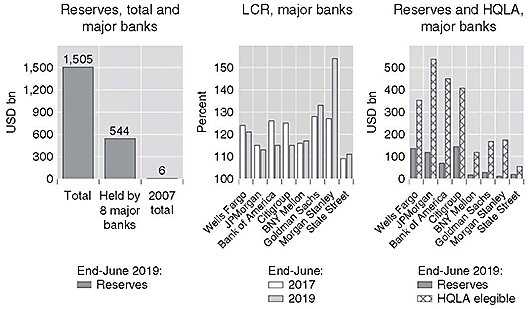

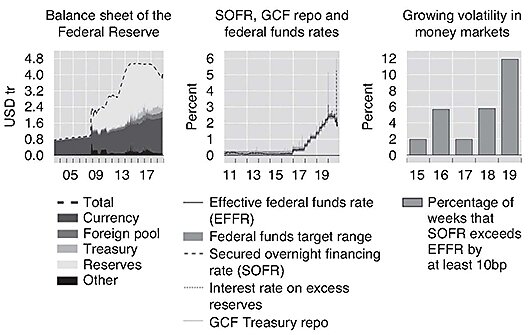

It is not surprising then that issues of monetary policy operations have recently attracted renewed interest. In the past year, there have been several episodes—so far mainly temporary phenomena—of monetary markets “getting backed up.” Indeed, most market and official commentaries have largely concluded that the acute stress in money markets seen in mid-September 2019 and, for that matter, at the end of 2018, has one main source: the shrinking of the Fed’s balance sheet and the concomitant drain of liquidity in the form of reserves. Questions abound about whether these episodes are simply a series of one-off events or whether they are signs of a more fundamental corrosion of the financial pipes that could lead to more persistent and, possibly, larger failures in the future.

In this article, I will argue that recent money market stresses are, in many respects, symptoms of deeper pathologies. While it is true that these stresses have gone hand-in-hand with a smaller Fed balance sheet, the blame lies elsewhere. Namely, private-sector incentives to efficiently reallocate reserves in the financial system have weakened and, hence, undermined the soundness of money markets. At the same time, concerns are growing that the incentives to monitor the actions and motivations of money market participants have eroded. From this “incentives” perspective, many of the solutions generally being considered may be off the mark.

To sketch out the implication of this incentives perspective for reforms of the monetary policy operational framework, the paper is structured as follows. The next section offers evidence supporting the claim that the modestly shrinking Fed balance sheet is not the underlying cause of the money market stresses. I then address the question of why the floor system has not been working as advertised, emphasizing instead the deeper roots of the problem associated with the ways in which monetary policy operations have been adapted to the new financial regulatory environment. Finally, the article turns to some strategic and tactical options for reforming monetary policy operations that move in the direction of strengthening the efficiency of money markets while retaining the financial stability benefits of the new liquidity regulations.

) represent data from early August to mid-September; the plus signs (+) represent data in the first half of October. Other than the two diamond shapes (♦) representing the third and fourth weeks of September, the statistical relationship appears unchanged since late 2014. The data for the second half of September look in retrospect like a few outliers in an otherwise stable structural relationship.

) represent data from early August to mid-September; the plus signs (+) represent data in the first half of October. Other than the two diamond shapes (♦) representing the third and fourth weeks of September, the statistical relationship appears unchanged since late 2014. The data for the second half of September look in retrospect like a few outliers in an otherwise stable structural relationship.