During the last U.S. recession in 2007–2009, the Federal Open Market Committee (FOMC) reduced the target federal funds rate by about 5 percentage points, and that target was maintained near zero—the FOMC’s assessment of its effective lower bound (ELB)—for about seven years thereafter. The funds rate has subsequently been lifted above the ELB but currently stands at around 1.5 percent (as of late 2019) in a context of moderate U.S. growth, subdued inflation pressures, and a turbulent global environment. Thus, an increasingly urgent question is how the Federal Reserve would provide sufficient monetary stimulus in the face of the next adverse shock that hits the U.S. economy.1

The minutes of recent FOMC meetings indicate that policymakers are now actively considering the possibility of adopting a so-called makeup strategy for mitigating the ELB. Such a strategy entails a commitment to maintain an accommodative stance beyond the timeframe over which the ELB is binding, thereby inducing an elevated period of inflation to “make up” for previous inflation shortfalls. As noted in the FOMC minutes, however, the effectiveness of a make-up strategy “depends on the private sector’s understanding of the strategy and on their confidence that future policymakers would follow through on promises to keep policy accommodative.”2

Indeed, published transcripts from FOMC meetings in 2011–2012 indicate that such concerns were crucial to the FOMC’s discussions about how to frame its forward guidance at that juncture. For example, at the November 2011 FOMC meeting, William Dudley (then serving as president of the Federal Reserve Bank of New York and vice chair of the FOMC) emphasized that the FOMC’s calendar-based forward guidance was merely a projection, not a commitment, noting that “making binding commitments might be viewed as potentially reckless in a world where the outlook is highly uncertain.”

At the same meeting, Janet Yellen (then serving as Federal Reserve Board vice chair) indicated:

We need to be mindful of the intrinsic limits on our ability to make credible promises over time horizons that extend beyond several years. We need to follow a pragmatic approach for promoting the stability of economic activity and inflation, recognizing the limits of our understanding of the structure and evolution of the economy and of our ability to anticipate or plan for all possible contingencies.

Finally, Elizabeth Duke (a Federal Reserve Board member) also underscored the hazards of making commitments about the FOMC’s future policy actions, noting:

The public could focus on the potential for the rotation of voters to change the path or the potential for the two open seats and the upcoming term endings on the Board to bring about a philosophical change or, in the worst case for credibility, the political debate could become fixated on effecting such a change through legislation or personnel changes.3

Unfortunately, such concerns cannot be readily addressed in the Federal Reserve Board’s workhorse macroeconomic model, known as FRB/US. That model was developed and launched in the mid-1990s and has undergone only modest changes since then, including revisions to the wage and price equations in 2014 and some further streamlining in 2018.4 Simulations of the FRB/US model are limited to one of two assumptions about how households, businesses, and financial market participants form their expectations of future monetary policy: (1) vector autoregressions (VARs), which imply that FOMC forward guidance about its policy strategy has no effect whatsoever; or (2) model-consistent expectations, which imply that the private sector has a complete understanding of the dynamic behavior of the economy (as captured by the FRB/US model itself), and that the FOMC’s policy strategy is completely transparent and fully credible.5

In this article, we examine the effectiveness of makeup strategies, drawing on a burgeoning academic literature regarding the “forward guidance puzzle” as well as our own work on this topic.6 Our analysis highlights three specific pitfalls of makeup strategies: (1) the impact of forward guidance is diminished in models with plausible assumptions about the private sector’s expectations formation; (2) the effectiveness of such strategies is likely to be further attenuated by the imperfect credibility of policymakers’ commitments; and (3) policymakers’ ability to make a firm commitment to such a strategy may be hampered by model uncertainty—that is, their own imperfect knowledge of the dynamic structure of the economy.

Expectations Formation

During the 1990s and 2000s, analytical studies of monetary policy in New Keynesian (NK) models were generally conducted under the assumption of model-consistent expectations (MCE), often referred to as “rational expectations.” For example, Goodfriend and King (1997); Rotemberg and Woodford (1997); and Clarida, Gali, and Gertler (1999) analyzed optimal monetary policy in small stylized NK models, and Eggertsson and Woodford (2003) extended that approach to consider the implications of the ELB. Such methods were subsequently employed in analyzing optimal policies in the MCE version of the FRB/US model as well as the dynamic stochastic general equilibrium (DSGE) models in use at many other central banks.7

However, subsequent analysis by Del Negro, Giannoni, and Patterson (2012) pointed out that conventional NK models had utterly unrealistic implications regarding the potency of forward guidance at long time horizons—a finding referred to as the “forward guidance puzzle.” In particular, a transitory nominal interest rate cut announced far in advance—say, 5 or 10 years in the future—generates markedly greater stimulus than if that same rate cut were implemented immediately. This result hinges on the MCE assumption (i.e., the central bank can make announcements about future monetary policy with full transparency and credibility) as well as other structural assumptions embedded in conventional NK models.

Thus, a burgeoning academic literature has succeeded in formulating a new vintage of NK models in which the forward guidance puzzle is substantially diminished or resolved.8 Some of the most prominent contributions to this literature include:

• McKay, Nakamura, and Steinsson (2016) formulate an NK model with heterogeneous households who face uninsurable income risks and borrowing constraints.

• Angeletos and Lian (2018) analyze a class of NK models in which the expectations of the private sector are heterogeneous, perhaps due to distinct beliefs about the structure of the economy, attentiveness to incoming data, or access to nonpublic information.

• Gabaix (2019) formulates an NK model with bounded rationality, that is, cognitive discounting is embedded into the expectations formation of households and firms.

• Hagedorn, et al. (2019) examine an NK model with incomplete financial markets in which the central bank’s forward guidance may be largely offset by shifts in the distribution of taxes, transfers, and corporate dividends.

Under specific assumptions, each of the first three approaches implies a specific set of modifications that can be readily incorporated into a conventional small-scale NK model.

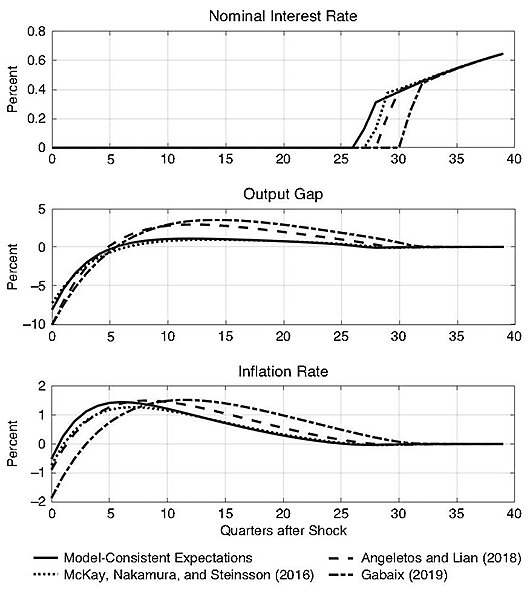

Therefore, in our own recent work, we have analyzed the performance of optimal monetary policy at the ELB for each of these three specifications compared to the conventional NK model with MCE (see Levin and Sinha 2019). Figure 1 compares these alternative specifications under the benchmark assumption that the central bank’s policy strategy is completely transparent and credible. In particular, we consider a stylized experiment in which the natural rate of interest drops sharply in the initial period and then reverts back gradually toward its steady-state value. In particular, the natural rate remains negative for 23 quarters (nearly six years) before turning positive. In effect, this shock represents a scenario involving a large and persistent shortfall in aggregate demand, perhaps roughly similar in magnitude to the impact of the global financial crisis on the U.S. economy. The optimal monetary policy involves a commitment to a “lower-for-longer” strategy, so that the actual nominal interest rate is pinned at the ELB for an additional year or two after the natural rate becomes positive. Even with this policy in place, the initial impact of the shock is severe: the output gap is about −8 percent and inflation falls noticeably below target. Nonetheless, the optimal monetary policy induces a rapid recovery involving a persistent boom in output and an elevated level of inflation over the subsequent half decade. For each of the model specifications, the optimal policy is markedly more aggressive than a pure make-up strategy.9 In particular, the initial shortfall of inflation is relatively modest and transitory, while the overshooting of inflation is substantial (about one percentage point above target) and persistent (only subsiding after about five years).

FIGURE 1: OPTIMAL MONETARY POLICY WITH FULL CREDIBILITY

SOURCE: Authors’ calculations.

Evidently, a pure makeup strategy may not be adequate, but a commitment to a more aggressive “lower-for-longer” strategy could be reasonably effective in mitigating the ELB if such a commitment were fully transparent and credible. Before reaching any definitive conclusions, however, it would be sensible to examine the performance of such strategies in larger-scale DSGE models that incorporate a range of alternative specifications regarding the private sector’s expectations formation.

Imperfect Credibility

Now we turn to scenarios in which the central bank has more limited credibility, especially with regard to policy commitments that extend over a multi-year timeframe.10 The challenge of imperfect credibility has been readily apparent from the historical record on disinflationary episodes. Indeed, as emphasized by the landmark study of Bernanke et al. (2001), the mere announcement of an inflation target had little or no effect on actual inflation in several advanced economies. In such cases, however, the central bank can start gaining credibility immediately by tightening the stance of monetary policy at the start of the disinflation and then easing gradually as actual and expected inflation move downward toward the target.11

By contrast, gaining credibility may be particularly difficult when the economy undergoes a persistent shortfall in aggregate demand that pins the nominal interest rate at the ELB over a protracted period. In such circumstances, the central bank may emphasize its intention to follow a “lower-for-longer” strategy once the ELB is no longer binding, but policymakers have no practical means of earning credibility upfront by taking immediate action to demonstrate their commitment to the strategy. Indeed, the commitment remains completely vacuous as long as the natural rate of interest remains below the ELB and cannot be put into practice until the natural rate rises above that threshold.

In light of these considerations, we now analyze the optimal monetary policy when its credibility depends on the length of time over which policy is pinned at the ELB. In particular, we assume that the private sector perceives a risk that in any given period, the central bank may renege on its prior commitment and revert to a purely discretionary policy, that is, the central bank would simply adjust the nominal interest rate in line with the natural rate of interest once the ELB was no longer binding. For simplicity, we assume that the central bank’s commitment is fully credible once the ELB is no longer a binding constraint, because from that point onward, the private sector can directly observe that the “lower-for-longer” strategy is being implemented. It should also be noted that the central bank is fully cognizant of its own imperfect credibility and takes that into account in formulating its optimal policy strategy.

We calibrate the degree of imperfect credibility so that the probability of reneging is perceived to be 2.5 percent in any given quarter. Thus, in our benchmark scenario where the ELB is binding for about seven years, the private sector initially perceives 50/50 odds that the central bank will follow through with its commitment to the “lower-for-longer” strategy. Those perceived odds rise gradually over time as the central bank continues to reiterate its commitment and the time approaches when the commitment will be implemented. This calibration seems broadly consistent with the concerns flagged in past FOMC discussions about the extent to which its composition evolves gradually over time as a result of staggered terms, retirements, and other sources of turnover.

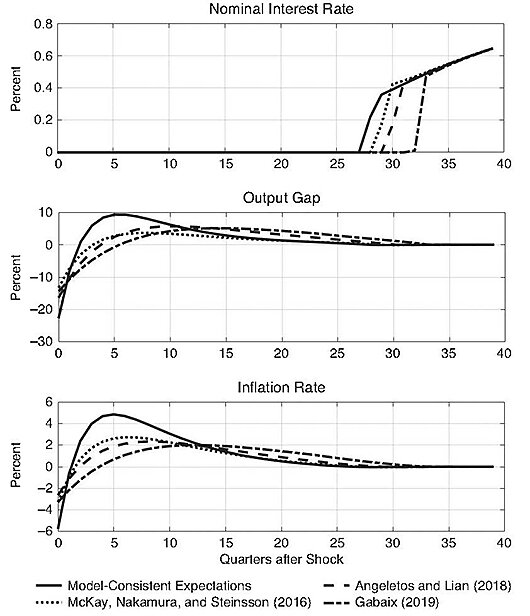

As shown in Figure 2, the timing of liftoff from the ELB under imperfect credibility is roughly similar to that implied by perfect credibility (as shown previously in Figure 1).

FIGURE 2: OPTIMAL MONETARY POLICY WITH IMPERFECT CREDIBILITY

SOURCE: Authors’ calculations.

Interestingly, the deterioration in macroeconomic stabilization is most severe in the baseline model with MCE. As emphasized in various studies of the forward guidance puzzle, this model exhibits a very strong feedback loop: when the nominal interest rate is pinned to the ELB, a decline in inflation raises the ex ante real interest rate, which in turn exerts further downward pressure on real output and inflation. Consequently, when faced with imperfect credibility, the central bank adopts a more aggressive “lower-for-longer” strategy, inducing a huge economic boom that helps dampen the initial downturn. In particular, the output gap initially plummets to around −20 percent and then rebounds to around +10 percent, while inflation initially drops 5 percent below target and then surges 5 percent above target.

Nonetheless, imperfect credibility induces a marked deterioration in macroeconomic stability, regardless of the particular specification of expectations formation. For example, in the specification of Angeletos and Lian (2018), the output gap drops sharply to around −15 percent and then exhibits a sustained boom of around 5 percent, while inflation initially falls 2 percent below target and then overshoots the target by 2 percent for several years.

Model Uncertainty

As in most previous studies of monetary policy at the ELB, the foregoing analysis in this article has assumed that policymakers have a complete understanding of the true dynamic structure of the economy, as captured by a specific macroeconomic model. Under this admittedly heroic assumption, it is reasonably straightforward to determine the monetary policy strategy that provides optimal stabilization outcomes in that particular model.

Nonetheless, it has long been recognized that an appropriate monetary policy strategy should provide robust performance in the face of model uncertainty (see McCallum 1988; Taylor 1993, 1999; and Hansen and Sargent 2001). That literature has underscored the pitfalls of policy strategies that hinge on the accuracy of longer-horizon forecasts or that are fine-tuned to the characteristics of a specific model.12

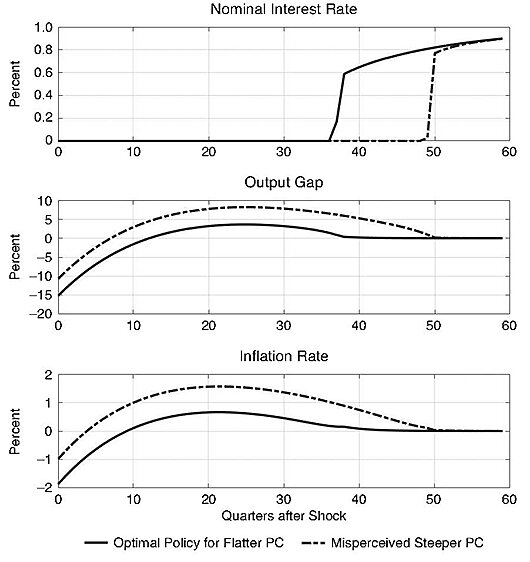

To illustrate these considerations in the present context, we now focus on a particular aspect of the NK model that is a subject of ongoing analysis and debate, namely, the specification of the New Keynesian Phillips Curve (NKPC). For the analysis shown in the previous figures, we calibrated the NKPC slope coefficient using the estimate obtained by Amato and Laubach (2003). Now we consider the possibility of an even flatter NKPC, with a slope coefficient of 0.01, a bit less than half the slope of 0.024 in our baseline calibration. For simplicity, we conduct this analysis using the model of Gabaix (2019), and we assume that the central bank’s policy strategy is fully transparent and credible to the private sector. The results are shown in Figure 3.

FIGURE 3: PITFALLS OF MODEL UNCERTAINTY

SOURCE: Authors’ calculations.

If the central bank knows that the NKPC is very flat (as denoted by the solid line in each panel), then the optimal policy prescribes a protracted period of about nine years at the ELB, that is, about two years longer than in the baseline calibration shown in Figure 1. That policy reflects the fact that a flatter NKPC attenuates the feedback loop noted above, namely, a shift in the output gap has muted effects on inflation and hence induces a smaller movement in the real interest rate. Consequently, this optimal policy is associated with a deeper recession of around −15 percent, a more modest initial decline in inflation, and a shallow but highly persistent phase of overshooting thereafter.

Now we consider the scenario in which the NKPC actually has a relatively flat slope of 0.01 but the central bank incorrectly formulates its “optimal” policy strategy based on a steeper slope of 0.024. In effect, the central bank’s strategy mistakenly embeds a relatively strong feedback loop between the output gap, the inflation rate, and the real interest rate, and that misperception results in a dramatic set of policy errors.

As indicated by the dash-dotted lines in the figure, the nominal interest rate remains at the ELB for nearly 50 quarters, inducing a huge and persistent boom in which the output gap peaks at nearly 10 percent. The deviation from price stability is somewhat milder due to the actual flatness of the NKPC; nonetheless, the inflation rate is elevated by more than 1 percent above target for nearly a decade.

Of course, this exercise is merely illustrative, involving a single parameter in a small stylized NK model. In practice, policymakers face a high degree of uncertainty not only about the determination of inflation but about many other aspects of the economy. Indeed, the minutes of the September 2019 FOMC meeting indicate that the Committee had an extensive discussion of makeup strategies, in which a number of participants referred to the staff’s analysis of the FRB/US model and highlighted “the need for more robustness analysis of simulation results along several dimensions and for further comparison to other alternative strategies.”13

Conclusion

While U.S. growth continues to be remarkably resilient, the global economy remains turbulent and unpredictable. Moreover, financial market participants now anticipate that the federal funds rate is likely to remain at or below 2 percent over coming years—markedly lower than its level preceding the last recession—and hence the ELB is very likely to reemerge as a binding constraint in coming years. Thus, it is crucial for the Federal Reserve to take steps to mitigate the ELB and thereby ensure that the FOMC has the ability to offset severe adverse shocks to the economy.

Nonetheless, adopting a makeup strategy is not a satisfactory approach for mitigating the ELB. A large literature has analyzed the “forward guidance puzzle” and concluded that the effectiveness of forward guidance is substantially diminished in models with plausible assumptions about the private sector’s expectations formation. Moreover, the efficacy of such strategies is likely to be further attenuated by imperfect credibility and model uncertainty.

Therefore, as emphasized by Bordo and Levin (2018, 2019), an urgent priority for the Federal Reserve should be to move ahead with the provision of digital cash as an effective way of mitigating the ELB. This approach can ensure that monetary policy will be systematic and transparent during normal times and that the FOMC will continue to have the ability to fulfill its mandate of fostering maximum employment and price stability.

References

Amato, J., and Laubach, T. (2003) “Estimation and Control of an Optimization-Based Model with Sticky Prices and Wages.” Journal of Economic Dynamics & Control 27: 1181-215.

Angeletos, G., and Lian C. (2018) “Forward Guidance without Common Knowledge.” American Economic Review 108 (9): 2477–512.

Archer, D., and Levin A. (2019) “Robust Design Principles for Monetary Policy Committees.” In J. Simon (ed.), RBA Annual Conference Volume, 233–51. Sydney, Australia: Reserve Bank of Australia.

Bernanke, B.; Kiley, M.; and Roberts, J. (2019) “Monetary Policy Strategies for a Low-Rate Environment.” American Economic Association Papers and Proceedings 109: 421–26.

Bernanke, B.; Laubach, T.; Mishkin, F.; and Posen, A. (2001) Inflation Targeting: Lessons from the International Experience. Princeton, N. J.: Princeton University Press.

Bodenstein, M.; Hebden, J.; and Nunes, R. (2012) “Imperfect Credibility and the Zero Lower Bound.” Journal of Monetary Economics 59:135–49.

Bordo, M.; Erceg, C.; Levin, A.; and Michaels, R. (2007) “Three Great American Disinflations.” National Bureau of Economic Research, Working Paper No. 12982. Reprinted in M. D. Bordo (2019). The Historical Performance of the Federal Reserve: The Importance of Rules, 243–89. Stanford, Calif.: Hoover Institution Press.

Bordo, M., and Levin, A. (2018) “Central Bank Digital Currency and the Future of Monetary Policy.” In M. D. Bordo, J. Cochrane, and A. Seru (eds.), The Structural Foundations of Monetary Policy, 143–78. Stanford, Calif.: Hoover Institution Press.

__________ (2019) “Improving the Monetary Regime: The Case for U.S. Digital Cash.” Cato Journal 39 (2): 383–405.

Brayton, F.; Laubach, T.; and Reifschneider, D. (2014a) “The FRB/US Model: A Tool for Macroeconomic Policy Analysis.” Federal Reserve Board. Available at www.federalreserve.gov/econresdata/notes/feds-notes/2014/a‑tool-for-macroeconomic-policy-analysis.html.

__________ (2014b) “Optimal-Control Monetary Policy in the FRB/US Model.” Federal Reserve Board. Available at www.federalreserve.gov/econresdata/notes/feds-notes/2014/optimal-control-monetary-policy-in-frbus-20141121.html.

Christiano, L.; Eichenbaum, M.; and Evans, C. (2005) “Nominal Rigidities and the Dynamic Effects of a Shock to Monetary Policy.” Journal of Political Economy 113 (1): 1–45.

Clarida, R.; Gali, J.; and Gertler, M. (1999) “The Science of Monetary Policy: A New Keynesian Perspective.” Journal of Economic Literature 37 (4): 1661–707.

Del Negro, M.; Giannoni, M.; and Patterson, C. (2012) “The Forward Guidance Puzzle.” Federal Reserve Bank of New York, Staff Report No. 574. (Revised December 2015.)

Eggertsson, G., and Woodford, M. (2003) “The Zero Bound on Interest Rates and Optimal Monetary Policy.” Brookings Papers on Economic Activity 2003 (1): 139–211.

Erceg, C., and Levin, A. (2003) “Imperfect Credibility and Inflation Persistence.” Journal of Monetary Economics 50 (4): 915–44.

Gabaix, X. (2019) “A Behavioral New Keynesian Model.” Manuscript, Harvard University. Available at https://scholar.harvard.edu/files/xgabaix/files/behavioral_new_keynesian_model.pdf.

Goodfriend, M., and King, R. (1997) “The New Neoclassical Synthesis and the Role of Monetary Policy.” In B. Bernanke and J. Rotemberg (eds.), NBER Macroeconomics Annual 1997, 231–96. Cambridge, Mass.: MIT Press.

Hagedorn, M.; Luo, J.; Manovskii, I.; and Mitman, K. (2019) “Forward Guidance.” Journal of Monetary Economics 102:1–23.

Hansen, L., and Sargent, T. (2001) “Robust Control and Model Uncertainty.” American Economic Review 91(2): 60–66.

Hebden, J., and Lopez-Salido, D. (2018) “From Taylor’s Rule to Bernanke’s Temporary Price Level Targeting.” Finance and Economic Discussion Paper 2018-051. Available at www.federalreserve.gov/econres/feds/files/2018051pap.pdf.

Kiley, M., and Roberts, J. (2017) “Monetary Policy in a Low Interest Rate World.” Brookings Papers on Economic Activity 2: 317–72.

Laforte, J. (2018) “Overview of the Changes to the FRB/US Model (2018).” Federal Reserve Board. Available at www.federalreserve.gov/econres/notes/feds-notes/overview-of-the-changes-to-the-frb-us-model-2018–20181207.htm.

Laforte, J., and Roberts, J. (2014) “November 2014 Update of the FRB/US Model.” Federal Reserve Board. Available at www.federalreserve.gov/econresdata/notes/feds-notes/2014/november-2014-update-of-the-frbus-model-20141121.html.

Levin, A. (2014) “The Design and Communication of Systematic Monetary Policy Strategies.” Journal of Economic Dynamics and Control 49: 52–69.

Levin, A.; Onatski, A.; Williams, N.; and Williams, J. (2006) “Monetary Policy under Uncertainty in Micro-Founded Macroeconometric Models.” In M. Gertler and K. Rogoff (eds.), NBER Macroeconomics Annual 2005. Cambridge, Mass.: MIT Press.

Levin, A., and Sinha A. (2019) “Imperfect Credibility of Forward Guidance Strategies for Mitigating the Effective Lower Bound.” Manuscript, Dartmouth College.

Levin, A.; Wieland, V.; and Williams, J. (1999) “The Robustness of Simple Monetary Policy Rules under Model Uncertainty.” In J. Taylor, J. (ed.), Monetary Policy Rules. Chicago: University of Chicago Press.

__________ (2003) “Performance of Forecast-Based Monetary Policy Rules under Model Uncertainty.” American Economic Review 93: 622–45.

Levin, A., and Williams, J. (2003) “Robust Monetary Policy Rules with Competing Reference Models.” Journal of Monetary Economics 50: 945–75.

McCallum, B. (1988) “Robustness Properties of a Rule for Monetary Policy.” Carnegie-Rochester Conference Series on Public Policy 29: 173–203.

McKay, A.; Nakamura, E.; and Steinsson, J. (2016) “The Power of Forward Guidance Revisited.” American Economic Review 106 (10): 3133–58.

Nakata, T., and Sunakawa, T. (2019) “Credible Forward Guidance.” Finance and Economics Discussion Series 2019-037. Available at www.federalreserve.gov/econres/feds/files/2019037pap.pdf.

Reifschneider, D., and Wilcox, D. (2019) “Average Inflation Targeting Would be a Weak Tool for the Fed to Deal with Recession and Chronic Low Inflation.” Peterson Institute for International Economics, Policy Brief 19–16.

Rotemberg, J., and Woodford, M. (1997) “An Optimization-Based Econometric Framework for the Evaluation of Monetary Policy.” In: B. Bernanke and J. Rotemberg (eds.), NBER Macroeconomics Annual 1997, 297–361. Cambridge, Mass.: MIT Press.

Smets, F., and Wouters, R. (2003) “An Estimated Dynamic Stochastic General Equilibrium Model of the Euro Area.” Journal of the European Economic Association 1(5): 1123–75.

Taylor, J. (1993) “Discretion versus Policy Rules in Practice.” Carnegie-Rochester Conference Series on Public Policy 39:195–214.

__________ (1999) “A Historical Analysis of Monetary Policy Rules.” In J. Taylor ( ed.), Monetary Policy Rules, 319–48. Chicago: University of Chicago Press.

Walsh, C. (2018) “Simple Sustainable Forward Guidance at the ELB.” Working Paper, University of California, Santa Cruz. Available at http://people.ucsc.edu/~walshc/MyPapers/SimpleSustainableForwardGuidance.pdf.

Cato Journal, Vol. 40, No. 2 (Spring/Summer 2020). Copyright © Cato Institute. All rights reserved. DOI:10.36009/CJ.40.2.13.

Andrew T. Levin is Professor of Economics at Dartmouth College and a Research Associate of the National Bureau for Economic Research. He is also an International Research Fellow of the Centre for Economic Policy Research and an adviser to the central banks of Norway (Norges Bank) and Sweden (Sveriges Riksbank). Arunima Sinha is Assistant Professor of Economics at Fordham University. The views expressed here are solely those of the authors and do not represent the views of any other person or institution.

About the Authors

Andrew T. Levin is Professor of Economics at Dartmouth College and a Research Associate of the National Bureau for Economic Research. He is also an International Research Fellow of the Centre for Economic Policy Research and an adviser to the central banks of Norway (Norges Bank) and Sweden (Sveriges Riksbank). Arunima Sinha is Assistant Professor of Economics at Fordham University. The views expressed here are solely those of the authors and do not represent the views of any other person or institution.

This work is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License.