Against the backdrop of solid economic performance and balanced but salient risks, Federal Reserve Chairman Jerome Powell used his comments at this year’s Jackson Hole symposium to outline the case for continuing, gradual interest rate increases (Powell 2018). A monetarist cross-check of Powell’s macroeconomic analysis, organized around the recent behavior of nominal gross domestic product (NGDP), supports his optimistic outlook and confirms the need for additional but gradual policy tightening. A reconsideration of the risks presently facing the central bank, however, highlights the further advantages that would accrue if the Federal Open Market Committee (FOMC) used a specific monetary policy rule to guide its future actions, even as it continues to confront uncertainty regarding the structural relationships through which those actions transmit their effects through the economy.

Current Monetary Conditions

Chairman Powell delivered his upbeat message at Jackson Hole with specific reference to the recent behavior of unemployment and inflation, while acknowledging the difficulty that macroeconomic theory has in reconciling the low levels of both variables with the Phillips curve, which depicts an inverse relationship between the two. NGDP growth provides another useful index of the effects that monetary policy is having on the economy. Examination of its recent trends provides another view — a cross-check that can be used to reinforce or dispel doubts raised by Powell’s more traditional, Keynesian approach.

As the sum of real GDP growth and nominal price inflation, NGDP growth conveniently captures, in a single number, the Fed’s performance in satisfying both sides of its dual mandate for maximum sustainable growth with stable prices. At the same time, however, NGDP, precisely because it is a nominal variable, measured in units of dollars, is under the central bank’s control in the long run. No one should expect the Fed to be able to hit a numerical target for NGDP growth on a quarterly or even an annual basis. But, if FOMC members are dissatisfied with the average rate of NGDP growth prevailing over a period of several years, they can always adjust their monetary policy strategies to successfully bring about whatever sustained acceleration or deceleration in nominal income growth they desire.

Moreover, the Fed’s ability to regulate the growth rate of NGDP does not depend on the stability of the Phillips curve relationship that clearly concerned Powell and is the focus on the Federal Reserve Board staff study (Erceg et al. 2018) that he referred to in his comments at Jackson Hole. Going all the way back to David Hume ([1752] 1985), economists have puzzled over the lack of stable patterns through which monetary policy actions appear to affect real variables, like output and unemployment, first, before changing nominal variables later — what Milton Friedman (1948: 254) famously called the “long and variable lags.” But, empirical studies such as Lucas (1980) and Sargent (1982) leave no doubt that, consistent with economic theory, the average growth rate of nominal variables like NGDP are satisfactorily pinned down by the central bank’s monetary policy strategy. Moreover, in the current environment, where various nonmonetary forces may well be causing the very low rate of measured unemployment to overstate the true degree of resource utilization in the U.S. economy, focusing instead on the real component of NGDP growth guards against one of the risks alluded to in Powell’s remarks: a policy stance that becomes inappropriately restrictive out of concern for inflationary pressures working through a misperceived Phillips curve.

Finally, as noted by Tobin (1983) and McCallum (1985), the equation of exchange MV = PY identifies nominal income (PY) as a measure of the money supply (M) that gets adjusted automatically for shifts in velocity (V). Thus, analyses based on the behavior of NGDP growth provide a monetarist cross-check against mainstream Keynesian approaches, like Powell’s, organized around the Phillips curve instead. According to this monetarist view, interactions between trends in M, reflecting monetary policy actions that affect the money supply, and V, interpreted following Friedman (1956) with reference to the determinants of money demand, replace those between the actual and natural rates of unemployment as the key mechanisms determining inflation.

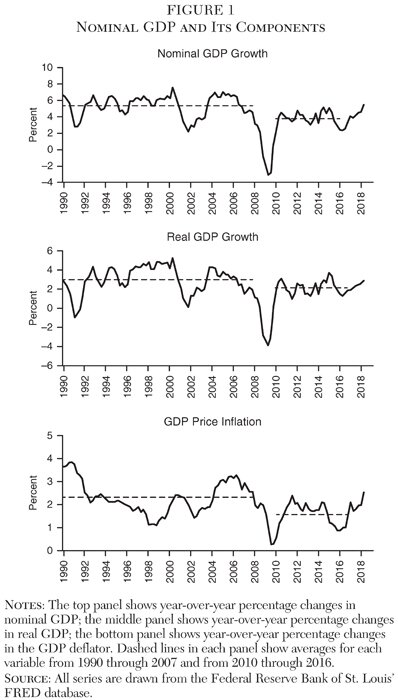

For all these reasons, it is very reassuring that a systematic look at the recent behavior of NGDP growth reinforces Chairman Powell’s positive assessment of current monetary conditions and thereby strengthens his case for additional monetary tightening. The graphs in Figure 1 update those presented in a previous SOMC position paper (Ireland 2016) focusing on shifts in NGDP growth following the financial crisis and Great Recession of 2007–09. With the most recent data appended, these graphs reveal that monetary conditions today appear quite different from how they were just two-and-a-half years ago.

To facilitate comparisons, all three panels, plotting year-over-year growth rates of NGDP, real GDP, and the GDP price deflator, also show with dashed lines the averages for each series over two distinct subperiods.1 The first, running from 1990 through 2007, establishes the precrisis normal long-run growth rate for each series. The second, running from 2010 through 2016, excludes the worst years of the crisis and recession to focus most specifically on the extended period of disappointingly slow growth and stubbornly sluggish inflation that followed.

The top panel of Figure 1 shows that average annual NGDP growth fell by 1.5 percentage points, from 5.3 to 3.8 percent, moving from the 1990–2007 period to 2010–16. This observation alone highlights that, despite holding short-term policy rates close to zero for nearly seven years, and despite expanding the size of its balance sheet massively through three rounds of large-scale asset purchases, the Federal Reserve struggled to deliver needed monetary stimulus to the U.S. economy during and after the crisis and recession.

The remaining two panels reveal that this shortfall in NGDP growth breaks down into roughly equal shares attributable to real and nominal components. Average annual real GDP growth declined from 3.0 percent, 1990–2007, to 2.2 percent, 2010–16. Perhaps this persistent slowdown in real economic growth also reflects the effects of tight monetary policy. But surely, other factors, lying well beyond the Fed’s control, including slow labor force growth brought about by demographic shifts and sluggish productivity growth caused by a slowdown in the pace of technological advancement and fiscal and regulatory disincentives for capital investment and entrepreneurship, also played a role. On the other hand, GDP price inflation declined, too, from 2.3 to 1.6 percent across the same two periods. If one accepts Friedman’s (1968b: 39) dictum that “inflation is always and everywhere a monetary phenomenon,” it is difficult to escape the conclusion that very low interest rates by themselves do not signal that monetary policy was excessively accommodative over much of the postcrisis period. To the contrary, using NGDP as a guide, it appears that monetary policy was inappropriately tight.

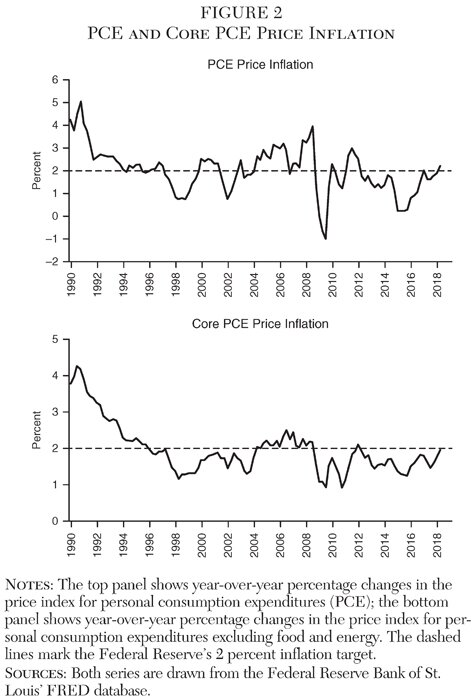

It is equally if not more striking to note, however, how much monetary and economic conditions have improved since 2016. NGDP growth, real GDP growth, and GDP price inflation have all been trending higher. Over the four quarters ending with 2018:2, NGDP grew at a 5.4 percent rate, breaking down into 2.9 percent real GDP growth and 2.5 percent GDP price inflation. These numbers resemble most closely those that regularly prevailed before the financial crisis, suggesting that, finally, U.S. economic performance is returning to normal. Similarly, Figure 2 plots year-over-year percentage changes in the price indices for personal consumption expenditures and core personal consumption expenditures, the FOMC’s preferred measures of inflation. Both have moved steadily upward over the past year, converging back to the Fed’s long-run target of 2 percent.

How can this acceleration in the growth of nominal variables be squared with the fact that since late 2015, the FOMC has gradually been raising its short-term policy rates? Partly, we are seeing once again the long and variable lags with which monetary stimulus applied in the past is finally affecting the inflation today. But, it is important to recognize, in addition, that under the Fed’s Wicksellian approach to conducting monetary policy by managing interest rates instead of the money supply, what matters is not so much the level of policy rates as the relationship between those rates and the underlying natural rate of interest. Indeed, in the New Keynesian framework on which Fed policy is based, maintaining stable prices requires the central bank to track exactly, with its interest rate decisions, underlying movements in the natural rate (see Gali 2015: 103).

As noted by Hetzel (2018), the shocks hitting the U.S. economy in 2007 and 2008 most likely pushed the natural rate of interest well below zero. Stymied by the zero lower bound on its policy rates, the FOMC struggled to deliver enough monetary accommodation. Today, by contrast, as the economy continues to gather momentum and risk aversion fades, the natural rate has almost certainly moved back into positive territory. Despite a higher federal funds rate, therefore, it is conceivable that monetary policy is more accommodative now than it was two or three years ago.

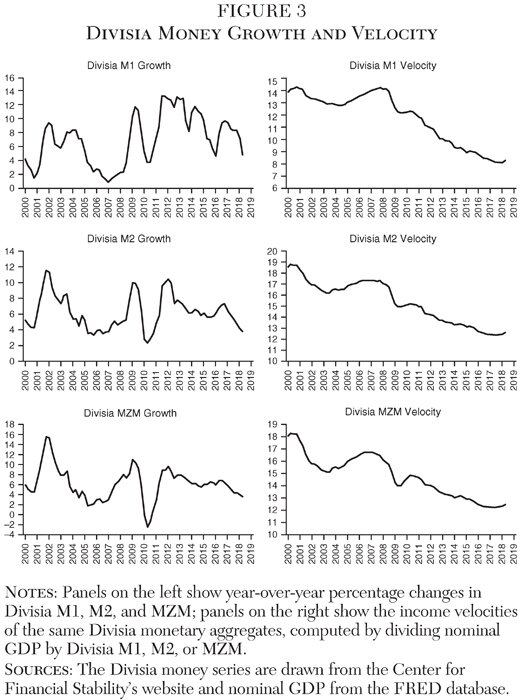

None of this is to say that the interest rate increases implemented so far have not had their desired effect of tightening monetary policy conditions, relative to the counterfactual scenario in which the FOMC had left rates near zero for an even more prolonged period of time. Figure 3 plots year-over-year growth rates in the Divisia M1, M2, and MZM monetary aggregates to show that all these measures of money growth have slowed noticeably as the Fed has raised its policy rates. Without those interest rate increases, inflationary pressures would be even stronger today.

The accompanying panels for the same figure reveal, as well, that longstanding downward trends in the velocities of the monetary aggregates have reversed over the past 12 months. This, too, is as expected. Anderson, Bordo, and Duca’s (2017) recent work on money demand attributes the previous, downward trend in velocity to three factors: declining interest rates, elevated risk aversion, and the Fed’s balance sheet expansion, which drove private funds out of government bonds and into the deposit components of broader monetary aggregates. Now, with interest rates rising, risk aversion fading, and the Fed’s balance sheet normalization well underway, that same money demand model predicts, correctly, that velocity should be on the rebound. Rising velocity implies, in turn, that to prevent nominal income growth from accelerating further, with a coincident overshoot of inflation above target, further tightening of monetary conditions is necessary.

Thus, when viewed from a monetarist perspective, economic conditions today appear as an inverse image of how they seemed as recently as 2016. Then, the Fed was still struggling to bring inflation back to 2 percent, while the disappointing growth of the real economy tipped the balance of risks to the downside, making it necessary for the FOMC to exercise extreme caution in renormalizing its policies. Now, the Fed’s biggest challenge is to scale back the degree of monetary accommodation sufficiently to avoid a costly overshoot of inflation. Fortunately, the renewed vigor of the real economy makes it easier for the Fed to refocus its attention on controlling inflation. But Chairman Powell is right: a gradual approach to raising rates seems most prudent, in light of continuing uncertainty about the exact level of the natural rate of interest, chronic instability in the Phillips curve, and above all the considerable deceleration of broad money growth that is already evident in Figure 3.

Policy Strategies for Managing Risks

As both Keynesian and monetarist analyses make clear, adjustments to the FOMC’s policy rates are needed to maintain an appropriate monetary stance as economic conditions change. This point can be difficult to communicate to households and business owners, who inevitably see higher interest rates as impacting, first and foremost, the costs of borrowing to finance purchases of homes and automobiles and to fund capital investment projects. It can be even more difficult to communicate in the political arena, since elected officials with shorter time horizons will almost always prefer faster economic growth and lower unemployment in the short run, even at the cost of higher inflation down the road.

FOMC members have resisted calls from academic economists and even from members of Congress to adopt and announce a specific rule to help guide their interest rate decisions. And yet, by following a rule, they would be helping themselves communicate more effectively. Any sensible interest rate rule, regardless of the specific weights it places on objectives for inflation on the one hand and the output gap or unemployment rate on the other, will surely imply that, with inflation so close to 2 percent, output at or above potential, and unemployment below 4 percent, short-term interest rates need to be higher than the Fed’s policy rates are today. Consistent reference to any such policy rule would help clarify, therefore, that the gradual rate increases envisioned by the FOMC are necessary, not to derail the expansion, but simply to bring policy back to where it would ordinarily be, given current economic conditions.

To be sure, the Fed and the U.S. economy face risks from all sides. Escalating trade wars, a marked deterioration of global financial conditions, or a reversal of the recent trend toward deregulation are just a few of the most obvious threats to the domestic economy, any one of which might cause the Fed to delay the additional interest rates increases that have already been discussed, or even prompt a reversal of those interest rate hikes that have already been put in place. On the other hand, inflationary pressures could build more rapidly than expected as the lingering effects of the financial crisis and Great Recession continue to fade. In that case, the FOMC might have to raise rates more quickly than presently anticipated.

But by adopting and announcing a policy rule now and making consistent reference to it as they remain on Powell’s preferred, gradual path, FOMC members would, in fact, be giving themselves more flexibility to depart from that path if economic circumstances do change in these ways or any other. The rule would help crystalize, in the public’s mind, the idea that interest rates need to change when the underlying state of the economy changes. By adhering to the rule, the Fed’s credibility would be enhanced, not threatened, when adjustments to the expected interest rate path need to be made in response to shifts in the economic outlook. Observers would then see the FOMC as raising or lowering interest rates so that policy remains consistent with well-defined and unchanging objectives, not because the Committee has become more “hawkish” or “dovish” in its dominating sentiments.

Chairman Powell correctly points out, with reference to the underlying study by Erceg et al. (2018), that the Fed’s uncertainty about the natural rates of interest and unemployment and the slope of the Phillips curve make it much more difficult to use monetary policy to fine-tune the economy. But to infer, from his comments, that because natural rates are unobservable, the best the FOMC can do is to proceed, meeting by meeting, to do whatever the majority of its members think is best leaves the Committee vulnerable to the mistakes that will inevitably occur and the criticisms that will surely follow. This is every amateur Fed watcher’s dream: to be able to sit back and wait until after the fact to explain, with full certainty, what the FOMC should have done, without having to propose a strategy of their own that works better in real time. The Fed could better protect itself, instead, by identifying a rule that acknowledges uncertainty about the workings of the economy and delivers acceptable results nonetheless. This was the lesson that Orphanides (2003) drew from his analysis of Fed policy during the Great Inflation of the 1970s, and it applies just as well today.

Finally, along these lines, it is worth recalling that the same admirable brand of Socratic ignorance that informs Powell’s comments at Jackson Hole also underlies Friedman’s (1968a: 15) case for the simplest policy rule, to stabilize the money growth rate:

We cannot predict at all accurately just what effect a particular monetary action will have on the price level and, equally important, just when it will have that effect. Attempting to control directly the price level is therefore likely to make monetary policy itself a source of economic disturbance because of false stops and starts. Perhaps, as our understanding of monetary phenomena advances, the situation will change. But at the present stage of our understanding . . . I believe that a monetary total is the best current available immediate guide or criterion for monetary policy — and I believe that it matters much less which particular total is chosen than that one be chosen.

Allan Meltzer (1995: 69) expands on Friedman’s argument to make the case for policy rules more generally:

Perhaps the best-known feature of monetarism is the recommendation that policy be conducted by following rules. Rules may be adaptive, not fixed, and can adjust in a predictable way to permanent changes in real growth or intermediation. . . . The required level of information for a successful discretionary policy — one that minimizes the uncertainty that the public must bear — is simply not available.

In doing so, Meltzer identifies the “monetarist propositions” that support his case for rules: that economic forecasts are never accurate enough to allow the central bank to smooth out fluctuations on average, that long and variable lags make it impossible to predict the timing with which or even the ultimate extent to which policy actions will affect the economy, and that the private sector operates most efficiently when policymakers remove their own actions as a source of risk and uncertainty.

Conclusion

Precisely because of — and not despite — the risks and uncertainties that are the focus of Chairman Powell’s comments at Jackson Hole, a more rule-based approach to policymaking would serve the Fed best at present. By adopting and announcing a specific monetary policy rule, the FOMC would communicate its plans more effectively, insulate itself from political pressures, protect itself from unfair ex post criticism, and remove uncertainty about its own policy actions as a source of unwanted economic volatility.

References

Anderson, R. G.; Bordo, M. D.; and Duca, J. V. (2017) “Money and Velocity during Financial Crises: From the Great Depression to the Great Recession.” Journal of Economic Dynamics and Control 81 (August): 32–49.

Erceg, C.; Hebden, J.; Kiley, M.; Lopez-Salido, D.; and Tetlow, R. (2018) “Some Implications of Uncertainty and Misperception for Monetary Policy.” Finance and Economics Discussion Series 2018-059. Washington: Board of Governors of the Federal Reserve System (August 9). Available at www.federalreserve.gov/econres/feds/files/2018059pap.pdf.

Friedman, M. (1948) “A Monetary and Fiscal Framework for Economic Stability.” American Economic Review 38 (June): 245–64.

__________ (1956) “The Quantity Theory of Money: A Restatement.” In Studies in the Quantity Theory of Money, 3–21. Chicago: University of Chicago Press.

__________ (1968a) “The Role of Monetary Policy.” American Economic Review 58 (March): 1–17.

__________ (1968b) “Inflation: Causes and Consequences.” In Dollars and Deficits, chap. 1. Englewood Cliffs, N.J.: Prentice-Hall.

Gali, J. (2015) Monetary Policy, Inflation, and the Business Cycle, 2nd ed. Princeton, N.J.: Princeton University Press.

Hetzel, R. L. (2018) “Some Like the Economy Hot: Or, Reviving the Monetarist/Keynesian Debate.” Working Paper No. 110, Johns Hopkins University, Institute for Applied Economics, Global Health, and the Study of Business Enterprise (June 25). Available at http://sites.krieger.jhu.edu/iae/files/2018/06/SAE-No.110-June-2018-Some-Like-the-Economy-Hot.pdf.

Hume, D. ([1752] 1985) “Of Money.” Reprinted in Essays: Moral, Political, and Literary, 1777 ed. Indianapolis: Liberty Fund.

Ireland, P. N. (2016) “Why Has Nominal Income Growth Been So Slow?” Position Paper, Shadow Open Market Committee (April 29). Available at http://shadowfed.org/wp-content/uploads/2016/04/IrelandSOMC-April2016.pdf.

Lucas, R. E. Jr. (1980) “Two Illustrations of the Quantity Theory of Money.” American Economic Review 70 (December): 1005–14.

McCallum, B. T. (1985) “On Consequences and Criticisms of Monetary Targeting.” Journal of Money, Credit, and Banking 17 (November, Part 2): 570–97.

Meltzer, A. H. (1995) “Monetary, Credit and (Other) Transmission Processes: A Monetarist Perspective.” Journal of Economic Perspectives 9 (Fall): 49–72.

Orphanides, A. (2003) “The Quest for Prosperity without Inflation.” Journal of Monetary Economics 50 (April): 633–63.

Powell, J. H. (2018) “Monetary Policy in a Changing Economy.” Speech given at the “Changing Market Structure and Implications for Monetary Policy” symposium sponsored by the Federal Reserve Bank of Kansas City, Jackson Hole (August 24). Available at www.federalreserve.gov/newsevents/speech/powell20180824a.htm.

Sargent, T. J. (1982) “The Ends of Four Big Inflations.” In R. E. Hall (ed.), Inflation: Causes and Effects. Chicago: University of Chicago Press.

Tobin, J. (1983) “Monetary Policy: Rules, Targets, and Shocks.” Journal of Money, Credit, and Banking 15 (November): 506–18.

1The GDP price deflator is a measure of the level of prices in a given year for domestically produced final goods and services. It is calculated as GDP deflator = (nominal GDP/real GDP) × 100.