Even forward guidance constitutes a form of self-constraint, though admittedly of a weaker sort. Some make a distinction between “Odyssean guidance,” in which the central bank intends to “tie its hands” in the interest of moving expectations, versus “Delphic guidance” that aims only to reveal its honest forecast in the interest of transparency (Campbell et al. 2012). But in either case, if the economy evolves in a way that was not anticipated, the ex ante pronouncement may act ex post as a constraint on policy decisions in ways that intervening events have rendered unwelcome.

I am increasingly convinced that the constraint must be very loose. Central bankers chronically end up unable to fulfill commitments to nominal targets, rules, or even their own forward guidance. The reason, in most cases, is not that they are insincere, but rather that unforeseen shocks come along after the policy is set. These shocks can make it highly undesirable to stick with the target or, in some cases, can make it impossible.

Satisfying Constraints Is Harder than It Sounds

Consider a selection of possible examples, out of many, where central banks were unable to fulfill commitments. Start with nominal targets, such as fixing the price of gold, the exchange rate, the money growth rate, or the inflation rate.

When Milton Friedman (1948) argued for rules over discretion, the rule that he had in mind was a fixed rate of growth of the money supply. He temporarily won the debate in 1980. But the Fed was forced to abandon its experiment with monetarism in 1982, because of a big increase in the demand for money. Velocity shocks render money targets unworkable.

To take an example from abroad, the Bundesbank continued to pay lip service to M1 targets until the end of its life, but usually missed its targets. The same is true of other countries today that still cite the money supply when the IMF requires them to declare their nominal anchor. Late in his life Friedman admitted that he had overestimated the stability of the money demand function.

Consider, second, inflation targeting (IT) (e.g., Svensson 1999). Inflation targeters also chronically miss their targets. Traditionally they would miss on the upside, failing to bring inflation down as much as promised. But since the 2008 crisis, advanced countries have missed their targets on the downside, failing to bring inflation up as much as promised. The United States undershot its inflation target for 10 years following the Great Recession, despite quadrupling the monetary base and — eventually — reattaining full employment. Japan made an all-out commitment in 2013 to raising its inflation rate to 2 percent. This was the centerpiece of Abenomics, the platform on which the new government had come to office. Yet five years later, Japan still hasn’t even achieved 1 percent inflation.

Price level targeting has been proposed as an alternative to inflation targeting, but would be even less credible. It is true that in a deflationary episode such as 2008–09, a price level target cleverly gets expectations working in a more powerful way, if one assumes that the targets are believed. (The price level target requires that the central bank makes up for misses, while an inflation target lets bygones be bygones.) But why should the public believe such a target?

The same is true for proposals to set an inflation target of 4 percent rather than 2 percent (Blanchard, Dell’Ariccia, and Mauro 2010). Following a period when central banks have been unable to achieve modest targets like 2 percent inflation, why should the public find the proclamation of a more aggressive target credible?

One is reminded of a diet plan that targets losing 1 pound the first week, 2 pounds the second week, etc., with a stipulation that if the participant fails to lose weight the first week, then he is supposed to lose 3 pounds the second week instead of 2, and if he fails that, then 4 pounds the third week, etc. Not a credible penalty. Another analogy is proposed penalties in international agreements to cut emissions of greenhouse gases (if a country misses its target, it has to cut that much more the next period). A third analogy is the penalties that are supposedly part of Europe’s Stability and Growth Pact (if Italy wantonly misses its budget target, it is to pay a penalty the next period, making it even harder to achieve the required budget target).

History has also shown it difficult to comply with rules that specify a multivariable reaction function for the central bank. The Taylor Rule (1993), of course, became inoperable when interest rates unexpectedly hit the zero lower bound in 2008. What would the Fed have done if the Taylor Rule had previously been legislated and in 2008 turned out to have the unintended effect of legally requiring an impossible interest rate of minus 3 percent?

Such stories apply to forward guidance as well. The Fed repeatedly postponed its own predictions of the dates at which it was expected to raise interest rates in 2015–16. The postponements were attributable to a slight slowing in the economic growth rate and thus were appropriate. To be sure, the Fed had repeated endlessly that its dot plots and other forward guidance were only best-guess forecasts and that ultimate decisions would be data-driven. But one suspects that the Fed found the repeated postponements somewhat embarrassing nonetheless.

Even guidance in the minimal form of thresholds hasn’t worked. In December 2012, the FOMC said it would keep interest rates at zero “at least as long as the unemployment rate remains above 6.5 percent.” As it happened, that threshold was reached in April 2014, not because the economy had grown unexpectedly fast but because the labor force participation rate had declined. The Fed was not ready to signal an increase in interest rates. The guidance was abandoned.1

Similarly, in August 2013 the Bank of England said it would not consider raising rates until U.K. unemployment fell to 7.0 percent. That threshold was reached within 6 months (here the unexpected development was evidently a productivity shock), long before the Bank was ready to consider tightening. The guidance was abandoned. These difficulties were the consequence of statements that seemed reasonable at the time but were highly vulnerable to future shocks.2

The Case for Nominal GDP Targeting

Now to the question, to whatever extent the central bank is to be constrained by a rule, even if only weakly, what should that rule be? I am one of those who have argued for nominal GDP (NGDP) targeting (Frankel 1995, 2013). The reason is that it is more robust with respect to shocks than the leading alternatives: it is less likely one will regret having committed to it. In the hey-day of monetarism when the leading candidate for nominal anchor was M1, the argument for NGDP targeting was that it was (by definition) immune from the velocity shocks that plagued M1 targeting.3

Interest in NGDP targeting revived around 2011–12. Proponents this time include Romer (2011), Hatzius (2011), Woodford (2012), Sumner (2014), and Beckworth and Hendrickson (2016). The proposal has particularly flourished on the internet.4

The alternative to beat is no longer an M1 target, which crashed-and-burned in the 1980s, but an inflation target. The case in favor of a NGDP target is still its robustness with respect to shocks. But relative to an inflation target, the advantage of NGDP targeting is robustness with respect to supply shocks. These include productivity shocks and commodity shocks.5 In the presence of an adverse supply shock, an inflation target implies a needlessly tight monetary policy and a needlessly large recession.6 Where an inflation target can push the authorities to tighten in the face of an adverse shock, NGDP targeting allows the impact of the shift to be automatically divided between some loss of price stability and some loss in the output objective. That is roughly speaking what one would want to do anyway, even if one had discretion.

Inflation targeting, especially flexible inflation targeting, has many passionate defenders (e..g., Svensson 2009). I hasten to make clear that I approve of the central bank being transparent about what it sees as the long-run inflation rate (along with the long-run growth rate and unemployment rate). If this is all that is meant by flexible inflation targeting, then fine. But if we are talking about some degree of commitment at a 1- or 2-year horizon, then I still see problems from supply shocks.

Proponents of NGDP targeting have also come up with a third-generation argument concerning financial stability inspired by the global financial crisis: Via countercyclical inflation, NGDP targeting improves the distribution of risk between debtors and creditors (see Koenig 2013; Sheedy 2014; Azariadis et al. 2015; and Beckworth 2018).

What Are the Drawbacks of Nominal GDP Targets?

One common argument against NGDP targets is that the authority cannot hit them. The same point applies to inflation targets, however. Either way, nobody proposes to stake all credibility on hitting the target.

A second common argument is that the person in the street does not understand what NGDP is, or how it breaks down into real GDP and the price level. Central bankers fear the public would hold them responsible for hitting a real GDP target that might be rendered impossible by an adverse productivity shock. This could well be true. But it is all the more reason to avoid choosing an ex ante target like inflation that in the event of an adverse supply shock must be abandoned ex post amid feeble explanations about the unforeseen development. If a central bank adopted NGDP targeting, it would implicitly and explicitly make the point that it has no control over productivity shocks or commodity shocks. It is better to make that point ex ante than ex post.

Third, NGDP numbers are revised over time by the statistical agencies. This problem does indeed seem a drawback of NGDP targeting, but not a fatal one, especially if the commitment is to be loose anyway.

If the Target Is to Be NGDP, How Strong Should the Commitment Be?

I once thought that it would be easier to hit a two-year target for NGDP growth within a given range (say plus or minus 1 percent) than to hit a corresponding target for inflation. The logic was that monetary policy largely has to pass through NGDP anyway, to get to inflation: Inflation can be deflected from its target by both supply and demand shocks, while NGDP can only be deflected by demand shocks. But I no longer am so sure of that. I still think NGDP targets would be better than inflation targets if they could be achieved, but I am no longer so confident that they can be achieved.

For this reason, one should not stake a lot of credibility on a particular target for NGDP growth, even with a target range (just as the Fed does not currently stake a lot of credibility on hitting its inflation target precisely, in the short term).

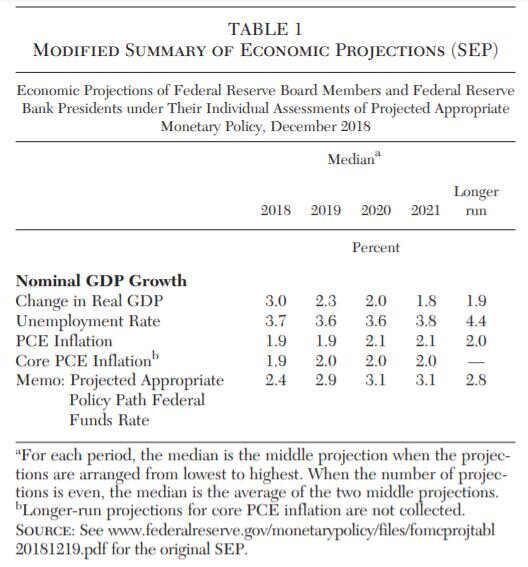

I come out with a very modest proposal. The Fed should add a row for Nominal GDP to the FOMC’s Summary of Economic Projections (SEP). This seems a useful idea even if the governors and district presidents who fill out the SEP table simply were to derive their projected NGDP growth numbers by taking the sum of the real growth row and the inflation rate row of the table (though inflation in the SEP table is currently the PCE deflator, not the GDP deflator).

I would prefer that NGDP be reported in the first row of the SEP table, above the rows for real growth, unemployment, inflation, and the fed funds rate (Table 1), and that the public be allowed to infer that the Fed was now paying some attention to NGDP.

Should Politicians Constrain the Fed?

Rules are one kind of constraint on the central bank’s discretion; but another kind is control by the rest of the government. In recent years, Congress and the White House have made attempts to rein the Fed in. If they were to succeed in puncturing the Fed’s vaunted independence, there is reason to think that the effect would be to make monetary policy procyclical.

Consider a few quotes, out of many that one could equally well have chosen:

• On November 15, 2010, 23 conservative economic and financial leaders wrote a letter to the Wall Street Journal protesting the Fed’s monetary easing and warning of “currency debasement and inflation.” At the time the unemployment rate was 9.8 percent.7

• On September 29, 2011, Donald Trump tweeted: “The Fed’s reckless policies of low interest and flooding the market with dollars needs to be stopped or we will face record inflation.” Unemployment was still 9.0 percent.

• On July 19, 2018, President Trump said: “I am not happy about [interest-rate increases]” (Wall Street Journal 2018). And on October 11: “the Fed is out of control.” The unemployment rate had by then fallen to 3.7 percent.

This and other historical evidence8 suggests that if the politicians who want to bring the Fed under control got their way, they might act procyclically instead of countercyclically. They could tighten monetary policy when unemployment exceeded 9 percent and loosen when it was lower than 4 percent. Needless to say, such a pattern would work to exacerbate the swings in the business cycle.

The conclusion? Let the Fed do its job.

References

Abrams, B. (2006) “How Richard Nixon Pressured Arthur Burns: Evidence from the Nixon Tapes.” Journal of Economic Perspectives 20 (4): 177–88.

Azariadis, C.; Bullard, J.; Singh, A.; and Suda, J. (2015) “Optimal Monetary Policy at the Zero Lower Bound.” Federal Reserve Bank of St. Louis, Working Paper 2015-010A (May). Available at http://research.stlouisfed.org/wp/2015/2015-010.pdf.

Beckworth, D. (2018) “Better Risk Sharing through Monetary Policy?: The Financial Stability Case for a Nominal GDP Target.” Mercatus Working Paper. Arlington, Va.: Mercatus Center at George Mason University (December 21).

Beckworth, D., and Hendrickson, J. R. (2016) “Nominal GDP Targeting and the Taylor Rule on an Even Playing Field.” Mercatus Working Paper. Arlington, Va.: Mercatus Center at George Mason University (October).

Bhandari, P., and Frankel, J. (2017) “Nominal GDP Targeting for Developing Countries.” Research in Economics (Elsevier) 71 (3): 491–506.

Blanchard, O.; Dell’Ariccia, G.; and Mauro, P. (2010) “Rethinking Macroeconomic Policy.” IMF Staff Position Note. Washington: International Monetary Fund (February 12).

Campbell, J.; Evans, C.; Fisher, J.; and Justiniano, A. (2012) “Macroeconomic Effects of Federal Reserve Forward Guidance.” Brookings Papers on Economic Activity (Spring): 1–54.

Frankel, J. (1995) “The Stabilizing Properties of a Nominal GNP Rule.” Journal of Money, Credit and Banking 27 (2): 318–34.

__________ (2007) “Responding to Crises.” Cato Journal 27 (2): 165–78.

__________ (2012) “Central Banks Can Phase in Nominal GDP Targets Without Damaging the Inflation Anchor.” VoxEU (December 19).

__________ (2013) “Nominal GDP Targets Without Losing the Inflation Anchor.” In L. Reichlin and R. Baldwin (eds.) Is Inflation Targeting Dead: Central Banking after the Crisis, 90–94. London: Centre for Economic Policy Research.

__________ (2014) “Recent ‘U-turns’ in Central Banks’ Forward Guidance Were Avoidable.” Views on the Economy and the World blog. Available at www.jeffrey-frankel.com/2014/01/26/recent-u-turns-in-central-banks-forward-guidance-were-avoidable.

Friedman, M. (1948) “A Monetary and Fiscal Framework for Economic Stability.” American Economic Review 38 (3): 245–64.

Hatzius, J. (2011) “The Case for a Nominal GDP Level Target.” US Economics Analyst, Goldman Sachs Global ECS Research (October).

Koenig, E. (2013) “Like a Good Neighbor: Monetary Policy, Financial Stability, and the Distribution of Risk.” International Journal of Central Banking (June): 57–82.

Meade, J. (1978) “The Meaning of Internal Balance.” Economic Journal 88: 423–35.

Romer, C. (2011) “Dear Ben: It’s Time for Your Volcker Moment.” New York Times (October 29).

Sheedy, K. D. (2014) “Debt and Incomplete Financial Markets: A Case for Nominal GDP Targeting.” Brookings Papers on Economic Activity (Spring): 301–61.

Sumner, S. (2014) “Nominal GDP Targeting: A Simple Rule to Improve Fed Performance.” Cato Journal 34 (2): 315–37.

Svensson, L. (1999) “Inflation Targeting as a Monetary Policy Rule.” Journal of Monetary Economics 43 (3): 607–54.

__________ (2009) “Flexible Inflation Targeting: Lessons from the Financial Crisis.” Speech at Bank for International Settlements, Basel.

Taylor, J. B. (1993) “Discretion versus Policy Rules in Practice.” Carnegie-Rochester Conference Series on Public Policy 39: 195–214.

Tobin, J. (1980) “Stabilization Policy Ten Years After.” Brookings Papers on Economic Activity 1: 19–72.

Woodford, M. (2012) “Methods of Policy Accommodation at the Interest-Rate Lower Bound.” Paper presented at the Federal Reserve Bank of Kansas City Jackson Hole Symposium (August).

Woodward, B. (2000) Maestro: Greenspan’s Fed and American Boom. New York: Simon and Schuster.

Wall Street Journal (2018) “Donald Trump Says He’s ‘Not Happy’ about Federal Reserve Interest-Rate Increases” (July 19).

1 See www.federalreserve.gov/newsevents/pressreleases/monetary20140319a.htm.

2 The vulnerability was predicted (e.g., Frankel 2012: fn 3; 2014).

3 The original proposal was from Meade (1978) and Tobin (1980), followed by analysis from many others.

4 Including contributions of David Beckworth (at Macro Market Musings), Scott Sumner (at Money Illusion), Lars Christensen (at Market Monetarist), and Marcus Nunes (at Historinhas).

5 Weather shocks, natural disasters, and terms of trade shocks, along with big productivity shocks, make NGDP targeting particularly relevant for developing countries (Bhandari and Frankel 2017).

6 For example, in July 2008, the European Central Bank decided to raise interest rates just as the world was sliding into the Great Recession. That move was hard to explain other than as an IT-induced reaction to spiking oil prices.

7 Signers included Michael Boskin, Charles Calomiris, Niall Ferguson, Kevin Hassett, Douglas Holtz-Eakin, David Malpass, Paul E. Singer, and John B. Taylor.

8 To take two more examples, Presidents Richard Nixon and Ronald Reagan both put pressure on the Fed to ease monetary policy at times when inflation and growth were already relatively high. Frankel (2007) summarizes the episodes under “Inflation Crises,” citing evidence from Abrams (2006) and Woodward (2000), respectively.