At the November 2011 Federal Open Market Committee (FOMC) meeting, the FOMC discussed the potential benefits of nominal gross domestic product (NGDP) targeting. A memo by staff economists suggested that NGDP targeting could result in improved inflation and unemployment outcomes under a variety of scenarios. Former Federal Reserve chairman Ben Bernanke recalls this discussion in his memoir about the financial crisis:

We considered the theoretical benefits of the approach, but also whether it was desirable, or even feasible, to switch to a new framework at a time of great economic uncertainty. After a lengthy discussion, the Committee firmly rejected the idea. I had been intrigued by the approach at first but came to share my colleagues’ reservations about introducing it at that time. Nominal GDP targeting is complicated and would be very difficult to communicate to the public (as well as to Congress, which would have to be consulted) [Bernanke 2015: 517–18].

Since then, policymakers and others have continued to discuss whether NGDP targeting or other alternative targets could alleviate the constraint of the effective lower bound on nominal interest rates, improve policy robustness, promote greater financial stability, or even address distributional concerns (Koenig 2010; Billi 2014; Azariadis et al. 2015; Garín, Lester, and Sims 2016).n protectionist measures, with other issues addressed by specialized treaties and international organizations.1 For example, Romer (2011) argues that targeting a path for the level of NGDP (NGDP level targeting, or NGDPLT) would encourage the Fed to act more aggressively in downturns, boosting confidence and expectations of future inflation. Temporarily higher expected inflation in downturns would stimulate spending and employment, and inflation expectations should decline as the economy approaches its target path.

NGDPLT could improve not only macroeconomic, but also financial, stability by addressing an important credit market friction known as nonstate contingent nominal contracting (Bullard and DiCecio 2019). That is, many debt contracts specify a fixed stream of nominal repayments, but the future income that will repay this debt is uncertain. Sheedy (2014) shows that with such a friction, NGDP targeting can improve the functioning of financial markets by stabilizing the debt-to-GDP ratio, facilitating efficient risk sharing.

Even as the literature on NGDP targeting and optimal monetary policy continues to grow,2 policymakers remain hesitant to abandon the status quo. In 2011, the FOMC thought that the time was not right to switch to a new monetary policy framework. In this article, I suggest that the time is better now. I argue that the status quo is so unpopular and precarious that a new target would do more good than harm for central bank credibility. In the current context, the case for NGDPLT is especially strong.

The Federal Reserve and its peers face what Andy Haldane, chief economist at the Bank of England, describes as the “twin deficits” problem: a deficit of understanding and a deficit of trust. He explains, “Because a lack of trust inhibits understanding, and because a lack of understanding contaminates trust, these Twin Deficits are inextricably entwined” (Haldane 2017).

I discuss evidence of the severity of these deficits, based on my own and others’ research. Then I argue that the interaction of these deficits with a wave populist sentiment could have major implications for central bank independence and the conduct of monetary policy. Central banks around the world are facing intense political pressures to focus less on inflation and more on the real economy. The flexibility of a dual mandate or a flexible inflation target can invite and exacerbate such pressures by allowing “each side of the political divide to latch onto its preferred policy indicator” (Sumner 2012: 19).

In some cases, central banks have already faced legal changes to their monetary policy frameworks. I will discuss the case of the Reserve Bank of New Zealand (RBNZ), the first central bank to adopt inflation targeting. With a 2018 amendment to the Reserve Bank of New Zealand Act, the RBNZ is also the first to abandon inflation targeting.3 The RBNZ now has a dual mandate.

The New Zealand experience holds important lessons for inflation targeting central banks and the Federal Reserve. Like RBNZ, these central banks will increasingly face pressure to put more emphasis on employment and other objectives. Whether through new legislation, through the appointments process, or through informal methods, politicians will make it more difficult for central banks to operate independently within their current frameworks. Central banks may be better off changing on their own terms. Adopting NGDPLT could signal concern for the real economy and willingness to break from the status quo, which could fend off populist impulses to change monetary policy in more drastic and potentially harmful ways. In the long term, an NGDPLT could be easier to communicate, more popular, and less prone to political interference than a flexible inflation target or dual mandate.

Unpopular by Design

Modern central banks are unpopular by design. That is, to avoid inflation bias, we delegate monetary policy to a central bank that is independent and conservative, where conservative means that the central bank places a larger weight on inflation stabilization than does society as a whole (Rogoff 1985). This type of delegation allows the central bank to pursue policies that are beneficial in the long run but politically unpopular in the short run (Alesina and Stella 2010).

This unpopularity is readily apparent. The Federal Reserve, in particular, is frequently criticized by progressive think tanks, various interest groups, the president, and parts of the popular press for its emphasis on low inflation, pitted as contrary to the interest of labor and communities. For example, Dylan Matthews of Vox writes that “the Fed has deliberately chosen to keep hundreds of thousands, if not millions, of people from finding work that they could have found with looser policy, in the name of preventing inflation” (Matthews 2019).

“Fed Up” is a coalition of the Center for Popular Democracy, the American Federation of Labor and Congress of Industrial Organizations, and other labor and community organizations that calls on the Federal Reserve “to adopt pro-worker policies for the rest of us.” The home page of the Fed Up Coalition (http://whatrecovery.org) adds:

The truth about the economy is obvious to most of us: not enough jobs, not enough hours, and not enough pay—particularly in communities of color and among young workers. Some members of the Federal Reserve think that the economy has recovered. They want to raise interest rates to slow down job growth and prevent wages from rising faster. That’s a terrible idea.… The Fed can keep interest rates low, give the economy a fair chance to recover, and prioritize full employment and rising wages.

Why does it matter if central banks are unpopular? Economists and central bankers tend to worry more about central bank credibility than central bank popularity. In the political science literature, however, the concepts of credibility and popularity are closely related. As van Zuydam (2014) notes:

To be credible, leaders need to be competent, trustworthy, and caring for their audience.… The audience’s needs, interests and wishes should be perceived to match with what the leader in question has to offer.… After all, credibility is a relational and dynamic concept in which it is the audience who time and again decides whether the leader in question is worthy of being attributed credibility.

Economists have typically used a narrower definition of credibility. When Blinder (2000) surveyed central bankers to assess their attitudes about credibility—a “central concern in practical central banking circles”—he intentionally did not define the term, noting that it “is much used these days, and in a variety of different ways.” Around 90 percent of central bankers told Blinder that credibility and dedication to price stability were “quite closely related” or “nearly the same.” They valued credibility primarily for its presumed role in keeping inflation low and reducing the cost of disinflation.

McCallum (1984) attributes the tight association of credibility with low inflation in the central banking context to Fellner (1976, 1979).4 Even in 1984, McCallum worried that to conflate credibility with low inflation expectations was “to abuse language as well as to create unnecessary possibilities of confusion.” His concern was quite prescient: in 2016, the Financial Times reported that “central banks have resorted to ever more ingenious methods to convince a sceptical public that they still have the ability to create inflation.… The longer they fail to meet their core goals, the more corrosive the effect on their credibility.”5

Moreover, even with inflation very low, central banks face credibility problems in the form of acute “twin deficits” of understanding and trust, as I will discuss in the next section. In the subsequent section, I will discuss how these deficits might prompt politically motivated challenges to central bank independence and legitimacy.

The Twin Deficits

Haldane (2017) uses the phrase “twin deficits” to refer to the deficits of understanding and deficits of trust facing central banks. The deficit of understanding is well-documented. In a survey I conducted with Alex Rodrigue, only a quarter of our respondents knew of the Fed’s 2 percent inflation target, and most respondents were unaware of recent inflation statistics. Two-thirds of respondents identified Janet Yellen as (then) Fed chair, out of three possible options (Binder and Rodrigue 2018). Similarly, households in the United Kingdom and New Zealand know very little about the Bank of England or RBNZ and their inflation targets (Afrouzi et al. 2015; Haldane 2017).

The deficit of trust is also apparent. Gros and Roth (2009) use data from the Eurobarometer to show that citizens’ trust in the ECB declined in almost all eurozone countries in the first years of the financial crisis. Roth (2009) argues that the financial crisis eroded institutional trust more broadly.

Even as the economy has recovered and unemployment has fallen to historic lows, the Federal Reserve has relatively low public approval. In an April 2019 Gallup poll, just 6 percent and 42 percent of respondents said that the Federal Reserve Board is doing an excellent job or a good job, respectively.6 Less than half of respondents reported having a “great deal” or “fair amount” of confidence in Fed Chairman Jerome Powell to “do or recommend the right thing for the economy.”7 Moreover, opinions of the Fed tend to reflect respondents’ political preferences. For example, former chairman Bernanke—originally appointed by President George W. Bush and reappointed by President Barack Obama—was viewed more favorably by Republicans under Bush and by Democrats under Obama.8 Households do not seem to trust the Fed and its leaders to pursue nonpartisan policies in societal interest.

These “deficits” both reflect and contribute to challenges in communication. Coibion et al. (2018) document the “abysmal track record of the typical communication strategies of central banks in affecting households’ and firms’ inflation expectations.” Less than 6 percent of respondents to the Bank of Japan’s Opinion Survey on the General Public’s Views and Behavior in June 2019 say that the bank’s explanations to the public are clear or somewhat clear.9 In previous work, I have argued that the literature on central bank communication has been mostly disjointed from a large and highly applicable literature on political communication because of the perception that central banks are outside of the political realm (Binder 2017a, 2017b). One implication of this literature is the need to tailor the form, delivery, and content of communication to audience needs, so that communication is relatable, comprehensible, and engaging.

Recently, central banks are taking political and behavioral insights more seriously. The Bank of England, for example, is experimenting with alternative versions of its Inflation Report that use simpler language, visual summaries, and relatable practical examples. Some of these alternative versions improve self-reported and tested comprehension. They are also associated with greater self-reported trust in the Bank of England, though the effect is small (Bholat et al. 2018; Haldane and McMahon 2018).

Challenges to Independence and Legitimacy

The unpopularity of central banks, and the deficits of understanding and trust described in the previous section, could have profound implications for central bank independence and legitimacy. The Federal Reserve, like many central banks, is independent within the government, not independent of the government. That is, the Fed’s mandate was established by Congress and the Fed is ultimately accountable to Congress (and through Congress, to the public).10 As former Federal Reserve chair Ben Bernanke said in a 2013 press conference:

Congress is our boss. The Federal Reserve is an independent agency within the government. It’s important that we maintain our policy independence in order to be able to make decisions without short-term political interference. At the same time, it’s up to the Congress to set our structure, to set our mandate, and that’s entirely legitimate… obviously, they represent the public, and they certainly have every right to set the terms on which the Federal Reserve operates and so on.11

Binder and Spindel (2016: 2) document that “successive generations of politicians have made and remade the Federal Reserve System to reflect (often shifting) partisan, political and economic priorities.” They show that the number of House and Senate bills targeting the Federal Reserve was higher during the Great Recession and its aftermath than in any other time in the postwar era.

In addition to or in place of legislative changes to the central bank’s mandate or structure, politicians may interfere with the central bank’s efforts to pursue its objectives by pressuring or criticizing the bank or via the appointments process. Politicians will be most tempted to do so when populist sentiment is strong (de Haan and Eijffinger 2017; Goodhardt and Lastra 2017; Issing 2018; Masciandaro and Passarelli 2018). Indeed, in the past few years, there are frequent news reports of populist “threats” to central banks and their independence.12 The Financial Post, for example, writes that “In the Age of Trump, central banks are only one populist uprising away from losing cherished independence … explaining why so many of them, including the Bank of Canada, are working harder to establish a bond with the public.13

Rogoff (2019) notes that:

With the global rise of populism and autocracy, central-bank independence is under threat, even in advanced economies. Since the 2008 financial crisis, the public has come to expect central banks to shoulder responsibilities far beyond their power and remit. At the same time, populist leaders have been pressing for more direct oversight and control over monetary policy.… Not too long ago, central-bank independence was celebrated as one of the most effective policy innovations of the past four decades, owing to the dramatic fall in inflation worldwide. Recently, however, an increasing number of politicians believe that it is high time to subordinate central banks to the prerogatives of elected officials.

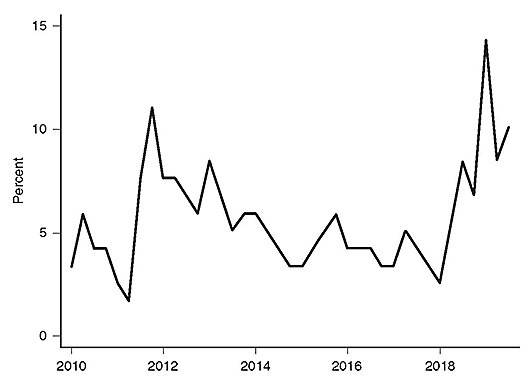

The evidence supporting Rogoff’s claims is more than anecdotal. I have constructed a quarterly panel dataset on political interference or pressure on 118 central banks from 2010 to 2019 using a narrative approach and find that it is very common for politicians to exert pressure on the central bank, regardless of the bank’s legal independence (Binder 2019a).14 More than 90 percent of the time, the pressure is for looser monetary policy. Figure 1 shows the share of central banks in the sample that reportedly face political pressure in each quarter. Around 6 percent of central banks face political pressure in an average quarter, and 40 percent face political pressure at some point in my sample.

FIGURE 1: SHARE OF CENTRAL BANKS FACING POLITICAL PRESSURE IN EACH QUARTER

SOURCE: Updated data from Binder (2019a). Sample includes 118 central banks. Data are publicly available at https://osf.io/kjcfh/.

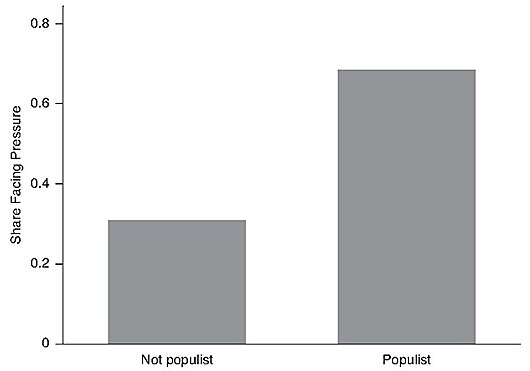

I show that bouts of political pressure tend to be followed by higher inflation. Political pressure is more likely under certain types of political regimes than others. Importantly, Figure 2 shows that populist government leaders are strongly associated with political pressure on the central bank. Nationalist executives are also more likely to exert political pressure on the bank.

FIGURE 2: POPULISM AND POLITICAL PRESSURE ON CENTRAL BANKS

NOTE: Figure 2 includes 32 central banks, of which 19 are in countries with a somewhat populist, populist, or very populist leader based on codings of leaders’ speeches.

SOURCES: Populism data are from the Global Populism Database (Hawkins et al. 2019). Data on political pressure on central banks is from Binder (2019a) from 2010Q1 through 2019Q1.

Case Study: New Zealand

The Reserve Bank of New Zealand adopted inflation targeting in 1989 with the passage of the RBNZ Act, which gave the RBNZ a mandate to provide “stability in the general level of prices.” At least 37 other banks followed suit in adopting inflation targeting (Roger 2009). In Binder (2019b), I document the political forces that eventually led the inflation targeting framework to be replaced by a dual mandate in 2018.

In New Zealand, the governor of the RBNZ sets the monetary policy target in a public Policy Targets Agreement (PTA) with the Minister of Finance (McDermott and Williams 2018). The PTA is renegotiated when a governor is reappointed or when a new governor is appointed. The first PTA set an inflation target band of 0 to 2 percent consumer price index (CPI) inflation.

Following a binding referendum in 1993, New Zealand switched from a First Past the Post to a Mixed Member Proportional (MMP) voting system. In the 1996 election, the first to use the MMP system, the National Party (conservative) remained in power, but only by forming a coalition with New Zealand First (NZ First), a nationalist and populist party, led and founded by Winston Peters. Peters had campaigned on reforming the Reserve Bank, arguing that the 0 to 2 percent inflation target was contributing to an overvalued exchange rate. A new PTA in 1996 widened the target to 0 to 3 percent and changed the explanation of the bank’s objective, emphasizing that price stability was not an end in and of itself, but would promote economic growth and employment (McDermott and Williams 2018).

Subsequent PTAs, under both National-led and Labour-led (center-left) coalition governments, continued the trend toward more “flexible” inflation targeting. For example, the 2002 PTA moved the target band to 1 to 3 percent and changed the target horizon to “on average over the medium term” instead of a 12-month horizon (McDermott and Williams 2018). In 2013, Peters introduced unsuccessful legislation “to ensure that the primary function of the Reserve Bank is broadened to include other critical macroeconomic factors such as the rate of growth, export growth, the value of the dollar, and employment as well as price stability.”

In the 2017 election, neither the Labour Party nor the National Party received a majority of votes. Labour regained power in coalition with NZ First and with support from the Green Party. The Labour Party had campaigned on adding some form of full employment objective to the RBNZ Act, a goal shared by NZ First. Part of the coalition agreement was a commitment to review and reform the Reserve Bank legislation. The result was a December 2018 amendment to the RBNZ Act that gives the RBNZ a formal dual mandate to pursue both price stability and maximum sustainable employment. The amendment also changes the governance of the RBNZ, adding a monetary policy committee (MPC) in place of a single governor. Controversially, and unusually, the MPC includes a treasury representative as a nonvoting member.

National Party Member of Parliament Judith Collins says that the 2018 legislation “has been a policy of the Green Party, it’s been a policy of the New Zealand First Party, and it’s been a policy of the New Zealand Labour Party.”15 But RBNZ leaders have argued that the mandate change improves credibility. Assistant Governor Christian Hawkesby (2019) argues that “The first building block of credibility is the renewal of a social licence to operate … granted by the public when an institution is seen to fulfil its social obligations.” Hawkesby continues:

Inflation has been low and stable in New Zealand for nearly 30 years. There is a greater appreciation that low inflation is a means to an end, and not the end itself. In the fight to lower inflation that was perhaps easy to forget. The end goal is, of course, improving the wellbeing of our people. For many in the general public, employment is one tangible measure of wellbeing.

Similarly, Governor Adrian Orr (2019) has embraced the reforms, claiming that “The business of central banking is evolving as circumstances change.” Orr adds:

Institutions must therefore adapt in keeping with shifting political, economic, environmental, and social realities, so as to serve the well-being of the people. After all, it is from people that institutions derive their ‘social license’ to operate—their legitimacy. Earning and retaining institutional legitimacy is an evolving challenge.

It is too early to evaluate the effects of the recent changes to the RBNZ. There is much to admire in Hawkesby and Orr’s statements, and in the reforms overall—most of all the recognition that institutional legitimacy comes from serving the well-being of the people and that maintaining this legitimacy sometimes requires that central banks evolve. But there is also a risk that a monetary framework based on multiple objectives could invite unwanted political interference into monetary policy conduct, allowing “each side of the political divide to latch onto its preferred policy indicator and to argue that money is either too easy or too tight” (Sumner 2012: 19).16

Time for NGDPLT

Like RBNZ, other central banks have faced and will continue to face pressure to reduce their focus on inflation and increase their focus on other outcomes, especially as high inflation becomes a more distant memory and/or as populist movements gain strength. Other central banks may also need to evolve to preserve or restore their “social license” to operate.

In the case of RBNZ, changes were externally imposed on the bank. But perhaps other central banks would be better off reforming proactively, on their own terms. As Rogoff (2019) says, “to shield monetary policy from populists of the left and the right, central bankers cannot afford to rest on their laurels.” A strong argument for adopting NGDPLT soon is that doing so could fend off populist urges to impose reforms that could be less effective. That is, willingness to break from an unpopular status quo could boost central banks’ institutional legitimacy in the short term.

In the longer term, the macroeconomic and financial stability benefits that could follow would further improve legitimacy and credibility. For a comprehensive discussion of the benefits and practical implementation details of NGDPLT, see Beckworth (2019). Beckworth explains how NGDPLT serves as a velocity-adjusted money supply target, a work-around to the supply shock problem and to incomplete financial markets, an anti-zero lower bound tool, and a way to do rules-based monetary policy. In this article, I will rather discuss why, given the “twin deficits” and political pressures I have described, the timing is right for central banks (particularly the Fed) to consider changing their target.

A Smooth Transition

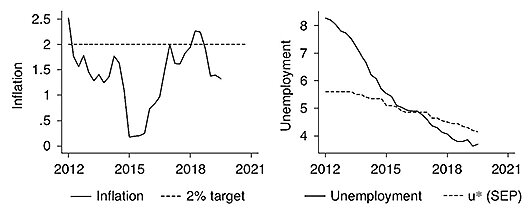

How has the Fed implemented its dual mandate in recent years? Figure 3 plots U.S. PCE inflation and unemployment since 2012, when the 2 percent target for PCE inflation was announced. The right panel of Figure 3 also shows the median projection of longer-run unemployment from the FOMC’s Summary of Economic Projections (SEP), which can be interpreted as estimates of the natural rate of unemployment (u*) (Bernanke 2016). Not only has inflation been persistently below target, but it has remained below target even as unemployment has fallen below the Fed’s estimates of u*.

FIGURE 3: INFLATION, UNEMPLOYMENT, AND THE DUAL MANDATE

In fact, by announcing an NGDPLT now, the Fed could claim that they are merely formalizing a target that they have informally pursued, with great success, in recent years. For the sake of optics, and because consumers tend to have a preference for working with round numbers (Binder 2017c), they might wish to announce a 5 percent growth path from this point forward. Either way, merely showing a graph similar to Figure 4 could alleviate some of the confusion and uncertainty associated with a change in target.

Improved Understanding and Trust

There are several reasons to believe that following a transition to NGDPLT, the new target could help to mitigate the deficits of understanding and trust. Some of these benefits come via facilitating communication.

First, NGDPLT would allow the Fed to frame its policy decisions in terms of income rather than inflation. Part of the difficulty of inflation targeting is that many people either do not know what inflation is or understand it very differently than central bankers do. Many people do not understand that higher inflation can be a consequence of higher aggregate demand. On surveys of consumer expectations, for many consumers, reported inflation expectations are really a proxy for their beliefs about the general state of the economy—that is, consumers report higher inflation expectations when economic sentiment is poor (Kamdar 2018; Binder 2019d). Sumner (2011) thus argues that “Inflation targeting gives the public the wrong impression, and the resulting political reaction impedes the Fed’s ability to carry out its work.”

A related benefit of NGDP targeting is that it implies countercyclical inflation by construction, consistent with consumers’ understanding of how the economy works. This could help consumers form more accurate perceptions and expectations about both real and nominal variables. Macroeconomic literacy would become easier to teach, because macroeconomic dynamics would be more intuitive.

Consumers’ low knowledge about inflation poses difficulties for central banks’ ability to monitor expectations and understand consumer behavior, even as central banks are devoting more resources to surveying consumer expectations. These difficulties could be alleviated under NGDPLT. For example, in 2013, the Federal Reserve Bank of New York introduced the Survey of Consumer Expectations (SCE), a monthly survey that collects a rich variety of expectations data for a rotating panel of respondents. The respondents take the survey up to 12 times in a row. My coauthor and I show that the inflation expectations survey responses are subject to large panel conditioning effects (Binder and Kim 2019). That is, after participating in the first round of the survey, respondents make large downward revisions to their inflation forecasts, so respondents of longer survey tenure have lower and more accurate forecasts than respondents of shorter tenure.

It appears that taking the expectations survey prompts respondents to look up information about inflation. This means that survey respondents’ expectations are no longer representative of the population’s expectations, because survey respondents are more informed than the general population. This leads to the appearance that inflation expectations are more “anchored” than they really are in the population.

The SCE does not ask about real or nominal GDP growth expectations, but it does ask for respondents’ expectations of their own income growth. We find no evidence of panel conditioning effects in response to this question, suggesting that consumers have well-formed expectations of their own nominal income and that their reported nominal income expectations can be more reliably used for inference about expectations in the population. This also suggests that consumers may have an easier time providing aggregate nominal income expectations than providing inflation expectations, though more evidence is needed. This, in turn, would allow the central bank to more reliably monitor their credibility.

The single, explicit, numerical target associated with NGDPLT should make it easier for the public to verify whether the central bank is doing what it has promised to do, easier for the central bank to justify the policy stance at any point in time, improving transparency and accountability. The single target will make it harder for politicians to argue that the stance of policy is too easy or too tight.

Another argument for a single target is that it will reduce the reliance on monetary policymakers as “policymakers of last resort” or “the only game in town.” When central banks take on too many objectives, this can absolve fiscal and other policymakers of the consequences of their actions, so that “policymakers better suited to address various issues may be even less likely to act when the central bank is seen as the agent responsible for the outcome” (Davig and Gurkaynak 2015: 355).

Conclusion

No central bank target or mandate should be thought of as permanent: they can always be changed, and change is sometimes required to preserve institutional legitimacy.

I have described how New Zealand’s inflation target became more and more flexible until it was replaced with a dual mandate. The New Zealand experience highlights two defining features of the current monetary policy environment. First is that there is a strong political will to change the targets, frameworks, and governance central banks, especially where populist undercurrents are strong. Second is that central banks face credibility and legitimacy problems in the form of acute “twin deficits” of understanding and trust. These features, of course, are interrelated, as the twin deficit feeds into the political will to change central banks.

Now may be an opportune time to adopt NGDPLT. The lack of popular will to defend the monetary policy status quo could reduce the disruption of a transition to NGDPLT. In the longer run, NGDPLT would facilitate communication with the public, improve accountability, and promote sound policy and economic stability.

References

Afrouzi, H.; Kumar, S.; Coibion, O.; and Gorodnichenko, Y. (2015) “Inflation Targeting Does Not Anchor Inflation Expectations: Evidence from Firms in New Zealand.” Brookings Papers on Economic Activity (Fall): 151–225.

Alesina, A. F., and Stella, A. (2010) “The Politics of Monetary Policy.” NBER Working Paper No. 15856.

Azariadis, C.; Bullard, J.; Singh, A.; and Suda, J. (2015) “Optimal Monetary Policy at the Zero Lower Bound.” Federal Reserve Bank of St. Louis, Working Paper 2015–010A (May).

Barro, R. J., and Gordon, D. B. (1983) “Rules, Discretion and Reputation in a Model of Monetary Policy.” Journal of Monetary Economics 12 (1): 101–21.

Beckworth, D. (2019) “Facts, Fears, and Functionality of NGDP Level Targeting: A Guide to a Popular Framework for Monetary Policy.” Mercatus Special Study. Mercatus Center at George Mason University, Arlington, Va.

Beckworth, D., and Hendrickson, J. R. (2020) “Nominal GDP Targeting and the Taylor Rule on an Even Playing Field.” Journal of Money, Credit, and Banking 52 (1): 269–86.

Bernanke, B. S. (2015) The Courage to Act: A Memoir of a Crisis and Its Aftermath. New York: W.W. Norton.

___________ (2016) “The Fed’s Shifting Perspectives on the Economy and Its Implications for Monetary Policy.” Hutchins Center on Fiscal and Monetary Policy, Brooking Institution (August 8).

Bholat, D.; Broughton, N.; Parker, A.; Meer, J. T.; and Walczak, E. (2018) “Enhancing Central Bank Communications with Behavioural Insights.” Bank of England Staff Working Paper No. 750.

Billi, R. M. (2014) “Nominal GDP Targeting and the Zero Lower Bound: Should We Abandon Inflation Targeting?” Tech. Rep. 270, Sveriges Riksbank Working Paper Series.

Binder, C. (2017a) “Fed Speak on Main Street: Central Bank Communication and Household Expectations.” Journal of Macroeconomics 52: 238–51.

___________ (2017b) “Federal Reserve Communication and the Media.” Journal of Media Economics 30 (4): 191–214.

___________ (2017c) “Measuring Uncertainty Based on Rounding: New Method and Application to Inflation Expectations.” Journal of Monetary Economics 90: 1–12.

___________ (2019a) “Political Pressure on Central Banks.” Working Paper, Haverford College.

___________ (2019b) “Death of a Dogma: The End of Inflation Targeting in New Zealand.” Working Paper, Haverford College.

___________ (2019c) “Central Bank Communication and Disagreement about the Natural Rate Hypothesis.” Working Paper, Haverford College.

___________ (2019d) “Long-Run Inflation Expectations in the Shrinking Upper Tail.” Working Paper, Haverford College.

Binder, C., and Kim, G. (2019) “Panel Conditioning in the Survey of Consumer Expectations.” Working Paper, Haverford College.

Binder, C., and Rodrigue, A. (2018) “Household Informedness and Long-Run Inflation Expectations: Experimental Evidence.” Southern Economic Journal 85 (2): 580–98.

Binder, S., and Spindel, M. (2016) “Independence and Accountability: Congress and the Fed in a Polarized Era.” Center for Effective Public Management at Brookings (April).

Blanchard, O. (2018) “Should We Reject the Natural Rate Hypothesis?” Journal of Economic Perspectives 32 (1): 97–120.

Blinder, A. (2000) “Central-Bank Credibility: Why Do We Care? How Do We Build It?,” American Economic Review 90 (5): 1421–31.

Bullard, J., and DiCecio, R. (2019) “Optimal Monetary Policy for the Masses.” Federal Reserve Bank of St. Louis, Working Paper No. 2019–009C (April 2).

Coibion, O.; Gorodnichenko, Y.; Kumar, S.; and Pedemonte, M. (2018) “Inflation Expectations as a Policy Tool?” NBER Working Paper No. 24788.

Davig, T., and Gurkaynak, R. (2015) “Is Optimal Monetary Policy Always Optimal?” International Journal of Central Banking 11 (S1): 353–84.

de Haan, J., and Eijffinger, S. (2017) “Central Bank Independence under Threat?” CEPR Policy Insight.

Fellner, W. (1976) Towards a Reconstruction of Macroeconomics: Problems of Theory and Practice. Washington: American Enterprise Institute.

___________ (1979) “The Credibility Effect and Rational Expectations: Implications of the Gramlich Study.” Brookings Papers on Economic Activity (1): 167–78.

Financial Times (2016) “The Growing Challenge to Central Banks’ Credibility” (September 23).

Garín, J.; Lester, R.; and Sims, E. (2016) “On the Desirability of Nominal GDP Targeting.” Journal of Economic Dynamics and Control 69: 21–44.

Goodhardt, C., and Lastra, R. (2017) “Populism and Central Bank Independence.” Open Economies Review 29: 49–68.

Goy, G.; Hommes, C. H.; and Mavromatis K. (2018) “Forward Guidance and the Role of Central Bank Credibility under Heterogeneous Beliefs.” De Nederlandsche Bank Working Paper No. 614.

Gros, D., and Roth, F. (2009) “The Crisis and Citizens’ Trust in Central Banks.” Vox (September 10).

Haldane, A. G. (2017) “Everyday Economics.” Speech given at Birmingham’s Nishkam High School (November 27). Available at www.bankofengland.co.uk/speeches.

Haldane, A., and McMahon, M. (2018) “Central Bank Communication and the General Public.” American Economic Review 108 (May): 578–83.

Hawkesby, C. (2019) “Maintaining Credibility in Times of Change.” Remarks delivered at the Institute for Monetary and Economic Studies, Bank of Japan, Tokyo, May 30.

Hawkins, K. A.; Aguilar, R.; Jenne, E.; Kocijan, B.; Kaltwasser, C. R.; and Silva, B. C. (2019) Global Populism Database: Populism Dataset for Leaders 1.0. Available at www.populism.byu.edu.

Issing, O. (2018) “The Uncertain Future of Central Bank Independence.” In S. Eijffinger and D. Masciandaro (eds.), Hawks and Doves: Deeds and Words—Economics and Politics of Monetary Policymaking. London: Centre for Economic Policy Research.

Kamdar, R. (2018) “The Inattentive Consumer: Sentiment and Expectations.” Working Paper, Department of Economics, U.C. Berkeley.

Koenig, E. F. (2010) “The Case for Targeting the Level of Nominal Spending.” Available at www.federalreserve.gov/monetarypolicy/files/FOMC20101013memo02.pdf.

Kool, C. J. M., and Thornton, D. L. (2015) “How Effective Is Central Bank Forward Guidance?” Federal Reserve Bank of St. Louis Review 97 (4): 303–22.

Krugman, P. (1998) “It’s Baaack: Japan’s Slump and the Return of the Liquidity Trap.” Brookings Papers on Economic Activity 29: 137–206.

Kydland, F. E., and Prescott, E. C. (1977). “Rules Rather than Discretion: The Inconsistency of Optimal Plans.” Journal of Political Economy 85: 473–92.

Masciandaro, D., and Passarelli, F. (2018) “Populism, Financial Inequality and Central Bank Independence: A Political Economics Approach.” BAFFI CAREFIN Centre Research Paper No. 2018–74.

Matthews, D. (2019) “The Fed’s Bad Predictions Are Hurting Us.” Vox (May 24).

McCallum, B. T. (1984) “Credibility and Monetary Policy.” In Price Stability and Public Policy, 105–28. Kansas City, Mo.: Federal Reserve Bank of Kansas City.

McDermott, J., and Williams, R. (2018) “Inflation Targeting in New Zealand: An Experience in Evolution.” Speech delivered to the Reserve Bank of Australia Conference on Central Bank Frameworks, Sydney, April 12.

Orr, A. (2019) “In Service to Society: New Zealand’s Revised Monetary Policy Framework and the Imperative for Institutional Change.” Speech delivered at Wharewaka Function Centre, Wellington, March 29.

Roger, S. (2009) “Inflation Targeting at 20: Achievements and Challenges.” IMF Working Paper 09/236. Washington: International Monetary Fund.

Rogoff, K. (1985) “The Optimal Degree of Commitment to an Intermediate Monetary Target.” Quarterly Journal of Economics 100 (4): 1169–89.

___________ (2019) “How Central Bank Independence Dies.” Project Syndicate (May 31).

Romer, C. (2011) “Dear Ben: It’s Time for Your Volcker Moment.” New York Times (October 29).

Roth, F. (2009) “The Effect of the Financial Crisis on Systemic Trust.” Intereconomics 44 (4): 203–08.

Selgin, G. (2018) “Some ‘Serious’ Theoretical Writings That Favor NGDP Targeting.” Alt‑M (June 19).

Sheedy, K. D. (2014) “Debt and Incomplete Financial Markets: A Case for Nominal GDP Targeting.” Brookings Papers on Economic Activity (Spring): 301–61.

Sumner, S. (2011) “Re-Targeting the Fed.” National Affairs. No. 9 (Fall).

___________ (2012) “The Case for Nominal GDP Targeting.” Mercatus Center Research Paper, George Mason University (October 23).

___________ (2014) “Nominal GDP Targeting in Developing Countries.” EconLog (August 23).

van Zuydam, S. (2014) “Credibility as a Source of Political Capital: Exploring Political Leaders’ Performance from a Credibility Perspective.” Paper prepared for the ECPR Joint Sessions, Salamanca, Spain.

This work is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License.