Following the 2007–2008 global financial crisis (GFC) and subsequent sovereign debt crisis in Europe, there has been a renewed interest in exploring the relationship between government debt and economic growth. One of the cornerstone studies on the subject that triggered an emergence of new literature was Carmen Reinhart and Kenneth Rogoff’s “Growth in a Time of Debt” (2010), which became widely cited and influential among commentators, academics, and policymakers in the debate surrounding austerity and fiscal policy in debt-burdened economies. Much of the research that followed the GFC uses panel data analysis of the debt-growth nexus using datasets from the World Bank, International Monetary Fund (IMF), European Commission, and Organisation for Economic Co-operation and Development (OECD).

A notable pattern emerges from that research: high levels of public debt have a negative impact on economic growth.

The main objective of this survey is to review the existing economic literature published during the period 2010 to 2020 on the relationship between public debt levels and economic growth. In addition, the survey will review the claim that there is a nonlinear debt threshold above which debt has a significant deleterious impact on growth rates.

This article explains how studies were identified for the survey sample, provides an overview of the theories of how public debt impacts economic growth, reviews the findings of the 40 studies in the survey sample, and concludes with some recommendations for future research.

Identification of Study Sample

The survey of literature incorporates datasets on public debt and growth from the World Bank’s World Development Indicators, the International Monetary Fund’s World Economic Outlook, the European Commission’s annual macroeconomic (AMECO) database and Eurostat database, and the OECD’s Economic Outlook. Twenty-seven of 40 studies use at least one World Bank database, 14 of 40 use at least one IMF database, 10 of 40 use either AMECO or Eurostat datasets, and 11 of 40 use at least one OECD database.

The choice of studies in the survey is limited to those observing multiple countries (a minimum of seven) to avoid simply observing dynamics that exist in isolated samples or smaller datasets. It was determined that large datasets surveying multiple countries should offer more comprehensive observations of debt-growth dynamics. While an overwhelming majority (33 of 40) of the studies in the survey are published in peer reviewed journals, which may offer higher quality analysis, the survey also includes a smaller number (7 of 40) of nonscholarly articles published by reputable institutions including the Federal Reserve Bank, the Bank for International Settlements, and the World Bank.

For this survey, only articles published in the English language between the years 2010 and 2020 were included. This 10-year period of publications was chosen based on peak interest in the subject following the GFC and the publication of Reinhart and Rogoff’s seminal study in 2010. Once these criteria were established, the survey sample was obtained using search terms in Google Scholar such as “debt and growth,” “public debt and economic growth,” and “debt growth threshold.” Some additional studies were added to the survey sample upon reviewing the references and citations of initial studies in the sample. Nineteen of the studies used a sample of advanced and developing nations, 11 used European Union or European countries, 8 used advanced countries only, and just 2 studies focused on developing countries.

Many of the studies in the sample find a negative correlation between debt and growth. More recent studies (e.g., Pegkas, Staikouras, and Tsamadias 2020) rely on Granger causality tests using a vector autoregression model. These tests may be more reliable in determining whether changes in public debt levels are useful in forecasting changes in future growth rates.

The survey studies employ various identification strategies in their empirical analysis, with most studies in the sample using panel data across time, while other studies employ time series analysis, a cross-sectional observation, or a combination of these approaches. A key advantage of using a panel data model approach is that it highlights individual heterogeneity, if there are some differentiating qualities across cross-sections. The larger datasets of the panel data method also allow for a more accurate measurement of the independent effects of the sample, which cross-sectional and time series methods may not account for. In addition, various linear and nonlinear regression methods are adopted across the pool of studies, and many of the studies in the sample employ endogenous or neoclassical growth models.

Theoretical Overview of the Debt-Growth Nexus

While there has been a revival in interest in the relationship between public debt and economic growth since the GFC, economists have long theorized about the various channels through which public debt may affect growth. Since the 1960s, neoclassical economists have noted how increases in taxation, to finance interest payments on the nation’s growing domestic and foreign government debt, negatively affect gross capital stock formation (Diamond 1965). Keynesian economists, meanwhile, have argued that rising public debt induces productive public spending and has a positive multiplier effect on the economy (Leão 2013).

The various channels through which high and growing public debt levels adversely affect economic growth include (1) the crowding out of private investment (Elmendorf and Mankiw 1999) as government borrowing competes for funds in the nation’s capital markets; (2) higher long-term interest rates caused by an excess supply of government debt and greater credit risk premia (Codogno, Favero, and Missale 2003; Ardagna, Caselli, and Lane 2007; Kumar and Baldacci 2010; Attinasi, Checherita, and Nickel 2011; Von Hagen, Schuknecht, and Wolswijk 2011); (3) higher distortionary taxes to fund future liabilities and rising debt repayments (Dotsey 1994); and (4) an increase in the rate of inflation (Cochrane 2011).

In recent years, New Keynesian economists have argued that debt levels are of little concern as they relate to other economic factors as long as interest rates on the public debt remain below rates of economic growth in the long run (Blanchard 2019). This view of the debt-growth relationship may overlook existing primary budget deficit dynamics as well as the upward pressures of an increasing debt ratio (public debt as a share of GDP) on long-term interest rates. Acknowledging these uncertainties, more recent observations suggest that large increases in the debt-to-GDP ratio could lead to much higher taxes, lower future incomes, and intergenerational inequity (Boskin 2020).

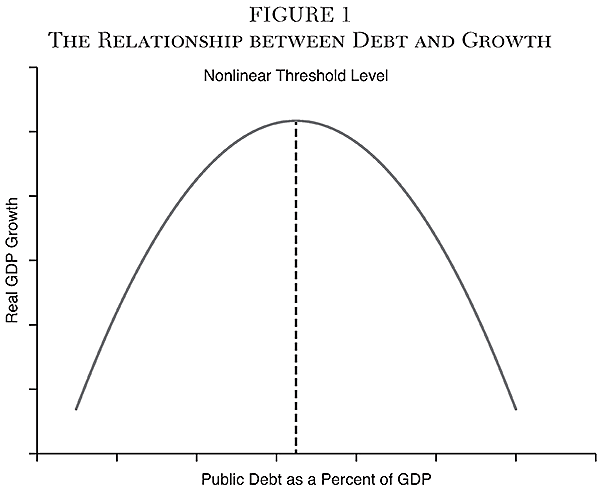

Aside from these theoretical arguments, there exists another theory that corroborates the existence of a nonlinear relationship between public debt levels and economic growth—namely, the threshold or nonlinear effect theory. According to this theory, increases in government debt levels have positive growth effects when debt levels are low, but these effects become negative when debt levels increase beyond a certain threshold level (Reinhart and Rogoff 2010).

Figure 1 shows that, at low debt levels, increases in the debt ratio provide positive economic stimulus in line with conventional Keynesian multipliers. Once the debt ratio reaches heightened levels (nonlinear threshold), further increases in the debt level as a percentage of GDP have a negative impact on economic growth (Baum, Checherita-Westphal, and Rother 2013). Existence of a nonlinear threshold would imply that neoclassical theories on the relationship between debt and growth may be well grounded. Such theories suggest that the distortionary impact of future tax increases to achieve debt sustainability will likely lower potential economic output (Barro 1979). Additionally, a nonlinear threshold could suggest that increased government borrowing competes for funds in the nation’s capital markets, which in turn raises interest rates and crowds out private investment, confirming the debt overhang theory.

Survey Sample Results

The survey starts by reviewing the nine studies in the sample that do not seek to find a nonlinear threshold. The remainder of this section will then review the 31 studies in the survey that explore whether there is a nonlinear threshold level at which debt has an adverse impact on economic growth.

Studies Not Exploring a Threshold Level

Starting with studies that focus solely on the debt and growth relationship, Calderón and Fuentes (2013) run time series, cross-country growth regressions to test whether public debt hinders growth and whether economic policy ameliorates this effect. Using a large dataset of 136 countries from 1970 to 2010, the authors find a robust negative relationship between public debt and growth. Interestingly, the quality of institutions, sound domestic policy, and outward-oriented policies can help to reduce this negative effect.

Zouhaier and Fatma (2014), using World Bank data, find that the ratio of total external debt to GDP is statistically significant and negatively affects growth. In particular, they find that an increase in the debt ratio by 10 percentage points will cause real GDP growth to fall by 0.28 percentage points. The sample includes 19 developing countries for the period 1990 to 2011. The study runs a dynamic panel regression (Arellano-Bond estimator) with controls for investment, trade openness, inflation, and other factors.

Siddique, Selvanathan, and Selvanathan (2016) use an autoregressive distributed lag (ARDL) model—with controls for trade, population, and capital formation—to observe whether debt as a proportion of GDP affects growth in 40 indebted countries from 1970 to 2007. The authors find that the debt variable has a negative and statistically significant influence on GDP in both the short run and long run, which is consistent with prior expectations. They also note that higher debt levels have a negative impact on economic growth for debt-ridden countries, because a large proportion of their output is used to repay debts to foreign lenders, which creates a disincentive to invest.

Snieška and Burksaitiene (2018) adopt an ordinary least squares (OLS) and autoregressive (AR) model with cross-section data to analyze the influence of changes in real public debt, real private debt, and deflated house prices on GDP in 24 European Union (EU) countries. Small eurozone countries were excluded from the analysis due to fluctuations of their small economies caused by the volatile influence of offshoring financial services on their growth dynamics. The results suggest that, in the 24 European Union countries observed, the negative influence of public debt growth on the economy is significant when evaluated using zero, one, and two year lags.

Lim (2019) revisits the relationship between debt and growth from a vantage point that considers the totality of private and public debt. The study sample includes 41 countries from 1952 to 2016. It uses a vector autoregression (VAR) model as its baseline and estimates the panel VAR using generalized method of moments (GMM). Lim finds a negative relationship between the rate of total debt accumulation and economic growth, with a one standard deviation innovation in the former leading to a 0.2 percentage point contraction in the latter.

Abubakar and Mamman (2020) employ a two-stage least squares regression to estimate a decomposed model examining the effects of public debt on economic growth in 37 OECD countries. The approach of this study is unique among the literature, in that the authors examine the permanent versus transitory effects of public debt on economic growth. The findings reveal that public debt exerts a significant negative permanent and positive transitory effect on economic growth. The magnitude of the negative permanent effect of debt was found to be larger than the positive transitory effect. In addition, while all country groups experienced negative permanent effects, not all country groups experienced positive transitory effects.

Asteriou, Pilbeam, and Pratiwi (2020) examine the relationship between public debt on both short- and long-run economic growth in 14 Asian countries for the period of 1980–2012. The authors use an ARDL model and a mean group (MG) estimator to allow for heterogeneity in the short-run and long-run relationship. To overcome omitted variable bias, control variables such as average years of schooling, trade openness, and investment ratios are included in the model. The authors find that a 1 percentage point increase in the government debt-to-GDP ratio will lower economic growth by 0.012 to 0.125 percentage points. In the long run, the magnitude of the two different regimes is somewhat higher in the region of 20.091 to 20.132 percentage points indicating that an increase in public debt will lead to a significant adverse effect on economic growth.

Pegkas, Staikouras, and Tsamadias (2020) use AMECO data and find that there is a negative long-run effect of public debt on growth. Furthermore, the results indicate that there is long-run unidirectional causality running from investment, trade openness, and human capital to growth and bidirectional causality between public debt and growth. The sample includes 12 eurozone countries for the period 1995 to 2016. The study runs a time series analysis and applies a fully modified least squares approach with control variables including investment, human capital, and trade openness, as well as a dummy variable for the economic and financial crisis in 2009. The authors recommend that eurozone countries should base their growth strategies on fiscal consolidation.

Employing two-stage least squares methodology and using similar control variables as most of the existing literature, Ghourchian and Yilmazkuday (2020) compare the effects of government consumption and government debt on economic growth in 83 countries from 1960 to 2014. The results reveal that a 1 percentage point increase in the ratio of government debt to GDP would reduce real GDP growth by about 0.01 percentage point, while a 1 percentage point increase in the ratio of government consumption to GDP leads to a decline in real economic growth of about 0.1 percentage point, on average across countries. In terms of policy recommendations, restrictions on government debt are shown to be more important in preventing negative growth effects for countries with higher trade openness, lower inflation, or higher financial depth.

Studies That Explore the Existence of a Threshold

Now turning to studies that explore the existence of a debt threshold, Caner, Grennes, and Koehler-Geib (2010) examine 99 countries between 1980 and 2008 and find that the threshold level of the average debt ratio on GDP growth is 77 percent for all countries in the sample. If debt is above this threshold, each additional percentage point of debt costs 0.017 percentage point of annual real growth. The study uses a least squares regression model with controls for trade openness and inflation among other variables.

Reinhart and Rogoff (2010) is arguably the cornerstone study on the subject of debt and growth post-GFC. Paul Krugman (2013) argues that their study has had “more immediate influence on public debate than any previous paper in the history of economics.” In order to determine the effects of government debt on growth, the authors compiled data covering 1946 to 2009 from the IMF, World Bank, and OECD for 44 countries. The study finds that, across both advanced and emerging economies, high debt-to-GDP levels (90 percent and greater) are associated with notably less growth. Countries with debt-to-GDP ratios greater than 90 percent have median growth roughly 1.5 percent lower than that of the less-debt-burdened groups and mean growth almost 3 percent lower.

Cecchetti, Mohanty, and Zampolli (2011) adopt a bivariate least squares model for annual and five-years-ahead growth rates of per capita GDP, with country and time-period fixed effects included. The authors seek to find nonlinear threshold effects of debt on growth for government debt, nonfinancial corporate debt, and household debt. The results from a sample of 18 OECD countries from 1980 to 2010 reveal that, when the ratio of public debt to GDP reaches about 85 percent, a further 10 percentage point increase reduces trend growth by more than 0.10 percentage point.

Checherita-Westphal and Rother (2012) employ a two-stage least squares regression model with control variables for fiscal indicators (e.g., average tax rate and fiscal balance) and long-term real interest rates, among other factors. The study investigates the average impact of government debt on per capita GDP growth in 12 Euro Area countries from 1970 to 2011. The authors find a nonlinear impact of debt on growth with a turning point—beyond which the government debt-to-GDP ratio has a deleterious impact on long-term growth—at about 90 to 100 percent of GDP. In addition, the negative growth effect of high debt may start already from levels of around 70 to 80 percent of GDP.

Afonso and Jalles (2013), using World Bank data, find a negative effect of the debt ratio. The growth impact of a 10 percentage point increase in the debt ratio is −0.2 percentage point for countries with debt ratios above 90 percent. Notably, the authors find an endogenous debt ratio threshold at 59 percent of GDP for the full sample. The sample includes a large dataset of 155 countries from 1970 to 2008. The study uses a neoclassical growth model for their analysis with a main focus on combined cross-section time series regressions and adopts a (pooled) OLS method with fixed effects and time dummies to allow for common long-run growth in per capita GDP.

Baum, Checherita-Westphal, and Rother (2013) investigate the relationship between public debt and economic growth for Euro Area countries from 1990 to 2010. Using a series of least squares regressions, the study finds that, in line with Keynesian theory, the short-run impact of debt on GDP growth is positive. However, the positive transitory effect decreases to close to zero and loses significance beyond public debt-to-GDP ratios of around 67 percent. For high debt ratios (above 95 percent) the impact of additional debt has a negative impact on economic activity, suggesting a nonlinear threshold level somewhere between 67 and 95 percent of GDP.

Chudik et al. (2013) use a cross-sectional augmented distribution lag estimator to examine the long-run effects of public debt and inflation on economic growth. Using the IMF Financial Statistics dataset, the study observes 40 developing and advanced countries from 1965 to 2010. On growth effects, the authors find that a 1 percentage point increase in the level of debt/GDP, if sustained, reduces real output by 0.048 to 0.068 percentage point. These estimates are statistically significant at a high level in all cases. On the existence of a nonlinear threshold, the authors find no universally applicable threshold level; however, when countries with an upward debt trajectory are observed separately, a negative and statistically significant threshold is identified for debt ratios above 60 percent.

After finding coding errors in the Reinhart and Rogoff study, Herndon, Ash, and Pollin (2013) attempted to more accurately represent the relationship between public debt and growth. Adopting a locally smoothed regression function, they find that the growth rate for countries carrying a debt-to-GDP ratio greater than 90 percent is actually 2.2 percent, not −0.1 percent as reported by Reinhart and Rogoff. They also find, in contrast to Reinhart and Rogoff, that there is no common nonlinear threshold. Their results, nevertheless, still reveal that growth rates decline as debt ratios increase; but growth rates do not fall off a nonlinear cliff as suggested by other studies.

Kourtellos, Stengos, and Tan (2013) calibrate an augmented Solow growth model to investigate the possibility of multiple growth regimes using a comprehensive set of growth determinants as threshold variables including, among others, the debt-to-GDP ratio, institutions, ethnic fractionalization, and trade openness. Estimates of the threshold parameter are based on a least squares method, while slope coefficients are obtained using GMM. For the 82 countries under observation, the study finds that, for low-democracy regimes, higher public debt results in lower growth, but this is not the case in high-democracy regimes. The findings suggest that the negative growth effects of debt are dependent upon the quality of a country’s institutions—in this case, no nonlinear common threshold is identified for the sample.

Padoan, Sila, and Van Den Noord (2013), using OECD data, examine the effect of fiscal policy on the growth path of the economy for 28 OECD countries from 1960 to 2011. The authors adopt a GMM instrumental variable estimation and explore the existence of a threshold effect by searching over a grid of different thresholds to find the one that minimizes the residual sum of squares. Consistent with findings of other studies, a threshold level is identified between 82 and 91 percent of GDP. Specifically, increasing public debt by 1 percentage point on average will reduce GDP growth the following year by 0.012 percentage points, whereas it will reduce the average annual growth over the next five years by 0.028 percentage points.

Topal (2014) explores the relationship between debt and growth and whether there exists a nonlinear threshold or multiple thresholds within the sample of 12 eurozone countries. With control variables for old-age dependency, gross capital formation, and population growth, the study employs a two-stage least squares estimation. Using a similar threshold model approach as Padoan, Sila, and Van Den Noord (2013), the study finds that debt levels up to a ratio of 71.66 percent have a positive impact on growth. Beyond this threshold, debt has no statistically significant impact on growth, and, beyond a second threshold of 80.2 percent, the growth effect turns negative.

Afonso and Alves (2015) find an average debt ratio threshold of around 75 percent among 14 European countries from 1970 to 2012. Calibrating a neoclassical growth model with control variables, the authors find that government debt has a negative effect on economic growth, both in the short and long term. More specifically, the results show a negative impact of −0.01 percentage point for each 1 percentage point increment of public debt, although debt service has a 10 times worse effect on growth. The study runs OLS regressions with fixed effects in order to account for omitted variable bias, while a two-stage least squares estimator is used to correct for the problem of endogeneity.

Bökemeier and Greiner (2015) run a pooled OLS regression with fixed effects to study the effects of public debt on economic growth and whether a nonlinear threshold level exists. For a small sample of seven advanced countries from 1970 to 2012, the study yields empirical evidence for a negative relationship between the public debt ratio and the growth rate of economies in subsequent periods. The link between debt and growth seems to be characterized by a linear relationship since the authors find that empirical evidence for nonlinearities is weak.

Dincă and Dincă (2015) use AMECO data to explore the relationship between the ratio of government debt to GDP and the per capita GDP growth rate for a sample of 10 former communist countries, currently members of the EU 27, for the 1999 to 2010 period. The study uses a quadratic equation with a set of control variables and country and time fixed effects. The results show a statistically significant non-linear relationship between the government debt ratio and the per capita GDP growth rate for all the analyzed countries. A government debt turning point is found at a debt ratio around 51 percent. Every 1 percentage point growth in the debt ratio above this point is found to negatively suppress the GDP growth rate by 0.1626 percentage point.

Eberhardt and Presbitero (2015) use a common correlated effects (CCE) estimator to account for the presence of unobserved heterogeneity. The results are estimated using OLS regressions to model the potential nonlinearity within and across countries in the debt–growth relationship. Observing a large dataset of 118 countries from 1961 to 2012, the authors find some support for a negative relationship between public debt and long-run growth across countries, but no evidence for a similar, let alone common, debt threshold within countries.

Égert (2015) puts a variant of the Reinhart and Rogoff dataset to a formal econometric testing to see whether public debt has a negative nonlinear effect on growth if public debt exceeds 90 percent of GDP. Using a multivariate growth framework and Bayesian model averaging, the study assesses a sample of 44 advanced countries from 1960 to 2010. Broadly similar to much of the existing literature, a positive relationship between debt and growth was identified at low levels of debt, which is counteracted by negative effects at higher levels of debt. However, contrary to most studies that identify a threshold range around 60 to 100 percent of GDP, this study finds that the negative nonlinear effect kicks in at much lower levels of public debt (between 20 and 60 percent). The authors suggest that the findings may indicate that high-return public investment opportunities may exist at low levels of public infrastructure and debt.

Mercinger, Aristovnik, and Verbič (2015) employ a GMM estimator with instrumental variables to examine whether there is a turning point in the debt ratio where growth effects turn negative. To solve the problem of heterogeneity, the study includes a fixed effects estimator for the sample of 36 countries from 1980 to 2010. The results indicate that the connection between the public debt-to-GDP ratio and annual GDP growth has a nonlinear relationship with a possible critical threshold point beyond which the debt ratio has deleterious effects on growth. For advanced countries the threshold is found between 90 and 94 percent of GDP, while for emerging countries the threshold is much lower, at around 45 percent.

Woo and Kumar (2015) explore the impact of high public debt on long-run economic growth, the existence of threshold effects, nonlinearities, and differences between advanced and emerging market economies. The analysis is based on a panel of countries over almost four decades and employs a variety of estimation methods, including pooled OLS, robust regression, between estimator, fixed effects, and system generalized method of moments regressions. The estimated effects of debt suggest that a 10 percentage point increase in the initial debt ratio is associated with a slowdown in growth of per capita GDP around 0.2 percent per year. The study finds evidence of nonlinearity, with only high (above 90 percent of GDP) levels of debt having a significant negative effect on growth. The authors conclude that the adverse effect largely reflects a slowdown in labor productivity growth mainly due to slower capital accumulation. Extensive robustness checks confirm their results.

Baglan and Yoldas (2016) use Reinhart and Rogoff’s historical multicountry dataset and adopt a flexible semiparametric model with standard fixed effects. The study sample includes 20 advanced countries during the postwar period (1954 to 2008). The results reveal that average annual GDP growth gradually declines by about 0.5 percentage point as the debt-to-GDP ratio climbs from about 75 to 100 percent, with most of the effect taking place over the 85 to 95 percent range. These findings are consistent with other studies that find that each 10 percentage point increase in the debt ratio results in a decline in GDP growth of 0.2 percentage point (Afonso and Jalles 2013; Woo and Kumar 2015) above a threshold level.

Brida, Gómez, and Seijas (2017) explore the dynamic relationship between public debt and economic growth by using a nonparametric approach based on data symbolization and clustering methods. The typical approach to comparing and clustering a set of time series involves the construction of Minimal Spanning Trees and Hierarchical Trees. Upon applying this unique approach to a dataset of 16 advanced countries for the period 1977 to 2015, the results show the existence of a negative relationship between debt and growth in line with most of the previous empirical literature on this topic. During the analyzed period and for the countries studied, country output dynamic performance was found to be driven by a 90 percent debt-to-GDP threshold.

Gómez-Puig and Sosvilla-Rivero (2017) implement a time series analysis for 11 Euro Area countries to examine whether the threshold beyond which a public debt change may have a detrimental effect on economic growth changes across Euro Area countries during the 1961–2015 period. As members of the Euro Area, countries are obligated to following the rules of the Stability and Growth Pact (SGP), one of which is to keep government debt ratios below 60 percent of GDP. Calibrating a neoclassical growth model with control variables for population growth, capital formation, trade openness, and other factors, the study uses a two-stage least squares instrumental variable technique to estimate the finally selected model. In all the countries under study (with the exception of Belgium) a debt increase begins to have detrimental effects on growth well before the SGP debt ceiling is reached. The thresholds identified range from as low as 21 percent in France to as high as 61 percent in Belgium.

Ahlborn and Schweickert (2018) challenge the homogenous debt effects view of other studies and instead seek to observe cross-country heterogeneity in the debt and growth relationship. The study identifies three county clusters with distinct economic systems: Liberal (Anglo-Saxon), Continental (Core EU members), and Nordic (Scandinavian). The results identify a clear negative growth effect in Continental countries when debt levels reach around 75 percent of GDP and the same effect is found in Nordic countries, but at a lower threshold of around 60 percent. Interestingly, a debt threshold is not identified for Liberal countries, suggesting that perhaps the liberal institutional framework alleviates the negative effects of a high debt burden. The study applies a fixed effects estimation as the baseline regression with standard control variables, while a two-stage least squares regression is employed to deal with endogeneity.

Karadam (2018) employs a panel smooth transition regression framework to identify the existence of threshold effects in the public debt-growth relationship. The study observes a large dataset of 134 countries from 1970 to 2012. The results reveal that the impact of public debt on growth turns from positive to negative gradually after some threshold level has been reached. The threshold is found to be lower for developing countries at around 88 percent and around 106 percent for the remainder of the sample, corroborating earlier studies that find similar dynamics (Mercinger, Aristovnik, and Verbič 2015).

Caner, Fan, and Grennes (2019) adopt a slightly different approach from previous studies by analyzing how the interaction of public and private debt influences economic growth. Using an endogenous panel threshold model with standard control variables, the authors examine whether there is a nonlinear threshold relation between the interaction of public and private debt and GDP growth. The relationship is identified using pooled OLS regressions and the GMM method, while robustness checks are conducted for longer time periods and a measure for financial/banking crisis. The study finds a threshold effect of the interaction between the public and private debt variables and economic growth is found to be negative and significant when it reaches the level of 137 percent. The negative effect of public debt on economic growth is found to be larger when private debt is larger for the sample of 29 OECD countries observed.

Bhimjee and Leão (2020) employ a polynomial regression of order two (i.e., a quadratic specification) to capture the linear and the nonlinear effects of public debt on output. The study sample includes 19 countries in the Euro Area from 1995 to 2016 using data from the AMECO database. The study concludes that a majority of the member states’ public debt and GDP trajectories are in compliance with the existence of underlying country-specific sovereign debt Laffer curves in the Euro Area. However, the findings suggest the existence of country-specific thresholds (as opposed to a universal threshold valid for all countries). The majority of countries in the sample have debt threshold levels between 50 and 105 percent of GDP (except Estonia and Latvia), while the Euro Area average threshold is found to be 79 percent.

Alshammary et al. (2020) examine whether a debt-to-GDP threshold exists in the public debt and economic growth relationship for 20 Middle East and North Africa countries from 1990 to 2016. The study applies a fixed effect threshold regression approach with standard control variables. The authors find that the effect of public debt on economic growth is significant and positive only below the threshold value of debt to GDP. More precisely, debt has a promoting influence on economic growth when the debt is less than 58 percent of the GDP, but turns negative above this threshold level. This is broadly consistent with other studies that find lower debt thresholds for developing countries.

Pham, Mai, and Nguyen (2020) use World Bank data to test the existence of a debt-growth threshold level using a bootstrap method. The survey sample includes 13 Asian countries (high and middle income) from 2004 to 2015. The results suggest that for the whole sample the impact of public debt on GDP is not statistically significant until a threshold level of 72.5 percent is reached. Beyond this threshold level, public debt has a negative and statistically significant impact on growth. The authors conclude with recommendations for reducing excessive public expenditure, reforming the tax system, and enhancing investment performance.

Swamy (2020) employs a Solow growth model and estimates panel data growth regressions with country-specific fixed effects and time-specific fixed effects. Using a two-step GMM estimator for a very large worldwide dataset of 252 countries from 1960 to 2009, the study observes a negative relationship between government debt and growth. The point estimates of the range of econometric specifications suggest a 10 percentage point increase in the debt-to-GDP ratio is associated with 23 basis point reduction in average growth. These specifications are consistent with the findings of other studies that find similar debt effects on growth (Afonso and Jalles 2013; Woo and Kumar 2015; Baglan and Yoldas 2016). In terms of thresholds, the results reveal that debt has positive effects on growth for countries with debt below 60 percent of GDP, negligible effects for countries between 60 and 90 percent, and a downward trend in growth for those with higher than 90 percent—turning sharply downward at around 110 percent.

Finally, Vinokurov, Lavrova, and Petrenko (2020) use a panel regression procedure and the GMM method, while cluster analysis was applied to address the unobserved heterogeneity of countries’ institutional development. The primary objective of the study is to examine the nonlinear influence of government debt on economic growth, while accounting for the development of countries’ institutions using the World Bank’s Worldwide Governance Indicators (WGI). The study finds that countries with weak political institutions have a 37 percent debt threshold and countries with strong institutions generally have thresholds above 56 percent. Observing the 12 most institutionally developed Eurozone countries for the period of late 1990s and early 2000s, above a threshold of around 100 percent, debt growth has negative impact on economic performance.

Conclusion

The survey explores 40 studies from the existing economic literature published during the period 2010 to 2020 on the relationship between public debt levels and economic growth. In addition, the survey analysis reviews the claim that there is a nonlinear debt threshold, above which debt has a significant deleterious impact on growth rates. A notable pattern emerges from existing research published since the GFC, pointing toward a broadly well-founded conclusion that high levels of public debt have a negative impact on economic growth. The empirical evidence for a nonlinear debt-growth threshold suggests that, while such thresholds might exist, there may not be a common threshold level and they may be largely dependent upon other factors such as a country’s level of development and the quality of its institutions.

The findings of the survey analysis offer some valuable lessons for those interested in the debt-growth nexus. For the 40 studies reviewed, 36 studies identify a statistically significant (linear or nonlinear) negative effect of public debt on growth. Of the 4 remaining studies, 2 studies find that the negative effects of public debt on growth can be largely alleviated by good quality institutions and good policy, while 2 studies find some evidence, albeit weak evidence, for the existence of a negative debt-growth relationship.

For the 31 studies that explore the existence of a nonlinear threshold effect, 25 studies find the existence of a nonlinear threshold, 4 studies do not find a common threshold, and 2 studies find that the existence of a nonlinear threshold largely depends on institutional factors. For the 25 studies that provide threshold estimates, mean and median threshold levels can be calculated from the full sample of 25 studies. For advanced countries, mean and median threshold levels are found at 78 percent and 82 percent of GDP, respectively. For developing countries, mean and median threshold levels are found at 61 percent and 56 percent of GDP, respectively.

While the findings presented in this article broadly support the debt overhang hypothesis, there are several ways that future research might offer more robust empirical avenues for exploration. For example, there is great scope to examine the debt and growth relationship in low-income economies, for which current research is more limited. In this survey, most of the studies focus on mixed samples of countries or samples of advanced countries. In light of low private investment levels in low-income economies, debt dynamics may be driven by highly desired public investment, while lower-quality institutions associated with low-income economies likely reduce the threshold levels at which debt adversely effects growth.

In terms of economic models adopted, many of the studies in the sample find a relationship between debt and growth that exhibits correlation. Future research should instead prioritize the adoption of economic models that measure the causal relationship between debt and growth to avoid concerns that the findings demonstrate only correlation, rather than causation. More recent studies (Pegkas, Staikouros, and Tsamadias 2020) have adopted Granger causality tests based on a vector autoregression model. These types of causality tests may be more reliable in determining whether changes in public debt levels are useful in forecasting changes in future growth rates—in other words, these studies may be able to better demonstrate predictive causality, rather than correlation.

Another weakness with an empirical focus on correlation is that it fails to recognize the bidirectional relationship that may exist between the two variables, public debt and economic growth. Lower rates of economic growth could be responsible for increasing levels of public debt, or a third factor could jointly effect both variables (such as a financial crisis). It is important, therefore, that future research focuses on finding a causal link and establishes whether a unidirectional or bidirectional causal relationship exists between public debt and economic growth. Future studies should also ensure that confounding factors and variables are adequately controlled for. Most of the studies in the literature survey do properly control for country and time fixed effects, but some studies use simple growth regressions that may offer less robust results.

Given that some studies in the survey find that growth effects depend largely on institutional quality, future research should focus on heterogeneity. In addition, future studies should also seek to explore the various channels through which public debt may hinder economic growth, such as a focus on investment and productivity channels. This approach would provide a more rigorous explanation for the various mechanisms through which debt may reduce growth.

While most studies in the survey seek to identify common nonlinear threshold levels, some studies that instead focus on country-specific dynamics find that threshold levels can vary significantly across countries. Mercinger, Aristovnik, and Verbič (2014) find that the turning point is notably different for old and new EU member states, while Gomez-Puig and Sosvilla-Rivero (2017) find that the threshold levels differ significantly for specific countries in the EU. Future research should, in addition to observing common threshold levels, take a more in-depth assessment of country-specific threshold dynamics when examining multiple country survey samples.

While weaknesses in the economic literature undoubtedly exist, they do not invalidate the broadly well-founded conclusion drawn from the survey of 40 empirical studies—that high levels of public debt have a negative impact on economic growth.

As both advanced and developing countries continue to increase their debt ratios, this literature survey offers policymakers some valuable lessons—namely to be cognizant of the negative growth effects that result from increasing public debt ratios. To avoid these negative growth effects, advanced countries should aim to keep their debt ratios at sustainable levels, preferably below 80 percent of GDP, while developing countries should aim to keep their debt ratios below 60 percent of GDP.

References

Abubakar, A. B., and Suleiman O. M. (2020) “Permanent and Transitory Effect of Public Debt on Economic Growth.” Journal of Economic Studies. DOI:10.1108/JES-04–2020-0154.

Afonso, A., and Alves, J. R. (2015) “The Role of Government Debt in Economic Growth.” Review of Public Economics 215 (4): 9–26.

Afonso, A., and Jalles, J. T. (2013) “Growth and Productivity: The Role of Government Debt.” International Review of Economics and Finance 25: 384–407.

Ahlborn, M., and Schweickert, R. (2018) “Public Debt and Economic Growth: Economic Systems Matter.” International Economics and Economic Policy 15 (2): 373–403.

Alshammary, M. D.; Karim, Z. A.; Khalid, N.; and Ahmad, R. (2020) “Debt-Growth Nexus in the MENA Region: Evidence from a Panel Threshold Analysis.” Economies 8 (4): 1–12.

Ardagna, S.; Caselli, F.; and Lane, T. (2007) “Fiscal Discipline and the Cost of Public Debt Service: Some Estimates for OECD Countries.” B.E. Journal of Macroeconomics 7 (1): 1–33.

Asteriou, D.; Pilbeam, K.; and Pratiwi, C. E. (2020) “Public Debt and Economic Growth: Panel Data Evidence for Asian Countries.” Journal of Economics and Finance 45 (1): 270–87.

Attinasi, M.; Checherita, C.; and Nickel, C. (2011) “What Explains the Surge in Euro Area Sovereign Spreads during the Financial Crisis of 2007–2009?” In R. W. Kolb (ed.), Sovereign Debt: From Safety to Default. Hoboken, N. J.: John Wiley.

Baglan, D., and Yoldas, E. (2016) “Public Debt and Macroeconomic Activity: A Predictive Analysis for Advanced Economies.” Studies in Nonlinear Dynamics and Econometrics 20 (3): 301–24

Barro, R. J. (1979) “On the Determination of the Public Debt.” Journal of Political Economy 87 (5): 940–71.

Baum, A.; Checherita-Westphal, C.; and Rother P. (2013) “Debt and Growth: New Evidence for the Euro Area.” Journal of International Money and Finance 32: 809–21.

Bhimjee, D., and Leão, E. (2020) “Public Debt, GDP and the Sovereign Debt Laffer Curve: A Country-Specific Analysis for the Euro Area.” Journal of International Studies 13 (3): 280–95.

Blanchard, O. (2019) “Public Debt and Low Interest Rates.” American Economic Review 109 (4): 1197-229.

Bökemeier, B., and Greiner, A. (2015) “On the Relation between Public Debt and Economic Growth: An Empirical Investigation.” Economics and Business Letters 4 (2): 137–50.

Boskin, M. (2020) “Are Large Deficits and Debt Dangerous?” NBER Working Paper No. 26727.

Brida, J. G.; Gomez, D. M.; and Seijas, M. N. (2017) “Debt and Growth: A Non-Parametric Approach.” Physica A: Statistical Mechanics and Its Applications 486: 883–94.

Calderón, C., and Fuentes, R. (2013) “Government Debt and Economic Growth.” Inter-American Development Bank, Working Paper No. 4641.

Caner, M.; Grennes, T. J.; and Köhler-Geib F. N. (2010) “Finding the Tipping Point: When Sovereign Debt Turns Bad.” In C. A. P. Braga and A. V. Gallina (eds.), Sovereign Debt and the Financial Crisis. Washington: World Bank.

Caner, M.; Fan, Q.; and Grennes, T. (2019) “Partners in Debt: An Endogenous Nonlinear Analysis of Interaction of Public and Private Debt on Growth.” Mercatus Center at George Mason University, Mercatus Working Paper.

Cecchetti, S. G.; Mohanty, M. S.; and Zampolli F. (2011) “The Real Effects of Debt.” Bank of International Settlements, BIS Working Paper No. 352.

Checherita-Westphal, C., and Rother, P. (2012) “The Impact of High Government Debt on Economic Growth and Its Channels: An Empirical Investigation for the Euro Area.” European Economic Review 56 (7): 1392–405.

Chudik, A.; Mohaddes, K.; Pesaran M. H.; and Raissi M. (2013) “Debt, Inflation and Growth Robust Estimation of Long-Run Effects in Dynamic Panel Data Models.” Federal Reserve Bank of Dallas, Globalization and Monetary Policy Institute Working Paper No. 162.

Cochrane, J. H. (2011) “Understanding Policy in the Great Recession: Some Unpleasant Fiscal Arithmetic.” European Economic Review 55 (1): 2–30.

Codogno, L.; Favero, C.; and Missale A. (2003) “Yield Spreads on EMU Government Bonds.” Economic Policy 18 (37): 503–32.

Diamond, P. A. (1965) “National Debt in a Neoclassical Growth Model.” American Economic Review 55 (5): 1126–50.

Dincǎ, G., and Dincǎ, M. S. (2015) “Public Debt and Economic Growth in the EU Post-Communist Countries.” Journal for Economic Forecasting (June): 119–32.

Dotsey, M. (1994) “Some Unpleasant Supply Side Arithmetic.” Journal of Monetary Economics 33 (3): 507–24.

Eberhardt, M., and Presbitero, A. F. (2015) “Public Debt and Growth: Heterogeneity and Non-linearity.” Journal of International Economics 97 (1): 45–58.

Égert, B. (2015) “Public Debt, Economic Growth and Nonlinear Effects: Myth or Reality?” Journal of Macroeconomics 43: 226–38.

Elmendorf, D. W., and Mankiw, N. G. (1999) “Chapter 25 Government Debt.” In J. B. Taylor and M. Woodford (eds.), Handbook of Macroeconomics. Amsterdam, Netherlands: Elsevier.

Ghourchian, S., and Yilmazkuday, H. (2020) “Government Consumption, Government Debt and Economic Growth.” Review of Development Economics 24 (2): 589–605.

Gómez-Puig, M., and Sosvilla-Rivero, S. (2017) “Heterogeneity in the Debt-Growth Nexus: Evidence from EMU Countries.” International Review of Economics and Finance 51: 470–86.

Herndon, T.; Ash, M.; and Pollin R. (2013) “Does High Public Debt Consistently Stifle Economic Growth? A Critique of Reinhart and Rogoff.” Cambridge Journal of Economics 38 (2): 257–79.

Karadam, D. Y. (2018) “An Investigation of Nonlinear Effects of Debt on Growth.” Journal of Economic Asymmetries 18: 1–13.

Kourtellos, A.; Stengos, T.; and Tan, C. M. (2013) “The Effect of Public Debt on Growth in Multiple Regimes.” Journal of Macroeconomics 38: 35–43.

Krugman, P. (2013) “How the Case for Austerity Has Crumbled.” New York Review (June 6).

Kumar, M. S., and Baldacci, E. (2010) “Fiscal Deficits, Public Debt, and Sovereign Bond Yields.” IMF Working Paper No. 10/184.

Leão, P. (2013) “The Effect of Government Spending on the Debt-to-GDP Ratio: Some Keynesian Arithmetic.” Metroeconomica 64 (3): 448–65.

Lim, J. J. (2019) “Growth in the Shadow of Debt.” Journal of Banking and Finance 103: 98–112.

Mercinger, J.; Aristovnik, A.; and Verbič, M. (2015) “Revisiting the Role of Public Debt in Economic Growth: The Case of OECD Countries.” Engineering Economics 26 (1): 61–66.

Mercinger, J.; Aristovnik, A.; and Verbič, M. (2014) “The Impact of Growing Public Debt on Economic Growth in the European Union.” Amfiteatru Economic Journal 16 (35): 403–14.

Padoan, P. C.; Sila, U.; and Van Den Noord, P. (2013) “Avoiding Debt Traps: Fiscal Consolidation, Financial Backstops and Structural Reforms.” OECD Journal: Economic Studies 2012 (1): 151–77.

Pegkas, P.; Staikouras, C.; and Tsamadias C. (2020) “On the Determinants of Economic Growth: Empirical Evidence from the Eurozone Countries.” International Area Studies Review 23 (2): 210–29.

Pham, T. H. A.; Mai, B. D.; and Nguyen, T. T. (2020) “The Impact of Public Debt on Economic Growth of ASEAN 1 3 Countries.” International Journal of Economics and Business Administration 8 (4): 87–100.

Reinhart, C. M., and Rogoff, K. S. (2010) “Growth in a Time of Debt.” American Economic Review 100 (2): 573–78.

Siddique, A.; Selvanathan, E. A.; and Selvanathan, S. (2016) “The Impact of External Debt on Growth: Evidence from Highly Indebted Poor Countries.” Journal of Policy Modeling 38 (5): 874–94.

Snieška, V., and Burksaitiene, D. (2018) “Panel Data Analysis of Public and Private Debt and House Price Influence on GDP in the European Union Countries.” Engineering Economics 29 (2): 197–204.

Swamy, V. (2020) “Debt and Growth: Decomposing the Cause and Effect Relationship.” International Journal of Finance and Economics 25 (2): 141–56.

Topal, P. (2014) “Threshold Effects of Public Debt on Economic Growth in the Euro Area Economies.” SSRN Working Paper, Social Science Research Network.

Vinokurov, E.; Lavrova, N.; and Petrenko, V. (2020) “Optimal Debt and the Quality of Institutions.” Eurasian Development Fund for Stabilization and Development Working Paper No. 20/4, Eurasian Development Bank.

Von Hagen, J.; Schuknecht, L.; and Wolswijk, G. (2011) “Government Bond Risk Premiums in the EU Revisited: The Impact of the Financial Crisis.” European Journal of Political Economy 27 (1): 36–43.

Woo, J. and Kumar, M. S. (2015) “Public Debt and Growth.” Economica 82 (328): 705–39.

Zouhaier, H., and Fatma, M. (2014) “Debt and Economic Growth.” International Journal of Economics and Financial Issues 4 (2): 440–48.

This work is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License.