Everyone has ideas and assumptions about how an economic system works best. At one extreme are those who think that the market should operate in a decentralized manner and that the free action of economic agents maximizes the generation of goods and services and promotes growth. In their opinion, individuals are motivated by the benefits they expect from their activities and therefore try to produce goods and services that consumers want. The role of the government is to provide a set of rules that facilitate competition and exchange, thus ensuring that the factors of production are used efficiently. In that framework, there is limited room for state action, either through the creation of public companies or through controls on voluntary exchanges, whether affecting prices, the quality or characteristics of goods, or outright prohibitions. Advocates of that philosophy also believe in the benefits of international trade, in order to profit from comparative advantages across borders. That perspective is not necessarily incompatible with the acceptance of certain income redistribution mechanisms, although attention is paid to ensuring that they do not generate inefficiency or incentives for opportunistic behavior. That set of beliefs can be defined as a free market mentality.

On the other end of our economic mentality spectrum are those who think that government has an active role to play in the production and distribution of wealth and goods. They believe the state must regulate, direct, and control economic activity in order to protect individuals and society as a whole. Although they do not necessarily deny that private initiative is useful, they believe its role should be limited, and that in many activities state enterprises should be preferred, since they take into account social needs and costs. In that paradigm, individuals are expected to behave altruistically and without taking personal profits into consideration. That mentality—expecting the state to play a paternal role in ensuring the well-being of the members of society—can be called interventionist or socialist. At the extreme are those who advocate a pure communist system, where there is no room for private firms as all economic activity is fully directed by the organs of the state.

Most people prefer some mixture of the two models described. In virtually every country there are people who passionately defend free markets, while others have very interventionist mentalities. Between those extremes innumerable combinations exist: conservatives, moderate socialists, liberals, reformist communists, social democrats, etc. An ideological range is often present among members of the same political party, churches, clubs, unions, or business associations, though one would expect, for example, that the average economic mentality of an organization of entrepreneurs dedicated to foreign trade would be more favorable to free markets than that presented by the members of a union of farmers who produce for local consumption. In a similar way, countries present ideological “averages” that allow us to make differentiations among those that are more aligned with a free market mentality and those aligned with an interventionist mentality.

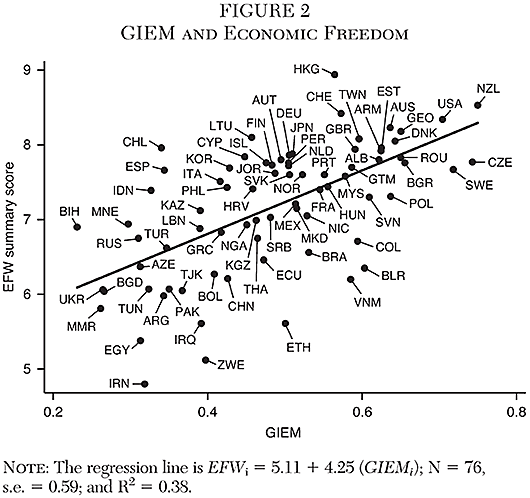

In generating scores for countries, GIEM provides an empirical tool for pursuing a line of research considered important by renowned academics. Economic historian Douglass North was awarded the Nobel Prize in Economic Sciences for shedding light on the role of institutions in enabling the industrial revolution. North gradually changed his initial position, which considered institutions and their evolution as a result of the action of maximizing political agents, and moved toward a greater consideration of the persistence of mental models transmitted between generations (see also Zweynert 2009). North (2005) acknowledged that good institutions were ultimately based on the shared mentality that predominates in a specific society at a given moment. If a population’s culture was supportive of a market system, this would have strong practical effects because economic freedom provided the conditions for economic growth.

The famed Russian-born historian Alexander Gerschenkron (1962) focused on the preconditions for economic development in his book, Economic Backwardness in Historical Perspective. In particular, he pointed to the negative impact on economic development from public hostility toward entrepreneurs and markets. He stated that adverse dominant social attitudes could significantly affect economic growth (which for him meant industrialization) if they crystallized into governmental action affecting institutions. For Gerschenkron, there was a “crying need” for further research on the topic, especially relating what he called the “coefficient of changeability” of a society—that is, the extent to which some communities seem stuck in a particular mental framework and others evolve in light of changing circumstances or evidence.

The founder of modern business strategy theory, Michael Porter (2000), holds that the basis for institutional frameworks favorable for growth is popular support for competition, openness to globalization and international trade, an understanding that free markets benefit a majority of society, and an awareness of the pernicious effects of government favoritism. Without those beliefs, he argues, it is probable that an alternate view may take root—a view that is more favorable to the existence of noncompetitive rents, such as those granted by protectionist economic policies. A similar point has been made by the distinguished economist and historian Deirdre McCloskey (2016), herself a student of Gerschenkron at Harvard. McCloskey shows the importance of “articulated ideas about the economy” or, more precisely, “about the sources of wealth, about positive-sum as against zero-sum economic games, about progress and invention” (McCloskey 2016: 503).

The dominant economic mentality in societies manifests itself not only in the norms and cultural expressions of the people, but also in the actual laws and regulations that stipulate the role of the state in economic matters. That occurs particularly in democratic systems where political parties and leaders tend to express the prevailing ideas of their constituents in their platforms and actions. In such processes there are surely other relevant factors, such as the action of pressure groups—for example, business people sheltered by tariffs, trade unions protected by restrictions on labor mobility, and public officials whose jobs are secure. It should be noted, however, that the existence of such groups is more likely if they operate in a cultural environment that embraces government intervention.

The different institutional frameworks existing in the various nations have been and are measured by various metrics that are published periodically, including the Economic Freedom of World index prepared by the Fraser Institute (Gwartney et al. 2020) and The Index of Economic Freedom of The Heritage Foundation (Miller, Kim, and Roberts 2020). The data used as inputs of those rankings include indicators of business freedom, of the development of capital and labor markets, of monetary stability, of the size of government, of protection of property rights (including ease of transfer), of reliable enforcement of contracts, and of impediments to international trade. In general, institutional quality, as measured through these rankings, is strongly correlated with per capita income and development (De Haan, Lundström, and Sturm 2006). Those studies confirm that adequate institutional frameworks favor capital accumulation, realization of gains from trade, and efficient use of the factors of production.

Is it possible to quantify the values people hold through survey data? A common argument against the use of surveys is that true preferences are revealed only by observable actions. However, preferences over institutions and policy frameworks are different from preferences in goods and services. The former preferences are revealed in political choices, such as elections, in which the individual has virtually no reason to expect that his or her choice will have an effect on the outcome. Therefore, “elections are surveys” (Caplan 2006: 132). Moreover, elections rarely offer choices that cleanly differentiate between economic mentalities. When it comes to values regarding institutions and policies, surveying people’s opinions is arguably more useful than measuring particular behaviors.

Once surveys are accepted as useful sources on values, they can be quantified in a quite straightforward way by asking how strongly people support or oppose a certain idea or opinion—a well-established methodology in social psychology. Indeed, a quantitative examination of “culture” has contributed much to the understanding of economic development and the evolution of institutions (Alesina and Giuliano 2015).

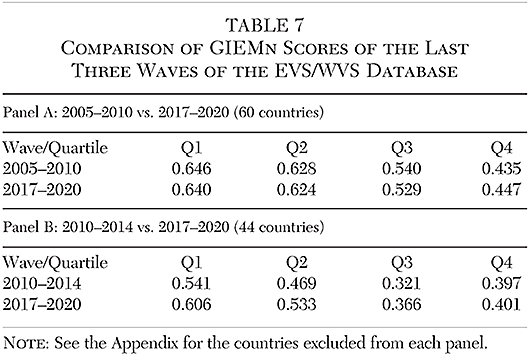

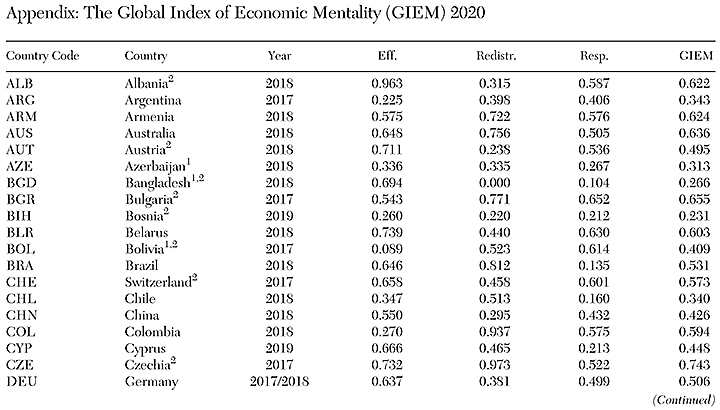

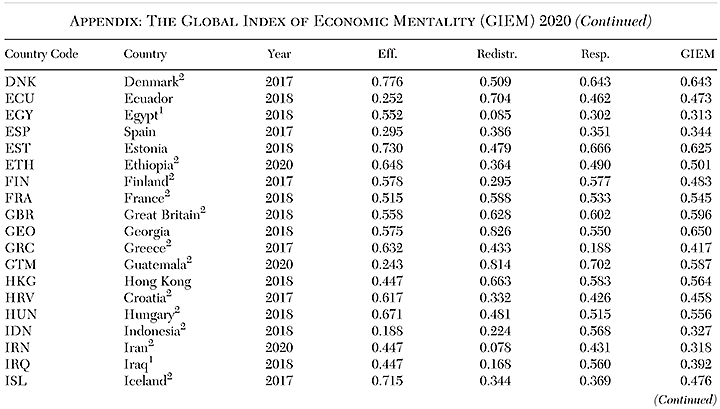

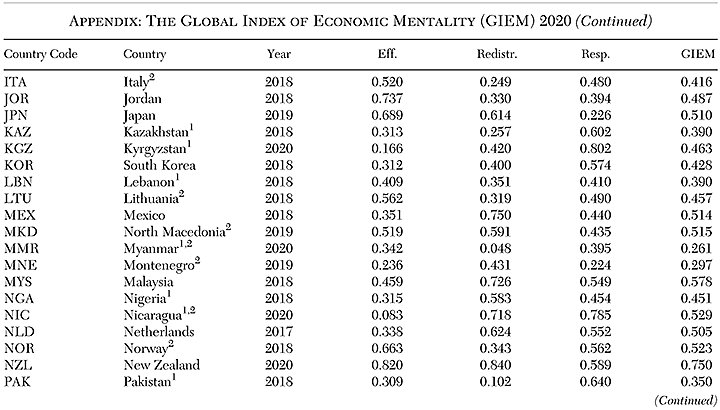

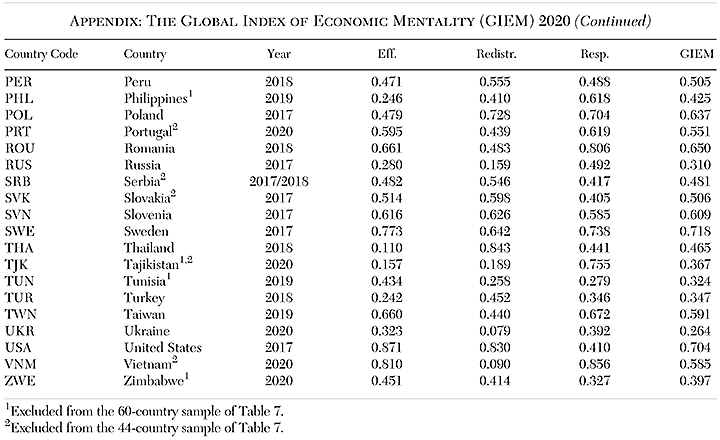

Czeglédi and Newland (2018a) constructed a Free Market Mentality Index using as inputs some of the questions included in the World Values Survey (WVS 2015) and European Values Study (EVS 2011).1 Both of those projects attempt to measure the evolution of values and beliefs of the population in many countries, by means of periodic surveys (generally every four years). The EVS began studying attitudes in Europe in the late 1970s, and the WVS was launched as a global project in 1981. The two studies complement, and are compatible with each other, as most of the questions that are asked are equivalent. The two databases are combined and are referred to here as the EVS/WVS database. The recent release of the data corresponding to the seventh wave of the World Values Survey and the fifth wave of the European Values Study (EVS/WVS 2020a) taken during the period 2017–2020 has presented an opportunity to generate a new and more complete version of GIEM.

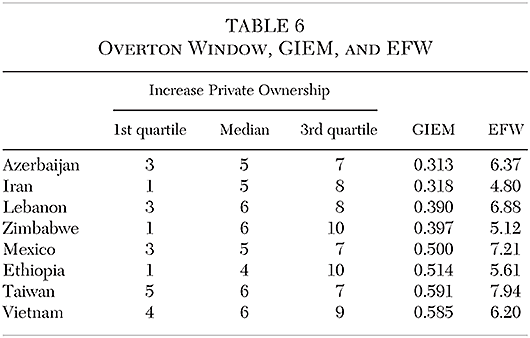

GIEM quantifies the extent to which people prioritize private initiative, free competition, and personal responsibility, as opposed to greater government intervention, income redistribution, and a supportive government. It can be seen as an attempt to measure the Overton Window (Lehman 2018)—the idea that there is a range of policy alternatives considered “politically acceptable” in a society at a given moment—as it relates to overall economic ideology of a country.

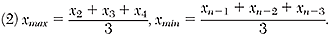

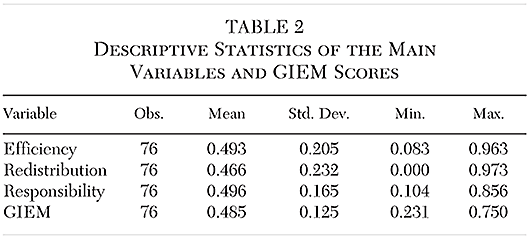

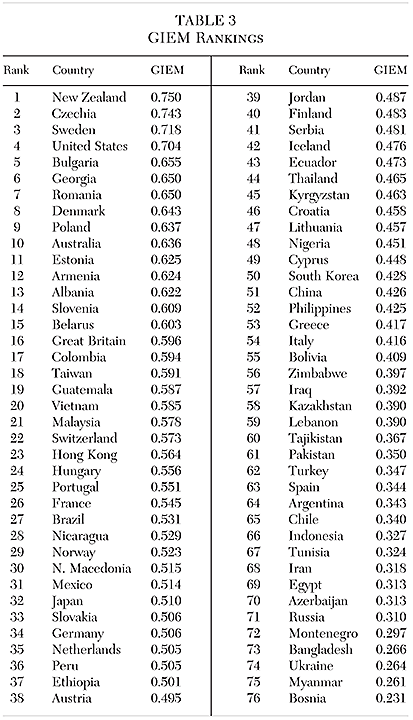

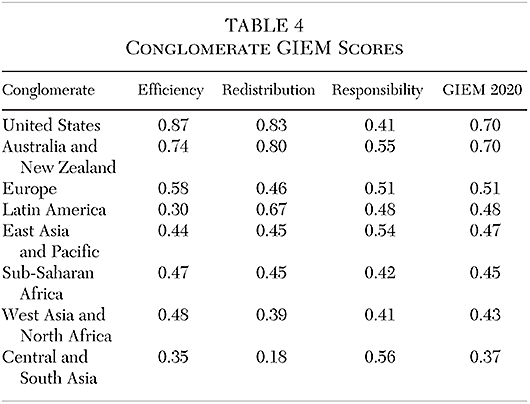

Like its predecessors, GIEM measures popular support for economic freedom, but is limited by the questions that are available in EVS/WVS (2020a). That means that the multidimensional nature of support for (or rejection of) free markets is imperfectly captured in the GIEM. Table 1 presents the six questions we utilized from the EVS/WVS, grouping them into three variables.

- The first variable, efficiency, explores the extent to which people believe private ownership and competition between firms produce desirable economic results. The original scales of both questions have been reversed so that the higher number signals a more pro-market view.

- The second variable, redistribution, evaluates the extent to which people are in favor of a redistributive state. Should the government redistribute income to create more equal outcomes? The two questions for this variable concern whether an ideal democratic government would tax the rich to give it to the poor. This variable therefore shows people’s views on what the government should do without much regard to whether it is able to do it. The scaling of these two questions also has been reversed so higher values align with the capitalist perspective that taxation for the sake of redistribution is not economically beneficial.

- The third variable, responsibility, quantifies the extent to which people believe that the individual is responsible for his or her own well-being, as contrasted with a view that the government should directly take action against poverty and in favor of income equality. This variable differs from the second one inasmuch as this one considers the tradeoffs that a choice between a more or less market-based economic order would involve. These two questions raise the question of whether people think that more government intervention negatively or positively affects incentives to behave responsibly.