Bernstein et al. (2019) used a database that provides individual data for 160 million adults living in the United States. The data include the first five digits of the person’s Social Security number, as well as name, living addresses, year of birth, and gender. The first five digits allow the researchers to determine the year the individual got a Social Security number. Most natives get those numbers when they are born, when they are relatively young, or when they get their first job at age 16. Bernstein et al. identified immigrants as individuals who get their Social Security number in their 20s or later.2 The authors merged (linked) an individual’s immigration status determined in the first dataset with patent data from the U.S. Patent and Trademark Office. Thus they found that 23 percent of all patents went to immigrants between 1976 and 2012. This number is 40 percent higher than their share of the U.S. inventor population. The high number of patent citations indicates that the patents tend to be of high quality.

Bernstein et al. (2019) also investigated the possibility of spillover effects from an increase in immigrant inventors over the productivity of native inventors. They estimated the impact of a collaborator’s premature death (i.e., before age 60) on the future productivity of the living collaborator. They found the death of an immigrant collaborator reduces the native inventor’s productivity (patents or patent citations) over time by 50 to 65 percent. If the premature death involves a native collaborator, the productivity of the immigrant inventor declines less, between 28 and 35 percent.

Not surprisingly, there are clear spillover benefits from research collaboration. However, on the basis of those estimates, native inventors appear to gain more. The spillover benefits are the result of effectively combining the different knowledge and experience that each inventor brings to any project. The larger influence of the immigrant collaborators may be due to their bringing to research projects a foreign or possibly larger global knowledge base that differs from that of the average native collaborator.

Peri, Shih, and Sparber (2015) showed that foreign-born STEM workers were associated with an increase in productivity and wages in a sample of 219 U.S. cities from 1990 to 2010. In addition, they estimated that increases in foreign STEM workers could explain between one-third and one-half of aggregate growth in total factor productivity in the United States during that period. They estimated that this finding translated into native per capita income’s being 10 percent higher in 2010.3

If immigrants have different complementary skills when compared with native workers, then, with immigration, native workers can specialize and can take on the tasks they are best at. The result would be an increase in efficiency and lower costs. For example, as immigration increases, native workers shift into jobs that are more language intensive (sales and management). Immigrants focus on jobs that require fewer language skills, such as programming or construction. This increase in skill diversity and greater specialization improves productivity.

Peri (2012) examined the effects of increased immigration on long-term productivity growth in the 50 states and Washington, D.C., in 1960, 2000, and 2006. He found that immigration raised state growth in total factor productivity. He estimated that between one-third and one-half of the productivity growth increase had been caused by improved (i.e., more efficient) specialization of job tasks related to the increase in immigration.

Research has also looked at the effects of immigration at the firm level. Creative destruction is an important way in which innovation promotes economic growth. Superior products, services, or production methods of a new entrant will replace those of older incumbent firms. Khanna and Lee (2018) found that a 10 percent increase in H‑1B (immigrant) workers results in a 2 percent increase in firm entry and exit (i.e., increased creative destruction) across a wide set of U.S. industrial sectors.

Brown et al. (2020) used data from the U.S. Census Bureau’s Annual Survey of Entrepreneurs to compare the innovation activities of immigrants with those of natives in high-tech industries at the firm level. After controlling for demographic factors, startup financial resources, and specific industry, they found higher levels of innovative activities (e.g., new products and production techniques, higher R&D, more patents granted or pending) among immigrants than natives. Interestingly, despite higher levels of patents, the same data show that immigrants had fewer copyrights and trademarks, perhaps owing to the nature of the type of products (arts and marketing versus technology) for which copyrights and trademarks are sought. Those results and the higher level of patent activity are significant only when control variables are excluded from the empirical model.

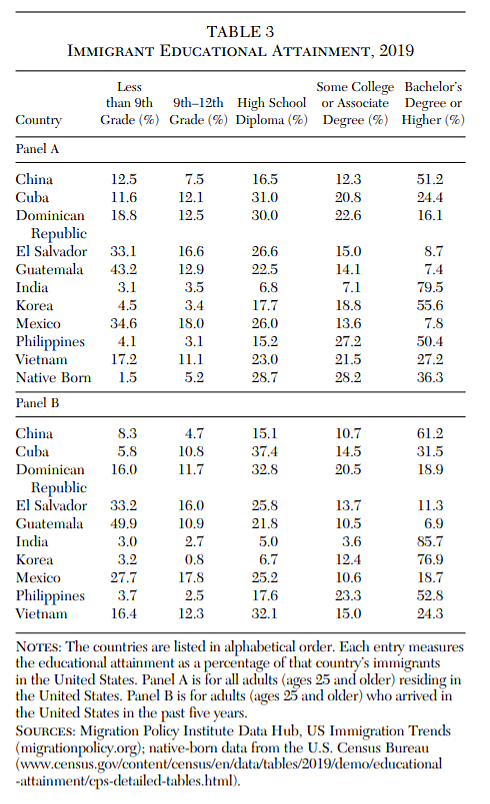

Ganguli, Kahn, and MacGarvie (2020) argue that one possible explanation for those results is that immigrants self-select from the right tail (high-skilled individuals) of the ability distribution. Furthermore, they argue that the right tail of the ability distribution is fatter than that of natives. This finding implies that immigrants have a larger percentage of individuals with STEM degrees or backgrounds. Hanson and Slaughter (2019) provide evidence that U.S. immigrants are overrepresented in STEM-related employment. This evidence is especially true for individuals with advanced degrees in STEM areas. For example, considering the workforce with PhDs, in 2013, foreign-born individuals between the ages of 25 and 54 made up 28.9 percent of hours worked by this elite population and 54.5 percent of STEM hours worked.

In a recent study, Burchardi et al. (2020) examined the impact of immigration on both innovation and economic dynamism for U.S. counties from 1975 to 2010. They stress that it is difficult to disentangle the causal relationship between immigration flows and innovation or economic performance. Does increased immigration improve the economy or does a strong economy attract immigrants? In this situation, researchers try to find variables that predict immigration flows but are not correlated with current economic conditions in the economy. For example, they might use the share of an economy’s population that are immigrants in the past to predict current immigration flows. So long as past immigration is not tied to current economic conditions, the estimated impact is unbiased in large samples. If past immigration is influenced by an unobserved factor that also impacts current economic conditions, then past immigration will not provide estimates with desirable statistical properties.4

In an effort to establish a causal relationship between immigration and innovation or economic dynamism, Burchardi et al. (2020) developed a model where immigration choices are influenced by economic and social factors. The model was used to calculated the amount of immigration caused by each factor. The non-European social factors component, which is independent of unobserved factors that also influence innovation and economic dynamism, was then used to predict immigration flows during the 1975–2010 period.

Burchardi et al. found immigration flows have a positive causal impact on U.S. county-level firm innovation and on economic dynamism. They found that a one standard deviation increase in migrants (approximately 12,000 migrants) increases the flow of patents to local firms in the county by 27 percent relative to the average patent flow. They also found more immigration increases economic dynamism or creative destruction. Once again, a one standard deviation increase in immigrants increases both job creation and destruction by 7 percent and 11 percent, respectively, relative to the average. It also increases real wages by about 3 percent relative to the average wage in a county. The authors also found that there are geographic spillovers to other counties, but they decline fairly quickly. The impact is also larger from immigrants with more education. This research shows immigration can have a significant impact on innovation and the performance of regional economies.

Finally, studies using firm data from the United Kingdom (Ottaviano, Peri, and Wright 2018) and France (Mitaritonna, Orefice, and Peri 2017) found that, where there are more immigrants, there are more productivity increases, which suggests greater innovation and improvements in efficiency occur within the affected firms.

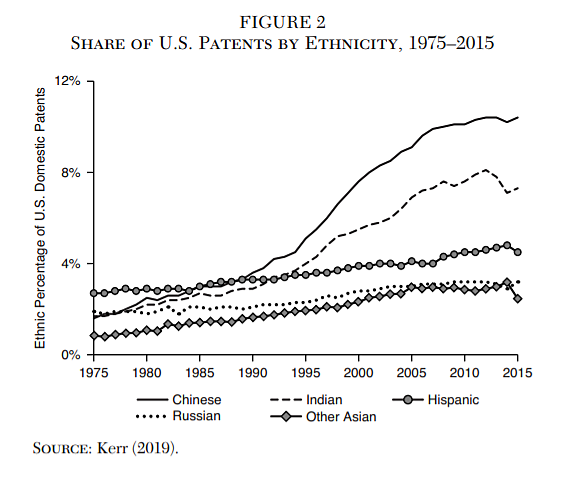

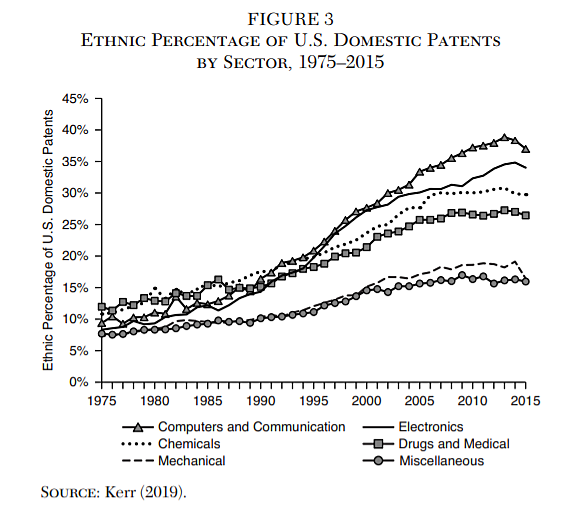

The research presented in this section indicates that immigrants tend to be innovative. This result is attributed to a large percentage of immigrants with STEM degrees. The share of U.S. patents going to immigrants has significantly increased over time. Immigrant inventors are a complement to native inventors, thus raising their productivity over time.

In summarizing the current research about immigration, entrepreneurship, and innovation, this article provides evidence that immigration—especially among high-skilled entrepreneurial immigrants—increases innovation, firm startups, and general economic dynamism. The share of U.S. patents going to foreign-born individuals is growing significantly. Higher levels of skilled immigrants increase patents in the United States. High-skilled immigrants make native innovators more productive. These findings tell us that immigrants are playing a growing and important role in the production of new ideas, which is the principal engine of growth in the United States, thereby raising the standard of living of all citizens.

Expanding immigration would be a desirable policy reform. Family-based visas do not have the same effect on innovation and entrepreneurship as do skill- and employment-based visas. This fact does not imply that, as a country, we should stop issuing family reunification visas. The same is true with respect to refugees. The visa policies for such groups are created for humanitarian reasons. However, the United States should consider expanding the number of visas issued to foreign-born entrepreneurs and to individuals with STEM degrees. At a minimum, the country can set the H‑1B visa quota at a level that more closely matches demand (Griswold 2020; Palagashvili and O’Connor 2021).

Akcigit, U., and Kerr, W. R. (2018) “Growth through Heterogeneous Innovations.” Journal of Political Economy 126 (4): 1374–443.

Azoulay, P.; Jones, B. F.; Kim, J. D.; and Miranda, J. (2020) “Immigration and Entrepreneurship in the United States.” NBER Working Paper No. 27778.

Bernstein, S.; Diamond, R.; McQuade, T.; and Pousada, B. (2019) “The Contribution of High-Skilled Immigrants to Innovation in the United States.” Stanford University Business School Working Paper.

Bloom, N.; Jones, C. I.; Reenen, J. V.; and Webb, M. (2020) “Are Ideas Getting Harder to Find?” American Economic Review 110 (4): 1104–44.

Brown, J. D.; Earle, J. S.; Kim, M. J.; and Lee, K. M. (2020) “Immigrant Entrepreneurs and Innovation in the U.S. High-Tech Sector.” In I. Ganguli, S. Kahn, and M. MacGarvie (eds.), The Roles of Immigrants and Foreign Students in U.S. Science, Innovation, and Entrepreneurship, 149–71. Chicago: University of Chicago Press.

Burchardi, K. B.; Chaney, T.; Hassan, T. A., Tarquinio, L.; and Terry, S. J. (2020) “Immigration, Innovation, and Growth.” NBER Working Paper No. 27075.

CBS News (2020) “Americans Weigh in on Issues before the Supreme Court: CBS News Poll.” Available https://drive.google.com/file/d/1BIG9z6d4OdhprnhaqQN0xbrwE14NPI3/view (June 8).

Congressional Budget Office (2020) Federal Responses to Declining Entrepreneurship. Washington: CBO.

Decker, R.; Haltiwanger, J.; Jarmin, R.; and Javier M. (2014) “The Role of Entrepreneurship in U.S. Job Creation and Economic Dynamism.” Journal of Economic Perspectives 28 (3): 3–24.

Fairlie, R. W. (2013) “Entrepreneurship, Economic Conditions, and the Great Recession.” Journal of Economics and Management Strategy 22 (2): 207–31.

Fairlie, R. W., and Desai, S. (2020) “2019 Early-Stage Entrepreneurship in the United States.” Kansas City: Ewing Marion Kauffman Foundation.

Fairlie, R. W.; Miranda, J.; and Zolas, N. (2018) “Job Creation and Survival among Entrepreneurs: Evidence from the Universe of U.S. Startups.” University of California, Santa Cruz, Working Paper.

__________ (2019) “Measuring Job Creation, Growth, and Survival among the Universe of Start-ups in the United States Using a Combined Start-up Panel Data Set.” Industrial and Labor Relations Review 72 (5): 1262–77.

Gallup (2020) “Immigration.” Available at https://news.gallup.com/poll/1660/immigration.aspx.

Ganguli, I.; Kahn, S.; and MacGarvie, M. (2020) “Introduction.” In I. Ganguli, S. Kahn, and M. MacGarvie (eds.), The Roles of Immigrants and Foreign Students in U.S. Science, Innovation, and Entrepreneurship, 1–14. Chicago: University of Chicago Press.

Griswold, D. (2020) “Coming to America: Finally Fixing Legal Immigration.” Discourse (November 10): 1–12.

Hanson, G. H., and Slaughter, M. J. (2019) “High-Skilled Immigration and the Rise of STEM Occupations in U.S Employment.” In C. R. Hulten and V. A. Ramey (eds.), Education, Skills, and Technological Change: Implications for Future U.S. GDP Growth. Chicago: University of Chicago Press.

Hunt, J. (2011) “Which Immigrants Are Most Innovative and Entrepreneurial?” Journal of Labor Economics 29 (3): 417–57.

Hunt, J., and Gauthier-Loiselle, M. (2010) “How Much Does Immigration Boost Innovation?” American Economic Journal: Macroeconomics 2 (2): 31–56.

Jones, C. I. (1995) “R & D–Based Models of Economic Growth.” Journal of Political Economy 103 (4): 759–84.

__________ (2002) “Sources of U.S. Economic Growth in a World of Ideas.” American Economic Review 92 (1): 220–39.

__________ (2016) “The Facts of Economic Growth.” In J. Taylor and M. Woodford (eds.), Handbook of Macroeconomics. Amsterdam: Elsevier B.V.

__________ (2020) “The End of Economic Growth? Unintended Consequences of a Declining Population.” NBER Working Paper No. 26651.

Kerr, W. R. (2008) “The Ethnic Composition of U.S. Inventors.” Harvard Business School Working Paper No. 08–006.

__________ (2019) The Gift of Global Talent: How Migration Shapes Business, Economy and Society. Stanford, Calif.: Stanford Business Books.

Kerr, S. P., and Kerr, W. R. (2020) “Immigrant Entrepreneurship in America: Evidence from the Survey of Business Owners, 2007 and 2012.” Research Policy. 49 (3): 1–18.

Khanna, G., and Lee, M. (2018) “High-Skill Immigration, Innovation, and Creative Destruction.” NBER Working Paper No. 24824.

Krol, R. (forthcoming) “Immigration and American Labor Market Outcomes.” Arlington, Va.: Mercatus Center at George Mason University, Working Paper.

Liang, J.; Wang, H.; and Lazear, E. P. (2018) “Demographics and Entrepreneurship.” Journal of Political Economy 126 (51): S140–S196.

Lincicome, S. (2020) “The COVID Vaccines Are a Triumph of Globalization.” Cato Institute Commentary (December 8).

McCloskey, D. N. (2016) Bourgeois Equality: How Ideas, Not Capital or Institutions, Enriched the World. Chicago: University of Chicago Press.

Mitaritonna, C.; Orefice, G.; and Peri, G. (2017) “Immigrants and Firms’ Productivity: Evidence from France.” European Economic Review 96: 62–82.

Nowrasteh, A., and Powell, B. (2021) Wretched Refuse? The Political Economy of Immigration and Institutions. New York: Cambridge University Press.

Ortega, F., and Peri, G. (2014) “Openness and Income: The Roles of Trade and Immigration.” Journal of International Economics 92 (2): 231–51.

Ottaviano, G. I., and Peri, G. (2006) “The Economic Value of Cultural Diversity: Evidence from U.S. Cities.” Journal of Economic Geography 6 (1): 9–44.

Ottaviano, G.; Peri, G.; and Wright, G. C. (2018) “Immigration, Trade, and Productivity in Services.” Journal of International Economics 112: 88–108.

Palagashvili, L., and O’Connor, P. (2021) “Unintended Consequences of Restrictions on H‑1B Visas.” Arlington, Va.: Mercatus Center at George Mason University, Policy Brief.

Peri, G. (2012) “The Effect of Immigration on Productivity: Evidence from U.S. States.” Review of Economics and Statistics 94 (1): 348–58.

Peri, G.; Shih, K.; and Sparber, C. (2015) “STEM Workers, H‑1B Visas, and Productivity in U.S. Cities.” Journal of Labor Economics 33 (S1, Part 2): S225–S255.

Romer, P. A. (1990) “Endogenous Technological Change.” Journal of Political Economy 98 (2): S71–S102.

Wooldridge, J. M. (2010) Econometric Analysis of Cross Section and Panel Data. Cambridge, Mass.: MIT Press.