In addition to foreign investment absorption, Hong Kong plays a pioneering role in the internationalization of the renminbi (RMB). Despite the lack of comprehensive statistics on the volume of offshore RMB transactions, Hong Kong is for sure one of the largest, if not the largest, global centers for offshore RMB businesses. According to the Triennial Central Bank Survey (BIS 2019), for instance, Hong Kong was the largest global offshore RMB foreign exchange market, with an average daily turnover of US$107.6 billion as of April 2019, considerably higher than the US$56.7 billion for London and the US$42.6 billion for Singapore.

For the rest of the world, the OECD countries in particular, Hong Kong not only acts as a springboard for foreign firms’ investment and expansion into the Chinese markets, but also benefits foreign countries given Hong Kong’s special status under the “one country, two systems” principle of the Basic Law. For instance, the United States has persistently run a merchandise trade surplus with Hong Kong (US$11.7 billion in 2019), and American financial institutions earn lucrative profits through their investment banking activities and other financial services in Hong Kong.2

Even before the return of Hong Kong to Chinese sovereignty in 1997, all these stakeholders have had economic incentives to maintain and promote Hong Kong’s status as an international financial center. In recent years, however, this situation has become more difficult to sustain because of political and ideological divergence and conflicts partly arising from China’s promotion of national revival, more generally known as the “Chinese Dream,” since 2013.

China’s Drive to Create a Global Financial Center

There should be no doubt that China recognizes the importance of an international financial center in fulfilling the Chinese Dream: the nation needs money and finance to accomplish its series of grand projects like Made in China 2025, internationalization of the RMB, the Belt and Road Initiative, as well as development of the Guangdong–Hong Kong–Macau Greater Bay Area. Following economic reform in 1978, the Chinese leaders put forward several strategic economic plans to develop Shanghai, Shenzhen, and Qianhai into international financial centers.3 Moreover, in December 2019, about six months after the outbreak of anti-extradition bill protests in Hong Kong, there was news, though officially unconfirmed, that President Xi Jinping endorsed the diversification of Macau into a global center for tourism and finance—probably as a contingency plan to replace Hong Kong if the social unrest in Hong Kong deteriorated. In June 2020, China’s State Council released an ambitious master plan to transform Hainan into its largest free-trade port, including liberalization of the financial sector and free exchange of capital, by 2035 (Wong 2020).

However, things are easier said than done; none of these strategic plans have materialized. Undeniably, there are more stock markets and financial institutions than before, but all these Chinese cities are still far from being an international financial center comparable to Hong Kong. The Chinese government seemingly had the confidence that it could design and build up a financial center, or even financial centers, through economic planning. Yet nearly a century ago, in the socialist calculation debate, Mises and Hayek had already correctly pointed out that central economic planning was both erroneous and infeasible in theory and practice.

The Infeasibility of Central Planning

In a planned economy, the central planner will inevitably fail to coordinate production plans and allocate resources efficiently, because of at least two major problems.4 First, in socialist or centrally planned economies, goods and services are transferred rather than exchanged via markets; hence, they are either unpriced or irrationally priced. Economic calculation is therefore infeasible in the absence of a market price system where relative prices play both a signaling and rationing function to promote efficient use of resources (Mises [1920] 1990).

Second, economic calculation cannot be made by simulation of markets under market socialism or central planning because of a knowledge problem (Hayek 1937, 1940, 1945). According to Hayek’s pathbreaking insight, the knowledge relevant to rational economic calculation exists as dispersed bits of incomplete knowledge possessed by millions of separate individuals rather than in an integrated form given to the central planner. Moreover, individuals may have no or little incentive to convey their knowledge to the central planner. This incentive problem, together with the prohibitively high communication and search costs associated with the available dispersed knowledge at a given moment, implies that it is virtually impossible to make the most effective use of the available dispersed information for efficiently allocating society’s scarce resources under central planning. This Hayekian knowledge problem, as Kirzner (1984) argues, cannot become solvable by any planned search for the necessary information, because the planner has only limited knowledge and is likely unaware of his own ignorance. Nevertheless, the knowledge problem can be overcome by the alertness of private firms and entrepreneurs to profit opportunities through the competitive discovery process in a decentralized market economy (Hayek 1978a; Kirzner 1984).

Hayek followed the Austrian tradition of Carl Menger and held that money, like language and law, is one of the complex social institutions whose evolutionary outcomes are the result of human action, not deliberate design (see, e.g., Hayek 1960: chaps. 2 and 4; 1967a; 1973: chaps. 1–2; 1978b: 37–39; and 1988). Moreover, the evolutionary outcomes are inherently path dependent. This notion of society’s spontaneous order is equally applicable to the development or evolution of monetary and banking systems.5

Hong Kong’s Financial Development as a Spontaneous Order

Hong Kong’s rise as an international financial center is an example of a spontaneous order that emerged given limited government and the rule of law. During the 1970s and 1980s, when Hong Kong went through an economic transformation from a manufacturing city into a financial center, the Hong Kong government did not have any economic plan to deliberately turn the city into an international financial center. Hong Kong had, however, certain favorable factors, like its geographical location, a meeting point of East and West, free trade, no exchange control, freedom of press, low tax rates, a credible legal system, a corruption-free government, and its doctrine of “positive non-interventionism.”6 At the same time, there were the trends of globalization and China’s economic reform and opening up its door to the rest of the world.7

All these factors acted together, at the right place and at the right time, to help establish Hong Kong as a vibrant global financial center. International investors, entrepreneurs, and financial institutions reacted to the changing market forces and gained from the business opportunities. Metaphorically, it can be said that the invisible hand turned Hong Kong into an international financial center. The role of the Hong Kong government was mainly to provide a stable and fair business environment, and at most it only provided some measures or policies to nudge or facilitate the process of financial development. Even the celebrated linked exchange-rate system, which has provided monetary stability for decades so far, was a response to the political and financial crisis triggered by the uncertainty surrounding the Sino-British negotiations on Hong Kong’s future after 1997. It was not deliberately designed and introduced by the Hong Kong government, as reflected by the fact that even the official exchange rate of US$15HK$7.8 was chosen arbitrarily as a rough average of the market exchange rate before and after the crisis rather than an “optimal” rate based on an economic plan or model.

Why China Still Lacks a Global Financial Center

The Chinese government seems to have overlooked Hayek’s invaluable insights and Hong Kong’s experience.8 Against the backdrop of China’s rapid surge to become the world’s second largest economy and also rising nationalism triggered by the Chinese Dream, the Chinese government appears to have dogmatically believed that it can establish an international financial center on its own through economic planning. This belief was partly reflected by the above-mentioned strategic plans and partly by the editor-in-chief of the Global Times, who, in rebutting U.S. Secretary of State Mike Pompeo’s criticism of China’s National Security Law for Hong Kong, declared: “China’s strength determines that there will inevitably be an international financial center on its coastline. It will be wherever China wants it to be, actually” (Hu 2020).

Furthermore, the Chinese government appears to assume that it can simply take over Hong Kong’s financial infrastructure and then deploy its own comrades and patriotic financiers to maintain the operation of an international financial center. This is partly reflected by China’s increasing participation in Hong Kong’s financial markets and also by its tightening grip on Hong Kong.

A Fatal Conceit

China’s dream of having a competitive global financial market without creating the institutional infrastructure needed for such a system is what Hayek would call a “fatal conceit.” It is a profound and mistaken belief that “man is able to shape the world around him according to his wishes” (Hayek 1988: 27). Without economic freedom, protection of private property rights, and freedom of the press, there is little chance that Beijing can create a credible international financial center that people can trust.

Rule of Law and Freedom of Information

The rise and fall of financial centers can be attributable to many causal factors like war, politics, ideology, infrastructure, technology, human capital, tax system, and regulatory regime, to name just a few. Two other crucial factors—namely, the rule of law and freedom of information—are highly relevant and merit further analysis here for at least a couple of reasons. First of all, Hong Kong’s considerable comparative advantage over China in financial matters can be attributable to many factors, but it is a marked contrast between Hong Kong and China in these two areas.9 It is a matter of grave concern that the gradual erosion of the rule of law and freedom of press in Hong Kong in recent years will jeopardize its status as an international financial center. Furthermore, these two crucial factors are important because banking and finance, in both theory and practice, involve structuring, administering, and enforcing financial contracts to overcome the problems arising from imperfect information.

Financial intermediaries have a comparative cost advantage in producing information and monitoring financial transactions to mitigate or to resolve the adverse-selection and moral-hazard problems arising from information asymmetries (see Leland and Pyle 1977: Campbell and Kracaw 1980; and Diamond 1984, to name just a few). Information, both ex ante and ex post, can have social value if it enables an expansion in the set of enforceable risk-sharing arrangements like tradable securities or state-contingent claim contracts. As an example of the benefit of ex ante information, good banks in Hong Kong during the relatively free banking regime of the 1960s used lower deposit rates and higher reserve ratios as signals to depositors about their underlying quality so as to separate themselves from bad banks (Chu 1999). For the benefit of ex post information, all parties to a financial contract have to be able to rely on the public ex post information so as to observe and validate the actual state occurrence, otherwise they would not be able to enforce the existing contract or to negotiate a new contract. It is well known that the asymmetric information problems can cause markets to break down or even disappear (Akerlof 1970). Therefore, banking and finance is essentially an information industry and no city can hope to become an international financial center if there are serious barriers to the dissemination of news and information.

Financial centers, like money and merchants, emerge as intermediaries of trade and facilitate the expansion of exchange opportunities beyond autarky, leading to what Hayek (1973) calls “the extended order of human cooperation.” But how do borrowers, lenders, and financial institutions establish trust? Is a borrower’s or financial institution’s promise to pay on a certain date reliable? How can lenders or investors be sure that their securities are not “lemons” (Akerlof 1970)? These are just some of the problems that have to be overcome in order to achieve this Hayekian state. To a large extent, freedom of information alleviates the asymmetric information problems, but freedom of information alone is insufficient for the trading of financial contracts and also the rise of an international financial center. This is because, as J. R. Hicks (1969: 34) noted, “Trading is trading in promises; but it is futile to exchange promises unless there is some reasonable assurance that the promises will be kept.” Therefore, in order to protect private ownership rights and to punish dishonest traders, trading governance mechanisms, such as a sound rule of law, are also needed for the rise and sustainability of financial centers over time. Besides the rule of law, third-party information dissemination regarding dishonest traders is another form of a trading governance mechanism commonly used in commercial transactions. Yet this mechanism would not be fully effective, or even become infeasible, in the absence of freedom of information.10

Empirical Evidence

A main objective of this article is to examine the influence of the rule of law and freedom of information on international financial centers. The evolution of financial centers is a complex phenomenon. So instead of resorting to sophisticated econometrics, I look into the available data to identify if there exists a pattern as predicted by theory and, if so, based on the identified pattern, explain the principle behind the complex phenomenon to be explained (Hayek 1967b, 1967c).

From Z/Yen Group’s reports of the Global Financial Centres Index since 2008, the top 15 international financial centers by the five areas of competitiveness as well as the leading financial centers in the major regions are selected.11 Some countries have more than one international financial center, but we count only one of them for each country. For the United States, for example, New York is included but other financial centers like San Francisco and Chicago are omitted. A reason for so doing is that the other data used in this empirical analysis are mainly based on countries rather than on cities. Nonetheless, I obtain a quite representative sample of 54 major international financial centers in the world, ranging from global financial centers like London and New York to regional financial centers like Sydney and Johannesburg. More importantly, these international financial centers are functional centers rather than paper centers or booking centers like Bahamas and the Cayman Islands.12

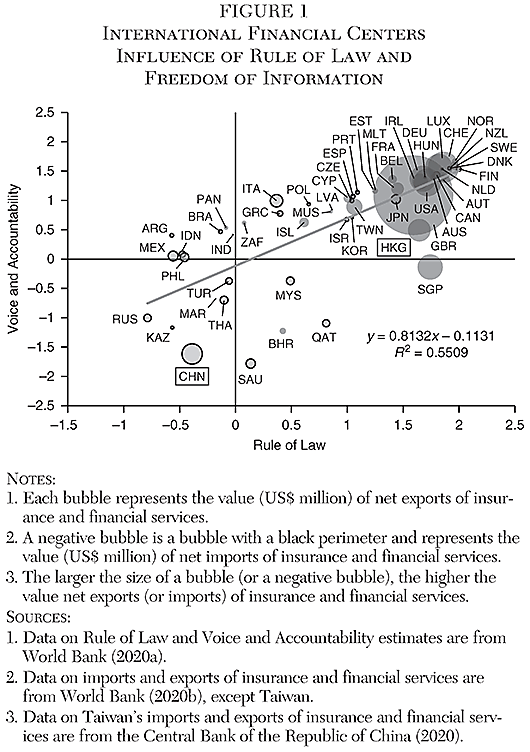

For each selected international financial center, I use estimates of Rule of Law and Voice and Accountability from the World Bank’s Worldwide Governance Indicators Database.13 The Rule of Law estimate for each financial center captures perceptions of the extent to which agents have confidence in and abide by the rules of society, and in particular the quality of contract enforcement, property rights, the police, and the courts, as well as the likelihood of crime and violence. Meanwhile, the Voice and Accountability estimate is used as a proxy for freedom of information because it captures perceptions of the extent to which a country’s citizens are able to participate in selecting their government as well as freedom of expression, freedom of association, and a free media. Each estimate gives a country’s score ranging from minus 2.5 to 2.5. A higher positive score denotes stricter adherence to the rule of law (or freedom of information), while a more negative score suggests a stronger violation of the rules or underlying principles or beliefs. Although the scores for each selected country in our sample do not change considerably over time, the average scores for these two estimates over the years 2008 to 2019 are taken as the indicators or indexes in this cross-sectional analysis.

If both the rule of law and freedom of information are not determinants in the evolution of international financial centers, a scatter plot of international financial centers with these two factors would reveal no systematic pattern and international financial centers are more or less randomly distributed regardless of the extent of the rule of law or freedom of information. If only one of them, say, the rule of law, influences the evolution of international financial centers, then there would be an expected systematic pattern such as international financial centers being more likely found in countries that rank high in the rule of law index. Under our maintained hypothesis, both factors are conducive to the evolution of international financial centers, and therefore it is expected that international financial centers are more commonly found in countries that rank high in terms of both the rule of law and freedom of information indexes. Diagrammatically, international financial centers are expected to cluster in the region of the scatter plot where both indexes are high in value.

As shown in the bubble chart (Figure 1), the empirical evidence unambiguously supports our hypothesis. There is a positive correlation between the rule of law and freedom of information indexes, as evidenced by the cross-sectional regression.14 At the same time, a big cluster of international financial centers is found in the first quadrant (top right) of the diagram, although some international financial centers deviate away from this cluster because of other political and economic factors. These findings indicate that both the rule of law and freedom of information are conducive factors for international financial centers. Furthermore, the cluster shows that it not only contains more international financial centers but also that they are larger in size as indicated by the third dimension of the chart: size of bubbles. Each bubble measures the volume of net exports of insurance and financial services of a country, the data of which are obtained from the World Bank’s World Development Indicators Database.15 The larger the bubble, the higher is the average value of net exports of insurance and financial services over the period under study. As expected, the largest bubbles are found in the advanced industrial countries with the global financial centers, and they are, in order, the United Kingdom (London), Switzerland (Zurich), the United States (New York), Luxembourg, and Germany (Frankfurt), followed by a close tie between two small open economies—Singapore and Hong Kong. As a matter of fact, these bubbles in the cluster are so large, particularly the one of the United Kingdom, that they bury many countries’ bubbles clustered around them and we can see only the country labels in the diagram. Fortunately, Hong Kong’s bubble (labeled as HKG in Figure 1) is big enough that we can still see part of it beneath the largest bubble of the United Kingdom.

Conversely, when a country registered net imports of insurance and financial services, it is represented by a negative bubble (with black perimeter) in Figure 1. As can be seen, negative bubbles are more commonly found in countries with low scores of both the rule of law and freedom of information, although there are exceptions. Similarly, the larger the negative bubble, the higher is the value of net imports of insurance and financial services. The largest negative bubbles are, respectively, China (labeled as CHN in Figure 1), Italy, Mexico and Saudi Arabia. Except Italy, these countries, notably China, are among the countries with the lowest scores in both the rule of law and freedom of information. We should not erroneously confuse China’s large net imports of insurance and financial services with its huge capital imports during this period, although they can be correlated because, say, foreign investors may have a home bias in favor of dealing with their own countries’ transnational banks instead of Chinese banks.

Whatever the true reasons for China’s large net imports of insurance and financial services—and despite the gradual increase in Shanghai’s ranking, because of China’s rapid economic growth and businessmen’s optimism about the Chinese markets—the trade statistics reveal that Shanghai has not yet established itself as a global financial center. A financial center is essentially a collection of financial intermediaries that provide a wide range of financial services to their clients. In a closed economy, these financial services, though they have value added, do not appear in the trade balance. In an open economy, however, an international financial center provides financial services not only domestically but also regionally and internationally. China’s large net imports of insurance and financial services imply an undersupply of financial services in the domestic financial sector in China and they imply that Shanghai as an international financial center is not comparable to London and New York. The former remains the champion of global net exporter of financial services despite the post-war relative decline of the British domestic economy whereas the latter continues to thrive regardless of the perennial U.S. trade deficit. From this perspective, Shanghai is not even comparable to Singapore and Hong Kong, two leading net exporters of financial services in the world despite their small open economies with virtually no natural resources. Indeed, China’s financial reform in the last four decades has built a large financial sector by establishing large numbers of various types of financial institutions and growing financial assets, but at the expense of efficiency and corporate governance. The negative effects of its repressive financial policies have already begun to take a toll on its economic and financial performance in recent years, and further market-oriented financial reforms are urgently needed to sustain growth and stability in the foreseeable future (Huang and Ge 2019).

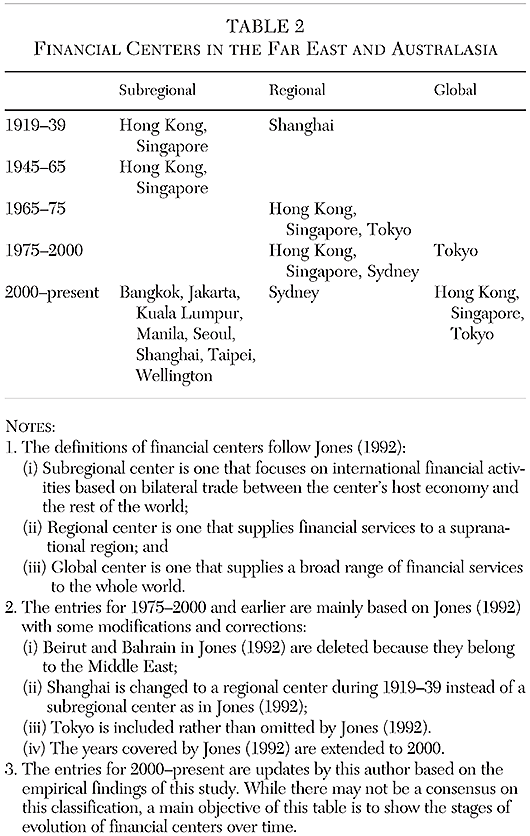

Rome was not built in a day. It took decades for Hong Kong to evolve from a subregional financial center to a regional center and ultimately to an international, if not global, financial center. This lengthy evolution process is also found in the emergence and rise of other financial centers (Table 2). There is simply no clear evidence indicating that a financial center can leapfrog ahead of its rival into the top position of a global financial center. But when Rome fell, it burned in one day. Shanghai was the premiere financial center of the Far East before World War II, but it lost not only its glory but also its status after the civil war in China. Other examples abound. Florence is reputed to have been the world’s first international financial center in the 13th century, but it was probably also the first one ruined by sovereign or country risk when Edward III, King of England, repudiated his debt a century later. War, politics, and ideology, as history clearly shows, can lead to the rapid fall of financial centers.

Hong Kong’s Future

Under collectivism and nationalism, China’s rubber-stamp parliament, the National People’s Congress (NPC), enacted the National Security Law for Hong Kong on June 30, 2020, without first releasing the full draft of the law to Hong Kong’s 750 million citizens, let alone having any public consultation. Despite Beijing officials’ claim that the law will only strengthen the “one country, two systems” framework, the law is highly contentious and has been strongly criticized by free, democratic nations. The law is generally perceived to further undermine, if not end, Hong Kong’s autonomy under the “one country, two systems” principle and also, from a Hayekian perspective, to bring Hong Kong another step further toward the road to serfdom. That is because Chinese nationalism, like socialism and Germany’s National Socialism, champions government control of politico-economic decisionmaking and empowers the state over the individual, which inevitably leads to a loss of individual freedoms (Hayek 1944).

After being rated the freest economy in the world for a quarter of a century, Hong Kong slipped and lost its standing to Singapore (Heritage Foundation 2020). Meanwhile, Hong Kong is no longer the third largest financial center in the world, after New York and London. In March 2020, it fell to sixth place (Z/Yen Group 2020). In addition, Fitch and Moody’s have downgraded Hong Kong’s credit rating twice since September 2019. Although we should not be overly concerned about these downgrades in the short run, they do point to the difficulties and challenges facing Hong Kong in maintaining its status as an international financial center. The lower ratings are commonly attributed to the ongoing protests in Hong Kong triggered by the Hong Kong government’s abortive attempt to introduce the extradition bill. The key issue is whether Hong Kong can continue to maintain its autonomy under “one country, two systems.”

Fitch expressed openly that one of the reasons for the downgrade of Hong Kong’s credit rating was its increasing linkages to mainland China. Although another credit rating agency, Standard and Poor’s, did not downgrade Hong Kong’s credit rating over the last couple of years, it has already stated quite openly that it would do so if Hong Kong failed to maintain its autonomy under “one country, two systems.”

As far as financial development is concerned, the National Security Law for Hong Kong has also increased concern over the future of Hong Kong as an international financial center. Indeed, Hong Kong will lose its current special status when it is deemed by other countries to have lost its autonomy and become part of China. President Trump’s Executive Order on Hong Kong Normalization (White House 2020) has already revoked Hong Kong’s preferential status of being treated separately from China, in accordance with the United States–Hong Kong Policy Act of 1992. The newly passed Hong Kong Autonomy Act (Gilroy, Owens, and Tovar 2020) can potentially hamper Hong Kong’s status as an international financial center because it empowers the U.S. president to impose sanctions on financial institutions that do business with entities that undermine Hong Kong’s autonomy under “one country, two systems.” Even though no provision related to Hong Kong’s currency board system has been made yet, any departure from the link to the U.S. dollar would no doubt be detrimental to Hong Kong’s status as a global financial center.

This article draws on certain Hayekian ideas, such as the Hayekian knowledge problem and spontaneous order, to better understand financial development in Hong Kong and China. Ignorance or neglect of such ideas can lead to devastating consequences. A case in point is Hong Kong. If Hong Kong drifts from its grounding in the rule of law and individual freedom, under pressure from the Chinese mainland, its dynamic financial markets may suffer as investors lose trust in Hong Kong’s institutions.

Hong Kong as an International Financial Center

Collectivism and Nationalism

Hong Kong’s financing and insurance industries account for about 20 percent of GDP and more than 6 percent of the total labor force.1 These figures do not include the closely related industries like law, accounting, and information technology, not to mention the vital and conducive role of a financial system to the functioning of an economy.

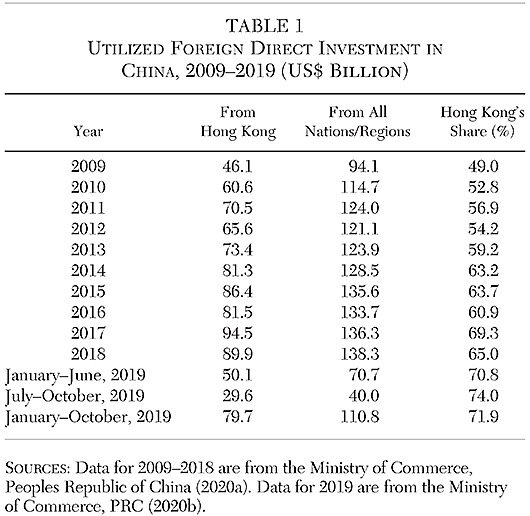

Hong Kong is an indispensable window through which China absorbs foreign investment and new technology. According to statistics released by the Ministry of Commerce of the People’s Republic of China (2020a, 2020b), more than half of the actually utilized foreign investment during the last decade came from Hong Kong (Table 1). Over the years, foreign investment in China was on an upward trend until 2018, and the share of foreign investment coming from Hong Kong had also increased from just below 50 percent in 2009 to 65 percent in 2018, reflecting the increasing reliance of China on Hong Kong as a source of foreign investment. After 2018, China’s foreign investment from Hong Kong and the rest of the world declined noticeably, at least in the first 10 months of 2019. Despite the apparent slowdown in foreign investment in China and the anti-extradition protests in Hong Kong in 2019, Hong Kong has remained the largest source of foreign investment for China and its investment share has become relatively more important at the same time.

Under collectivism and nationalism, China’s rubber-stamp parliament, the National People’s Congress (NPC), enacted the National Security Law for Hong Kong on June 30, 2020, without first releasing the full draft of the law to Hong Kong’s 750 million citizens, let alone having any public consultation. Despite Beijing officials’ claim that the law will only strengthen the “one country, two systems” framework, the law is highly contentious and has been strongly criticized by free, democratic nations. The law is generally perceived to further undermine, if not end, Hong Kong’s autonomy under the “one country, two systems” principle and also, from a Hayekian perspective, to bring Hong Kong another step further toward the road to serfdom. That is because Chinese nationalism, like socialism and Germany’s National Socialism, champions government control of politico-economic decisionmaking and empowers the state over the individual, which inevitably leads to a loss of individual freedoms (Hayek 1944).

After being rated the freest economy in the world for a quarter of a century, Hong Kong slipped and lost its standing to Singapore (Heritage Foundation 2020). Meanwhile, Hong Kong is no longer the third largest financial center in the world, after New York and London. In March 2020, it fell to sixth place (Z/Yen Group 2020). In addition, Fitch and Moody’s have downgraded Hong Kong’s credit rating twice since September 2019. Although we should not be overly concerned about these downgrades in the short run, they do point to the difficulties and challenges facing Hong Kong in maintaining its status as an international financial center. The lower ratings are commonly attributed to the ongoing protests in Hong Kong triggered by the Hong Kong government’s abortive attempt to introduce the extradition bill. The key issue is whether Hong Kong can continue to maintain its autonomy under “one country, two systems.”

Fitch expressed openly that one of the reasons for the downgrade of Hong Kong’s credit rating was its increasing linkages to mainland China. Although another credit rating agency, Standard and Poor’s, did not downgrade Hong Kong’s credit rating over the last couple of years, it has already stated quite openly that it would do so if Hong Kong failed to maintain its autonomy under “one country, two systems.”

As far as financial development is concerned, the National Security Law for Hong Kong has also increased concern over the future of Hong Kong as an international financial center. Indeed, Hong Kong will lose its current special status when it is deemed by other countries to have lost its autonomy and become part of China. President Trump’s Executive Order on Hong Kong Normalization (White House 2020) has already revoked Hong Kong’s preferential status of being treated separately from China, in accordance with the United States–Hong Kong Policy Act of 1992. The newly passed Hong Kong Autonomy Act (Gilroy, Owens, and Tovar 2020) can potentially hamper Hong Kong’s status as an international financial center because it empowers the U.S. president to impose sanctions on financial institutions that do business with entities that undermine Hong Kong’s autonomy under “one country, two systems.” Even though no provision related to Hong Kong’s currency board system has been made yet, any departure from the link to the U.S. dollar would no doubt be detrimental to Hong Kong’s status as a global financial center.

Conclusion

It is questionable if the National Security Law for Hong Kong can actually promote national security or economic and social stability, particularly given the growing tensions in the Sino‑U.S. relations following the outbreak of the Covid-19 pandemic. It is also questionable whether the law is really in the interests of both China and Hong Kong. Without Hong Kong’s special status as an international financial center, as well as a window to absorb foreign investment and new technologies for China, it is unlikely China can continue to experience robust growth. Empirical evidence from numerous cross-country studies has clearly indicated that such factors as rule of law, civil liberties, capitalism, investment, and openness to trade are good for economic growth, whereas factors like wars and market distortions are bad. Without the good factors, nationalism alone cannot make the Chinese Dream a reality.

References

Akerlof, G. (1970) “The Market for Lemons: Quantitative Uncertainty and the Market Mechanism.” Quarterly Journal of Economics 84: 488–500.

Aoki, M. (2001) Toward a Comparative Institutional Analysis. Cambridge, Mass.: MIT Press.

Bank for International Settlement (BIS) (2019) BIS Quarterly Review (December). Basel, Switzerland: BIS.

Campbell, T., and Kracaw, W. A. (1980) “Information Production, Market Signalling, and the Theory of Financial Intermediation.” Journal of Finance 35: 863–82.

Census and Statistics Department, Hong Kong SAR (2020) Hong Kong Monthly Digest of Statistics (June).

Central Bank of the Republic of China (2020) National Statistics, Republic of China. Available at https://eng.stat.gov.tw/mp.asp?mp=5.

Chu, K. H. (1999) “Free Banking and Information Asymmetry.” Journal of Money, Credit and Banking 31: 748–62.

Diamond, D. (1984) “Financial Intermediation and Delegated Monitoring.” Review of Economic Studies 51: 393–414.

Dorn, J. A. (1998) “China’s Future: Market Socialism or Market Taoism?” Cato Journal 18 (1): 131–46.

________ (2019) “China’s Future Development: Challenges and Opportunities.” Cato Journal 39: 173–88.

Gilroy, T.; Owens, I.; and Tovar, A. (2020) “President Trump Signs into Law the Hong Kong Autonomy Act.” SanctionsNews, BakerMcKenzie blog (July 14). Available at https://sanctionsnews.bakermckenzie.com/president-trump-signs-into-law-the-hong-kong-autonomy-act.

Hanson, D. (2012) “Positive Non-Interventionism: The Policy that Unleashed Hong Kong.” AEIdeas (March 22).

Hayek, F. A. (1937) “Economics and Knowledge.” Economica 4 (13): 33–54.

________ (1940) “Socialist Calculation: The Competitive ‘Solution.’” Economica 7 (26): 125–49.

________ (1944) The Road to Serfdom. Chicago: University of Chicago Press.

________ (1945) “The Use of Knowledge in Society.” American Economic Review 35 (4): 519–50.

________ (1960) The Constitution of Liberty. Chicago: University of Chicago Press.

________ (1967a) “The Result of Human Action but Not of Human Design.” In Studies in Philosophy, Politics and Economics, 96–105. Chicago: University of Chicago Press.

________ ([1955] 1967b) “Degrees of Explanation.” In Studies in Philosophy, Politics, and Economics, 3–21. Chicago: University of Chicago Press.

________ ([1964] 1967c) “The Theory of Complex Phenomena.” In Studies in Philosophy, Politics, and Economics, 22–42. Chicago: University of Chicago Press.

________ (1973) Law, Legislation and Liberty. Volume I: Rules and Order. London: Routledge.

________ (1978a) “Competition as a Discovery Procedure.” In New Studies in Philosophy, Politics, Economics and the History of Ideas, 179–90. Chicago: University of Chicago Press.

________ (1978b) Denationalization of Money: The Argument Refined. London: Institute of Economic Affairs.

________ (1988) The Fatal Conceit: The Errors of Socialism. Chicago: University of Chicago Press.

Heritage Foundation (2020) Miller, T.; Kim, A. B.; and Roberts, J. M. (eds.), 2020 Index of Economic Freedom. Washington: Heritage Foundation.

Hicks, J. R. (1969) A Theory of Economic History. Oxford: Oxford University Press.

Hu, X. (2020) “Pompeo Makes Arrogant, Hysterical Statements about HK Autonomy.” Global Times (May 28).

Huang, Y., and Ge, T. (2019) “Assessing China’s Financial Reform: Changing Roles of the Repressive Financial Policies.” Cato Journal 39: 65–85.

Jao, Y. C. (1997) Hong Kong as an International Financial Centre: Evolution, Prospects, and Policies. Hong Kong: City University of Hong Kong Press.

Jones, G. (1992) “International Financial Centers in Asia, the Middle East, and Australia: A Historical Perspective.” In Y. Cassis (ed.), Finance and Financiers in European History, 1880–1960, 405–28. Cambridge: Cambridge University Press.

Kirzner, I. (1984) “Economic Planning and the Knowledge Problem.” Cato Journal 4 (2): 407–18.

Leland, H. E., and Pyle, D. H. (1977) “Information Asymmetries Financial Structure, and Financial Intermediation.” Journal of Finance 32: 371–81.

McCarthy, I. (1979) “Offshore Banking Centers: Benefits and Costs.” Finance and Development 16: 45–48.

Ministry of Commerce, People’s Republic of China (2020a) Statistical Bulletin of FDI in China 2019.

________ (2020b) News Release of National Assimilation of FDI, various issues. Available at http://mofcom.gov.cn.

Mises, L. V. ([1920] 1990) Economic Calculation in the Socialist Commonwealth. Auburn: Ludwig von Mises Institute.

O’Driscoll, Jr., G. P. (1994) “An Evolutionary Approach to Banking and Money.” In J. Birner and R. Zijp (eds.), Hayek, Co-ordination and Evolution: His Legacy in Philosophy, Politics, Economics, and the History of Ideas, 126–40. London: Routledge.

White House (2020) “The President’s Executive Order on Hong Kong Normalization” (July 14). Available at https://www.whitehouse.gov/presidential-actions/presidents-executive-order-hong-kong-normalization.

Wong, D. (2020) “Hainan FTZ Masterplan Released to Establish China’s Biggest Free Trade Port by 2035.” China Briefing, Dezan Shira & Associates (June 5).

World Bank (2020a) Worldwide Governance Indicators Database. Washington: World Bank. Available at https://databank.worldbank.org/source/worldwide-governance-indicators.

(2020b) World Development Indicators Database. Washington: World Bank. Available at https://databank.worldbank.org/source/world-development-indicators.

Yeager, L. B. (1994) “Mises and Hayek on Calculation and Knowledge.” Review of Austrian Economics 7 (2): 93–109.

Z/Yen Group (2020) Global Financial Centres Index 27, and also reports in previous years since 2008. London: Long Finance.

This work is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License.