The emergence of large corporate organizations in digital markets has attracted substantial press coverage. Much of that coverage describes these organizations in derogatory terms like “big tech,” “behemoths,” “gatekeepers,” “giants,” “goldilocks,” and “titans.” The press also makes extensive use of the concept of “monopoly,” which raises the question of whether the press representation of monopoly is in line with the socio-legal baseline enshrined in antitrust laws. To test that hypothesis, this article features a longitudinal study looking at press coverage of monopolies over a 150-year period.

Our inquiry points out three biases. First, press coverage of monopolies is usually negative and distorts the meaning of monopoly found in the antitrust literature. Second, data show that press coverage of the emergence of monopolies is more widespread than stories of their disappearance. Third, the coverage of monopolies is often clustered around “hot topics.”

This article proceeds as follows. We begin with a discussion of the basic hypothesis that motivates our study — namely, a possible discrepancy between the representation of monopoly in the mass media and the antitrust meaning of the term. Next, we review the literature related to the biases generally encountered in mass media and discuss potential antitrust and regulatory applications. We then analyze the use of “monopoly” in the press by looking at 150 years of press coverage. Finally, we sketch out some policy implications of our findings.

Parallel Narratives of Monopoly

We posit that there are two conflicting narratives about monopoly: the first is conveyed by the mass media, while the second is enshrined in the antitrust laws. The mass media coverage of digital economy markets often uses “monopoly” as a buzzword to convey a biased vision of monopoly. In contrast, antitrust laws in the United States and European Union (EU) tend to make a more dispassionate use of the term. There is no underlying assumption that monopolies should, by their very nature, be sanctioned. Instead, antitrust laws reflect a compromise whereby monopoly is treated as a mostly unobjectionable market fact, in which legal consequences are triggered when certain additional factors are present. On the basis of this observation, we formulate the hypothesis that the mass media conveys a normative representation of monopoly that deviates from the positive interpretation prevailing in the social-legal order.

The Monopoly Buzzword

The start of the 21st century has played center stage to the swift rise of the digital economy and a raft of global corporations. Unsurprisingly, the success of these firms in the marketplace has caught the interest of the press and the public alike.

A random search of the mass media coverage of digital economy firms denotes an observable tendency to discuss them in monopoly terms. If we restrict our inquiry to The Economist, Wall Street Journal, New York Times, Washington Post, and Guardian, from June 7, 2012, to June 7, 2017, we find numerous articles that use the terms “monopoly,” “digital,” and “technology.” Several recurring features can be observed.

First, large digital economy firms have been labeled as “monopolies” by the press. Amazon (Streitfield and Scott 2015), Apple (Tsukayama 2013), Facebook (Taplin 2016), Google (Business Leader 2015), Uber (Wadhwa 2014), and Yahoo (Leaders 2016c) are all said to enjoy, or to have enjoyed, a monopoly. Microsoft is the most frequently mentioned “monopoly,” although this term is often linked to past antitrust findings. In one article in the Guardian, all the above firms (and others) are brought under the umbrella category “digital monopolies” (Pasquale 2015).

Second, the monopoly label is sometimes literal, sometimes metaphorical. A nontrivial amount of mass media coverage we have surveyed discusses digital economy firms with terms like “giant” (Leaders 2012a; Garside 2014), “titans” (Carr 2014), “behemoth” (Carr 2014), “empire” (Neil 2015; Leaders 2016a), “colossus” (Leaders 2012b), and “walled gardens” (Leaders 2012b).

Third, in some instances, the mass media does not directly tag the monopoly label on digital economy firms, yet the narrative indirectly achieves that result by recourse to historical analogy. In this variant, digital economy firms are often compared to well-known instantiations of monopoly companies in contemporary history. This includes Standard Oil (Briefing 2014, 2017), AT&T (Neil 2015), Microsoft (Leaders 2016b), and AOL (Editor’s Note 2014). Sometimes the historical reference is less explicit, and the mass media calls upon memories of times when monopolies were said to be the industry norm. Thus, we find references to such terms as “trustbusting” (Leaders 2014) and “robber barons” (Wadhwa 2014).

Fourth, the mass media representation of digital economy companies as monopolies is found in both reporting and commentary journalism, though the line between those two categories is sometimes blurred (Stiglitz 2016). This confluence may denote some spillover from the normative opinions conveyed in commentary pieces to objective renditions of facts in reporting pieces.

Finally, in most of the press articles we examined, the word “monopoly” is pejorative. For example, in a piece on Silicon Valley companies in the New York Times, the authors write: “The word ‘monopoly’ has a distinctly nefarious ring to it, conjuring up images of thuggish industrialists in smoky rooms, scheming to undermine their rivals” (Gelles and Isaac 2016). Some articles underline the peril posed by these “monopolists” by adding cartoon representations — of the kind found in H. P. Lovecraft imagery — that are reminiscent of the famous Standard Oil octopus.

Admittedly, this brief overview of the representation of digital economy firms as monopolies in the mass media is not dispositive. But it may be suggestive of a wider trend, whereby the press’s representation of monopoly deviates from its positive and legally accepted understanding. In the next subsection, we explore, and carry further, this conjecture by comparing the representation of monopolies in the press with that found in the antitrust statutes on both sides of the Atlantic.

The Socio-legal Baseline: U.S. and EU Antitrust Laws

Constitutional political economies define various rules of law that operationalize social preferences. Among them are “rules of the market order” that “coordinate the actions of individuals” and “define the private spaces within which each of us can carry on our own activities” (Brennan and Buchanan 1985: 12–15). Antitrust rules are an important component of market rules and reflect a socio-legal understanding of monopoly.

If we focus analysis on antitrust laws in the United States and European Union, we can derive several principles regarding the concept of monopoly.

• First, a monopoly is not a bad state of the world. Neither U.S. nor EU antitrust laws take a categorically hostile view of monopoly through the formulation of a general prohibition in statutory law or a per se prohibition in case law.

• Second, antitrust laws do not presume that a monopoly position will be durable.

• Third, society admits that monopoly market positions may sometimes generate efficiencies not found in less concentrated market structures.

Antitrust Neutrality toward Monopoly Positions. A certain agnosticism toward monopoly can be observed in several areas, and at several levels of U.S. and EU antitrust laws. To start, the unilateral conduct statutes of both jurisdictions do not proscribe the possession of a monopoly position. In the United States, Section II of the Sherman Act states that it is unlawful to “monopolize” (or “attempt” to monopolize) and liability is focused on the behavioral process that degenerates into a monopoly position or inefficiently perpetuates one. In the European Union, Article 102 of the Treaty on the Functioning of the EU (TFEU) forbids “any abuse” of a “dominant position” and liability focuses on the conduct constitutive of an exploitation of a dominant market position. A finding of dominance is thus not sufficient to trigger EU antitrust liability.

Antitrust doctrine has on numerous occasions confirmed these important nuances. In the United States, it is conventionally admitted that Section 2 of the Sherman Act catches the process of willful acquisition or maintenance of monopoly. In United States v. Grinnell Corp.,1 the Supreme Court ruled that “the offense of monopoly under § 2 of the Sherman Act has two elements: (1) the possession of monopoly power in the relevant market and (2) the willful acquisition or maintenance of that power as distinguished from growth or development as a consequence of superior product, business acumen or historic accident.”2 Moreover, it is apparent from the Congressional Record leading up to the adoption of Section 2 of the Sherman Act that Congress did not seek to outlaw the mere possession of monopoly power.3 In the EU, where the concept of monopoly does not appear in statutory law, and where the somewhat looser concept of dominance is used as a surrogate to monopoly, the Court of Justice affirmed in Michelin that “a finding that an undertaking has a dominant position is not in itself a recrimination.”4

The neutrality of antitrust law toward monopoly can also be observed at the remedial level. Neither the Sherman Act nor EU statutory laws give courts and agencies a power to dismember monopoly or dominant firms. Granted, both the enforcement of the Sherman Act and EU statutory laws can lead to divestiture orders. But such orders remain contingent on proof of illegal willful monopolization or abusive conduct and are strictly limited to restoring the “but for infringement” state of the world. In the past, the conventional statutory (and doctrinal) limitations of the U.S. and EU antitrust statutes have fueled proposals supporting the adoption of “deconcentration” legislation to supplement existing statutes. Those initiatives have generally registered little success on both sides of the Atlantic (Kovacic 1988: 1105; Calkins 2005: 421).

Similarly, both the U.S. and EU unilateral conduct laws denote a certain tolerance for monopoly outcomes, yet in distinct ways. In the United States, the Supreme Court has expressly insulated monopoly pricing from any form of statutory liability. In Verizon v. Trinko,5 the U.S. Supreme Court said that: “The mere possession of monopoly power, and the concomitant charging of monopoly prices, is not only not unlawful; it is an important element of the free-market system.”6 In the EU, in contrast, the expansive wording of Article 102a in TFEU refers to the open-textured concept of “unfair pricing.” Yet, EU law does not distinctly single out monopoly pricing as a source of liability. Instead, some scholarly commentary insists that the prohibition is aimed against prices that deviate from what is perceived as “fair,” regardless of the possession of monopoly power (Joliet 1970: 243). The upshot is that, despite statutory divergences on both sides of the Atlantic, firms are mostly free to charge a monopoly price without risking antitrust exposure.

Merger law seemingly constitutes an important exception to the neutrality of antitrust law toward monopoly — a merger to monopolize would be notoriously difficult under both U.S. and EU merger laws. In the United States, antitrust remediation is conditioned on proof of a “substantial lessening of competition,” while in the EU it is based on a “significant impediment to effective competition,” not on the creation of a monopoly position. At least on paper, the law leaves a narrow window to redeem mergers that generate significant efficiencies or salvage a failing firm. Ultimately, the relevant question is how a given transaction might affect the competitive landscape.

A Monopoly Market Share Does Not Imply the Persistence of Market Power. In both U.S. and EU antitrust laws, the durability of a monopoly position is a necessary, though not sufficient, condition for a finding of infringement. This is true in both unilateral conduct and merger laws, where conventional antitrust methodology requires an analysis of barriers to entry and expansion. Antitrust fact finders thus seek to forecast whether pre- and post-entry profits can attract new firms to the market, regardless of the size of the share detained by the incumbent.

In this regard, antitrust doctrine has established that the possession of a monopoly market share does not presumptively denote a durable market position. Dissenting in Eastman Kodak, Justice Scalia criticized a Court of Appeals judgment that had analytically confused “circumstantial power” with a “dominant” firm’s “market power in any relevant sense.” Quoting Judge Posner’s dissent in Parts & Elec. Motors v. Sterling,7 Scalia opined that a “brief perturbation in competitive conditions” is indeed “not the sort of thing the antitrust laws should worry about.”8

In Microsoft/Skype, the General Court (GC) of the EU adopted a similar perspective. It acknowledged that “market shares of more than 50 percent are liable to constitute serious evidence of a dominant position.” At the same time, the GC insisted on the insufficiency of such threshold inquiries in the determination of market power. It noted: “The consumer communications sector is a recent and fast-growing sector which is characterized by short innovation cycles in which large market shares may turn out to be ephemeral. In such a dynamic context, high market shares are not necessarily indicative of market power and, therefore, of lasting damage to competition.”9

The point is that, in the realm of antitrust enforcement, a monopoly is only actionable in the presence of some persistence, usually denoted by the stability of market shares. Antitrust laws thus look beyond the optics of single-seller positions and do not take as given that monopoly shares bring a “quiet life,” as John Hicks (1935: 8) once wrote.

A Monopoly Position May Be Efficient. U.S. and EU antitrust laws contemplate the possibility of efficient monopolies. This can be seen at several junctures. First, the prospect of future market power gives firms incentives to invest, notably in innovation ex ante (Arrow 1962: 609–26; Schumpeter 1976: 74). This key finding of economic science was expressly admitted in U.S. antitrust law in the Supreme Court’s Trinko ruling. Writing for the majority, Justice Scalia famously argued that “the opportunity to charge monopoly prices — at least for a short period — is what attracts ‘business acumen’ in the first place; it induces risk taking that produces innovation and economic growth.”10 Similarly, European competition law redeems otherwise abusive practices if firms under litigation can show that they are necessary to induce economic efficiencies. The open-ended nature of the European Court of Justice’s case law suggests that fostering innovation may be one such justification (Auer 2017: 676).

Second, in both jurisdictions, monopolies are ranked as a somewhat lesser concern than cartels. As George Stigler (1982: 5) once observed, the Sherman Act was “primarily a law against trusts,” and much less concern was leveled by Congress at monopoly power. This hierarchy in concerns is nowhere best seen at play than in Trinko, where the trade-off between monopoly and collusion was clearly in display. Among the public policy reasons advanced to vindicate immunity for dominant firms’ refusal to deal, the Supreme Court held that “compelling negotiation between competitors may facilitate the supreme evil of antitrust: collusion.”11 In other words, monopolies may pose a smaller threat than collusion because they can entail productive efficiencies, such as economies of scale or network effects.

Third, merger regulations across the globe tend to accept the idea that increased market concentration may nonetheless yield efficiencies. In their respective sections related to “efficiencies” and “consumer benefits,” the U.S. and EU horizontal merger Guidelines say in substance that “efficiencies almost never justify a merger to monopoly or near monopoly.”12 This wording should not be mistaken for what it is not: the Guidelines concede that, factually, mergers to monopolize may generate efficiencies, even though, legally, such efficiencies may be ignored by authorities. Merger laws’ reluctance to consider efficiencies in merger to monopolize cases is essentially predicated on a rule of thumb: the “experience” of the agencies, say the Guidelines, hints that as a rule, such efficiencies will be insufficient to outweigh monopoly power. As with any rule-based proxy, however, a risk of a false positive cannot be excluded.

Monopoly: Normative vs. Positive

At this stage, we can detect anecdotal evidence of the existence of two systems of belief about monopoly. On the one hand, the socio-legal consensus reflected in our antitrust laws views any industry subject to a monopoly position as a market fact. The term “monopoly” is essentially descriptive in content. It refers to the “state of or the quality of” a market where there is a single seller (Thornton 2004: 257–61). To take the words of Milton Friedman (1953: 259) in his famous article on the methodology of positive economics, the observation of a monopoly position is “independent of any particular ethical position or normative judgments.” On the other hand, the mass media tend to carry a pejorative representation of firms holding a monopoly position. The term “monopoly,” as used by the press, is primarily normative in nature. It surmises a market failure and invites a discussion on policy intervention. The difference is a matter of degree. It is not that antitrust laws naïvely view monopolies as a boon. To the contrary, a market position akin to monopoly is usually a necessary condition for intervention. But it is not a sufficient condition. This nuance often seems to be lacking from the media discourse on the subject.

Media Biases and Press Coverage of Monopolies

This section analyzes two main biases that might skew press coverage of monopolies.13 The first is proaudience bias and the second is generally referred to as herding or information cascades. We discuss how these biases might skew the media’s coverage of monopolies and show that press bias concerning monopolies is part of a much wider phenomenon that affects all areas of press coverage.

Proaudience Bias

Press outlets are profit-maximizing organizations. They have incentives to maximize sales of papers, subscriptions, and advertising space. In an industry that works on razor thin margins, this may lead press outlets to skew their coverage in order to increase sales. There is thus a possible misalignment between press organizations’ commitment to report “the truth” and their incentives to achieve profits. This proaudience bias can take various forms.

A first manifestation is known as sensationalism or spin bias (Mullainathan and Shleifer 2002). This refers to the tendency to overstate stories and focus on pieces with dramatic content. The press tends to favor alarming (pessimistic) content over reassuring (optimistic) content (Sandman 1994: 251–60). This phenomenon notably seems to be at play in the reporting of health news where medical studies that refute the relational effect between certain factors and health outcomes receive much less media coverage than those that confirm such effects (Koren and Klein 1991: 1824–26).14 One consequence is an overrepresentation of news stories that demonstrate the existence of a link between food X and illness Y.15 Many scholars posit that the preponderance of negative over positive content may be due to audience preferences. They show that demand is stronger for news with “negative” content, which pushes press outlets to overrepresent such stories (Trussler and Soroka 2014: 373). Moreover, from a purely theoretical standpoint, there are reasons to believe that competition between news outlets may intensify this phenomenon (Mullainathan and Shleifer 2002: 21). Competition might thus have a detrimental effect on news quality, creating incentives to prioritize coverage of bad news and to underreport counterevidence.

Another form of proaudience bias is the tendency of press organizations to present news in a manner that satisfies their audience. This second expression of proaudience bias runs along ideological rather that sensationalist lines, but the underlying driver is the same: press outlets are incentivized to tailor their news coverage to the priors of their readers in order to maximize sales. This is because they know that people tend to perceive news that does not match their views as inaccurate (Gentzkow and Shapiro 2006: 281; Lord, Ross, and Lepper 1979: 2098–109; Vallone, Ross, and Lepper 1985: 577–85). In the United States, some experiments show that the sales of liberal/conservative newspapers are higher in areas that voted for the presidential candidate whose ideology matched that of the paper (Sutter 2012: 3521–32). This alleged effect of reader ideology on newspaper sales might explain what some have identified as political biases in the U.S. press (Sutter 2000: 431; Groseclose and Milyo 2005: 1195; Lott and Hassett 2014). Beyond the traditional liberal-conservative division, it has also been argued that the social context in which audiences consume and discuss news may give rise to a bias in favor of collectivist, rather than market-based, solutions to social problems (Jensen 1979: 267–87).

Herding

A second source of bias stems from the rational tendency of humans toward herding or imitation. Faced with imperfect information, economic agents use the behavior of others as a signal. In so doing, they implicitly posit that the agents who have already made a decision enjoyed superior information (Banerjee 1992: 798). Even if rational, this behavior — also referred to as “information cascades” — can lead to suboptimal decisions, because the initial choices made by others may be due to random events or imperfect information too (Bikhchandani, Hirshleifer, and Welch 1992: 994; Banerjee 1992: 800).

The intuition can be illustrated with a simplified example.16 Consider a consumer faced with a choice between two restaurants and having no knowledge about their respective qualities. How should this consumer decide between these two options? A common shortcut is to rely on the number of consumers in each restaurant, under the assumption that higher attendance denotes higher quality. Although this seems like a reasonable decisional proxy, it is not without flaws. The underlying assumption is that most patrons based their decision on prior knowledge they held about each restaurant’s respective quality. But one can conceive of an extreme setting where a hypothetical first consumer made a decision at random, and where the second consumer followed the first, and so on and so forth. In this hypothesis, patrons would flock to one of the two restaurants without obvious reason.

In reality, however, it is important to consider that some agents might have relied on their own information, in which case herd behavior might not represent a suboptimal outcome. That said, the main upshot of herd theory is that agents’ choices under herding might deviate from the outcome that would be observed under perfect information, leading to the clustering of behavioral patterns and unstable outcomes (Bikhchandani, Hirshleifer, and Welch 1992: 1016).

Examples of herding have been documented in a wide array of sectors. Herding may, for example, explain why academics rush to cover the same topics (Banerjee 1992: 798). It is also said to explain uniform social behavior including fashion fads (Bikhchandani, Hirshleifer, and Welch 1992: 1015), managerial behavior (Brandenburger and Polak 1996: 524), and investment bubbles (Scharfstein and Stein 1990: 465–79; Bikhchandani and Sharma 2000: 279–310 ). Not surprisingly, herding can thus also be applied to the press, even though it has been less studied in this context. Uncertain about the topics that will prove most successful with their audience, press outlets may be tempted to mirror the successful stories of their rivals, rather than produce articles that their own information suggests would be most successful. The result may be an exaggerated buzz around some trending topics. Though this may be understandable for some matters of great importance — think of “breaking news” — this phenomenon may be more surprising when it is linked to more mundane and pedestrian issues.

Summation

We believe that the two sources of bias, which have just been exposed, may systematically skew the press’s depiction of monopolies. First, proaudience bias may guide the media to overemphasize the harmfulness of monopolies and underplay their potential virtues. It might also cause the press to be excessively bullish about the persistence of the monopoly and to focus on the alarming emergence of some monopolies rather than reassuring disappearance of others. Second, herding might lead the press to cluster around some recurring monopoly narratives, sectors, or companies. The following section tests these intuitions empirically.

Data from 150 Years of Press Coverage

To simplify matters, we limit our analysis to two main questions. The first is whether the press’s coverage of monopolies suffers from proaudience bias — that is, sensationalism. The second is whether press articles about monopolies tend to exhibit herding behavior. To test these hypotheses, we analyze a large sample of newspaper articles relating to monopolies from 1850 to 2000. We observe that press coverage is disproportionately negative and pessimistic, which supports the existence of proaudience (sensationalism) bias. Our data also lend support to herding behavior. We find that coverage of monopolies is clustered around “hot topics” that often receive an amount of attention that is an order of magnitude larger than other pieces.

Dataset

Our dataset of monopoly press coverage is taken from the ProQuest Historical Newspapers online database.17 We divided our search into six time periods: 1850–75; 1875–1900; 1900–25; 1925–50; 1950–75; and 1975–2000. For each of these periods, we searched for articles with “monopoly” as a keyword, sorted the articles by relevance, and entered the first 300 articles in our database, giving us a total of 1,800 articles. Although it is unclear how ProQuest determines an article’s relevance, our sample suggests that the main driving factors are the frequent use of the word “monopoly,” its presence in an article’s title, plus some random element.

ProQuest offers a different result with every search, so each of our two hypotheses is tested against a slightly different set of articles.18 Nevertheless, the selection procedure for both sets of articles is identical, and most articles are present in both datasets. Moreover, practical intricacies caused a number of items to appear more than once in the sample used to analyze the sensationalism-bias hypothesis. As a result, this sample contains 1,399 (rather than 1,800) articles.

We should also note that each dataset contains articles that are unrelated to our area of study, even though they are responsive to the “monopoly” keyword. Those articles have been removed from our results, though the line between relevant and nonrelevant articles is sometimes blurry. For example, we did not remove articles that deal with statutory monopolies, patent-protected monopolies, and firms protected by international tariffs (throughout history the press has often used the monopoly term to refer to such). As a result, our dataset contains some articles that do not match the conventional understanding of monopoly.

Sensationalism Bias: Tests and Results

To assess the sensationalism bias, we run two complementary tests. The first categorizes the articles from our dataset, depending on whether they can be deemed positive, neutral, or negative toward the alleged monopolists. The second test assigns to each alleged monopoly a buy, hold, or sell rating. Both assessments rely solely on the contents of the press articles and not on our own private information.

At this stage, two important remarks are in order regarding these classifications. First, the labels we assign to each article may deviate from their lay or technical meaning. For example, when assigning buy, hold, or sell ratings, we ignore common rules of thumb that finance professionals may use when assigning ratings to firms. Second, it is important to understand that the labeling exercise entails a certain degree of arbitrariness and subjectivity. To reduce the impact of these weaknesses on our findings, the conditions for an article to be counted as either “positive” or “sell” are particularly loose. This is done in order to submit our hypothesis to tests that are as strenuous as possible.

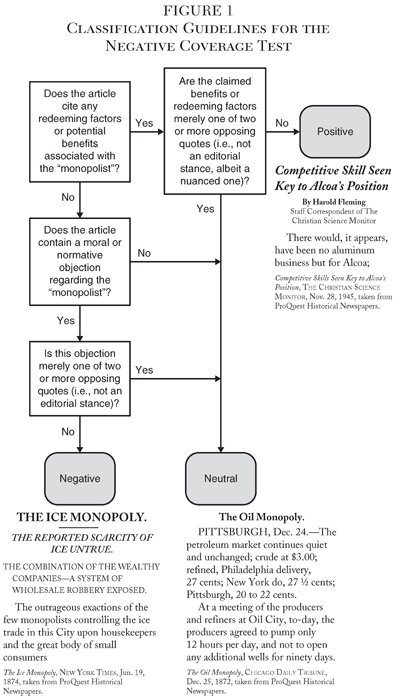

Our first test questions whether the press coverage of monopolists is excessively negative. This negativity bias may cause the press to focus only on the most egregious monopolies, or to give stories a negative spin. As a result, press coverage may not reflect the potential benefits generated by some monopolies. Figure 1 summarizes the guidelines used to label the press articles.

Our analysis sets a very low bar for articles to be assigned a positive or neutral rating. We label as positive any press article that mentions some redeeming factor or potential benefit generated by a monopoly. To meet this condition, the alleged benefit does not have to be a byproduct of market power (as might, for example, be the case for innovations that stem from a patent-protected monopoly). Likewise, the benefit does not have to be contemporaneous to the article. Any article that mentions some past benefit associated with the monopoly or one that might be expected in the future is classified as positive. The most obvious examples of potential benefits are the creation of new or improved products, the idea that the monopoly offers a product that is superior to that of its competitors, and that the monopoly firm creates a large number of jobs.

We assign a neutral rating to articles that are purely factual — for example, when articles mention that a trust increased prices. We also attribute this rating to articles where newspapers quote parties on both sides of a case. In such instances, one party often claims that the behavior of a monopolist is beneficial while the opposing party disagrees.

Finally, we deem to be negative all articles that go beyond a purely factual representation of monopolies and offer some objection — moral or normative — without mentioning any potentially redeeming elements. This may be due to newspapers taking an editorial stance or when they do not explicitly take a stance but only tell one side of a story.

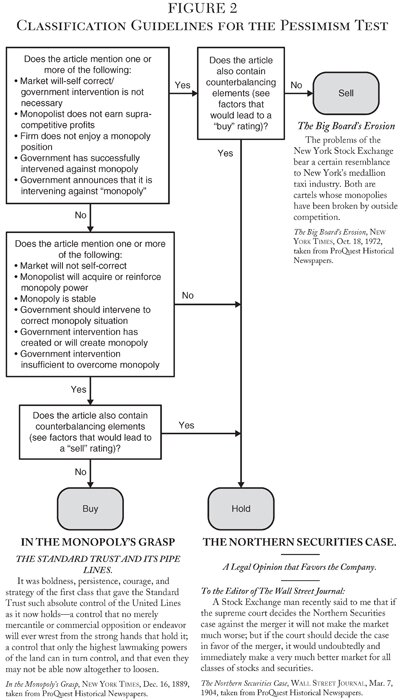

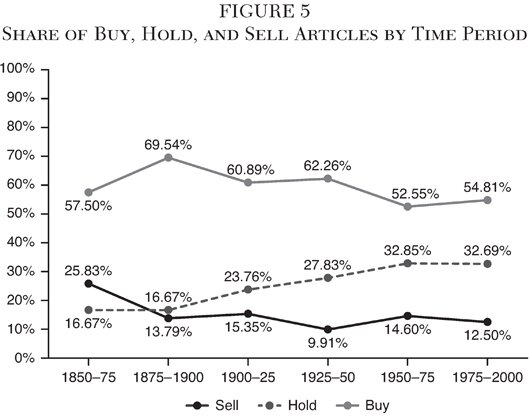

The second test seeks to generate a forecast on the basis of the information each article conveys about the health of the alleged monopolies it covers. We do this by assigning to each article a buy, hold, or sell rating — that is, we question whether the information conveyed in an article would cause otherwise uninformed investors to hold on to their stock of the monopoly, to buy more, or to sell. This test can be thought of as a proxy for the future harm (or benefits) that a monopoly is expected to generate. Our intuition is that the media tend to overestimate the persistence of monopolies and their menace to society, underplaying the possibility that market forces might rapidly correct the monopoly situation. This tends to be supported by the data, which show that press coverage of monopoly is mostly pessimistic. Figure 2 summarizes our classification guidelines.

To assign a rating, we use the following guidelines. We attribute a sell rating to articles that suggest the market will self-correct, a monopoly does not earn supracompetitive profits, or firms do not have a monopoly position. Conversely, we give a buy rating to articles that suggest the market will not self-correct, or that firms might acquire or reinforce a monopoly position. This includes articles that suggest a monopoly is stable. We assign a hold rating if there are elements of both improvement and decline — for example, when an article contemplates the possibility a monopoly might either prosper or fail.

We follow a number of additional guidelines for articles that relate to government intervention. If an article suggests that government intervention is desirable, we assign a buy rating; while in the opposite case, we assign a sell rating. When government intervention is deemed to curtail monopoly power, we assign a sell rating, but when intervention is deemed to create or reinforce a monopoly, we assign a buy rating. In the presence of mixed evidence (e.g., when a court case is pending), we assign a hold rating.19

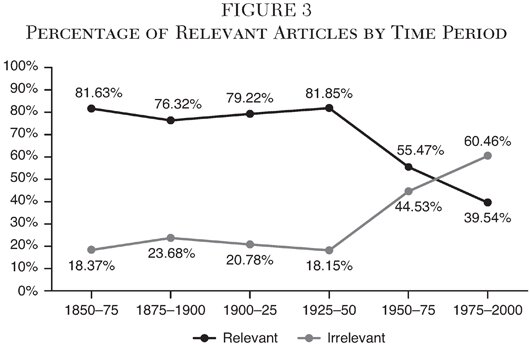

We find that 949 out of 1,399 articles (67.83 percent) are relevant to our study. The following results, shown in Figure 3, are derived from these 949 articles.

Although the database shows a temporal shift in the percentage of relevant articles (from roughly 82 percent to 40 percent), we cannot conclude that this is due to a substantive change in the press’s use of the word “monopoly.” Instead, the trend is notably due to the emergence of the board game “Monopoly.” In order to avoid sample bias, we excluded all articles that were linked to the board game from our other tests, even if they would otherwise have been deemed relevant. (A number of articles dealt with a trademark case wherein it was alleged that Parker Brothers had a monopoly over the Monopoly trademark.)

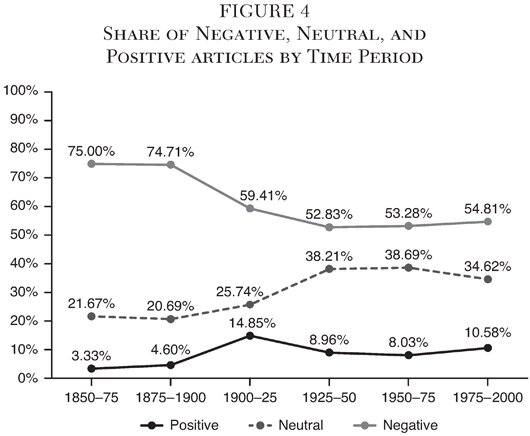

As far as our first test (negativity) is concerned, we find that press coverage of monopolies is mostly unfavorable. In total, our dataset contains 582 negative articles (61.32 percent), 284 neutral articles (29.92 percent), and only 83 positive articles (8.75 percent). The broad strokes of these results, shown in Figure 4, hold across all time periods, though there is some variance.

Our results notably show a marked decline in negative press coverage between 1875 and 1925. This 50-year time span coincides with the adoption of key antitrust statutes, such as the Sherman Antitrust Act (1890), the Clayton Act (1914), and the Federal Trade Commission Act (1914).

The second test (pessimism) also tends to confirm our intuition, though the trend is less pronounced than in the first test. Over the years, the press has purveyed a mostly bullish outlook on the persistence of monopolies. Our dataset contains 574 buy articles (60.48 percent), 235 hold articles (24.76 percent), and 140 sell articles (14.75 percent), as shown in Figure 5. One noteworthy trend is the steady increase in hold articles between 1900 and 1950.

The results of our first test (negative coverage) tend to show that the press casts the monopoly phenomenon in a particularly critical light. This is best evidenced by the fact that, out of 949 articles, only 83 (8.75 percent) mention any redeeming factor in favor of the monopolies they cover. Moreover, many of these 83 articles are not “positive” in the classic sense of the word. Redeeming benefits aside, the editorial stance of these articles is often adverse to alleged monopolists. In addition, it is important to note that the “monopolists” of our dataset may not actually possess any degree of market power. This makes press hostility even more salient. The upshot is that, for alleged monopolists, the best case scenario is often to receive a strictly factual coverage rather than one that is normatively or morally loaded.

At the same time, our data display a rise in “neutral” coverage, between 1875 and 1925. This trend coincides with the emergence of antitrust enforcement by competition authorities and courts. One hypothesis is that press coverage of this litigation tended to generate articles where the conflicting views of both parties are presented.20

The second test (pessimism) suggests that either the press focuses only on nascent monopolies rather than disappearing ones, or that the press is very poor at predicting the life expectancy of monopolies. If the press articles covered a random sample of monopolies, then we should see roughly as many articles about disappearing monopolies as emerging ones. This is because very few monopolies have survived the entire timespan of the dataset. One such example is the Diamond match company that was founded in 1881 and, soon after, accused of being a monopoly. The firm has survived to the present day with a healthy market share.

These findings are all the more surprising, given that the majority of the sell articles in our dataset do not cover the actual disappearance of a monopoly, or even its expected disappearance. Instead, they tend to involve instances where an antitrust decisionmaker — be it a court or an antitrust authority — has taken some form of action against the alleged monopoly. Because we limit our analysis to the information conveyed by the press, we often end up assigning a sell rating. This is a far cry from an article that might document the actual erosion of a monopoly through market forces.

Our results for both tests may be criticized on the grounds of selection bias. As far as the first test is concerned, readers might object that positive coverage of large firms may avoid using the term “monopoly.” Likewise, on the second test, coverage of market corrections might not mention that outcompeted firms previously held a monopoly. We offer two responses. First, our study ultimately focuses on the press’s use of the word “monopoly,” not on press coverage of large firms. In that regard, our results confirm that the monopoly terminology is mostly used to convey negative stories about firms. This use deviates from the socio-legal baseline enshrined in the antitrust statutes, where monopoly is not an inherently negative or persistent phenomenon. Second, the paucity of articles acknowledging some virtues of monopolists or dealing with the actual erosion of monopoly power tends to suggest that selection bias could not be the sole explanation. It seems unlikely that the press might systematically comment on these phenomena without ever using the term “monopoly.” Our research thus raises the broader prospect that monopolies might be the object of disproportionately negative and pessimistic press coverage.

Herding: Tests and Results

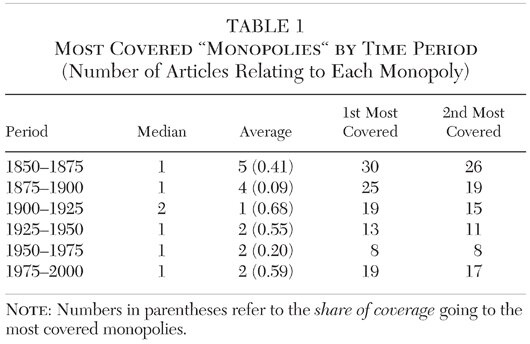

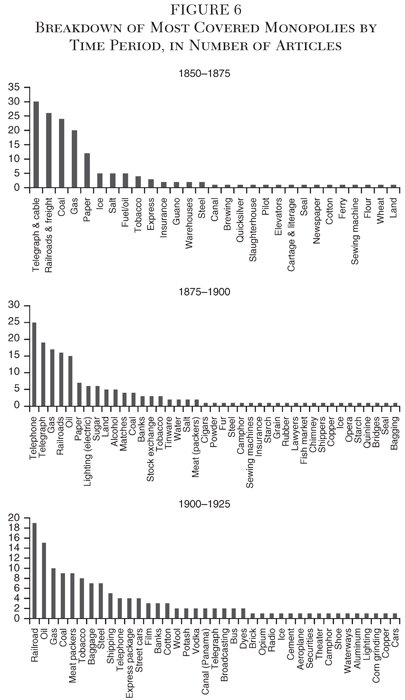

To test whether the press displays herding behavior in its coverage of monopolies, we look into the sectors most covered by the press throughout our dataset. We do this by assigning a sector to each alleged monopoly. Sometimes, when a single company is the object of all the monopoly coverage in a given sector, we name the sector after the monopolist. For example, in 1975–2000 we refer to Intel instead of microprocessors. In the other cases, we choose to refer to sectors rather than to individual companies for two main reasons. The first is that many articles concern trusts that comprise a number of firms. As a result, it is not always possible to identify the individual firms to which the press is referring specifically. The second reason is that companies might often be absorbed by other corporate entities or change names yet remain the object of continuous press coverage. Having assigned a sector to each article, we then examine which sectors received the most press coverage over each subperiod.

Table 1 shows that for each time period except 1950–75, the most covered sector receives at least five times more coverage than the average. Moreover, for every time period except 1900–25, the most covered article receives at least an order of magnitude more coverage than the median. Figure 6 gives a detailed breakdown of the monopolies that received the most coverage in each of these time periods.

Our data show that press coverage of monopolies is clustered around a number of hot topics. It is less clear whether this is due to herding or the intrinsic importance of the underlying topics. In some instances, press interest seems to be guided by the popularity of a subject rather than its economic relevance. In other cases, it seems clearer that the sector under examination was of vital importance to the economy at the time.

One intuition is that large antitrust cases often generate a substantial amount of press coverage. This was true, for example, in the antitrust litigation involving Bell Telephone, Standard Oil, and Microsoft. It is also true for regulatory interventions such as the 19th-century Railway Commissions. Of course, the coincidence of high levels of press coverage and antitrust intervention might be due to the significant impact of these “monopolies” on the daily lives of readers, rather than a causal relationship.

Policy Implications

If we are right that the press systematically exhibits biases when covering monopolies, then the logical next question is how this may affect antitrust policy. Exploring the policy implications of the existence of two parallel systems of belief about monopoly is necessarily speculative. We nonetheless proceed on the conservative assumption that the press’s normative stance regarding monopolies may be heard by antitrust policymakers. This is because it is realistic to consider that policymakers — both agencies and courts — are also readers of the mass media. In what follows, we identify three alternative vectors of influence by which the press may affect antitrust policy, with a particular focus on the digital economy.

Antitrust Indifference

In our first scenario, antitrust policymakers remain deaf to the mass media representations of monopolies. Convinced that the mass media is wrong, they keep applying statutory law and doctrine on monopolization in line with precedent. Arguably, this scenario is particularly plausible in antitrust governance systems predominantly subject to technocratic institutions (i.e., expert agencies) as opposed to antitrust governance systems that rely on nonspecialist institutions (e.g., adjudication, particularly civil and criminal juries). This is because technocratic institutions are more apt to detect flaws in the normative stance of the press. Plaintiffs know that normative claims on monopolies will be dismissed summarily by expert decisionmakers and are more likely to thrive with nontechnical decisionmakers. This scenario may also be more likely in substantive antitrust systems where evidence-intensive and context-dependent standards of liability, like the rule of reason, prevail.

The indifference of policymakers vis-à-vis the normative narrative on monopolies is not without consequences. The stock of unsatisfied demand for antitrust action (fueled by the mass media), puts pressure on the executive and legislative branches, which appropriate funds to antitrust agencies and pass antitrust statutes, to “do something.” This pressure may also spread to academia, when a group of scholars start to fret over the existence of “gaps” in statutory law and doctrine. The upshot is that incumbent policymakers face competition from other branches of government and are ultimately bound by the public’s appetite for increased intervention.

These very forces may have been at play in the United States during the late 19th and early 20th century. Our data tend to indicate that press coverage of monopolies became markedly less hostile after the adoption of key U.S. antitrust statutes. In that sense, the adoption of antitrust statutes may be seen as a response to public outcry over monopolies. The adoption of these statutes may have quenched the public’s thirst for antimonopoly enforcement.

Fast forward and there are striking similarities between today’s antitrust context and that which prevailed in the United States at the turn of the 20th century. The emergence of big tech is fueling calls for heightened enforcement of existing provisions and the adoption of new statutory instruments. Such a trend might ultimately lead to legislative and administrative reform, the early signs of which are already beginning to emerge (though history also suggests that such movements do not always achieve their legislative ambitions).21 The Democratic Party’s “New Antitrust” platform (Yglesias 2017) and Senator Elizabeth Warren’s (D-Mass.) famous “Competition in America” speech (Warren 2016) both spring to mind. If U.S. antitrust enforcement remains deaf to these calls, we expect that press coverage of monopolies will continue to veer toward the hostile and alarmist end of the scale, with some firms taking most of the flak.

Antitrust Adherence

In our second scenario, antitrust policymakers endorse the mass media representations of monopolies. Convinced that the mass media is right, these policymakers start to promote expansive interpretations of statutory law and doctrine to curb the power of digital economy monopolies.

In contrast to our previous scenario, endorsement of the normative monopoly narrative may be more likely in politicized systems. It is also easier to implement in antitrust regimes that apply per se liability rules in single firm conduct cases and merger law. This is because per se rules denote a bias against defendants, and thus the antitrust system is already closer to a blanket prohibition of monopolies.

Barring legislative changes, the endorsement of the normative monopoly narrative leads to discrete enforcement initiatives. The scope of existing antitrust provisions is expanded on a case-by-case basis against selected companies. The specific deterrence achieved in one antitrust case is hoped to give rise to general deterrence with other companies. Implementing this type of policy shift is a heavy process, subject to procedural constraints and judicial review.22

A possible stumbling block with this approach is that mass media outlets may fail to notice any significant adjustment in antitrust policy and keep nurturing demand for new rules and institutions for digital economy markets. At the same time, antitrust policymakers may lose political capital within their community because they distort positive law in disguise. Challenges before review courts are likely to become even more common as chasms develop between black letter law and its application. This may also lead the press to shift its scrutiny from enforcers toward courts.

In short, if antitrust policymakers are successful they may preempt outside intervention. Conversely, failure may lead to the same consequences as “antitrust indifference,” where antitrust authorities are outcompeted by the legislative or executive branches of government.

Antitrust Manufacturing Consent

Our third scenario is one where antitrust policymakers try to influence the media. To be more specific, antitrust policymakers attempt to quench the demand for enforcement by giving the mass media signs that normative monopoly positions are under active supervision, yet without changing anything to conventional antitrust law and doctrine.

Concretely, antitrust policymakers proactively interact with the mass media. They introduce the normative monopoly narrative in external communications and language protocols. Because they do not want to create binding legal effects, this is done in extra-legal instruments like soft law, press releases, and speeches.

In this scenario, policymakers speak with two voices. One system of discourse, which is pejorative in content, is targeted at the mass media and the public opinion. The other is reserved to the internal antitrust community, which is positive in meaning.

Interestingly, this third scenario is more plausible when antitrust governance is discharged by hybrid institutions that combine a high degree of politicization with career bureaucrats. In contrast, populist institutions cannot engage in proactive press campaigns and are thus condemned to silence.

There are similarities between this third scenario and the strategy pursued by the European Commission’s current leadership. On the one hand, Commissioner Margrethe Vestager has made numerous media outings, including a TED Talk (Vestager 2017; Lunch with FT 2017). In these statements, the commissioner spoke in terms that usually resonate with nontechnical audiences, such as “fairness,” “fear,” and “greed” (Vestager 2017). Despite these public pronouncements, there have been few changes to the way in which EU competition law has been applied. Legal documents, such as formal decisions, have steered clear of media catchwords and continued to apply established precedent — or at least claimed to do so.23

In this scenario, the mass media and the public feel they are heard, and the antitrust practitioners’ community does not feel betrayed. Demands for additional rules and institutions recede. The antitrust system faces no competition or relegitimization with the outside world, and maintains peace within the inside community.

Conclusion

This article has examined press coverage of monopolies throughout recent history, hoping to shed light on recent trends in the digital economy. The underlying dataset, containing more than 1,000 press articles and spanning 150 years, suggests that the press is mostly negative and pessimistic when it reports on monopolies. This record is a departure from the socio-legal baseline — which is essentially agnostic toward monopolies — and may be indicative of sensationalism bias. The data also indicate that the press may be prone to herding when it writes about monopoly. This is because reporting is clustered around a number of hot topics, which receive significantly more coverage than the average/median topic.

We hypothesize that this biased coverage may be part of a wider phenomenon, whereby the public’s unmet demand for antitrust enforcement fuels press coverage and vice versa. When this feedback loop reaches a tipping point, it may lead to shifts in policy at the initiative of antitrust authorities or from other branches of government. Conversely, strong enforcement — or at least the appearance thereof — may assuage the public’s appetite and take some bite off of press coverage of monopolists. The bottom line is that critically large gaps between press coverage and actual antitrust policy are hard to sustain.

A wider point is that the press may be quicker to react to changes in public demand than regulators, legislators, or governments. Press coverage may thus be a bellwether for future shifts in policy. If this is true, then recent press coverage of the digital economy augurs uphill battles for big tech firms.

References

Arrow, K. (1962) “Economic Welfare and the Allocation of Resources for Invention.” In The Rate and Direction of Inventive Activity: Economic and Social Factors, 609–26. Princeton, N.J.: Princeton University Press for the National Bureau of Economic Research.

Auer, D. (2017) “Appropriability and the European Commission’s Android Investigation.” Columbia Journal of European Law 23 (3): 647–81.

Banerjee, A. V. (1992) “A Simple Model of Herd Behavior.” Quarterly Journal of Economics 107 (3): 797–817.

Bikhchandani, S.; Hirshleifer, D.; and Welch, I. (1992) “A Theory of Fads, Fashion, Custom, and Cultural Change as Informational Cascades.” Journal of Political Economy 100 (5): 992–1026.

Bikhchandani, S., and Sharma, S. (2000) “Herd Behavior in Financial Markets.” IMF Staff Papers 47 (3): 279–310.

Brandenburger, A., and Polak, B. (1996) “When Managers Cover Their Posteriors: Making the Decisions the Market Wants to See.” RAND Journal of Economics 27 (3): 523–41.

Brennan, G., and Buchanan, J. M. (1985) The Reason of Rules: Constitutional Political Economy. New York: Cambridge University Press.

Briefing (2014) “Everybody Wants to Rule the World: Internet Monopolies.” The Economist (November 29).

__________ (2017) “Fuel of the Future: Data Is Giving Rise to a New Economy.” The Economist (May 6).

Business Leader (2015) “Google Dominates Search. But the Real Problem Is Its Monopoly on Data.” The Guardian (April 19).

Calkins, S. (2005) “Antitrust Modernization: Looking Backwards.” Journal of Corporate Law 31 (2): 421–52.

Carr, D. (2014) “Regulators Snooze as Titans Grow.” International New York Times (July 18).

Carroll, A. E. (2015) “Red Meat Is Not the Enemy.” New York Times (March 30).

Coase, R. (1974) “The Market for Goods and the Market for Ideas.” American Economic Review 64 (2): 384–91.

Editor’s Note (2014) “Facebook and WhatsApp, and AOL All over Again.” Washington Post ( March 2).

Friedman, M. (1953) “The Methodology of Positive Economics” In Essays in Positive Economics, 3rd ed., 3–16. Chicago: University of Chicago Press.

Garside, J. (2014) “From Google to Amazon: EU Goes to War against Power of U.S. Digital Giants.” The Guardian (July 6).

Gelles, D., and Isaac, M. (2016) “Challenging Uber, Lyft Bets on a Road Wide Enough for Two.” New York Times (January 9).

Gentzkow, M., and Shapiro, J. M. (2006) “Media Bias and Reputation.” Journal of Political Economy 114 (2): 280–316.

Green, M. J. (ed.) (1971) The Closed Enterprise System: The Nader Study Group Report on Antitrust Enforcement. Washington: Center for Study of Responsive Law.

Groseclose, T., and Milyo, J. (2005) “A Measure of Media Bias.” Quarterly Journal of Economics 120 (4): 1191–237.

Hicks, J. R. (1935) “Annual Survey of Economic Theory: The Theory of Monopoly.” Econometrica 3 (1): 1–20.

Jensen, M. C. (1979) “Toward a Theory of the Press” In K. Brunner (ed.) Economics Social Institutions, 267–87. Leiden, Netherlands: Martinus Nijhoff.

Joliet, R. (1970). Monopolization and Abuse of Dominant Position: A Comparative Study of the American and European Approaches to the Control of Economic Power. Liège, Belgium: Collection Scientifique de la Faculté de Droit de l’Université de Liège.

Koren, G., and Klein, N. (1991) “Bias against Negative Studies in Newspaper Reports of Medical Research.” Journal of the American Medical Association 266 (13): 1824–26.

Kovacic, W. E. (1988) “Failed Expectations: The Troubled Past and Uncertain Future of the Sherman Act as a Tool for Deconcentration.” Iowa Law Review 74 (5): 1105–50.

Leaders (2012a) “Battle of the Internet Giants: Survival of the Biggest.” The Economist (December 1).

__________ (2012b) “Survival of the Biggest: Battle of the Internet Giants.” The Economist (December 1).

__________ (2014) “Should Digital Monopolies Be Broken Up? Trustbusting in the Internet Age.” The Economist (November 29).

__________ (2016a) “Facebook: Imperial Ambitions.” The Economist (April 9).

__________ (2016b) “Tie Breaker: The Case against Google.” The Economist (April 23).

__________ (2016c) “The Parable of Yahoo: From Dotcom Hero to Zero.” The Economist (July 30).

Lord, C. G.; Ross, L.; and Lepper, M. R. (1979) “Biased Assimilation and Attitude Polarization: The Effects of Prior Theories on Subsequently Considered Evidence.” Journal of Personality and Social Psychology 37 (11): 2098–109.

Lott, J. R. Jr., and Hassett, K. A. (2014) “Is Newspaper Coverage of Economic Events Politically Biased?” Public Choice 160 (1–2): 65–108.

Lunch with FT (2017) “Margrethe Vestager on Holding Silicon Valley to Account.” Financial Times (September 22).

Mullainathan, S., and Shleifer, A. (2002) “Media Bias.” NBER Working Paper No. 9295.

Neil, I. (2015) “3 Innovative Companies Provide Clues to Google’s Strategy.” International New York Times (August 13).

Orbach, B., and Rebling, G. C. (2011) “The Antitrust Curse of Bigness.” Southern California Law Review 85 (3): 605–56.

Pasquale, F. (2015) “Why Europe Needs a Digital Regulator.” The Guardian (April 27).

Sandman, P. M. (1994) “Mass Media and Environmental Risk: Seven Principles.” Risk Health, Safety and Environment 5: 251–60.

Scharfstein, D. S., and Stein, J. C. (1990) “Herd Behavior and Investment.” American Economic Review 80 (3): 465–79.

Schumpeter, J. A. (1976) Capitalism, Socialism and Democracy. Abingdon, U.K.: Routledge.

Shuchman, M., and Wilkes, M. S. (1997) “Medical Scientists and Health News Reporting: A Case of Miscommunication.” Annals of Internal Medicine 126 (12): 976–82.

Silk, L. (1971) “Nader Antitrust Report.” New York Times (June 16).

Stigler, G. J. (1982) “The Economists and the Problem of Monopoly.” American Economic Review 72 (2): 1–11.

Stiglitz, J. (2016) “The New Era of Monopoly Is Here.” The Guardian (May 13).

Streitfield, D., and Scott, M. (2015) “Amazon’s E-Books Business Investigated by European Antitrust Regulators.” New York Times (June 11).

Sutter, D. (2000) “Can the Media Be So Liberal? The Economics of Media Bias.” Cato Journal 20 (3): 431–52.

__________ (2012) “Is the Media Liberal? An Indirect Test Using News Magazine Circulation.” Applied Economics 44 (27): 3521–32.

Taplin, J. (2016) “Forget AT&T. The Real Monopolies Are Google and Facebook.” New York Times (December 13).

Thornton, R. J. (2004) “Retrospectives: How Joan Robinson and B. L. Hallward Named Monopsony.” Journal of Economic Perspectives 18 (2): 257–61.

Trussler, M., and Soroka, S. (2014) “Consumer Demand for Cynical and Negative News Frames.” International Journal of Press/Politics 19 (3): 360–79.

Tsukayama, H. (2013) “Amazon’s Move against Apple Signals Greater Focus on Music.” Washington Post (January 19).

Vallone, R. P.; Ross, L.; and Lepper, M. R. (1985) “The Hostile Media Phenomenon: Biased Perception and Perceptions of Media Bias in Coverage of the Beirut Massacre.” Journal of Personality and Social Psychology 49 (3): 577–85.

Vestager, M. (2017) “How Competition Can Build Trust in Our Societies.” TED Talk speech given on September 20. Available at https://ec.europa.eu/commission/commissioners/2014-2019/vestager/announcements/how-competition-can-build-trust-our-societies_en.

Wadhwa, V. (2014) “Uber’s Legacy Hangs in the Balance: Digital Robber Baron or Respectable Innovator?” Washington Post (November 20).

Warren, E. (2016) “Reigniting Competition in the American Economy.” Keynote speech at New America’s Open Markets Program Event, June 29. Available at www.warren.senate.gov/files/documents/2016-6-29_Warren_Antitrust_Speech.pdf.

Yglesias, M. (2017) “Democrats’ Push for a New Era of Antitrust Enforcement, Explained.” Vox (July 31).

1United States v. Grinnell Corp., 384 U.S. 563 (1966).

2Id. at 570.

3See 21 Cong. Rec. 3151 (1890). Orbach and Rebling (2011: 623–31) show that Section 2 of the Sherman act did not seek to punish monopolies that were acquired by virtue of superior skill. They also argue that this initial stance was somewhat strained in the early 20th century, notably with the nomination of Justices Brandeis and Douglas to the Supreme Court. It remains that the possession of monopoly was never, absent at least some minor accompanying factors, outlawed in and of itself.

4Case C 332/81, NV Nederlandsche Banden-Industrie Michelin v. Commission, EU:C:1983:313, §57. It added: “but simply means that, irrespective of the reasons for which it has such a dominant position, the undertaking concerned has a special responsibility not to allow its conduct to impair genuine undistorted competition on the common market.”

5Verizon Communications v. Law Offices of Curtis V. Trinko, LLP, 540 U.S. 398 (2004).

6Id. at 407.

7Parts & Elec. Motors, Inc. v. Sterling Elec., Inc., 866 F. 2d 228, 236 (CA7 1988), (Posner, J., dissenting).

8Eastman Kodak Co. v. Image Technical Servs., Inc., 504 U.S. 451 (1992), (Scalia, A., dissenting).

9Case T-79/12, Cisco Systems Inc. et al. v. Commission, EU:T:2013:635, §69. See also Case C-177/16, EU:C:2017:689, §56.

10Trinko, 540 U.S. at 407.

11Id. at 408.

12See U.S. Horizontal Merger Guidelines, §84. The EU Guidelines provide at paragraph 84 that: “It is highly unlikely that a merger leading to a market position approaching that of a monopoly, or leading to a similar level of market power, can be declared compatible with the common market on the ground that efficiency gains would be sufficient to counteract its potential anti-competitive effects.”

13We omit a third potentially important source of bias that is commonly known as “gatekeeping.” Various forces may push media outlets to play an activist role in shaping policy outcomes (Trussler and Soroka 2014: 362). For example, Ronald Coase (1974) famously argued that the press systematically defends First Amendment rights when it suits its own interests, but not when it doesn’t.

14Shuchman and Wilkes (1997: 979) posit that press outlets are not the only ones to blame for sensationalism; the medical profession also bears some responsibility because authors and journals do not proactively prevent distortions by the media. We believe that such a claim can be transposed to the coverage of monopolies, where academics might be complicit in letting the press amplify their research. This alleged passivity is not surprising; if sensational information faces less competition to gain media traction, then journals have few incentives to downplay their findings.

15Carroll (2015) argues that the widespread coverage linking red meat to cancer is overblown and is part of a wider trend.

16The big simplification is that we assume agents have no private information, whereas the original theory of herding mandates that agents discount their own private information.

17The database can be accessed from ProQuest’s main search portal, at https://search.proquest.com.

18The tests were run at different point in time and required different information from the database. As a result, we had to create a new selection of articles for the sensationalism tests.

19It is not always easy to distinguish between government interventions, to which we assign a sell rating, and pending cases, to which we assign a hold rating (it is clear that government intervention does not necessarily lead to a conviction). In dubious cases, we try to ascertain whether the press contemplates that there are many possible outcomes to a situation or whether, instead, the press confidently presents government intervention as a solution. Note that our two tests have different default ratings. Faced with mixed information, we assign a positive rating in the negativity test and a hold rating in the pessimism test. This is because few would argue that monopolies are an unmitigated boon for society. It thus seems unrealistic to expect that there would be many press articles that cast monopolies in an entirely positive light. Mixed evidence is usually the most positive coverage that monopolies can expect to receive from the press. This is why we place mixed articles under the positive label. Conversely, there is no reason to believe that the media should be particularly bullish or bearish about the prospects of monopolies. It is thus reasonable to expect that articles with mixed evidence would occupy the middle ground of press coverage. We thus give them a hold rating. Though the default rating in our second test is hold, rather than sell, it seems important to highlight that the test nevertheless has a low requirement for articles to be assigned the latter rating. This is because many events that do not necessarily lead to the disappearance of a monopoly have been counted as sell articles. This is notably the case for many articles where a monopolist is convicted of an antitrust offense, even though such cases often do not lead to the erosion of a monopoly position. For example, Microsoft’s conviction for antitrust offenses did little to reduce its share of the operating system market.

20This coverage of antitrust cases may also fuel a number positive articles. In these cases, a press editorial may outline different viewpoints when analyzing a case, but without attributing them to the parties in the case. The difference between these articles and the previous ones is that the press takes ownership of the idea that there may be some redeeming virtue to a monopoly situation, while in the former articles, the press merely presents opposing viewpoints as a fact, without taking any ownership over them.

21One such example is the Nader Study Group Report on Antitrust (Green 1971). The report notably militated in favor of industry deconcentration but failed to gain sufficient traction (Silk 1971).

22This is reminiscent of the recent Google Shopping case in Europe. After a particularly lengthy procedure, almost seven years, the European Commission slapped Alphabet Inc. with a record fine of €2.42 billion for unlawful abuse in relation to its Google Shopping service. See Commission Decision No. AT.39740, (Google Search (Shopping), C(2017) 4444, slip. op. (June 27, 2017). On appeal, the company is notably arguing that the Commission developed a novel theory of harm that precludes the imposition of a fine. See Google and Alphabet v. Commission, Case T-612/17 (pending case). The upshot is that by relying on broad interpretations of existing case law, antitrust authorities will routinely expose themselves to judicial challenges by sanctioned firms. Accordingly, it is difficult to meet the public’s potential demand for increased enforcement without also giving rise to drawn-out legal battles.

23One of the clearest examples is that the Commission’s Google Shopping decision does not contain a single reference to the idea of “fairness,” even though Margrethe Vestager insisted on this concept in press communications. See Commission Decision No. AT.39740, (Google Search (Shopping), C(2017) 4444, slip. op. (June 27, 2017).