The U.S. Postal Service (USPS) is a large business enterprise operated by the federal government. It has more than 600,000 employees and more than $70 billion in annual revenues. Revenues are supposed to cover the postal service’s costs, but mail volume is plunging, and the USPS has been losing billions of dollars a year for more than a decade.

The USPS has a legal monopoly over letters and mailboxes. That policy is an anomaly because the federal government’s general economic stance is to encourage open competition in markets, yet the USPS monopoly prevents entrepreneurs from entering postal markets and trying to improve quality and reduce costs for consumers.

While mail volumes have fallen, the USPS has expanded its package business. But it makes no sense for a privileged federal entity to take business from private, taxpaying companies in the package industry. Postal and package markets are evolving rapidly, and the goal of federal policy should be to create a level playing field open for competition and innovation.

Europe is facing the same challenge of declining mail volume, and it has focused on opening postal markets and privatizing postal providers. The U.S. Congress should follow suit by privatizing the USPS and opening postal markets to competition. These reforms would give the USPS the flexibility it needs to cut costs and diversify, while providing equal treatment to businesses across postal and package markets.

USPS’s Predicament

Congress has given the USPS monopoly power over the delivery of first-class mail and access to mailboxes, the latter of which is a unique protection among the world’s postal systems.

The USPS also enjoys a range of other benefits (GAO 2017a: 19):

• It can borrow up to $15 billion from the U.S. Treasury at low interest rates.

• It is exempt from state and local sales, income, and property taxes; parking tickets; vehicle fees; and other charges.

• It pays federal corporate income taxes on its earnings from competitive products, but those taxes are circulated back to the USPS.1

• It is not bound by local zoning laws, is immune from a range of civil actions, and has the power of eminent domain.

• It has government regulatory power, which it can use to impede competitors.

On the other hand, Congress ties the hands of the USPS in many ways that prevent it from operating like a private enterprise. Congress restricts the USPS’s pricing flexibility, requires it to provide expansive employee benefits, imposes collective bargaining, and prevents it from cutting costs in various ways, such as by reducing delivery frequency and closing low-volume post offices.

The USPS’s financial challenges stem from its high cost structure and falling mail volumes, driven by the rise of email, Facebook, Evite, Internet bill paying, and online advertising. First-class mail volume in particular has shrunk by 45 percent since 2001 (USPS 2019). This has been a considerable blow to the USPS since first-class mail is its most profitable product (GAO 2017a).

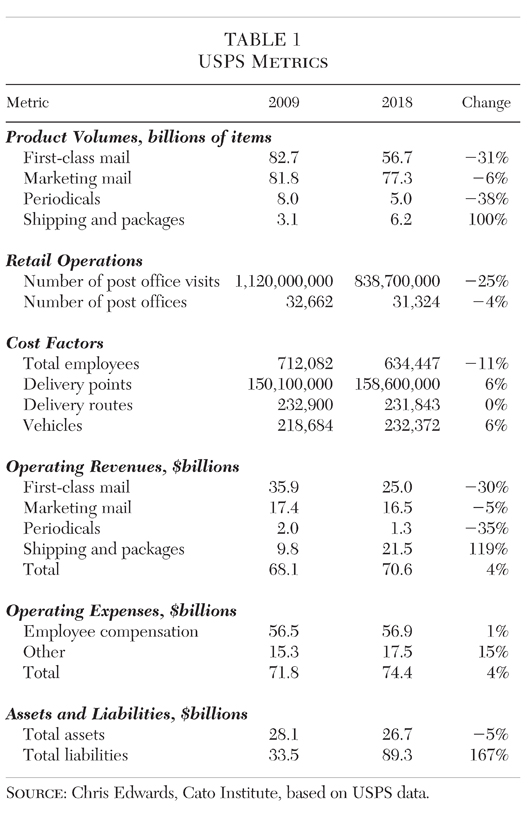

Table 1 shows data from USPS annual reports in 2009 and 2018 (USPS 2009, 2018b). The data indicate:

• Mail demand is falling and package demand is rising.

• Management has cut costs by reducing worker count. But Congress has resisted USPS efforts to close post offices, even though the number of USPS retail customers has plunged.

• Marketing mail — which is “junk mail” to most people — has become the largest type of mail by volume.

• More than three-quarters of USPS costs are for employee compensation. About four-fifths of the USPS labor force is unionized.

• Expenses are substantially higher than revenues.

• Assets are falling and liabilities are soaring.

The USPS has lost $69 billion since 2007 and will likely continue losing money unless there are major reforms (U.S. Treasury 2018: 2). Without restructuring, the USPS is expected to lose tens of billions of dollars over the next decade. Congress should make incremental reforms to reduce costs, such as allowing low-volume post offices to close, reducing labor expenses, ending collective bargaining, narrowing the requirements included within the USPS Universal Service Obligation (USO), and eliminating cross-subsidies. At the same time, Congress should prepare for longer-term changes by studying European experiences with postal service reform and readying the USPS for privatization and increased competition.

Incremental Reforms

The USPS is bleeding red ink and the company’s finances will likely get worse. The Trump administration is correct that the “USPS’s current model is unsustainable” (Executive Office of the President 2018: 69). To its credit, the USPS has taken steps on its own to reduce costs, including reducing employment, consolidating mail facilities, and reducing post office hours. But more needs to be done by the USPS and Congress. The following are some steps that policymakers should take to improve efficiencies and help stem losses in the near term.

Close Post Office Locations

The USPS operates more than 31,000 post offices.2 A USPS estimate from a few years ago found that the bottom 4,500 locations average just 4.4 customer visits a day (USPS 2012). These low-volume locations should be closed. When private businesses have falling demand for their products, they save costs by cutting lower-value activities. Congress should allow the USPS to do the same.

Cut Labor Costs

Labor costs account for more than three-quarters of USPS costs. By some measures, USPS labor compensation is higher, on average, than it is for private-sector workers in comparable organizations (Shapiro 2015a: 14). A U.S. Treasury analysis for 2017 found that employee costs at the USPS averaged $85,800 — higher than UPS’s $76,200 and FedEx’s $53,900 (U.S. Treasury 2018: 14).

The USPS has $110 billion in unfunded liabilities for retiree pension and health benefits, and its workforce is accruing more retirement benefits every year (U.S. Treasury 2018: 58). A 2006 law requires the USPS to begin paying down its health care liabilities, but the company has been defaulting on those payments.3 The USPS has also not made all of its required payments for employee pension costs in recent years.

There is debate about whether the USPS should prefund its health care costs or whether these obligations should be moved to Medicare, which would shift the burden to taxpayers. Another equally important issue is that the USPS will need to cut retirement benefits going forward. For decades, the private sector has been moving away from defined-benefit pension plans, and very few private employers offer retiree health benefits (Schuyler 2016). Congress should follow suit by cutting USPS retirement health benefits and offering new postal employees a defined contribution pension plan only.

End Collective Bargaining

Collective bargaining agreements cover about four-fifths of the USPS workforce. Such agreements reduce business flexibility. The Government Accountability Office (GAO) noted that USPS collective bargaining agreements “have established salary increases, cost-of-living adjustments, and the percentage of health insurance premiums paid by employees and the USPS” (GAO 2017a: 13). Disputes are handled in binding arbitration where there is no requirement for the USPS’s dire financial condition to be considered.

The Trump administration’s Postal Task Force recommended removing USPS compensation from collective bargaining, noting that other federal workers do not enjoy that privilege (U.S. Treasury 2018: 60). But why not remove collective bargaining from the USPS altogether? Just 6.4 percent of workers in the U.S. private sector are members of labor unions.4 The goal should be to move the USPS toward private sector labor and compensation standards.

Narrow the Universal Service Obligation

The federal government has adopted an expansive USO for the USPS including six-day delivery, uniform letter pricing, and other rules (U.S. Treasury 2018: 39). This is a much more expansive USO than many other countries have (GAO 2017b: 14). In a world before email, when mail volume was higher, such an expansive USO might have made sense. Today, however, it is not paper mail that “binds the nation together,” but rather the Internet. This is especially true for younger Americans, for whom the amount of mail received per week fell from 17 pieces in 2001 to just 10 pieces in 2017 (USPS IG 2018: 2). Millennials pick up and review their mail far less frequently than older Americans, and they are far more likely to pay their bills online (USPS IG 2018: 5–6).

In response to the increasing decline in paper mail use, Congress should reduce the number of days that USPS mail delivery is available and provide the USPS more pricing flexibility. Another option for cutting costs would be to install and use more cluster boxes for residential deliveries.

End Cross Subsidies

The USPS is not supposed to use earnings from monopoly products (mainly letters) to subsidize competitive products (mainly packages). However, some analysts argue that the USPS is cross-subsidizing through the way it allocates its institutional or overhead costs. In a 2015 study, economist Robert Shapiro found that the USPS uses profits on its monopoly products to subsidize express mail and package delivery (Shapiro 2015b). Shapiro estimated the value of these cross-subsidies at $3 billion or more a year. From the perspective of private package firms — which unlike the USPS must pay federal, state, and local taxes — this is unfair competition.

In addition, the Trump administration’s Postal Task Force noted, “The USPS’s ability to price last mile delivery and the delivery of small packages below those of private sector competitors distorts package markets” (U.S. Treasury 2018: 54). It added that the USPS is “distorting overall pricing in the package delivery market” and that “the USPS’s current cost allocation methodology is outdated, leading to distortions in investment and product pricing” (U.S. Treasury 2018: 2, 5).

In January 2019, the Postal Regulatory Commission (PRC) adopted a rule for the USPS to increase the share of institutional costs allocated to its package business, but the current share still may be too low to reflect full costs (U.S. Postal Regulatory Commission 2019; see also Taxpayers Protection Alliance 2019 and Zaiac 2019).

Over the past decade, the USPS has been capturing an increasing share of the overall U.S. package market (U.S. Postal Regulatory Commission 2019: 8). This is a concern because the USPS does not pay taxes and is perhaps leveraging its protected postal monopoly to subsidize the expansion. USPS package delivery has also been in the news because about 40 percent of Amazon’s massive delivery volume goes through the USPS (Gattuso 2018; Wingfield 2018). Meanwhile, Amazon accounts for about 25 percent of the USPS’s package business (Berman 2018). The details of Amazon’s deal with the USPS are private, which is troublesome given that the USPS is a public agency. However, it appears that Amazon is getting a deep discount compared with USPS’s published rates, which raises questions about whether the company is earning a reasonable return on the deal.

The USPS is getting increasingly entangled with other private businesses as well. FedEx and UPS are large users of USPS’s last mile delivery service. At the same time, the USPS contracts to FedEx for air transportation and other services. That would be fine if the USPS were a private and unsubsidized firm, but it is not. FedEx pays an average of $2 billion a year in taxes to federal, state, and local governments (Federal Express 2017).5 UPS typically owes between $1 billion and $2 billion a year just in income taxes (UPS 2018: 47). The USPS pays no taxes. That is not a level playing field, and it creates fairness problems and distorts the market.

Privatization and Competition

The postal and package markets may change dramatically in coming years as new technologies and upstart companies disrupt the major players. Amazon is pressing ahead with its own delivery systems while Uber-style delivery firms may grow in importance. Similarly, the USPS is becoming less of a mail company and more of a package company. In 2018, first-class mail revenues were $25 billion and falling, while shipping and package revenues were $22 billion and rising (USPS 2018b). The future is on the package side of USPS’s business, and the best way to embrace that future is with a privatized corporate structure. Congress should privatize the USPS, repeal its legal monopolies, and give the company the flexibility it needs to innovate and reduce costs. We should allow entrepreneurs to compete in the postal industry.

Privatization would be a bold reform, but a privatization revolution has swept the world since the 1980s. Governments in more than 100 countries have transferred thousands of state-owned businesses to the private sector. Railroads, airports, postal systems, and other businesses valued at more than $3 trillion have been privatized (Edwards 2016). Many academic studies have been conducted on these reforms, and the results are clear. In his book examining hundreds of reforms, finance professor William Megginson concluded, “[P]rivate ownership must be considered superior to state ownership in all but the most narrowly defined fields or under very special circumstances” (Megginson 2005: 52). Furthermore, “the weight of empirical evidence on the state versus private ownership question … now strongly supports those who believe that private ownership is inherently more efficient than state ownership. This is true even for natural monopolies” (Megginson 2005: 66).

With regard to postal reforms, Europe has led the way. Some nations have privatized their main postal companies, and the European Union has pressed its member nations to open their systems to competition. The Netherlands, for instance, which privatized its postal company in the 1990s, opened its postal markets to competition in 2009. Britain also opened postal markets to competition in 2006 and privatized the Royal Mail with share offerings in 2013 and 2015.6 Other countries, such as Austria and Italy, have also sold shares of their national postal companies. Germany began privatizing Deutsche Post with a stock offering in 2000 and opened its postal markets to competition in 2008. In a 2019 European report on the future of postal services, the Escher Group said, “Deutsche Post DHL is the most admired postal operator in the world” (Escher Group 2019: 2). The United States, on the other hand, ranks near the bottom of the Consumer Postal Council’s 26-country “Index of Postal Freedom” (Consumer Postal Union 2012).

However, European postal markets are no nirvana. They face the same challenges as the U.S. market does in terms of falling letter volumes. But Europe’s traditional postal firms (universal service providers or USPs) are making large changes in response. A 2018 report by the European Commission about the continent’s postal markets found that “many USPs have re-engineered postal networks and processes to cut costs”; “pressure from both letter volumes decline and competition in the parcel segment … has led to the use of new and more flexible employment models such as on-call work, temporary agency work, performance-related pay contracts as well as outsourced models”; and “increased competition has forced national postal operators to modernise their wage structure, e.g. introduce performance pay and other types of more flexible contracts” (European Commission 2018).

Among the other changes that European USPs had made in response to increased competition, the report listed “reduc[ing] required delivery speed for USO letters … and required delivery frequency”; “allowing USPs to shorten delivery routes by, for instance, delivering to a common street mail box instead of to the door”; and “closing down of post offices where the density of the postal retail network declined in 23 out of 32 countries.” The report also mentioned that “regulators [are] loosening requirements with respect to price regulation” (European Commission 2018).

Most European letter markets still have high USP market shares, but competition is slowly growing. As the Commission report noted, “the (high) concentration in the addressed letter market is declining.… In 2016, in eight countries at least 15 per cent of the postal market was comprised by non-USP postal operators. At least six out of these eight countries had end-to-end competition” (European Commission 2018: 74). One such private competitor is CityMail in Sweden, which delivers mail to more than half of the nation’s households every third day.7 Interestingly, the Commission report wrote that “Sweden has not had post offices at all since 2002,” as postal retail sales have moved to other businesses such as grocery stores (Jaag 2014). Similarly, in Germany, Deutsche Post “has few stand-alone branches now, having sold almost all of its 29,000 buildings. Most branches are in other businesses” (Rosenthal 2011). Postal and delivery markets are changing rapidly, and private companies have more flexibility than government bureaucracies to deal with the new challenges. With the rise of the Internet, the claim that mail is a natural monopoly needing special protection is weaker than ever.

The USPS has suffered huge declines in demand for its most profitable product, first-class mail. Private businesses in a similar situation would try to change direction and enter new markets. In Europe, for example, traditional postal companies are expanding into parcel and express services. The same European Commission report found that, “to compensate for lower scale economies, postal operators have made the pursuit of economies of scope as a key target.” (European Commission 2018: 27).

That makes sense for the competitive environment of Europe. But the USPS cannot diversify as freely as private businesses can, nor would we want the USPS entering other industries and unfairly competing with private businesses. As a tax-free entity, it would be distortionary for the USPS to enter, say, banking or grocery delivery. The way to solve this dilemma is to open postal markets, privatize the USPS, and allow it to compete freely. In recent years, the USPS has contracted out an increasing share of intermediate processing and transportation activities to private providers (U.S. Treasury 2018: 48). Thus, the USPS is becoming more “privatized” all the time. The logical next step is to fully privatize the USPS and provide it with more flexibility to meet the challenges ahead.

The Trump administration’s 2018 government reform proposal argued that “a privatized Postal Service would have a substantially lower cost structure, be able to adapt to changing customer needs and make business decisions free from political interference, and have access to private capital markets to fund operational improvements without burdening taxpayers. The private operation would be incentivized to innovate and improve services to Americans in every community” (Executive Office of the President 2018: 68). The proposal further noted, “A private postal operator that delivers mail fewer days per week and to more central locations (not door delivery) would operate at substantially lower costs” (Executive Office of the President 2018: 68).

A 2017 GAO report found that most of the postal experts it interviewed said that relaxing USPS monopolies “could induce USPS to become more efficient and increase innovation across the postal market” (GAO 2017b: 11). The experts “generally stated that the prospect of competitive pressure would stimulate USPS to be more efficient through both cost-cutting and general restructuring” (GAO 2017b: 11).

Privatization would also improve corporate governance. The USPS is overseen by a Board of Governors, but the Board has not been fully staffed for years. Currently, just two of nine appointed positions are occupied.8 This situation is typical of Washington dysfunction these days, and is unlikely to improve any time soon without privatization.

Another common failure of federal business ownership, evident within not only the USPS but also Amtrak and our air traffic control system, is underfunded capital investment. The USPS’s low cash flow is forcing it to defer needed investment. According to the Trump administration’s 2018 Postal Task Force report, not only is the USPS hamstrung in making necessary investments, but “projected liquidity constraints limit its ability to compete with the private sector in the development and implementation of new delivery technologies.” (U.S. Treasury 2018: 25, 49). Privatization would allow the USPS access to debt and equity markets for needed long-term investments.

Members of Congress often express concern when major companies do not pay taxes. Yet the USPS is a $70 billion company that does not pay taxes. A privatized USPS would pay federal, state, and local taxes, which would put the USPS on a level playing field with other businesses. A privatized USPS within a competitive environment would also have greater flexibility in terms of its pricing, service standards, decisions related to facility operations and closures, and other changes. Congress could still impose a USO on a privatized USPS, but it should substantially narrow that mandate, such as by requiring fewer delivery days. Other countries typically have narrower USOs than we do: some allow more cluster boxes, for example; some exclude bulk mail from universal service requirements; and some allow more flexibility in pricing (Soifer 2015). Some liberalized systems subsidize their USOs while others do not (U.S. Treasury 2018: 30). The 2018 European Commission report found that “one third of surveyed USPs received direct subsidies for the USO net cost.” (European Commission 2018: 31).

To allow a privatized USPS to compete fairly with other businesses, Congress could provide it with a line-item subsidy in the federal budget for a USO, although that may not be needed (U.S. Treasury 2018: 25).9 A former Postal Rate Commission expert argued that the USPS’s “monopoly is not necessary to preserve universal service.” (Cohen 2003). Some USPS supporters fear that rural areas would be left out unless the government required universal service, but some economists argue that may not be the case (Cohen 2003; Geddes 2005: 224). Rural postal routes can be as cost-effective as urban routes, and postal companies already have an incentive to provide universal service, since the value these services accrue to consumers increases the more addresses that are served.

Conclusion

Markets are changing and making a monopoly government postal model defunct. Household-to-household personal letters have plunged to just 3 percent of total mail volume today (USPS 2018a: Tables E.2, 3.1). Advertising represents 62 percent of the entire household mail volume (USPS 2018a: Table E.2). Bills and other business statements are the second largest type of mail, but they are being replaced by electronic payments, which now account for about 60 percent of all bill payments (Granger 2015). There are 290 billion emails sent around the planet every day (The Radicati Group 2019).

The Trump administration’s Postal Task Force found that the USPS’s current business model “is unsustainable and must be fundamentally changed if the USPS is to avoid a financial collapse and a taxpayer-funded bailout” (U.S. Treasury 2018: 32). And the 2017 GAO report on the USPS said that a “comprehensive package of actions is needed to improve USPS’s financial viability” (GAO 2017a: 1). That comprehensive package should involve privatizing the USPS and opening U.S. postal markets to competition. A 2019 Escher Group report found that these same innovations had allowed the European postal market to become “more competitive than ever, with the always-on consumer ushering in a tidal wave of change” (Escher Group 2019: 1). The U.S. Congress should begin ushering in such changes in this country.

References

Berman, J. (2018) “Trying to Separate the Facts from Fiction When It Comes to Trump and Amazon.” Logistics Management (April 6).

Cohen R. H. (2003) Postal Rate Commission, Testimony before the President’s Commission on the Postal Service (February 2).

Consumer Postal Union (2012) “Index of Postal Freedom.” Available at www.postalconsumers.org.

Edwards, C. (2016) “Options for Federal Privatization and Reform Lessons from Abroad.” Cato Institute Policy Analysis No. 794 (July 28).

Escher Group (2019) “The Future of Posts: Delivering Change in the World of Posts.” https://postandparcel.info/103567.

European Commission (2018) Main Developments in the Postal Sector (2013–2016). Brussels: Copenhagen Economics (July).

Executive Office of the President (2018) “Delivering Government Solutions in the 21st Century: Reform Plan and Reorganization Recommendations.” Washington: EOP (June). Available at www.hsdl.org/?view&did=812483.

Federal Express (2017) “Tax Facts” (July). Available at https://about.van.fedex.com/wp-content/uploads/2017/07/FedEx-Tax-Facts-July-2017.pdf.

Gattuso, J. L. (2018) “Amazon Controversy Makes the Case for a Private-Sector U.S. Postal Service.” Washington: Heritage Foundation (April 10).

Geddes, R. R. (2005) “Reform of the U.S. Postal Service.” Journal of Economic Perspectives 19 (3): 217–232.

GAO (Government Accountability Office) (2017a) “U.S. Postal Service: Key Considerations for Restoring Fiscal Sustainability.” GAO-17–404T (February 8).

__________ (2017b) “U.S. Postal Service: Key Considerations for Potential Changes to USPS’s Monopolies.” GAO-17–543 (June).

Granger, J. (2015) “How Americans Use the Postal Service: By the Numbers.” Pitney Bowes (August 26).

Jaag, C. (2014) “Postal-Sector Policy: From Monopoly to Regulated Competition and Beyond.” Swiss Economics (April).

Megginson, W. L. (2005) The Financial Economics of Privatization. Oxford, U.K.: Oxford University Press.

The Radicati Group (2019) “Email Statistics Report, 2019–2023.” Available at www.radicati.com/?p=15792.

Rosenthal, E. (2011) “Reinventing Post Offices in a Digital World.” New York Times (October 30).

Schuyler, M. (2016) “A Primer on the Postal Service Retiree Health Benefits Fund.” Tax Foundation (August 11).

Shapiro, R. J. (2015a) “The Basis and Extent of the Monopoly Rights and Subsidies Claimed by the United States Postal Service.” Sonecon (March).

__________ (2015b) “How the U.S. Postal Service Uses Its Monopoly Revenues and Special Privileges to Subsidize Its Competitive Operations.” Sonecon (October).

Soifer, D. (2015) “Universal Postal Services in Major Economies.” Consumer Postal Council (June).

Taxpayers Protection Alliance (2019) “Postal Perils and Promise: A Primer on Reform” (February 4). Available at protectingtaxpayers.org.

UPS (2018) 2018 Annual Report. Available at www.investors.ups.com/static-files/36277c15-d055-4147-b150-f3d0d8f35996.

USPS (U.S. Postal Service) (2009) “The Challenge to Deliver: Creating the 21st Century Postal Service.” 2009 Annual Report. Washington: USPS.

__________ (2012) “Our Plan to Preserve Rural Post Offices” (May 9). Available as https://about.usps.com/news/electronic-press-kits/our-future-network/assets/pdf/postplan-presentation-120509.pdf.

__________ (2018a) “The Household Diary Study 2017” (March). Available at www.prc.gov/docs/105/105134/USPS_HDS_FY17_Final%20Annual%20Report.pdf.

__________ (2018b) “U.S. Postal Service Reports Fiscal Year 2018 Results” (November 14). Available at https://about.usps.com/news/national-releases/2018/pr18_093.htm.

__________ (2019) “First-Class Mail Volume Since 1926” (April). Available at https://about.usps.com/who-we-are/postal-history/first-class-mail-since-1926.htm.

U.S. Postal Regulatory Commission (2019) “Order Adopting Final Rules Relating to the Institutional Cost Contribution Requirement for Competitive Products.” RM2017‑1 (January 3).

USPS IG (U.S. Postal Service Inspector General) (2012) “Taxing the Postal Service.” Available at www.uspsoig.gov/blog/taxing-postal-service.

__________ (2018) “Millennials and the Mail.” Available at www.uspsoig.gov/document/millennials-and-mail.

U.S. Treasury (2018) “United States Postal Service: A Sustainable Path Forward.” Report from the Task Force on the United States Postal System (December 4).

Wingfield, N. (2018) “Is Amazon Bad for the Postal Service? Or Its Savior?” New York Times (April 4).

Zaiac, N. (2019) “Two Cheers for Postal Regulators’ Move to Formalize Cost Rules.” R Street (January 10).

1 The USPS Inspector General (USPS IG 2012) noted that the USPS is required to “compute its assumed federal income tax on the income earned from its competitive products each year. Rather than paying that income tax to the Treasury, however, the Postal Service essentially pays itself. The money is transferred from the Competitive Products Fund to the Postal Service Fund, and can be used to fund the postal network as a whole.”

2 See https://facts.usps.com/size-and-scope.

3 The requirement was passed in the Postal Accountability and Enhancement Act of 2006.

4 See Bureau of Labor Statistics, www.bls.gov/news.release/union2.nr0.htm.

5 This is the five-year average of income, sales, property, and other taxes.

6 The privatized Royal Mail delivers letters and packages. The government retained the “Post Office,” which operates a retail chain providing postal and other services.

7 See www.citymail.se.

8 Three new members for the Board were confirmed by the Senate in August.

9 The estimated cost of the current expansive USO is about $4.4 billion a year, but a narrower USO would cost less (see U.S. Treasury 2018: 25).

This work is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License.