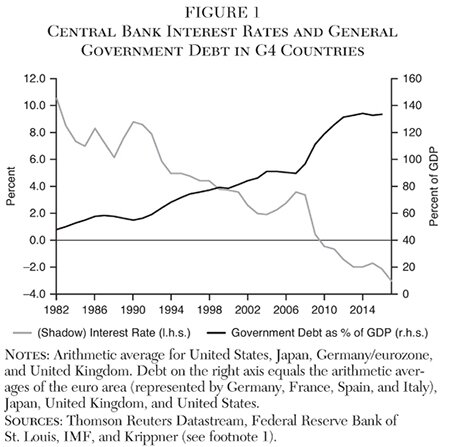

The world has moved into a low-interest rate trap. Since the mid-1980s, asymmetric monetary policy patterns—that is, sharp interest rate cuts during crises and hesitant interest rate increases during the post-crisis recoveries—have pushed interest rates toward zero (Hoffmann and Schnabl 2011) (see Figure 1).1 With short-term interest rates having reached the zero bound, unconventional monetary policies (i.e., extensive government and corporate bond purchases) have nudged long-term interest rates further downward.

The ultra-low interest rate policies encouraged financial market exuberance, which led to painful financial meltdowns, during which exploding debt of financial institutions was transformed into public debt to ensure financial stability. By pushing long-term interest rates downward, central banks are keeping growing general government debt levels (see Figure 1) sustainable and are discouraging efforts to reduce government spending. Inflated central bank balance sheets, which contain growing amounts of government bonds, erode the credibility of central banks.

Meanwhile, the exit from the low, zero, and negative interest rate policies is strongly dependent on the public debt levels, because every increase in interest rates threatens to cause a meltdown in the financial system and (thereby) to block the budgets of highly indebted countries (see Figure 1). For this very reason—while pretending to pursue inflation targets—the central banks in the core of the international monetary system either continue their extensive bond purchase programs (Bank of Japan, European Central Bank) or have moved very hesitantly toward the exit from ultra-loose monetary policies and financial repression (U.S. Fed, Bank of England).

The literature on the exit from the low interest rate environment is scarce. Summers (2014) argues that, given aging societies and a declining marginal efficiency of investment, the key interest rates set by the central banks reflect the gradual decline of the equilibrium interest rate in the industrialized countries. Given these assumptions an exit from the ultra-expansionary monetary policies is not necessary.

Reinhart and Sbrancia (2015) argue on the basis of historical experience that low nominal interest rates help to contain debt servicing costs and to reduce the real value of government debt. Thus, financial repression is seen as a pre-step for the exit from excessive monetary expansion. McKinnon (1993) has developed a blueprint for the exit from financial repression in emerging market economies based on the reconstitution of market forces, which has proven to be highly successful in many East Asian as well as Central and Eastern European countries, and in particular in China.

Low-Growth Effects of Financial Repression

McKinnon (1973) showed the negative growth effects of the financial repression imposed on the capital markets of emerging market economies in the 1950s and 1960s.2 Uncontrolled government expenditure financed by the expansion of the real stock of money undermined via repressed financial markets the efficiency of investment. With state-controlled interest rates the allocation of capital had become disconnected from market principles.3 Similarly, since the mid-1980s the asymmetric monetary policy patterns of the large central banks have disturbed the allocation function of capital markets by driving a wedge between the returns of financial assets and physical capital stock.

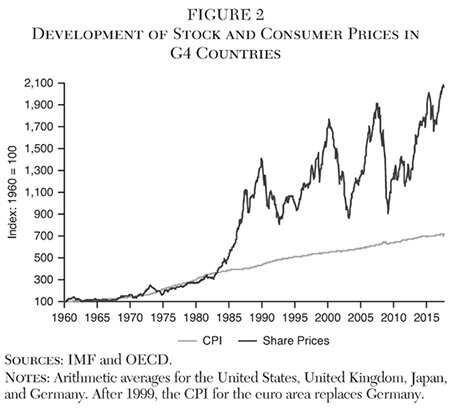

Since the mid-1980s asymmetric monetary policies have subsidized investment in financial assets. During upswings, low central bank interest rates have inflated asset prices, whereas during crises the decline of asset prices has been countered with even further interest rate cuts and unconventional monetary policy measures (Hoffmann and Schnabl 2011).4 As a result, since the mid-1980s asset prices—as represented in Figure 2 by the share prices in the four largest industrialized countries—have increased dramatically, leading to substantial speculation gains. Since 1985—despite substantial swings—the average increase in share prices per year has been close to 7 percent.

In contrast, investment in physical capital was discouraged because no public insurance mechanism was provided for risk linked to investment in innovation and attempts to increase the efficiency of the production process. The ultra-expansionary monetary policies have disturbed—like in the emerging market economies formerly plagued by financial repression—the adoption of best-practice technologies5 by undermining the allocation function of interest rates, which separates between investment projects with high and low expected returns. This has clouded growth perspectives and therefore profit opportunities of most enterprises.

Whereas interest rate cuts during boom phases encouraged investment projects with lower returns, during the crisis further interest rate cuts prevented the dismantling of investment projects with low marginal efficiency.6 On the global level, this resulted in an increasing number of zombie enterprises and zombie banks, which are kept alive by the low-cost liquidity provision of central banks (see Peek and Rosengreen 2005 as well as Cabellero, Hoshi, and Kashyap 2008 on Japan).7 Kornai (1986) dubbed this phenomenon “soft budget constraints” for the former centrally planned economies of central and eastern Europe. Unemployment was regarded as politically undesirable; thus, state-owned enterprises were subsidized with costless credit by state-controlled banks. The banks were kept alive with the help of the printing press of the central bank.

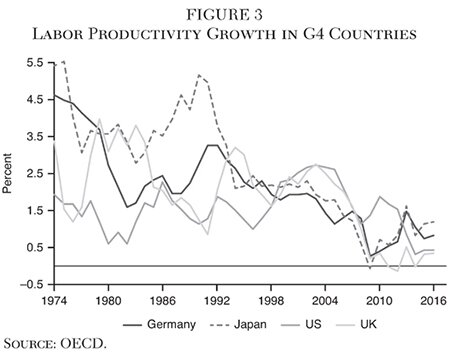

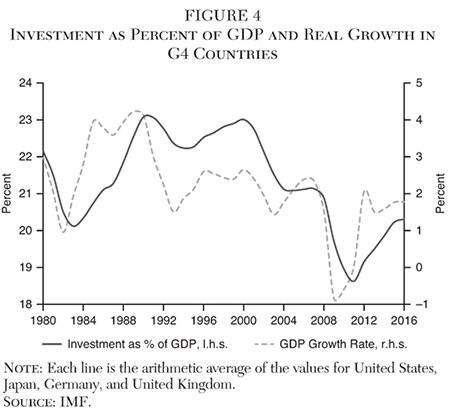

With resources remaining bound in low-return investment projects, a restraint has been put on efficiency-increasing innovation. In the neoclassical growth model, given a declining marginal efficiency of investment, output converges toward a steady state (Solow 1956, Swan 1956). Beyond that point, growth is only possible, if innovation takes place (Solow 1957). If, however, financial repression undermines the innovation process by binding resources in inefficient investment projects and reducing the incentive for household savings,8 then investments, productivity gains, and growth will slow. This is shown in Figures 3 and 4 for the United States, United Kingdom, Japan, and Germany.

Distribution Effects and Political Instability

The negative growth effects have been paired with far-reaching redistribution effects of the very expansionary monetary policies.9 First, if central banks depress government bond yields, the public sector gains at the cost of the private sector, which holds these assets. Second, the financial sector gains relative to the rest of the economy because currency units newly issued by the central bank are transferred first to the financial institutions, which can spend the newly issued currency units first. Each previously created currency unit held by other economic agents can purchase a smaller portion of goods, services, or assets (such as stocks and real estate) (Cantillon 1931).

Third, the higher income class (which owns the largest share of stocks and real estate) gains relative to the middle class (which tends to save in low-risk asset classes) because the excessive money creation inflates asset prices (see Figure 3), while it depresses returns on bank deposits and government bonds.

Fourth, young people lose relative to older people because productivity gains converging toward zero put a restriction on real wage increases. This burden is overproportionally shifted to newcomers in the labor markets, because older contracts allow for a stronger wage negotiation power. Given productivity gains close to zero, the wage level (and the social security benefits) of the younger generation declines compared to former generations. The real wage level of the younger generation declines even more when deflated by real estate prices. The acquisition of real estate has become increasingly difficult for young people in the economic centers.

Fifth, as financing conditions for bank-based lending deteriorate while financing conditions on capital markets improve, large banks and enterprises (which have direct access to capital markets) gain relative to small and medium banks and enterprises. A concentration process in both the financial and enterprise sector evolves.10 Sixth, if large enterprises and financial institutions are clustered in specific regions, regional economic disparity grows. Young people are forced to move from the peripheries to the centers to find employment.

All in all, the redistribution effects of ultra-loose monetary policies and financial repression lead to growing wealth and income inequality. According to Hayek (1976) people regard the granting of privileges to specific groups—such as investment bankers, managers of large enterprises, and real estate owners—as unjust. Even if in the short-term it is rational to ignore the impact of monetary policies for increasing inequality,11 in the longer term more and more people will call for change.

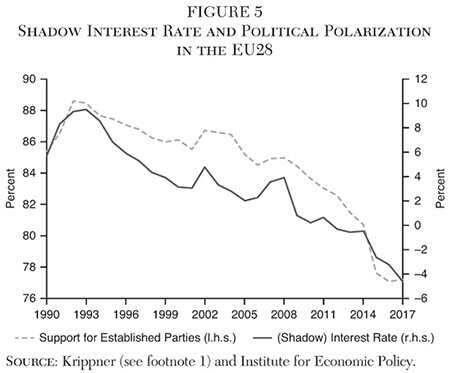

People who want to stress the need for more redistribution will tend to vote for very left parties or candidates. Others will move to the extreme right, as they see the solution to the problem in more economic (and thereby political) nationalism. The rise of nationalism is particularly favored when growing inequality is attributed in the public to globalization (see, e.g., Rodrik 2017). Figure 5 shows for the EU28 the average share of votes for the established parties in the EU, which has been declining together with “shadow” interest rates in the eurozone.12

The causality between increasingly loose monetary conditions and political destabilization goes in both directions. First, the preceding monetary expansion increases inequality and therefore the likelihood of political dissatisfaction. Second, the resulting loss of votes for the established parties triggers additional redistribution efforts by the governments, which aim to restore political stability (e.g., by increasing retirement benefits and providing more financial support for young families and periphery regions). To finance the additional government expenditure, additional government bond purchases (quantitative easing) of central banks become necessary, which initiates a new round of adverse redistribution effects of monetary expansion.13

Because growing political instability constitutes a severe threat for welfare and peace, a timely exit including an exit strategy from ultra-loose monetary policies is necessary.

Exit Strategies

Debt reduction via financial repression as proposed by Reinhart and Sbrancia (2015) is not a solution. The United States and United Kingdom could reduce their post–World War II debt burden of more than 100 and 250 percent of the nominal GDP because the postwar reconstruction provided an exogenous source of growth.14 In sharp contrast, today—by keeping interest rates artificially low—growth and therefore inflationary pressure are undermined by the very factor that has caused high government debt—that is, the extreme monetary expansion.15

As Friedman (1967) has noted, in the long run central banks are unable to influence real variables, such as the rate of unemployment, because expectations adjust to any monetary shock. Therefore, as in the emerging markets and the central and eastern European countries since the 1980s, in the industrialized countries a fundamental reconstitution of market principles is necessary to reanimate growth.

McKinnon (1993) shows that many emerging market economies that liberalized their financial markets and economic systems prior to the 1990s were able to achieve impressive economic growth. The most prominent growth miracle since the 1990s has been in China, although the liberalization process has been interrupted by the low interest rate policies of the industrialized countries.16 Meanwhile, in the most industrialized countries, new unsustainable exuberance in financial markets is contained by tighter financial supervision and comprehensive macroprudential measures, which have become, however, a main impediment for the efficient allocation of resources.17

McKinnon (1993) stressed that fiscal and monetary consolidation has to precede the liberalization of financial markets, otherwise the low-cost liquidity provision of central banks would trigger destabilizing turmoil in financial markets.18 The focus of fiscal consolidation in industrialized countries would be on curtailing expenditure, as the share of government expenditure as percent of GDP is high in most countries.

The fiscal consolidation process could be facilitated by a debt relief. For instance, postwar Germany and Japan achieved the reduction of public debt by outright default. In Germany in the course of a currency reform, government bonds, cash, and sight deposits were simply devalued. The resulting burdens were partially redistributed by taxing real assets, in particular real estate.19 As such a redistribution process is vulnerable to the influence of special interest groups, it is likely to further enhance political discontent. Therefore, a market-oriented debt reduction process based on gradual interest rate increases is the superior solution.

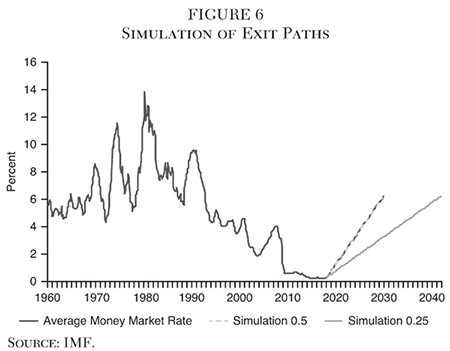

To achieve an exit without tears, which avoids major meltdowns in the financial sector and the bankruptcy of highly indebted states, the process has to be simultaneously credible, slow, transparent, sequenced along the yield curve, and internationally coordinated. As nominal interest rates at zero and real interest rates below zero can—from a Hayek-Mises perspective—be assumed to be far below the natural interest rate, a sustainable exit strategy would restore the long-term average in the postwar nominal short-term interest rate of about 6 percent.20 This long-term average before the start of the asymmetric interest rate path can be seen as a rough proxy of Hayek’s natural interest rate.

First, as monetary policies have become increasingly expansionary for more than three decades—as represented by the convergence of short-term and long-term interest rates toward zero and the gradual inflation of central bank balance sheets—expectations have become strongly tilted toward the persistence of the ultra-low interest rates. To shift the expectations toward an exit from ultra-low loose policies, a credible reversal is necessary. As inflation targeting regimes have contributed to the detrimental persistence of the ultra-loose monetary policies,21 the credible announcement of a fundamental change in the monetary policy strategy is a prerequisite for a shift in expectations.

For this purpose, consumer price index–based inflation-targeting regimes should be publicly dismissed, as they are mainly serving the perpetuation of government financing by central banks. The new monetary regime should be based on targeting the monetary base in the tradition of the quantity theory of money with base money growth being oriented to output growth.22 This strategy would minimize the destabilizing effects of monetary policies in financial markets.

Second, the exit from the ultra-low interest rate policies has to be slow because the structural distortions, which have been caused by the increasingly expansionary monetary policies, can be assumed to be immense. To avoid major economic disruptions including surging unemployment, the production factors have to be reallocated steadily. A gradual increase of interest rates would force governments to reduce debt by gradually cutting expenditure and streamlining social security systems. This would shift resources from the public sector back to the private sector.

Reducing the liquidity provision to the financial sector would deflate the balance sheets of financial institutions, thereby shifting resources from the financial sector to the enterprise sector. In particular, the financial sectors in the United States and United Kingdom would be consolidated, stimulating industrial production. As speculation would be reduced, investment banking would shrink more than traditional banking (which would be reanimated).

The commercial banks would have to restructure their balance sheets by removing bad loans. By doing so they would have to exert pressure on their debtors in the enterprise sector to increase efficiency. The enterprises would be forced to push forward innovation and efficiency gains in the production process. This would necessitate additional investment in fixed and/or human capital. As the consolidation process in the government, financial, and enterprise sectors would take time, the increase in short-term interest rates should not be more than, say, 0.5 or 0.25 percentage points per year.

Third, to stabilize expectations, the exit process has to be transparent by following an exit rule that aims to reconstitute the natural interest rate level.23 For example, the central bank could be restrained to hold increases in the policy rate to 0.5 or 0.25 percentage points per year for a predefined time period, without any possibility of suspending that rule. The slow, but rule-based interest rate increases would contain financial turbulence as the first move is small and further steps are slow and predictable. The slow speed of interest rate increases would give all involved institutions sufficient time to adjust, so that panic is misplaced. At the earliest, after a period of 12 (0.5) or 24 (0.25) years, the rule should be allowed to be reassessed and to be transformed into a revised monetary policy rule.24 The respective exit paths are shown in Figure 6.

Fourth, a forward-looking exit strategy should consider the fact that interest rates have become manipulated by central banks both at the short and the long end of the yield curve. Therefore, the exit process has to be sequenced along the yield curve. The exit from conventional monetary expansion (targeting the short-term interest rate) should precede the exit from unconventional monetary expansion (targeting the long-term interest rate).

Lifting the short-term interest rate first would stabilize the financial sector. Up to the present, zero- or close-to-zero interest rate policies have paralyzed the money market thereby restricting the lending of banks with liquidity shortages (but good lending opportunities). The conventional and unconventional monetary policies have depressed lending–deposit spreads as the traditional source of commercial banks’ income. This has particularly destabilized small and medium banks and their lending activity to small and medium enterprises.

If short-term interest rates increase, potential lenders on the money market would start lending again to banks with liquidity shortages. Both banks with liquidity overhangs and banks with liquidity shortages could generate additional profits. Banks with liquidity overhangs would gain from money market lending. Banks with liquidity shortages would gain, as additional business would be generated and lending-deposit spreads would increase. With growing profits of small and medium banks, lending to small and medium enterprises could grow, thereby supporting small and medium enterprises. The strengthening of the banking sector would contain concerns that banks have to be recapitalized by the governments. This would contribute to the stabilization of the public sectors.

As long-term interest rates would be kept under control via unconventional monetary policies in the first phase of the exit, this would help to stabilize financial institutions and insurance companies, which hold large amounts of government bonds. Sharp fluctuations of long-term interest rates in response to the announcement of the exit would be contained. Governments would gain some time to reduce expenditure and debt levels.

After a year, the restrictions on long-term interest rates should be gradually removed by reducing the stocks of government bond holdings of central banks. The reduction should follow an exit rule as well, specifying a specific amount per month. The rule could mirror inversely the build-up of government bond holdings, with respect to both timing and scale. The target point of the unwinding of government bond holdings should be fixed at the share of GDP as it prevailed before the start of the unconventional monetary policy measures.

Then, long-term interest rates also would be increasingly determined by market forces. Without unconventional purchases of government bonds by the central banks, long-term yields would be set again at the average of expected future short-term rates plus a liquidity premium. The gradual reduction of public debt would help to contain large shifts in risk premiums.

Fifth, the exit from low interest rates has to be coordinated among the four largest central banks—Federal Reserve, Bank of Japan, European Central Bank, and Bank of England—to avoid major disruptions in the foreign exchange markets. The recent history of tapering and the exit from low interest rates in the United States has shown that an isolated exit of only one major central bank from the ultra-low interest rate environment causes an appreciation of the domestic currency.

Discontent among export-oriented (i.e., large and politically influential) enterprises and the deflationary pressure of appreciation constitute a restraint on any unilateral exit strategy. A coordinated exit of all major central banks is a way to escape from the current prisoner’s dilemma in the international monetary system, which would avoid exchange rate disruptions. The coordination process would also enhance the credibility of the exit in every singly participating country.

Outlook

Many former developing countries and socialist planning economies have shown that the exit from low interest rate policies and financial repression is worthwhile because it nudges companies, banks, and citizens back into a market-oriented, spontaneous order. This boosts productivity gains and growth. Thus, today in the industrialized countries also, the exit from the asymmetric monetary policies would be equivalent to a reanimation of growth, as the hidden nationalization process in the financial and enterprise sector would be reversed.

In the industrialized countries, banks and enterprises still operate based on market principles (although the public sector fundamentally distorts price signals). International trade and capital flows remain widely liberalized, and robust legal frameworks prevail. Therefore, the adjustment to the new environment will be much easier compared to the transformation processes in the formerly financially repressed emerging market economies.

Most financial institutions, enterprises, and governments will be able to adjust. If some banks and enterprises fail, new ones will emerge. Most states would be able to adjust, as huge and inefficient budgets provide ample room for consolidation. Large assets owned by the public sector such as real estate and infrastructure would provide room for debt-equity-swaps. Insolvent states will be forced to restructure.

There are concerns that the exit from low interest rate policies would lead into a global crisis initiated by a meltdown in the financial sector. Yet the opposite is likely to be the case. The gradual decline of interest rates since the mid-1980s has not boosted but has paralyzed growth. It has increased volatility on financial markets, with the resulting uncertainty further depressing investment as a main determinant of growth. Therefore, inverting the process would imply in the medium term accelerating growth supported by growing financial stability.

To achieve an exit without tears, the exit process has to be credible, slow, transparent, sequenced over the yield curve, and internationally coordinated. Neglecting one of these principles would destabilize the exit path. The G7 would provide an appropriate platform for international coordination.

With incentives being restored, resources would be reshuffled from speculative investment toward investment in fixed and human capital. Economic activity would be reshuffled from the public to the private sector and from the financial sector to the enterprise sector. Both are likely to generate substantial productivity gains, which would be the basis for real wage increases. The reduction of financial market speculation would help to reduce wealth and income inequality. This would strengthen private consumption and encourage investment by enterprises, thereby creating better-paid jobs.

As speculation is discouraged, the richer part of the population would contribute more than other parts of the population to the adjustment process via a declining market value of their assets and lower payment for the highly ranked management. The access of low- and middle-income groups to assets such as stocks and real estate would be facilitated. Both factors would be regarded as just among major parts of the population and therefore help to restore political stability. This adjustment would help to promote free markets and free trade, which are the basis of long-run economic growth and welfare in the industrialized countries.

References

Caballero, R.; Hoshi, T.; and Kashyap, A. (2008) “Zombie Lending and Depressed Restructuring in Japan.” American Economic Review 98 (5): 1943–77.

Cantillon, R. (1931) Abhandlung über die Natur des Handels im allgemeinen. Jena, Germany: Fischer.

Caplan, B. (2001) “Rational Ignorance versus Rational Irrationality.” Kyklos 54 (1): 3–26.

Duarte, P., and Schnabl, G. (2017) “Monetary Policy, Income Inequality and Political Instability.” CESifo Working Paper 6734.

Friedman, M. (1967) “The Role of Monetary Policy.” American Economic Review 58 (1): 1–17.

Gerstenberger, J., and Schnabl, G. (2017) “The Impact of Japanese Monetary Policy Crisis Management on the Japanese Banking Sector.” CESifo Working Paper No. 6440.

Hayek, F. A. (1931) Prices and Production. New York: August M. Kelly.

__________ (1976) Law, Legislation, and Liberty. Vol. 2: The Mirage of Social Justice. Chicago: University of Chicago Press.

Hoffmann, A., and Schnabl, G. (2011) “A Vicious Cycle of Manias, Crises and Asymmetric Policy Responses: An Overinvestment View.” World Economy 34: 382–403.

__________ (2016) “The Adverse Effects of Ultra-Loose Monetary Policies on Investment, Growth and Income Distribution.” Cato Journal 36 (3): 449–84.

Kornai, J. (1986) “The Soft Budget Constraint.” Kyklos 39 (1): 3–30.

McKinnon, R. (1973) Money and Capital in Economic Development. Washington: Brookings Institution Press.

__________ (1993) The Order of Economic Liberalization: Financial Control in the Transition to a Market Economy. Baltimore: The Johns Hopkins University Press.

McKinnon, R., and Schnabl, G. (2014) “China’s Exchange Rate and Financial Repression: The Conflicted Emergence of the Renminbi as an International Currency.” China and World Economy 22 (3): 1–34.

Meade, J. (1978) “The Meaning of Internal Balance.” Economic Journal 88 (351): 423–425.

Mises, L. von ([1912] 1980) The Theory of Money and Credit. Reprint. Indianapolis: Liberty Classics.

__________ (1949) Human Action. New York: Foundation for Economic Education.

Peek, J., and Rosengren, E. (2005) “Unnatural Selection: Perverse Incentives and the Misallocation of Credit in Japan.” American Economic Review 95 (4): 1144–66.

Reinhart, C., and Sbrancia, M. B. (2015) “The Liquidation of Government Debt.” NBER Working Paper No. 16893.

Rodrik, D. (2017) “Populism and the Economics of Globalization.” Working Paper, John F. Kennedy School of Government, Harvard University.

Rogoff, K. (2017) The Curse of Cash. Princeton, N.J.: Princeton University Press.

Schnabl, G., and Müller, S. (2017) “Die Zukunft der Europäischen Union aus ordnungspolitischer Perspektive.” Universität Leipzig Wirtschaftswissenschaftliche Fakultät Working Papers 150.

Schumer, S. (2012) “How Nominal GDP Targeting Could Have Prevented the Crash of 2008.” In D. Beckworth (ed.) Boom and Bust Banking: The Causes and Cures of the Great Recession 146–47. Oakland, Calif.: Independent Institute.

Schumpeter, J. (1934) The Theory of Economic Development. Cambridge, Mass.: Harvard University Press.

Shaw, E. (1973) Financial Deepening in Economic Development. New York: Oxford University Press.

__________ (1957) “Technical Change and the Aggregate Production Function.” Review of Economics and Statistics 39 (2): 312–20.

Summers, L. (2014) “U.S. Economic Prospects: Secular Stagnation, Hysteresis, and the Zero Lower Bound.” Business Economics 49 (2): 65–73.

Swan, T. (1956) “Economic Growth and Capital Accumulation.” Economic Record 32 (2): 334–61.

White, L. H. (2015) “Hayek and Modern Macroeconomics.” George Mason University Working Paper in Economics 15-05.

1In Figure 1, unconventional monetary policy measures are converted into implied interest rate cuts. This leads to negative “shadow” interest rates in a close-to-zero interest rate environment. Implied (“shadow”) interest rates come from Leo Krippner. See www.rbnz.govt.nz/research-and-publications/research-programme/additional-research/measures-of-the-stance-of-united-states-monetary-policy/comparison-of-international-monetary-policy-measures.

2See also Shaw (1973). Financial repression was defined as a set of policy measures that constitute the transfer of wealth from the private to the public sector. The measures include interest rate controls, including low government bond yields, other price controls, state control of banks, and restrictions to international goods and capital flows.

3Whereas neoclassical theory regards real money balances and physical capital as substitutes, McKinnon (1973) stressed the complementarity.

4The increasing cyclicality of financial markets can be explained using the monetary overinvestment theories of Mises (1912) and Hayek (1931), which attribute overinvestment and exuberance in financial markets during the upswing to too low central bank interest rates. In crisis, central banks keep interest rates too high, thereby aggravating the crisis. In contrast to the monetary overinvestment theories, the monetary policy mistakes during the last three decades tended to be asymmetric: interest rates tended to be kept too low during the upswing, but were kept too high during the downswing. In Hayek (1931) the economy is in equilibrium when the central bank sets the central bank interest rate close to the natural interest rate. The natural interest rate is the interest rate that aligns saving and consumption preferences with the production structure over time. A fall in the central bank interest rate (capital market interest rate) below the natural interest rate causes a cumulative inflationary process, creating distortions in the production structure that later make an adjustment necessary (unless the central bank keeps on inflating credit at an ever-increasing pace and thereby artificially prolongs the credit boom). See also Hoffmann and Schnabl (2011).

5See Hayek (1968) on competition as a discovery procedure.

6The overinvestment theories by Mises (1912) and Hayek (1931) assume that central bank interest rates above the natural interest during the downturn trigger a dismantling of investment projects with low returns. Schumpeter (1934) dubbed this process cleansing effect: resources bound in investment projects with low or negative returns are freed and can be shifted into projects with higher returns. See also White (2015).

7Hayek (1976) would characterize this process as a gradual shift from a spontaneous to a planned order.

8Since the mid-1980s household savings rates have trended downward in all major industrialized countries, which puts into question the savings glut hypothesis (Summers 2014).

9For details see Hoffmann and Schnabl (2016) and Duarte and Schnabl (2017).

10For details on the concentration process in the financial sector of Japan, see Gerstenberger and Schnabl (2017).

11On the rational ignorance, see Caplan (2001).

12The support for established parties is defined as one minus the share of votes for extreme left and extreme right parties in parliamentary elections. For detailed information on the data see Schnabl and Müller (2017).

13If the decline of welfare for specific groups is publicly attributed to market forces and globalization, financial market regulation and barriers to international factors flows are encouraged, which puts an additional drag on growth.

14According to Reinhart and Sbrancia (2015), debts of 3 to 4 percent of GDP were liquidated annually by the interest rate and inflation effect of financial repression. Rogoff (2017) proposes to abolish cash to make financial repression as a tool to reduce public debt more effective. This would, however, further restrain economic freedom and growth.

15The transmission of the monetary expansion to financial markets has been mainly via declining interest rates, which caused—depending on the regulation and the mood of financial markets—inflationary pressure in changing segments of the international financial markets. In the case of the Federal Reserve, increasing deposits of commercial banks since 2008, which were remunerated at a moderate interest rate on required reserve balances and excess balances, cannot be seen as a sterilization tool because the monetary transmission worked via historically low interest rates. In Japan and the euro area, excess balances of commercial banks at the central banks emerged even without being remunerated or even being charged with negative interest rates. From this point of view, the growing balances of commercial banks at the central banks in many industrialized countries are more the consequence of subdued credit growth following the global financial crises rather than an indicator for sterilization.

16McKinnon and Schnabl (2014) show how the return of financial repression in China has been imposed from outside by the very low interest rate levels in the industrialized countries. This externally imposed financial repression has undermined the Chinese growth miracle by the build-up of tremendous overcapacities in the enterprise and real estate sectors.

17With the financial sector being more tightly controlled, the risks are currently building up in the enterprise sector, represented by sharply increasing volumes of (debt-financed) mergers and acquisitions as well as stock prices.

18Before liberalizing financial markets the monetary and fiscal system had to be converted from a passive mode that had simply accommodated the planned government expenditure into a constraint on the ability of enterprises, households and local governments to bid for scarce resources (McKinnon 1993: 3).

19The “Law on the Redistribution of Burdens” (Lastenausgleichsgesetz) of 1952 taxed real estate at a rate of up to 50 percent. As the resulting liability could be spread over a period of up to 30 years, the yearly burden could be financed out of the returns of the taxed assets. The real burden was further eased by moderate inflation.

20This value is based on the assumption that the long-term average in the inflation is 2 percent and therefore the long-term average in the real interest rates would be 4 percent. In the view of Hayek (1931) and Mises (1949), the real interest rate has to be positive because it represents a positive time preference rate.

21Since the mid-1980s, monetary expansion has increasingly become visible on asset rather than goods markets.

22Also, nominal GDP targeting may be an alternative (see Meade 1978 and Schumer 2012).

23This exit rule is not equivalent to a general monetary policy rule, which would be applied once a successful exit has occurred.

24With the purchasing power of people being strengthened, inflation would moderately pick up, rendering real interest rate increases smaller than nominal interest rate increases.