargo ship will divert to a deeper port first.

More truck and rail congestion and fewer, emptier ships is not a recipe for U.S. container shipping efficiency!

U.S. Trade Policy

Finally, as I explained over at the Cato blog a few weeks ago, U.S. trade policy is also likely contributing to the current shipping crunch because we just imposed extremely high (221 percent!) “trade remedy” (antidumping and countervailing duty) duties on imports of truck chassis, which are used to haul containerized merchandise around the country, originating in China—by far the largest producer of such products. (And this comes on top of the 25 percent tariffs that President Trump imposed on a wide range of Chinese imports in a separate “Section 301” case back in 2018.)

As I noted at the time, these duties are undoubtedly affecting the U.S. shipping market in two ways: (1) Chassis available to U.S. freighters have been exhausted at most of the biggest ports and rail terminals in the country, thus generating “extreme difficulties” in getting cargo delivered after a container ship arrives; and (2) there simply isn’t enough non‐China chassis capacity to meet current U.S. demand. Thus, the new U.S. duties are discouraging importers and freighters from bringing new capacity online (maintaining the chassis shortage and related shipping bottlenecks), and/or dramatically raising shipping costs, as freighters (importers, ocean carriers, truckers, etc.) suck it up and just buy Chinese chassis then pass on those costs to their customers. Indeed, in rebutting allegations that unions are to blame for the shipping crunch, ILWU officials cite the “shortage of chassis.” Others do the same.

(Spoiler: there’s plenty of blame to go around.)

Although these chassis duties are new, the issue is really a systemic, longstanding one: the decades-old laws authorizing them expressly prohibit the agencies from considering consumer and other economic harms when determining whether to apply duties. Many other national trade remedy systems have just this type of “public interest” test, which in this case could have allowed the agencies to reduce, delay, or decline to impose duties on chassis, thereby easing the shipping crunch a little. Because the United States doesn’t have such a provision, we get the blind enactment of prohibitive tariffs on badly needed chassis, while the economy reels from a massive shock to the global and U.S. shipping systems caused by a once‐in‐a‐generation pandemic.

Brilliant.

Summing It All Up

On the surface, the pandemic is the main cause of the “shipping crisis” and the related pain to the U.S. economy. And given the wild swings in global supply and demand—and players’ inability to snap their fingers and add new ships, warehouses, trains, or maybe even workers—these pressures will continue for the next several months, if not a little longer. But dig a little deeper, and we see that much of the current mess in the United States was decades in the making, reflecting systemic labor and trade policies that decrease the efficiency and flexibility that U.S. ports — and the economy reliant on them—enjoy in the best of times and desperately need in the worst. Sure, these same policies undoubtedly enrich a handful of U.S. workers and companies, but the shipping crisis has revealed some of their much bigger, usually-unseen harms—and the necessity of reform.

Broader lessons abound.