The Fed’s lax monetary policy produced the Great Inflation of the 1960s and 1970s, which was at the heart of the interest rate spikes and losses in real estate, agricultural, and energy loans during the 1980s, which produced the banking crisis of that period. A combination of accommodative monetary policy from 2002 to 2005, alongside Fed complicity with the debasement of mortgage underwriting standards during the mortgage boom of the 2000s, and Fed failures to enforce adequate prudential regulatory standards, produced the crisis of 2007–09 (Calomiris and Haber 2014: chs. 6–8).

It is worth emphasizing that the U.S. experience with financial crises is not the global norm; according to the IMF’s database on severe banking crises, the two major U.S. banking crises since 1980 place our country within the top quintile of risky banking systems in the world—a distinction it shares with countries such as Argentina, Chad, and the Democratic Republic of Congo (Laeven and Valencia 2013,Calomiris and Haber 2014).

In his review of Fed history, Allan Meltzer (2003,2009a,2009b,2014) points to two types of deficiencies that have been primarily responsible for the Fed’s falling short of its objectives: (1) adherence to bad ideas (especially its susceptibility to intellectual fads); and (2) politicization, which has led it to purposely stray from proper objectives. Failures to achieve price stability and financial stability reflected a combination of those two deficiencies.

Unfortunately, the failures of the Fed are not merely a matter of history. Since the crisis of 2007–09, a feckless Fed has displayed an opaque and discretionary approach to monetary policy in which its stated objectives are redefined without reference to any systematic framework that could explain those changes, has utilized untested and questionable policy tools with uncertain effect, has been willing to pursue protracted fiscal (as distinct from monetary) policy actions, has grown and maintains an unprecedentedly large balance sheet that now includes a substantial fraction of the U.S. mortgage market, has been making highly inaccurate near-term economic growth forecasts for many years, and has become more subject to political influence than it has been at any time since the 1970s. The same problems that Meltzer pointed to—bad ideas and politicization—now, as before, are driving Fed policy errors. I am very concerned that these Fed errors may result, once again, in departures from price stability and financial stability (Calomiris 2017a,2017b,2017c).

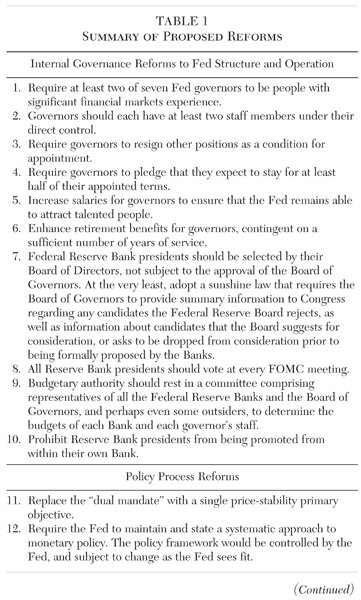

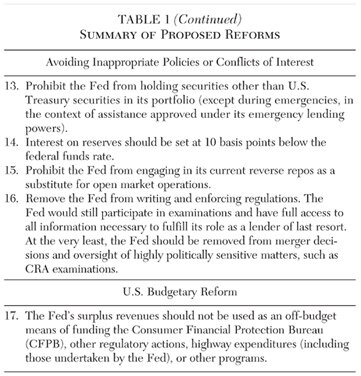

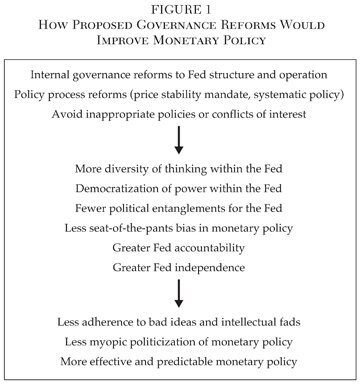

In this article, I show that the continuing susceptibility of the Fed to bad thinking and politicization reflects deeper structural problems that need to be addressed. Reforms are needed in the Fed’s internal governance, in its process for formulating and communicating its policies, and in delineating the range of activities in which it is involved. I will focus on three types of reforms that address those problems: (1) internal governance reforms that focus on the structure and operation of the Fed (which would decentralize power within the Fed and promote diversity of thinking); (2) policy process reforms that narrow the Fed’s primary mandate to price stability and that require the Fed to adopt and to disclose a systematic approach to monetary policy (which would promote transparency and accountability of the Fed, thereby making its actions wiser, clearer, and more independent); and (3) other reforms that would constrain Fed asset holdings and activities to avoid Fed involvement in actions that conflict with its monetary policy mission (which would improve monetary policy and preserve Fed independence).

Together these three sets of reforms would address the two most important recurring threats to monetary policy—short-term political pressures and susceptibility to bad ideas—and thereby improve the Fed’s ability to achieve its ultimate long-run goals of price stability and financial stability, which are crucial to promoting full employment and economic growth.Table 1 summarizes the reforms proposed here, andFigure 1 outlines the primary channels through which reforms would improve monetary policy.

The Need for Internal Governance Reforms

The Fed needs broad and fundamental changes to its internal governance. Internal governance reform should make the Fed more institutionally democratic and more diverse in its thinking. Those improvements, in turn, would make the Fed less susceptible to political pressure—because centralization of power in the chair invites more political pressures on the chair. They also would make the Fed less likely to adhere to bad ideas, because of a reduced likelihood of “group think.” My proposed changes are unlikely to have strong internal advocates within the Fed system (at the very least inside the beltway, at the Board of Governors), and therefore will require legislation. Ironically, although the Fed has been a champion of governance reform for banks as a means of improving their performance, it is much less receptive to recognizing its own governance problems.

In recent years, there has been an unhealthy increase in the centralization of power within the Fed, which has two parts: (1) the power of the Fed chair over the Federal Reserve Board; and (2) the concentration of power within the Federal Reserve System at the Board of Governors.

Daniel Thornton and David Wheelock (2014), both economists who have served for many years at the Federal Reserve Bank of St. Louis, provide some heuristic evidence on the need to reduce the power of the Fed chair over the Board of Governors. Thornton and Wheelock report that Federal Reserve Board governors have dissented from the chair only two times from 1995 to 2014. This compares to 65 dissents during the same period of time by Federal Reserve Bank presidents. Interestingly, presidents and governors had a similar pattern of dissents from 1957–95, about eight dissents per year for each group.

Surely, a well-informed and diligent group of six independent (nonchair) governors would find reason to disagree from time to time with the chair. Federal Reserve Bank presidents dissent frequently, and Supreme Court justices dissent with aplomb. Dissents remain common at the Bank of England. But somehow, Fed governors in recent years have become restrained from expressing their dissenting views.

This lack of dissent would seem strange to architects of the current Fed structure. When then-Fed chair Marriner Eccles testified before the Senate Banking Committee on March 4, 1935, regarding the proposed structure of the Federal Open Market Committee (FOMC), he complained that including only three Federal Reserve Board governors ran the risk that “a minority of the Board [of Governors] could adopt a policy that would be opposed to one favored by the majority [of the seven board members].” That argument convinced Congress to structure the FOMC to include all seven governors. Clearly, Eccles envisioned a healthy degree of potential dissent within the Board of Governors about monetary policy. That is no longer the case.

Three possible explanations emerge for this unhealthy trend toward uniformity at the Board of Governors, each of which indicates a need for reform. One possibility is that governors are selected based on their willingness to compromise and “to go along, to get along.” The chair has substantial discretionary power that can be wielded against uncooperative governors. This possibility, if true, is indicative of an unhealthy internal governance system that quashes independent thinking.

A second possibility is that many of the governors have become, de facto, short-timers who may not have a permanent stake in the system’s long-run management or performance. Why bother to dissent if you are leaving soon after arriving? If this explanation has merit, it indicates that Fed governors are not playing the role intended by the Federal Reserve Act, which entrusted them with significant authority, gave them long-term (14-year) appointments, and envisioned them as important contributors to shaping the policies of the Fed.

Finally, a third possibility is that governors may not have the information or background needed to support the formation of independent decisions. This is quite possible given that (nonchair) governors do not have any staff to support their own lines of research and inquiry, and historically their access to the Board’s staff has been limited. To the extent that limits are sometimes relaxed by the chair, this is a discretionary decision that can be reversed (and perhaps would be reversed if governors made use of staff to support positions that opposed the chair). Fed governors have complained publicly about the lack of independent staff to advise them, or the inability to speak to staff without permission. Former vice chairman Alan Blinder frequently complained about the limitations placed on his ability to communicate with Fed staff, and also complained about the “real reluctance to advance alternative points of view” at the Fed. Former governor Laurence Meyer said that he was “frustrated by the disproportionate power the chairman wielded over the FOMC,” and said that dissents were viewed as disruptive to the process of monetary policymaking (Calomiris 2014).

Not only is there a disturbing power imbalance within the Board of Governors, but also there has been a shift in power within the System toward Washington. Throughout the founding and operation of the Fed, it has always been recognized that the Board of Governors is more attuned to political pressures than the Fed presidents. The presidents, therefore, play a crucial role in deterring political influences that tend to make monetary policy myopic. The shift of power toward the Board has made it harder for Federal Reserve Bank presidents to challenge the point of view coming from the chair, and serves to politicize the Fed (e.g., through pressures applied by the administration to the chair).

One symptom of the shift of power toward Washington has been an increasingly aggressive “approval” process by the Board of Governors for nominees to be presidents of Federal Reserve Banks. The Fed Board of Governors has approval authority over the appointment of presidents, but recently they have been taking a more aggressive role in suggesting nominees and refusing to approve others. Although the discussion of this issue has been limited to those within the system—as well as journalists—recent presidential searches have purportedly resulted in the nonapproval of multiple finalist candidates put before the Federal Reserve Board by Boards of Directors of the Federal Reserve Banks.

In addition to the problems of excessive centralization of power in Washington and in the Fed chair, there has been a cultural shift at the Fed that has reduced the diversity of thinking and made the Fed more susceptible to academic fads. As recently as the 1970s, Fed governors and presidents typically were not academics steeped in the latest modeling fads of macroeconomics. But in recent years, it has become rare for governors or presidents to be people coming from backgrounds other than academia. This likely reflects several influences, including the increasing centralization of power within the system noted above, and changes in the structure of the banking industry; but it also probably reflects the increasing technical complexity of macroeconomic modeling, which many non-PhD economists find challenging to comprehend.1

The models the Fed has employed for policy purposes, however, have not proven to be of much value. The fashionable “dynamic stochastic general equilibrium” (DSGE) model, which was all the rage in Fed and academic thinking during the years leading up to the crisis, conceived of the economy as divorced from the banking sector (a sector that was not important enough to be included in the DSGE model). Needless to say, the banking crisis proved that this was an important omission. Since the 2007–09 crisis, DSGE models have been modified to try to incorporate the financial sector. Nevertheless, the consistent failure of the Fed to forecast economic growth over the past decade gives little reason for confidence in current Fed modeling.

In the past, many of the most successful Fed leaders did not put much stock in the latest fads of macroeconomic modeling. It is widely believed that Paul Volcker was the most successful Fed chair of the past several decades. In one Fed cartoon prepared for high school students, Paul Volcker is lovingly portrayed as a superhero wearing a red cape. Few would object to that characterization. Mr. Volcker’s combination of integrity, judgment, and courage stand alone:

• Integrity because—prior to his appointment—he leveled with President Carter about his intention to attack inflation aggressively.

• Judgment because he rejected the model-driven advice of some top Fed economists who adhered to “Phillips curve”–based projections; Volcker recognized that only a draconian policy change would be sufficient to establish Fed credibility in lowering inflation.

• Courage because he stayed the course despite sustained high unemployment and vilification from many academics who derided his policies—because they contradicted the received academic wisdom of the day.

If the Fed were to face a similar challenge again—and the risks associated with its balance sheet’s size and structure make that a real possibility—would someone emerge with the same combination of virtues? Sadly, the answer is perhaps not. People like Volcker—who took macroeconomic modeling with the appropriately large grain of salt, whose spine was stiffened by years in the trenches of global banking, and who deeply understood the psychology of financial markets—are unlikely to end up as leaders of today’s Fed.

That fact would not have pleased the Fed’s founders. The structure of the System, as originally conceived, and as reformed in 1935, was designed to ensure a healthy diversity of experience among its leaders. Fed leadership was supposed to combine those with experience in banking with political appointees with different life experience. Academics were absent from leadership positions, as they were not selected as political appointees until much later—Arthur Burns was the first academic to serve as chair. A system of 12 Federal Reserve Banks was intended to ensure that Fed leaders would be guided by diverse regional banking perspectives. Even at the Board, banking professionals sometimes dominated (e.g., Marriner Eccles was a Utah banker, and Paul Volcker worked at Chase when he wasn’t at the Treasury or the Fed).

Some Fed leaders I have spoken with tell me that nonacademics often lack understanding of key economic issues. That may be true, but every governor or president doesn’t have to understand statistics deeply to be able to contribute to the collective wisdom of the Fed. Sometimes the most important contribution one can make in a meeting is to question things that economists as a group accept too easily. It is worth emphasizing that group think about models has been a perennial problem at the Fed. In the 1920s–60s, it was the Riefler-Burgess “net free reserves” model; later it was the Phillips Curve; and more recently, the New Keynesian DSGE model.

Don’t get me wrong: technical modeling is necessary, but it is not helpful to fill the FOMC with people who use the same model. We need multiple models, and we need people who bring other facts and thinking to bear on economic questions. There is no better antidote to Fed group think than having FOMC members who are willing to scoff at economists’ certainties, especially if their own experiences provide credible alternative perspectives about how markets and people behave.

Promoting Democratization of Power and Diversity of Thinking within the Fed System

It is possible to construct new rules for Fed leadership that will reduce the centralization of power, enhance diversity, and reduce group-think risk.

Congress could require, for example, that at least two of the seven Fed governors be people with significant financial markets experience. Having at least two people on the Board with backgrounds in the financial industry—like Peter Fisher and Kevin Warsh—would create a critical mass of market-savvy opinion.

To further build diverse thinking at the Board, the power of the chair should be limited. For starters, to ensure that governors have access to necessary information and can act independently in their voting, governors should each have at least two staff members under their direct control, which would enable them to develop independent views.

Perhaps that reform would help to solve another problem: the short tenure of most governors. Governors’ terms are 14 years, but most leave after only two years. Before governors become fully educated to the intricacies and challenges of monetary policy, they are on their way back to the universities whence they came (to avoid losing their chaired professorships). Congress should require governors to resign their other positions, including university professorships, as a condition for appointment, and also ask them to pledge that they expect to stay on as governors for at least half of their appointed terms. Salaries for governors should also be increased to ensure that the Fed remains able to attract talented people. Part of the reason that governors return to academia so quickly is that for most of them their salaries as governors are much less than what they earn at universities. Furthermore, after two years on the FOMC, lucrative consulting and private board of directors appointments beckon. Retirement benefits for governors could also be enhanced, and made contingent on a sufficient number of years of service.

In addition to reforming the Board of Governors, Congress should increase the role of Federal Reserve Banks within the FOMC and increase their independence within the Fed System. Federal Reserve Bank presidents should be selected based on the independent decisions of their Board of Directors, and should not be subject to the approval of the Board of Governors. At the very least, if the Board of Governors is to retain its approval power, let’s adopt a sunshine law that requires it to provide summary information to Congress (which maintains all candidates’ privacy) regarding any candidates the Federal Reserve Board rejects, as well as information about candidates that the Board suggests for consideration, or asks to be dropped from consideration prior to being formally proposed by the Banks.

Congress also should change FOMC voting rules so that all Reserve Bank presidents vote at every meeting. That would promote diversity by giving more power and voice to the research staffs of the Reserve Banks. Current FOMC rules of rotation are designed to give greater weight to the Board, which effectively means the huge research staff controlled by the Fed chair.

Perhaps most important, the 12 Federal Reserve Banks should also be freed from the budgetary control of the Fed Board and its chair, who can use budgetary power (e.g., to limit the size and scope of their research activities) as a threat to gain cooperation on policy matters. For example, the Federal Reserve System could establish a committee comprising representatives of all the Federal Reserve Banks and the Board of Governors, and perhaps even some outsiders, to consider the budgets of each Bank and each governor’s staff.

It would further promote diversity of thinking if Federal Reserve Banks were prohibited from appointing Reserve Bank presidents from within their own Bank. When Federal Reserve Banks’ Boards were composed of regional banking and business leaders, Boards had a direct stake in Fed decisionmaking and presidents were selected from a broad pool of outsiders. Now, almost all Fed presidents are former Bank research economists (usually research directors). Although formal searches are always undertaken, it is hard to attract qualified outsiders to participate in that process when they know that the internal candidate has the inside track, based on his or her relationship with the Board, and even if they do participate, risk-averse Boards often prefer the devil they know to the one they don’t. The result is unhealthy inbreeding.

Policy Process Reforms: A Primary Price-Stability Mandate and Systematic Policy

The internal governance reforms outlined above must be supplemented with policy process reforms that ensure the right kind of accountability for the Fed by improving policy transparency, constraining unaccountable discretion, and discouraging politicization of monetary policy. Fed history shows that some of the Fed’s worst errors were the result of the wrong kind of accountability. As Allan Meltzer’s (2003,2009a,2009b,2014) work shows, including his three volume History of the Federal Reserve, Fed failures often have reflected political pressures on the Fed to accommodate deficits, or an excessive focus on short-term unemployment goals (with an eye to upcoming elections) at the expense of long-term inflation and unemployment goals. An important safeguard against monetary policy errors, therefore, is to promote greater independence of the Fed.

Paradoxically, unlimited Fed discretion does not result in greater independence of action because unlimited discretion invites political interference. Fed independence is best achieved by imposing discipline on the process of monetary policy in a way that sets clear objectives for policy and enhances accountability with respect to achieving those objectives.

The most obvious policy process improvement would be to repeal the “dual mandate” imposed on the Fed in the 1970s and replace it with a single primary price-stability mandate, as Paul Volcker and Alan Greenspan, among many others, have publicly championed.2 The sole primary objective of price stability is embodied in many other central banks’ charters, including those of the European Central Bank and the Bank of England. There are three arguments for adopting this policy in the United States.

First, price stability is an achievable long-run objective, and thus the Fed can be held accountable for achieving it. Indeed, long-run inflation is completely under its control. The Fed has a monopoly over the supply of currency. Inflation is the (inverse of the) value of money; if you control its supply, you control its value. Unpredictable short-term changes in demand and measurement problems make this hard to do on a short-term basis, but over sufficient time the Fed can control inflation. In contrast, the Fed cannot be held accountable for achieving a given unemployment target in the long run; indeed, economists agree that the long-run rate of unemployment is the result of factors outside of the control of the Fed.

Second, inflation matters for growth. High levels of inflation, or volatile inflation, result in lower output and higher unemployment in the long run. As Milton Friedman and many others correctly argued for many years, the reason to target price stability is not that we care about price stability per se (no one should), but rather because we care about employment and output; by making price stability the primary long-run objective of the Fed we ensure that the average levels of output and employment will be maximized in the long run. Paradoxically, the point of narrowing the Fed’s long-term mandate to inflation is to boost average employment.

Third, narrowing the Fed’s primary mandate protects it from myopic political pressures that are inherent in any democracy. Elections can lead politicians to pressure the monetary authority to make the wrong tradeoffs, such as boosting output today (in the interest of current voters) at the expense of higher inflation and lower output tomorrow (at the expense of future voters). Giving the Fed a narrow price stability primary objective provides cover for the Fed in defending itself against opportunistic attacks. Complicating monetary policy by introducing multiple goals (unemployment alongside price stability) makes it hard to hold the Fed accountable for its actions in the long run, while encouraging political pressures on the Fed to achieve an amorphous employment objective. I believe that the Fed’s risky QE3 program of purchasing mortgage-backed securities (MBS) and long-term Treasury bonds in an effort to demonstrate its commitment to reducing unemployment (which had very little effect in boosting employment) is an example, among many, of how such myopic political pressures can distort monetary policy.

The call for a single price-stability mandate is often misunderstood as reflecting a callous lack of interest in unemployment, but the opposite is the case. Economic studies have shown that in the long run there is no tradeoff between price stability and maximum employment; it follows that a single primary long-run commitment to price stability in no way requires a tradeoff of lower employment. Holding the Fed primarily to account for price stability does not preclude it from supporting the economy during slumps with countercyclical policy over the short or medium terms, as a secondary objective. Indeed, the Taylor Rule is an example of a policy that is consistent with both meeting a long-run inflation target and providing countercyclical influence. There is no doubt that a Fed with a single inflation mandate would continue to execute countercyclical policy aggressively. However, making price stability its sole primary objective ensures maximum sustainable growth and employment over the long run, while defending the independence of the Fed from short-term political pressures.

In addition to narrowing the Fed’s primary mandate to price stability, it would also enhance accountability and independence to require the Fed to maintain a systematic approach to monetary policy. This is crucial for two reasons: First, systematic policy defends against the dangers of discretionary, seat-of-the-pants policymaking that is susceptible to biases and socio-political pressures. One of the most important seat-of-the-pants biases is “dynamic inconsistency.” As academics and Fed researchers have long recognized, a non-rule-based monetary policy will tend to err both with respect to hitting its inflation target and with respect to optimally stabilizing the economy over the business cycle. These twin seat-of-the-pants biases are sometimes referred to as “inflation bias” and “stabilization bias” (see, for example,Faust and Henderson 2004), and are part of a long tradition in monetary policy research emphasizing the social welfare improvements that come from adherence to long-term commitments by the monetary policy authority (e.g.,Friedman 1948,1959,1968;Phelps 1968,1972;Kydland and Prescott 1977;Orphanides 2003a,2003b). Systematic rule-based policy is key to avoiding undue focus on the short term at a long-term cost to society.

Second, because businesses and households take decisions that depend on expectations about the future, including future policy decisions and their economic consequences, a systematic policy framework that makes monetary policy more predictable facilitates better private-sector decisions over time and enhances social welfare.

What constitutes systematic monetary policy? Clearly, not the status quo, which delegates monetary policy to Fed policymakers with broad mandates and allows these policymakers to employ unconstrained judgment in meeting those mandates.

Over its first century of operation, however, the Fed sometimes acted relatively systematically. Variation in the quality of Fed policymaking over time reflects, in part, variation in the degree to which policy was systematic and oriented toward clear long-term objectives. One reason for this diversity in outcomes over different periods is the immense discretionary power that the Federal Reserve has exercised over time in interpreting its mandate and in deciding monetary policy, as well as the lack of any effective oversight of the monetary policy process. Recognizing that appointed policymakers are humans and are susceptible to all the pressures and biases that humans face, reform legislation can play a crucial role in giving monetary policy a clear long-term focus and forcing it to implement a systematic policy process. Policy so conceived would be more predictable and less susceptible to fads, to short-term seat-of-the-pants biases, and to myopic political influences.

Does a systematic approach to monetary policy imply adherence to a rigid, static rule? If economists had a perfect understanding of the economy and the ability to observe and properly interpret shocks, and if the structure of the economy were unchanging, then monetary policy could be guided by a fixed policy rule that would specify how the Fed would react to observed shocks to maintain price stability and smooth the business cycle. But that is not a realistic vision of what systematic monetary policy would mean in the real world of changing economic structure and imperfect economic understanding.

Economists always have an incomplete understanding of the economy and face limitations in observing and interpreting shocks hitting the economy in real time, when policy decisions counteracting potential adverse effects of various shocks have to be made. As a result, there are divergent views and considerable uncertainty regarding precisely what the best monetary policy response to macroeconomic conditions may be. Furthermore, as the structure of the economy evolves over time, any algebraic rule characterizing the appropriate policy response to macroeconomic factors will have to adapt to changing circumstances. In addition, policymakers learn over time, and their understanding of appropriate policy responses, therefore, is also subject to change even if the structure of the economy is not changing.

The limitations introduced by these sources of uncertainty have been used by some to justify relying on policymakers’ “best judgment” with unlimited discretion. That is a fatuous argument. So long as the systematic formulation of monetary policy is flexible and able to adapt to changes in the economy’s structure and our understanding, uncertainty cannot justify the resistance to making policy systematic.

This point bears emphasis: the adoption of a simple, but flexible, monetary policy rule is clearly desirable because it can tackle uncertainty about the economy while avoiding the adverse consequences of unlimited discretion.

Let me be clear: a policy rule must be a specific algebraic formula that can be used to determine how monetary policy should respond to changes in macroeconomic conditions, as summarized by specific observable variables such as the current inflation and unemployment rates. By its very nature, such a policy rule ensures that policy is systematic, transparent, and accountable. If well designed (based on existing empirical evidence), the policy rule will also deliver good economic performance. Research with estimated models of the U.S. economy over the past few decades suggests that simple policy rules can be designed that would deliver good economic performance. Of course, there is reasonable disagreement about what the best rule would be, and care is required both in the evaluation of alternative policy rules and in their implementation. Sifting through this evidence and reaching appropriate judgments about which rule to apply, and adapting the rule over time as needed, should be the central functions of any monetary policy authority.

Taylor (2016) discusses recent progress in the evaluation of macroeconomic models, like those that would form the basis for the evolving Fed policy rule. Two important characteristics of the model evaluation process are noteworthy. First, models must be developed in what Taylor calls the “rules space” rather than the “path space.” Models in path space conceive of policy as the execution of isolated, hypothetical one-time policy actions. Models in rules space evaluate alternative policy rules in a framework in which policy actions occur within the context of the rules that produce them. Not only are rules-space models the only coherent approach to model the effects of policy on the economy (because, for example, they take account of expectations that are influenced by the existence of the rule), they are also ideally suited to inform an FOMC that is charged with developing and constantly improving its explicit monetary rule. Second, the model evaluation process must identify common performance criteria that would be used to evaluate the relative validity of a diverse range of models. Volker Wieland’s pioneering efforts to develop “The Macroeconomic Model Data Base” (seewww.macromodelbase.com) shows that this is possible (seeWieland et al. 2016). Wieland’s website invites all comers to propose models, and provides a platform in which they can be compared, debated, and verified empirically. An FOMC charged to follow and disclose its systematic approach to monetary policy could benefit from making use of just such a website. And a Fed structured to encourage diverse thinking would make effective use of it.

One might ask whether a flexible policy rule could be an effective constraint on unbridled discretion. After all, the FOMC would be free to change its rule at every meeting. Yes, it would, but it would have to do so as a committee, reaching agreement on the changes needed, and embodying those beliefs in observable parameter changes that outsiders could challenge. Outside opinions about the quality of FOMC deliberations and decisions about its rule would be a source of accountability, including at Congressional hearings, and the FOMC would have reason to care about its reputation as a crafter of empirically defensible rules.

To help fix ideas about how FOMC discussions would be likely to proceed, consider an example policy rule for the federal funds rate, f, based on the well-known Taylor (1993) rule:

(1)f = r![]() + π + a (π − 2) − b (u − u

+ π + a (π − 2) − b (u − u![]() )

)

This rule suggests that when the inflation rate equals the 2 percent target and the unemployment rate equals the natural rate of unemployment, u![]() , monetary policy should be neutral, that is, the federal funds rate should be equal to the sum of the real natural rate of interest, r

, monetary policy should be neutral, that is, the federal funds rate should be equal to the sum of the real natural rate of interest, r![]() , and the inflation target. If inflation is above the target, then policy should be tighter, with the degree of the policy response depending on the parameter a (in Taylor’s original formulation this was equal to 0.5). If the unemployment rate is above the natural rate of unemployment, as is typically observed in recessions, monetary policy should be eased, with the response governed by the parameter b. Considering different values for the parameters a and b is a simple way to see that care is required to ensure that a policy rule, if followed, will contribute to good economic outcomes over time. If b is set to zero, this rule does not respond at all to employment conditions and may lead to undesirable volatility in unemployment. If b is set to a very high value, say 10, this rule becomes very activist and may result in undesirable instability in both inflation and unemployment. Choosing parameters that would deliver the best macroeconomic performance depends on one’s beliefs about the economy. Alternative estimated models typically suggest somewhat different values for the parameters that work best.

, and the inflation target. If inflation is above the target, then policy should be tighter, with the degree of the policy response depending on the parameter a (in Taylor’s original formulation this was equal to 0.5). If the unemployment rate is above the natural rate of unemployment, as is typically observed in recessions, monetary policy should be eased, with the response governed by the parameter b. Considering different values for the parameters a and b is a simple way to see that care is required to ensure that a policy rule, if followed, will contribute to good economic outcomes over time. If b is set to zero, this rule does not respond at all to employment conditions and may lead to undesirable volatility in unemployment. If b is set to a very high value, say 10, this rule becomes very activist and may result in undesirable instability in both inflation and unemployment. Choosing parameters that would deliver the best macroeconomic performance depends on one’s beliefs about the economy. Alternative estimated models typically suggest somewhat different values for the parameters that work best.

The Taylor-type rule above also highlights an important issue relating to the natural rate of unemployment and the natural rate of interest. These concepts are unobservable and are typically estimated. However, estimates are uncertain and may vary considerably both over time and due to differences in estimation methodologies. Using a Taylor-type rule with the wrong estimates of the natural rates introduces a bias that results in deviations from price stability. As an example, the original formulation of the Taylor rule was based on the assumption that the natural rate of interest is 2 percent. Some analysts, including Federal Reserve officials, presently suggest that their preferred current estimates of the natural rate of interest are zero or even negative. The same policy rule with these two alternative assumptions would give policy prescriptions from the Taylor rule that would differ by 200 basis points or more.

I emphasize, however, that such disagreements about hard-to-measure concepts like the natural rate of interest are not insurmountable obstacles to agreeing on a rule. Indeed, alternative policy rules could be specified that do not depend on estimates of the natural rates to set policy and are therefore not subject to related uncertainty. For example, a rule might employ the values of the federal funds rate and the unemployment rate in the previous quarter, f−1 and u−1.

(2) f = f−1 + a (π − 2) − b (u − u−1)

Compared to the Taylor rule, this rule suggests that the federal funds rate should be raised (relative to its value a quarter earlier) if inflation is above the target and should be reduced if the unemployment rate is higher than it was in the previous quarter.

Simple rules, based on the examples above, can also make use of forecasts of economic activity and inflation. Indeed, there are many reasonable candidates for a simple policy rule. A critical issue in determining which rule the monetary authority should adopt among the many alternatives is how robust the rule is to the various sources of uncertainty and potential error. In a committee setting, such as the FOMC, there may be differences of opinion about what is the appropriate way to think about the U.S. economy that may not be possible to distinguish on the basis of available empirical evidence.

A reasonable criterion for designing a simple rule for the Federal Reserve would be the robustness of the rule to reasonable alternative models. This is how policy ought to be designed to defend against major inference errors in an environment of uncertainty.

Requiring the Fed to identify and adopt a policy rule along the lines highlighted above would replace meeting-by-meeting discretion and thus ensure that the harmful consequences of seat-of-the-pants policy are avoided. But as I have noted, given the complexity and continuous change of the economy, it would not be expected that any simple algebraic formula could be the basis for robust policymaking forever.

The goal in making monetary policy systematic is not to replace discretionary policy with an immutable rule, but rather to replace it with a systematic framework for selecting a simple and robust rule that foresees periodic reviews and adaptation. Nor would this process of discussing and disclosing come as an unprecedented innovation within the Fed. Publication of the simple rule that the FOMC would follow has a precedent in the Fed’s current publication of principles regarding its longer-run goals, which the FOMC has been publishing every January since 2012. As the FOMC adapts its rule over time, to ensure that best practices prevail in the evaluation process, it would be important that a high degree of transparency accompany the process of evaluation of alternative rules and any adaptations under consideration.

Crucially, the selected rule should be specified with sufficient detail to hold the FOMC accountable and eliminate meeting-by-meeting discretion. An outside observer should be able to determine the meeting-by-meeting setting of policy using only public information. If the rule’s implementation requires use of unobserved concepts that may vary from quarter to quarter, such as the natural rate of interest, then the methodology for tracking those changes over time should be made explicit so that it could be replicated with public information. Similarly, if the rule employs short-term projections of inflation, these projections should be in line with those available to the public. In other words, unaccountable discretion should not be introduced through the back door, for example by using a simple rule that responds to inflation projections based on policymakers’ “judgment” that cannot be independently reproduced and evaluated.

Because no simple rule can encompass satisfactorily crisis situations that might require a rapid policy response, an escape clause should be included that allows policy to deviate from the simple rule. In the past few decades, a few instances could be identified, perhaps once every decade or two, when a deviation from a simple rule could be necessary. To cover such contingencies, a comply-or-explain approach should be adopted, with the understanding that deviations are rare and related explicitly to crisis circumstances.

Providing the Fed with a single primary mandate of price stability and requiring it to maintain a systematic, flexible approach to policy are reforms that are long overdue. Several senior Fed policymakers recently mischaracterized the current legislative proposal (U.S. House of Representatives 2016) to require monetary policy to be systematic as dictating an immutable rule, such as the Taylor Rule, to the Fed. This is disingenuous. My understanding of the current proposed legislation is that it conforms to the proposal I lay out here: the Fed would determine its own policy rule, which would be subject to its decisions to alter the rule over time, and in emergency circumstances the Fed would not be rigidly bound to adhere to its stated framework.

The methodology and expertise necessary for the Federal Reserve to adopt a simple and robust policy rule that can preserve price stability and deliver good stabilization performance are available. Requiring a systematic approach will have a constructive effect on the substance of FOMC deliberations and their information content for outside observers, by encouraging much of the debate to focus on whether to revise the existing framework, and how to do so. This will make monetary policy more predictable, more understandable to the market, more accountable to Congress, and more independent of myopic political pressure. Given the undisputed benefits of avoiding seat-of-the-pants policymaking, preserving the Fed’s unlimited discretionary approach cannot be reasonably defended.

Limits on Fed Activities and Holdings

There are major problems that arise from combining monetary policy with other functions and powers. Most obviously, a systematic rule for monetary policy may mean little if it is only one of many things that the monetary policy authority is doing. Unaccountable discretion could arrive through the back door of other policies and undermine the commitment to systematic policy. And those other policies, because they would not be subject to the discipline of systematic thinking and accountability, would invite myopic political influence. Furthermore, other mandates on the Fed related to regulatory policy, or its own financial interests, may conflict with its role as a monetary policy authority.

These are not hypothetical problems. The Fed’s current fiscal and regulatory policy actions give it many policy levers other than those related to traditional monetary policy. Without reforms that limit Fed actions and holdings, even if the internal governance and policy process reforms suggested above were implemented, the Fed would continue to suffer from conflicts of interest and politicization risk that could encourage it to choose inferior monetary policy rules, or to undermine the effects of its systematic monetary policy rule with other actions. Additional reforms, therefore, are needed to avoid the conflicts and politicization that result from the current multiple roles, powers, and instruments of the Fed.

The Fed’s powers and toolkit have grown since the crisis of 2007–09. One of the most remarkable aspects of Dodd-Frank was the confidence it evinced in the Fed. The Office of Thrift Supervision was abolished after the 2007–08 crisis in response to its perceived incompetence. But Dodd-Frank enhanced the supervisory and regulatory powers of the Fed (which was a primary regulator of several of the most deeply troubled banks, including Citi and Wachovia).

That enhancement of Fed power was all the more remarkable when one considers that in March 2008, the U.S. Treasury circulated a “blueprint” explaining why it would be desirable to redesign the U.S. financial regulatory structure along functional lines. That change also would have reduced the conflicts of interest inherent in exercising of monetary policy and regulatory authority by removing many supervisory and regulatory powers from the Fed (Calomiris 2006,2013). Under the “blueprint,” the Fed would continue playing a key role in examinations, with full access to information that might be useful to it in its capacity as lender of last resort, but it would not play a central role in the rule setting or supervision of banks. The “blueprint” was put aside after the crisis, which largely reflected the skill of Fed advocates (especially Chairman Bernanke) in convincing Congress that the Fed was the most able and trustworthy party in which to vest many of the new regulatory powers created by Dodd-Frank.

Since the crisis, as the Fed’s powers have grown, so have its conflicts of interest. In particular, monetary policy experimentation has involved the Fed as a direct participant in financial markets in unprecedented ways. As of February 22, 2017, the Fed holds $1.8 trillion dollars in MBS on its balance sheet (which amounts to roughly one-sixth of the U.S. mortgage market), reflecting the Fed’s new role in spurring the economy by subsidizing mortgage finance costs. It is noteworthy that this new fiscal policy role of the Fed was not primarily the result of crisis support, but rather of Fed purchases of mortgage-backed securities as part of its “quantitative easing” experiments.

Many critics regard this as an inappropriate incursion into fiscal policy by the Fed. It also creates numerous conflicts of interest with respect to the Fed’s role as a regulator of banks. As a holder of MBS, the Fed has an incentive to avoid actions that might increase mortgage interest rates, even if that would be desirable as a matter of monetary policy. This is true for two reasons. First, any accounting losses on its MBS portfolio would increase the Fed’s contribution to the measured deficit, with obvious adverse political ramifications.3 Second, housing finance is a magnet for political interests, which implies severe continuing pressures on the Fed not to sell its mortgage portfolio, even if failing to do so serves to prop up a destabilizing housing bubble.

The Fed also sets interest rates banks earn on reserves. The Fed apparently intends to use this tool to potentially offer very high interest rates, if necessary, to dissuade banks from lending, as an alternative to selling its portfolio (and recognizing politically unappealing capital losses when doing so). Although Title II, Sec. 201, of the Financial Services Regulatory Relief Act of 2006, which authorized the payment of interest on reserves, clearly limited Fed discretion in setting interest payments by specifying that “balances maintained at a Federal Reserve Bank . . . may receive earnings . . . at a rate or rates not to exceed the general level of short-term interest rates,” the Fed appears to intend to side-step this legislative limit by creating a “range” of targeted values, with the interest on reserves expected to lie at the top of the specified range, and by reserving its right to “adjust the interest on excess reserves rate . . . as necessary for appropriate monetary control, based on policymakers’ assessments of the efficacy and costs of their tools.”4 Some politicians have already challenged the Fed to explain why it is appropriate for it to pay above-market rates on bank reserves. Clearly, this is a fiscal expenditure, just as paying zero interest is the commonly understood “reserve tax.” It is inappropriate for the Fed to make fiscal decisions about the taxes or subsidies transferred from the government to banks, and it is doubly inappropriate, given the Fed’s role as a bank regulator.

Not only do the Fed’s holdings of MBS and its setting of interest on reserves entail new fiscal actions and politicization risks, but also the Fed now acts as a repo counterparty, and will do so increasingly over time. This new activity (like setting interest on reserves) appeals to the Fed because it provides the Fed a means for avoiding the politically embarrassing recognition of capital losses that it would otherwise incur if it sold long-duration securities into the market as interest rates rise. Rather than sell securities from its portfolio to contract its balance sheet, the Fed engages in reverse repos, repeatedly lending those securities into the market until they mature, and thus avoiding sale while effectively reducing its balance sheet size.

Over the past several decades, repo has been an important alternative source of funding for lending in the U.S. economy, by both regulated banks and nonbank lenders. The massive expansion of the Fed’s balance sheet over the past decade has withdrawn a large amount of low-risk collateral from the market, thereby making repo funding of loans and other financial transactions harder to arrange.

Furthermore, the Fed’s imposition of the Supplementary Leverage Ratio (SLR) requirement has also reduced the supply of repo funding. This policy was announced in late 2012 and became effective in 2013. It includes the quantity of repos (and other items) in the regulatory measure of leverage. In effect, including repo in the SLR means that repo funding is more costly to banks that use it as a source of funding. Allahrakha, Cetina, and Munyan (2016) find that this new requirement significantly increased the cost of repo finance for regulated U.S. institutions.

The Fed’s dual role as regulator and repo counterparty raises important and disturbing questions about a new conflict of interest. As a repo counter-party, the Fed benefits financially from imposing the Supplementary Leverage Ratio, which reduces competitors’ abilities to transact in repo. Might the Fed have taken into account its own financial benefits from being able to engage in reverse repo on more favorable terms when setting regulations for its competitors?

When the Fed began contemplating its reverse repo tool (as a means to avoid sales of securities), it was already cognizant that it might want to engage in a large number of such transactions to avoid the political consequences of suffering losses on securities sales and thereby being perceived as contributing to government deficits. I do not claim to know whether the Fed’s new SLR rule was motivated in part by a desire to improve its own competitive position in the repo market, but the coincidence in timing between the SLR rule and the Fed’s entry into the repo market is disturbing, and there is no question that the Fed suffers a conflict of interest from being both a repo counter-party and a repo regulator.

These conflicts of interest are nothing new. The Fed’s regulatory power has long been a lightning rod for politicization, which has often placed the Fed at the center of highly contentious power struggles, often with disastrous consequences for both the economy and the Fed’s independence. There are many examples, but the most obvious one has been the Federal Reserve Board’s role as the arbiter of bank mergers in the last three decades. The Fed was given that role precisely because it could be counted upon to go along with an ill-conceived government policy, which designed the merger approval process to be a source of rent creation for merging mega banks in the 1990s, and ensured that those rents would be shared between merging banks and urban activist groups, which were given power to influence the merger approval process.

According to Fed officials with whom I have spoken, fears of possible congressional or administrative reprisals against the Fed that might have threatened its monetary policy actions were a major part of the explanation for the Fed’s willing participation in this farce. As Stephen Haber and I show in our book, Fragile by Design: The Political Origins of Banking Crises and Scarce Credit, Fed bank merger hearings focused on the testimony of activist groups about whether the merging banks were “good citizens,” a trait that was measured by the amount of loans and grants the merging banks had contractually promised to give the activists as the quid pro quo for their testimony. Those contractual promises exceeded $850 billion from 1992 to 2006. The Fed’s role in overseeing these unseemly political bargains not only lessened the Fed as an institution, but also helped to precipitate the risky mortgage lending that was at the heart of the recent subprime crisis.

The destabilizing debasement of mortgage standards and prudential bank regulatory standards—which were part and parcel of the political deal the Fed oversaw through its merger powers—profoundly contributed to the financial crisis of 2007–09. If the Fed had not been given the authority to approve mergers and set prudential capital standards, and if merger approval and prudential standards had been based on clear rules enforced by an independent regulatory body, then the subprime crisis might have been avoided, or at least substantially mitigated.

Removing the Fed from its regulatory role would not in any way prevent the Fed from examining banks and pursuing all the related supervisory functions that are necessary to a central bank’s lending function. Examination powers and some continued shared supervisory authority should be preserved. But there is no reason for the central bank to determine merger policy, whether banks should be permitted to act as real estate brokers, or other matters unrelated to central banking. And allocating that decisionmaking to the Fed does positive harm by putting the Fed in the line of fire with respect to highly charged political battles, which often results in inferior regulatory decisions and jeopardizes independent monetary policy.

Four reforms would avoid most of the problems that stem from combining the Fed’s monetary policy authority with its other authorities and powers. First, the Fed should not hold securities other than U.S. Treasury securities in its portfolio (except briefly in the context of assistance approved under its emergency lending powers).5 Second, rather than permit the Fed to set the interest rate paid on reserves, interest on reserves should be fixed at 10 basis points below the federal funds rate. Third, the Fed should be prohibited from competing with other intermediaries in the repo market. Fourth, the 2008 Treasury “blueprint” provided a thoughtful vision of how to reorganize the administration of financial regulation. Avoiding duplication of effort by consolidating regulatory functions (not only in banking, but also by creating a federal charter for insurance companies) is long overdue. This approach also would remove the Fed from the job of writing and enforcing regulations, which would free monetary policy from the conflicts that arise when it is combined with those tasks. The Fed would still participate in examinations and have full access to all information necessary to fulfill its role as a lender of last resort, as envisioned under the Treasury blueprint. At the very least, the Fed should be removed from merger decisions and oversight of highly politically sensitive matters, such as Community Reinvestment Act examinations.

Conclusion

Table 1 summarizes the three sets of reforms proposed in this testimony: internal governance reforms, policy process reforms, and limits on Fed asset holdings and activities. Together these proposed reforms would provide a new approach to governing monetary policy, which would result in better monetary policy decision-making than we have witnessed in the troubled first century of the Fed’s history (through the channels of influence summarized inFigure 1). A central bank that operates as a more democratic institution, is able to benefit from more diverse thinking, is required to follow transparent and systematic policy actions in pursuit of achievable objectives, is held accountable for its actions, and is freed from myopic political pressures and less conflicted by non-monetary policy mandates and tools would be much more likely to achieve the proper objectives of monetary policy.

There are practical political considerations that make 2018 an ideal time to push forward on needed reforms. A majority of Republicans have long favored many of the reforms listed here, but they have not been able to gain sufficient support from enough Democrats to enact policy reforms. Over the next two years, all seven Fed governors may be appointed by President Trump and confirmed by a Republican-majority Senate. It seems likely that many Democrats who have opposed Fed reforms in the past now may find it appealing to support measures that would make Fed policymaking more systematic, more receptive to diverse viewpoints, and more immune to political influences.

There is another reform relating to the Fed that should also be implemented, which does not fit into any of the categories discussed above. The Fed’s surplus revenues should not be used as an off-budget means of funding the Consumer Financial Protection Bureau, other regulatory activities (including those undertaken by the Fed itself), highway expenditures, or other programs. Those practices undermine honest government budgetary accounting and discipline. If the U.S. government wants to be taken seriously as an instrument of monetary reform, it must also be willing to subject itself to honest accounting.

References

Allahrakha, M.; Cetina, J.; and Munyan, B. (2016) “Supplementary Leverage Ratio and Repo Supply.” Working Paper, Office of Financial Research, U.S. Treasury.

Calomiris, C. W. (2006) “Alan Greenspan’s Legacy: An Early Look: The Regulatory Record of the Greenspan Fed.” American Economic Association Papers and Proceedings 96 (2): 170–73.

______ (2013) “How to Promote Fed Independence: Perspectives from Political Economy and History.” Working paper, Columbia University (March).

______ (2014) “Diversity Now.” The International Economy (Winter): 46–49, 83.

______ (2017a) Reforming Financial Regulation. Manhattan Institute.

______ (2017b) “Taming the Two 800 Pound Gorillas in the Room.” In R. Bliss and D. Evanoff (eds.) Public Policy and Financial Economics, forthcoming.

______ (2017c) “The Microeconomic Perils of Monetary Policy Experiments.” Cato Journal 37 (1): 1–15.

Calomiris, C. W., and Haber, S. H. (2014) Fragile By Design: The Political Origins of Banking Crises and Scarce Credit. Princeton, N. J.: Princeton University Press.

Calomiris, C. W.; Holtz-Eakin, D.; Hubbard, R. G.; Meltzer, A. H.; and Scott, H. (2017) “Establishing Credible Rules for Fed Emergency Lending.” Journal of Financial Economic Policy 9 (3): 260–67.

Eccles, M. (1935) “Testimony of Governor Marriner Eccles of the Federal Reserve Board on Banking.” Hearings before the Senate Committee on Banking and Currency, 74th Congress, 1st Session (March 4): 179 ff.

Faust, J., and Henderson, D. W. (2004) “Is Inflation Targeting Best-Practice Monetary Policy?” International Finance Discussion Paper No. 807 (May). Federal Reserve Board.

Friedman, M. (1948) “A Monetary and Fiscal Program for Economic Stability.” American Economic Review 38 (3): 245–64.

______ (1959) A Program for Monetary Stability. New York: Fordham University Press.

______ (1968) “The Role of Monetary Policy.” American Economic Review 58 (1): 1–17.

Kydland, F., and Prescott, E. (1977) “Rules Rather Than Discretion: The Inconsistency of Optimal Plans.” Journal of Political Economy 85 (3): 473–91.

Laeven, L., and Valencia, F. (2013) “Systemic Banking Crises Database.” IMF Economic Review 61 (2): 225–70.

Meltzer, A. H. (2003) A History of the Federal Reserve, Volume 1. Chicago: University of Chicago Press.

______ (2009a) A History of the Federal Reserve, Volume 2, Book 1. Chicago: University of Chicago Press.

______ (2009b) A History of the Federal Reserve, Volume 2, Book 2. Chicago: University of Chicago Press.

______ (2014) “Current Lessons from the Past: How the Fed Repeats Its History.” Cato Journal 34 (3): 519–39.

Orphanides, A. (2003a) “Monetary Policy Evaluation with Noisy Information.” Journal of Monetary Economics 50 (3): 605–31.

______ (2003b) “The Quest for Prosperity without Inflation.” Journal of Monetary Economics 50 (3): 633–63.

Phelps, E. S. (1968) “Money-Wage Dynamics and Labor-Market Equilibrium.” Journal of Political Economy 76 (4): 678–711.

______ (1972) Inflation Policy and Unemployment Theory. London: Macmillan.

Plosser, C. I. (2017) “Why the Fed Should Own Only Treasuries.” Defining Ideas (June 10). Available athttp://www.hoover.org/research/why-fed-should-only-own-treasuries.

Taylor, J. B. (1993) “Discretion versus Policy Rules in Practice.” Carnegie-Rochester Series on Public Policy 39: 195–214.

______ (2016) “Central Bank Models: Lessons from the Past and Ideas for the Future.” Keynote presentation at the workshop, “Central Bank Models: The Next Generation,” Bank of Canada (November 17).

Thornton, D. L., and Wheelock, D. C. (2014) “Making Sense of Dissents: A History of FOMC Dissents.” Federal Reserve Bank of St. Louis Review 96 (3): 213–27. Available atresearch.stlouisfed.org/publications/review/2014/q3/thornton.pdf.

U.S. Department of the Treasury (2008) “The Department of the Treasury Blueprint for a Modernized Financial Regulatory Structure” (March). Available atwww.treasury.gov/press-center/press-releases/Documents/Blueprint.pdf.

U.S. House of Representatives Committee on Financial Services (2016) “The Financial CHOICE Act: Creating Hope and Opportunity for Investors, Consumers, and Entrepreneurs: A Republican Proposal to Reform the Financial Regulatory System” (June 23). Available atfinancialservices.house.gov/uploadedfiles/financial_choice_act_comprehensive_outline.pdf.

Wieland, V.; Afanasyeva, E.; Kuete, M.; and Yoom, J. (2016) “New Methods for Macro-Financial Model Comparison and Policy Analysis.” In J. B. Taylor and H. Uhlig (eds.) Handbook of Macroeconomics, Volume 2. Amsterdam: Elsevier.

1The rise of nationwide branch banking in the 1990s caused important local and regional banks to largely disappear, which has changed the profiles of Federal Reserve Banks’ boards. The increasing rigor of Fed modeling at FOMC meetings (despite the inaccuracy of that modeling, especially in the years leading up to the subprime crisis) has fostered a culture that makes it quite difficult for nonacademics to challenge the assumptions of the chair’s preferred econometric model, however misspecified it may be. Even someone like Alan Greenspan, a trained economist who worked outside of academia and who resisted placing too much weight on forecasts from the Fed’s macroeconomic models, is missing in the ranks of Fed leadership today.

2With respect to the financial stability mandate, focusing monetary policy on price stability would also tend to avoid financial instability. Of course, aside from monetary policy, there are other important regulatory policy tools that should be used to promote financial stability (seeCalomiris 2017a).

3According to the Fed’s accounting rules, the Fed does not mark its portfolio to the market; it incurs losses on securities only if those securities are sold. The Fed’s capital losses affect the measured deficit, but on a consolidated basis they have no economic effect on the government’s deficit. Nevertheless, they matter politically, as critics of the Fed are likely to make use of its measured contribution to the deficit. Because that threat is real, the Fed will seek to avoid sales of assets that cause its measured contribution to the deficit to rise.

4See the September 2014 FOMC statement, available atwww.federalreserve.gov/monetarypolicy/policy-normalization.htm.

5See also Plosser (2017). For a discussion of how to make Fed lender-of-last-resort lending more credibly rule-based, see Calomiris et al. (2017).