While the ECB terminated its asset purchase program at the end of 2018 and is expected to increase interest rates in late 2019, financial instability is reemerging. Growing uncertainty about the fiscal discipline of the Italian government has triggered a significant increase in risk premiums on Italian government bonds. In particular, in Italy and Greece, but also in Germany, bad loans and assets remain stuck in the banking systems. In the face of the upcoming downswing, European banks do not seem ready for new financial turmoil.

In this fragile environment, the future path of the EMU is uncertain. To enhance the stability of the EMU, a group of German and French economists has called for a common euro area budget, for a strengthening of the European Stability Mechanism as lender of last resort for euro area countries and banks, as well as for a common European deposit insurance scheme (Bénassy-Quéré et al. 2018). In response, 154 German economists have warned against transforming the EMU into what they call a “liablity union,” which systematically undermines market principles and wealth (Mayer et al. 2018).

In 2018, a French-German initative to introduce a common euro area budget faced strong opposition from a group of northern European countries as well as from Italy, symbolizing the political deadlock concerning reforms of the EMU. This article explains the different views on the institutional setting of monetary policymaking in Europe from a historical perspective. It begins with a description of the economic and monetary order in postwar Germany. It then discusses the positive implications for the European integration process and the economic consequences of the transformation of postwar German monetary order. The final section offers some economic policy recommendations.

The Role of Germany’s 1948 Currency and Economic Reform in Germany’s Recovery

The currency reform in the three western occupation zones of Germany on June 20, 1948, formed the basis for West Germany’s impressive postwar recovery (Buchheim 1998). Until then, monopolization, central planning, price controls, and the state-led allocation of goods had determined the living conditions of Germans. The turnaround came due to the fortunate coincidence of three factors: (1) the U.S. occupying forces under General Lucius Clay believed in market principles and pushed toward the resolution of cartels (Ritschl 2016); (2) Walter Eucken (1952) and Franz Böhm (1950) had developed the academic foundations for a liberal economic and legal system; and (3) in 1947, Ludwig Erhard, an advocate of a liberal economic order, took over the leadership of the Special Office for Money and Credit (Sonderstelle Geld und Kredit), which was preparing the currency reform.

The reform was initated by the U.S. Congress, which aimed to reduce the economic burden on the starving German population. The first step was to eliminate the overhang of money that had been created by financing the war by printing fiat money. As money was in excessive supply, it disturbed the efficient use of resources. Most goods were rationed and only available on a certificate of entitlement that limited production. The overhang of money undermined the acceptance of the Reichsmark as a means of payment and store of value. A rapid economic recovery was to be expected, as the industrial plants had survived the war largely without serious damage (Ritschl 2005).

The Bank Deutscher Länder was founded in March 1948 as the predecessor of Deutsche Bundesbank (Buchheim 1998). The new Deutsche Mark (DM) banknotes were printed in the United States. On June 20, 1948, the population received 40 DM per capita. Companies and tradesmen received 60 DM per employee. Cash and bank deposits were exchanged at a ratio of 100 Reichsmark to 6.5 DM; debt at a ratio of 100:10; and wages, prices, and rents at a ratio of 1:1. Thus, the owners of physical assets such as goods, companies, and real estate gained while savers lost. A recompensation scheme (Lastenausgleich) provided only partial compensation (see Hughes 1999).

After drastic hardships of the prewar, war, and postwar periods, the currency reform became one of the “most striking positive collective experiences of the Germans.“1 While on June 19, 1948, many shops were still closed — allegedly due to being sold out or due to illness — from June 20 the shelves suddenly filled. The high demand quickly caused production to rise to prewar levels (Erhard 1958: 13–15).2 On the basis of the “Law Governing the Principles of Planning and Price Policy after the Currency Reform” of June 24, 1948, price controls were successively relaxed and wage freezes were lifted.

The large enterprises pushed for price controls and restrictions to market access. Erhard (1958: 101) vehemently opposed them: “Any fragmentation of the national economy into vested interests cannot therefore be allowed.” Erhard (1958: 136) regarded it as risky if entrepreneurs moved from personal responsibility to the socialization of risks. He saw cartels as detrimental for small and medium enterprises, which were not able to build cartels (Erhard 1958: 137–38). In his view, cartels would ultimately have to be paid by people with a lower standard of living. In 1958, the “Law against Restraints on Competition” came into force, which prohibited cartels and subjected mergers to the approval of the cartel office.3

Eucken (1952), one of the most prominent representatives of German ordoliberalism,4 formulated eight constitutive principles of a market economy, which were implemented in large parts of the economy:5

1. The primacy of monetary policy was applied: “All efforts to make a competitive order a reality are pointless unless a certain level of monetary stability can be ensured. Monetary policy thus has primacy for the competitive order.” (Eucken 1952: 256). The DM issued by the independent Deutsche Bundesbank formed a stable backbone for the economy.

2. The stable currency in combination with free prices ensured that prices provided reliable information about the scarcity of goods and consumer preferences.6 Therefore, the production structure was able to adapt to demand. Erhard (1958: 28) placed the consumer at the center of his economic policy: “The customer became king again; a buyers’ market began!“7

3. The markets were open. New companies could enter at any time, unprofitable companies had to leave the market. Monopoly supervision prevented excessive market power. Consumers benefitted from competition in the form of lower prices and thereby higher real wages.

4. In contrast to Soviet-occupied East Germany, private ownership of means of production was predominant, which was seen as an important prerequisite for an efficient allocation of resources. Only those who can privatize the profits will strive for the greatest possible efficiency.

5. Due to freedom of contract, excluding contracts that would build monopolistic power, everyone was free to organize his economic activities according to his strengths.

6. The liability principle guaranteed that profits could be retained, but also that losses had to be borne by the individual. Only if people can be made liable for their actions (it was assumed) will they act economically responsibly.

7. According to Eucken, economic policy should be constant and forward-looking. He was very cautious in using state interventions and defended market principles against interest groups.

8. Thus, as demanded by Eucken (1952) in his eighth principle, all seven principles were to be jointly fulfilled in broad areas of the West German economy.

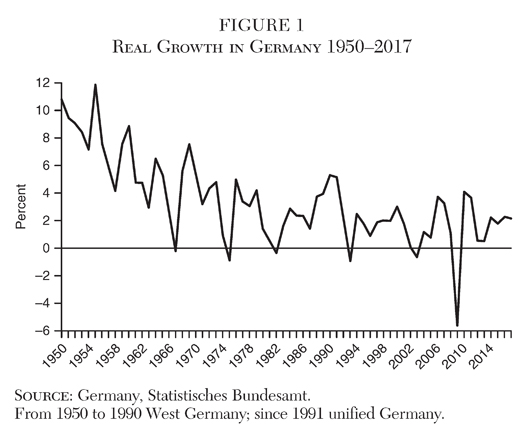

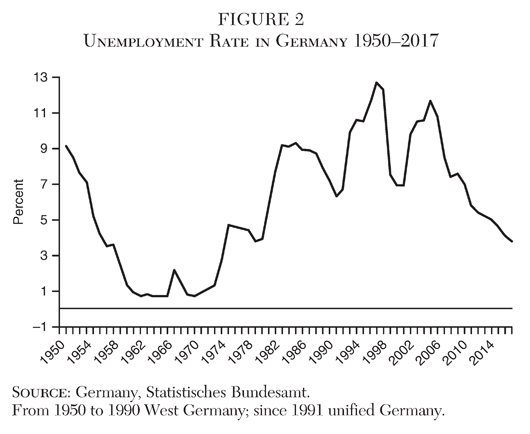

Even though sectors such as banking, insurance, transport, and many public monopolies remained excluded from free competition (Rhonheimer 2017), the free market economy could unfold its potential in an impressive way.8 Figure 1 shows the real growth rates of the Federal Republic of Germany since 1950, which between 1950 and 1990 refer to West Germany and since 1991 to unified Germany. While the economy was still idle in 1948, growth accelerated rapidly. Machinery ran smoothly, wages rose faster than prices, and unemployment fell steadily. While 1.3 million unemployed were registered in 1949 (Erhard 1958: 90), full employment was reached in 1962 with 0.7 percent unemployment (Figure 2).

Germany was surprised by an economic miracle that stood in fundamental contrast to the economically and politically fragile interwar period. The notion of “Wirtschaftswunder” emerged. Erhard, who was minister of economic affairs from 1949 to 1963 and chancellor from 1963 to 1966, embodied the new prosperity with his thick cigars. Erhard’s (1958) book Prosperity through Competition makes one aware that the market economy was anything but a self-runner and had to be constantly defended: “The danger of limitation of competition threatens constantly from many sides. One of the most important tasks … is, therefore, to secure free competition” (Erhard 1958: 2).

The programs of the political parties only slowly adapted to the evident economic success of the currency and economic reform. The Ahlen program of the Christian Democratic Union (CDU) of 1947, which aimed at overcoming capitalism and socialism, still had many elements also found in the East German socialist planning economy. Only in 1949 did the CDU turn to the market economy in the “Düsseldorf Guidelines,” which were written under the strong influence of Ludwig Erhard. The CDU combined the principles of ordoliberalism with the Christian social doctrine, which places normative values above the self-interest of individuals and social groups (Blank 1967).

The Social Democratic Party (SPD) initially opposed the reforms. “It is wrong to throw the sick man into cold water and expect him to swim,” raved SPD politician Kreyßig.9 In 1950, his party unsuccessfully filed a motion to remove Erhard from his office. Erhard (1958: 2) had countered that “prosperity for all” and “prosperity through competition” belonged inseparably together. The first postulate marked the goal; the second, the path leading to the goal. It was not until 1959 that the SPD admitted its support for the social market economy in the “Godesberg Programme” under the slogan “competition as far as possible, planning as much as necessary.” The German people followed Erhard and helped the CDU to an absolute majority in the 1957 election.

The fathers of the market economy must have realized that a pure market economy would have been politically difficult to defend without promising social balance. Both the CDU and the SPD had added to the market economy the attribute “social” to make it politically digestible. Eucken (1952) had formulated four regulative principles in addition to the eight constitutive principles: (1) monopoly control, (2) the control of excesses on the labor market (such as wages below the subsistence minimum), (3) the internalization of negative external effects (such as environmental pollution), and (4) redistribution in favor of very low-income groups through a progressive tax system.

Alfred Müller-Armack (1947) had proposed combining the principle of freedom on the market with that of social balance under the term “social market economy” (see also Müller-Armack 1956: 390). He saw three levels of sociality:

1. The social consequences of the market, which teaches people to be reliable and aligns production with the preferences of consumers.

2. The regulatory policy, which prevents monopolies and secures monetary stability.10

3. The redistributive policy, which should ensure the acceptance of the new order. Social equality was enshrined in the “Basic Law of the Federal Republic of Germany of 1949.” Article 20, paragraph 1 states: “The Federal Republic of Germany is a democratic and social federal state.”

Implications of German Postwar Growth for the European Integration Process

The great success of the reforms — real growth in Germany in the 1950s averaged 8 percent per year — spread throughout Europe. France, through the European Coal and Steel Community (1951), aimed to control the reviving West German economy by a “High Authority.” In the negotiations of the European Economic Community (from 1958), France could achieve common European institutions (institutional integration), which paved the way to a formal framework for redistribution from the north to the south. For its part, Germany, in the spirit of ordoliberalism, promoted the freedom for the flows of goods, services, labor, and capital in the common market (functional integration):11

The integration of Europe is more necessary than ever, it has become almost overdue. But the best kind of integration which I can imagine does not depend on the establishment of new offices and administrative procedures or a growing bureaucracy; it depends in the first instance on the reconstruction of a free international order, as best and most completely expressed in a free convertibility of the currency. Convertibility of the currency, of course, includes complete freedom of movement of goods, services and capital [Erhard 1958: 211].

While the common institutions formed the political basis for supranational decisionmaking in Europe, Germany’s liberal order became the economic basis for the European integration process, which was in the mutual interest of all Europeans (Müller and Schnabl 2018). The opening of European markets enabled Germany’s industry to benefit from economies of scale in industrial production. Additional productivity gains boosted wages and therefore the tax revenues of the German government. The southern and western European partner countries, whose growth models were based on central bank–financed government spending (De Grauwe 2012: 151), and thus exhibited less robust growth dynamics, benefitted from growing import demand from Germany.

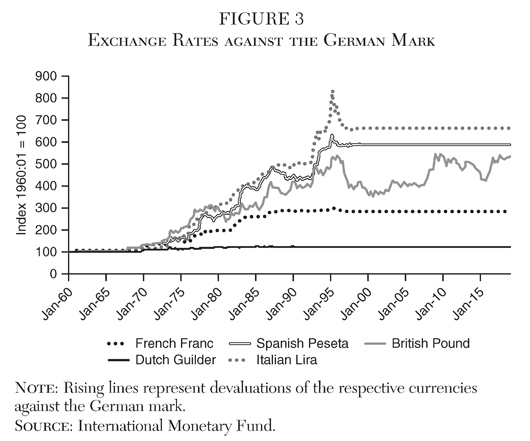

As the monetary policies of the southern and western European countries were expansionary in comparison to Germany, they could import parts of the German growth via the devaluation of their currencies (beggar-thy-neighbor). This was possible because the Deutsche Bundesbank, which was geared to the primacy of monetary stability, did not devalue the German mark in response to the devaluations of the other European currencies. The credible committment of the Deutsche Bundesbank to the stable currency thus prevented the destructive devaluation race that had occured in the 1930s after the successive dissolution of the gold parities.12

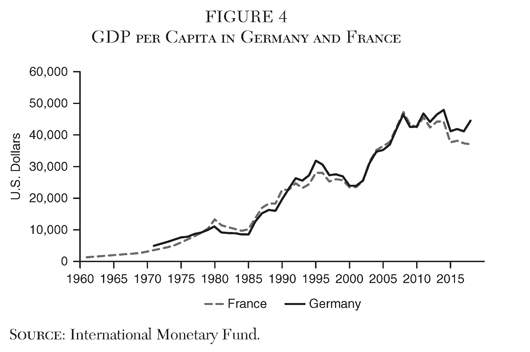

Figure 3 illustrates the significant devaluations of the French franc, Italian lira, Spanish peseta, and British pound against the DM up to the euro qualification process in the 1990s. The currencies of countries that became economically strongly intertwined with Germany, such as the Netherlands, remained tightly pegged to the German mark. The gradual depreciations of the southern and western European currencies constituted a persistent competitive disadvantage for the northern European export industries, which created a persistent pressure to innovate and increase efficiency. The resulting productivity gains formed the backbone for the large prosperity gains in postwar Europe. As a result, GDP per capita grew all over Europe, widely independent from the monetary regime, as shown in Figure 4 for Germany and France.

In Germany, the high productivity gains went hand in hand with a rapidly rising real wage level and a generous expansion of the social security system. High tax revenues enabled growing financial contributions to the European Community. The common agricultural policy and European regional policy created institutional platforms for redistribution of wealth from north to south. The size of these funds grew with the accession of more southern European states such as Greece, Spain, and Portugal. The net transfers of wealth from north to south created a positive climate for removing barriers to trade, services, capital, and labor movements, which boosted economies of scale in Germany and all of Europe. Germany’s net payments to the European institutions in 2017 amounted to around 14 billion euros, a volume similar to that of the domestic German regional equalization system (14.8 billion euros in 2017).

For a long time, the stability orientation of the Deutsche Bundesbank set limits to both the German welfare state and redistribution to other European countries. If tax revenues and the scope for borrowing were no longer sufficient to meet expenditure commitments, reforms were necessary as financing via the printing press was excluded. With the generous German welfare system and the high wage level being transferred to East Germany in the course of the German unification, the German welfare state reached its limits during the 1990s.

By 1994, national debt had grown close to the Maastricht threshold of 60 percent of GDP; unemployment had risen to a record 13 percent. To ensure the commitment to low debt as enshrined in the Maastricht treaty, extensive reforms were implemented under the slogan “Hartz IV” including tightened government spending (Burda and Seele 2016). The liberalization of the labor market led to wage restraints in the private sector, which went along with wage austerity in the private sector. The flexibilization of the labor market and the restructuring of the social security systems created the potential for new prosperity gains as represented by the subsequent persistent decline of unemployment.

The Transformation of the German Monetary Order and Its Impact on Europe

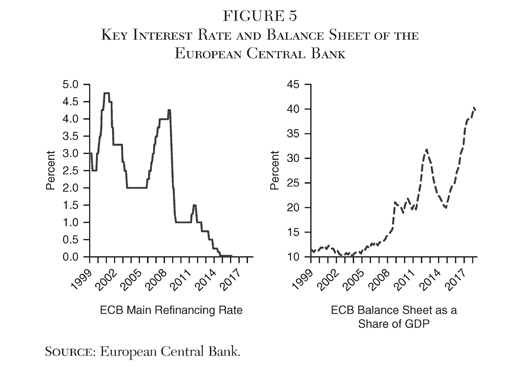

At this time, however, a fundamental turnaround for the German monetary and economic order was already on the horizon, triggered by the reorientation of European monetary policy. The ECB had been created after the blueprint of Deutsche Bundesbank as independent (Article 130 TFEU) and being primarily committed to price stability (Article 127 TFEU). Yet, following the bursting of the dotcom bubble (2000), the ECB stabilized the European economy — in particular low-growth Germany, France, and Italy — with sharp interest rate cuts (Figure 5). Large parts of the created liquidity went to the south of the euro area, where the capital inflows financed, from 2003 onward, increasingly excessive credit growth leading to real estate and stock market bubbles (Schnabl 2018). Real wages increased beyond productivity increases, and government expenditure increased fast on the back of (temporarily) inflated tax revenues.13

In 2007, capital inflows to the southern and western euro area countries dried out, triggering the European financial and debt crisis, which forced the ECB into an even more expansive monetary policy to stabilize the southern euro area crisis countries. The ECB lowered the main refinancing rate to zero. In response to the rising risk premia on southern euro area government bonds, ECB President Mario Draghi (2012) announced in July 2012 that he would do “whatever it takes” to prevent the euro area from breaking up. Thus, he gave an implicit guarantee declaration for all highly indebted euro states. This put into question the no bailout clause (Article 125 TFEU), which was intended to exclude the liability of the European Union (EU) and other member states for the debt of individual member states.

From March 2015 to December 2018, outright asset purchases equivalent to 2,600 billion euros inflated the ECB balance sheet (Figure 5). The purchases of government bonds by the ECB amounting to 2,000 billion euros can be seen to be in contradiction to the ban on the financing of government expenditure by the central bank (Article 123 TFEU).14 The ECB’s easy money eliminated rapidly rising risk premiums on the debt of the southern euro states.15

Growth Effects of the Change in the Monetary Order

The fundamental change in the monetary policy stance of the ECB is equivalent to a change in the German monetary and economic order. Whereas in 1948 the removal of the monetary overhang and the introduction of stable money had formed the backbone of the German economic miracle, the expansion of the monetary base far beyond the expansion of output eroded Eucken’s (1952) constitutive principles (Freytag and Schnabl 2017).

The negative impact of persistently low short-term (via conventional monetary policy) and long-term (via unconventional monetary policy) interest rates on German growth dynamics can be derived based on the overinvestment theory of Mises (1912) and Hayek (1931): An overinvestment boom is triggered by a fall of the interest rate set by the central bank below the natural interest rate, which constitutes a long-term equilibrium between savings and investment.16 The too-low central bank interest rate triggers an unsustainable credit-financed investment and speculation boom (Schnabl 2018).

First, investment projects with high return are financed. As the boom goes on, low-return investments are put on track. The average marginal efficiency of investment declines. As profits of banks and enterprises increase, stock prices and wages rise. With low interest rates, deposits are converted to stocks. As incomes grow and people feel richer, demand for real estate increases. Fast rising stock and real estate prices may attract speculators, making the rise in asset prices self-fulling, becoming disconnected from fundamentals.17

In the overinvestment theory of Mises (1912) and Hayek (1931), when all idle production factors are employed, wages and prices rise, tempting the central bank to finally increase the key interest rate again (as the ECB did from 2005 onward). The benchmark for the profitability of all past and future investment projects is lifted and low-return investment projects have to be dismantled.18 With the central bank keeping the interest rate high, a downswing occurs (as in the southern euro area since 2007) during which prices and wages fall. With low-yield investment projects being dismantled, production factors can be shifted to investment projects with higher returns during the following economic recovery.

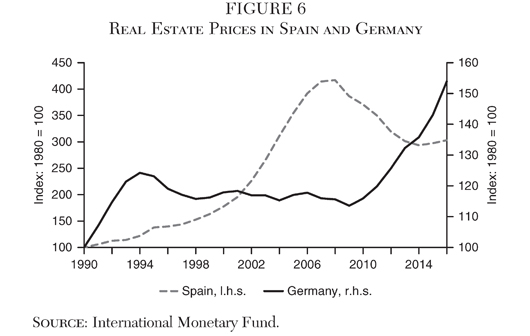

Following this pattern, between 2003 and 2007 the credit-financed booms in the southern euro area countries went along with stock and real estate bubbles (Schnabl 2018). Since 2008, the speculation boom has shifted to Germany. Figure 6 shows the sharp increase of real estate prices in Spain between 2003 and 2007, and in Germany since 2008. Yet, in contrast to the overinvestment theory, the ECB stabilized the southern euro area countries by sharply cutting interest rates and moving towards unconventional monetary policy measures. This prevented the cleasing effect and is keeping incentives, competition, and growth distorted.19

The Eased Constraints for German Enterprises

For German enterprises, the common European monetary policy represented a fundamental change in the business environment. Since 1948 the German mark had been a hard currency, being under persistent appreciation pressure, in particular since the breakdown of the Bretton-Woods System in the early 1970s.20 As central bank– financed growth impulses could not be expected, German enterprises had to continuously increase efficiency and innovate to stay competitive within Europe and world markets. The euro introduction and the ECB’s monetary policy eased this constraint for four reasons.

First, the introduction of the euro removed the appreciation pressure for exports to member states of the EMU, as intra-EMU exchange rates became irrevocably fixed. As in 1999, 44 percent of German exports went to the countries participating in the EMU. German enterprises had a significant relief from pressure originating in the depreciations of the other European currencies. After the outbreak of the European financial and debt crisis, ultra-low interest rates, along with the ECB’s large-scale asset purchases, substantially depreciated the euro and further boosted German exports.

Second, after the turn of the millennium, German attempts to comply with the Maastricht criteria triggered extensive labor market reforms and public wage austerity. The decline of the German wage level relative to other euro and noneuro countries increased German exports.

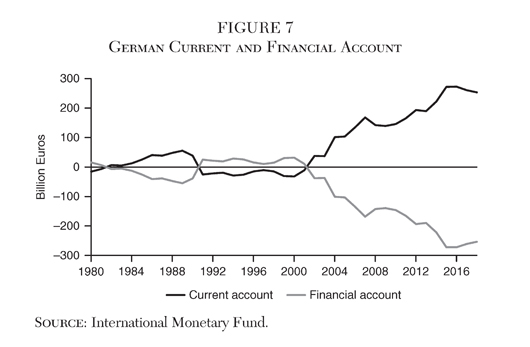

Third, Germany’s trading partners financed relative high wages and purchases of German goods via credit from Germany. Following the ECB’s interest rate cuts from 2001, German net capital exports, mainly to southern Europe, strongly increased (Figure 7). Since the outbreak of the European financial and debt crisis, private credit flows to southern Europe have dried up. Yet the sharply declining short-term and long-term interest rates, as well as the absorption of large parts of newly issued government bonds by the ECB, boosted capital outflows and depressed capital inflows. The resulting increase in German net capital outflows financed purchases of German goods mostly from outside the euro area (in particular, the United States), bringing the current account surpluses to new historical highs.

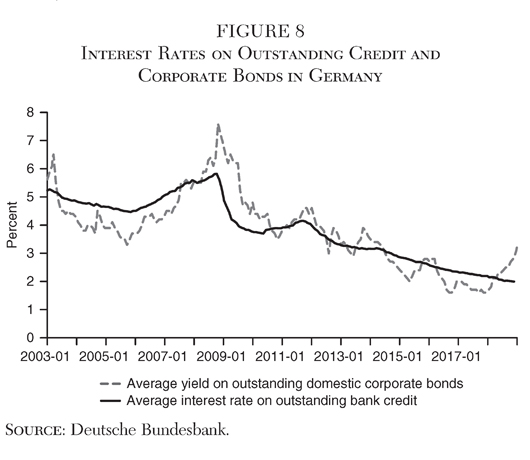

Fourth, the gradual interest rate cuts of the ECB reduced the financing costs for German enterprises. The average interest rate on credit to German enterprises declined from 5.8 percent in 1999 to 1.4 percent by 2018. The interest rate level fundamentally declined both for bank credit (to mostly small and medium enterprises) and financing on capital markets (of mostly large enterprises) (Figure 8). Between 2001 and 2005, and even more since the outbreak of the European financial and debt crisis in 2008, the financing conditions of German enterprises were strongly eased.

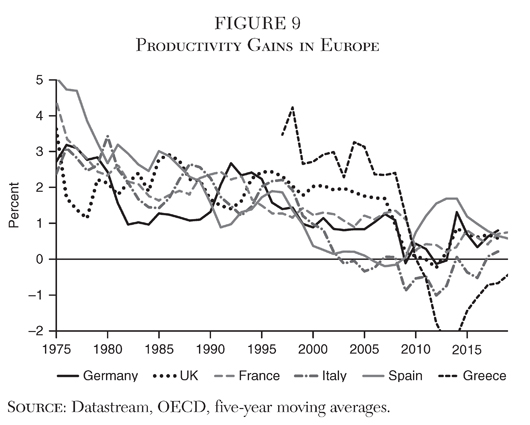

Therefore, from the point of view of Hayek’s (1968) “Competition as a Discovery Procedure,” the pressure on German and other northern European enterprises to increase efficiency and to innovate can be assumed to have become substantially reduced. Instead of generating profits via efficiency gains and innovation, German enterprises could realize windfall profits from reduced appreciation pressure, exchange rate depreciation, wage austerity, and steadily declining financing costs. As a result, the productivity gains of the German economy substantially declined, converging towards zero (Figure 9).

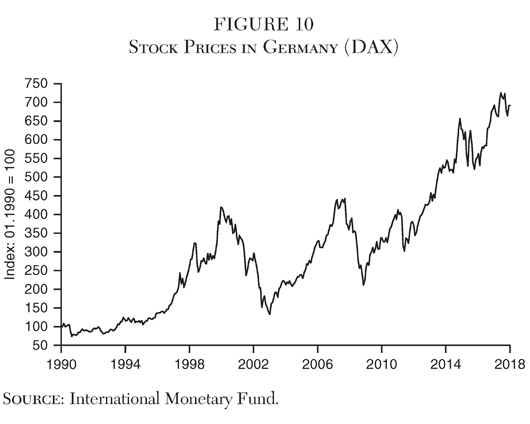

Both the exchange rate and interest rate effects of the euro and European monetary policy had concentration effects on the German enterprise sector, thereby restricting competition. Because large and large medium enterprises (hidden champions) are more export-oriented than medium and small enterprises, large enterprises have profited more from the increasing degree of exchange rate stability and, since 2008, from the strong euro depreciation. The sharp increase of net capital outflows since the turn of the millennium is equivalent to a relative shift from domestic to foreign demand, which boosted profits of export-oriented large enterprises relative to small and medium enterprises, which tend to be focused on the domestic market. The respective gain for large export-oriented enterprises is reflected in the substantial boost of stock prices since the start of the euro qualification period in 1996,21 and, in particular, since the advent of unconventional monetary policy measures in 2009. The German DAX, which is dominated by large, export-oriented industrial enterprises, has increased considerably (Figure 10).

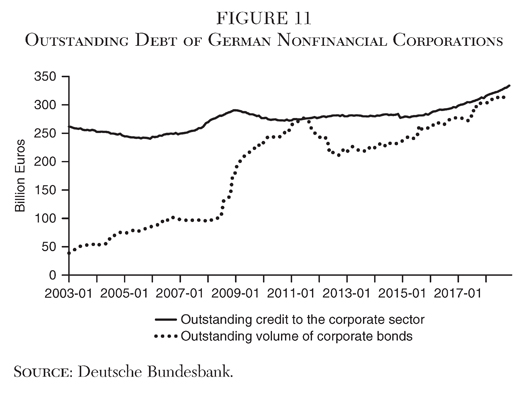

Furthermore, since 2008 the persistent low-interest rate and unconventional monetary policy of the ECB have depressed the interest margins of the traditional banking business (Borio et al. 2017).22 Tightened regulation and capital requirements, in response to the global financial crisis, increased the costs of banks dealing with macroprudential measures. Both factors have constrained, in particular, small and medium banks, which traditionally provide credit to small and medium enterprises. Bank credit to corporations has hardly increased in Germany since 2008 despite further declining interest rates and robust growth (Figure 11).

In contrast, large enterprises could finance themselves directly on capital markets, where interest rates were depressed by both conventional and unconventional monetary policy measures. Large enterprises with own banks, such as Volkswagen, can refinance themselves directly at zero interest rates at the ECB. In addition, from June 2016, in the course of the Corporate Sector Purchase Programme, the ECB bought corporate bonds with investment grade equivalent to 180 billion euros.23 With less regulation being made with respect to corporate bond markets, the large enterprises overproportionally profited from the postcrisis loose monetary conditions. As shown in Figure 11, the volume of outstanding corporate bonds increased substantially, approaching the volume of outstanding bank credit to corporations.

The large additional liquidity provisions for large enterprises provided an incentive for speculation rather than for investing in efficiency and innovation. For investment in efficiency gains and innovation, Eucken’s (1952) liability principle holds: while profits can be privatized, losses have to be born by the enterprises. In the case of speculation in financial markets during the upswing, profits can be privatized. During the financial crisis, there was a high probability that the ECB would contain losses by further monetary expansion.

Stock repurchases became attractive because they increase the value of the enterprise without increasing profit expectations. Leveraged buyouts of large enterprises, likewise, enhance a firm’s global market power (e.g., in the case of the takeover of Monsanto by Bayer). Increasing market power makes it easier to either increase prices or reduce wages, given the enhanced negotiating power of the larger enterprise versus customers and trade unions. Also, as the firm’s negotiating power versus small and medium subcontractors increases, subcontractors are pressured to cut prices and depress wages.

As large corporations are indirectly subsidized, Erhard’s conviction that economic policymakers should not promote specific economic interests seems to be neglected. The special interests in favor of greater concentration in the German economy, which are often welcomed by politicians,24 are in contrast to the perception of Erhard who had warned that cartels were no way of overcoming crises, because they would prevent the organic resolution of the crisis and thus aggravate the crisis.25 Meanwhile, to resist the high degree of price pressure in the global markets, small and medium enterprises are building strategic alliances that further undermine competition.

The Reshuffling of Intra-European Redistribution Channels

The decline of productivity gains in Germany has been accompanied by declining productivity gains in the southern euro area crisis countries. Since the turn of the millennium up to the year 2007, the credit inflows from Germany and other northern European banks have allowed for the buildup of low-return investment projects (see Gopinath et al. 2017). While private credit provision to the southern euro area has collapsed since the outbreak of the crisis, the quasi-credit provision via the TARGET2 payments system of the European System of Central Banks, combined with the ECB’s extensive government bond purchases and other rescue facilities, keeps undercapitalized banks and enterprises with low productivity alive.

Since 2010, Deutsche Bundesbank has accumulated assets within the Eurosystem’s TARGET2 payments system amounting to almost 1,000 billion euros. The claims of Deutsche Bundesbank and some other northern European countries are matched by growing liabilities of southern euro countries such as Italy, Spain, Portugal, and France (Figure 12). Since TARGET2 loans are nonrefundable and non-interest-bearing, they can be regarded as transfers in favor of other euro countries (Sinn 2018). This allows enterprise restructuring to be postponed and contributes to low or negative productivity gains.26

From the point of view of Mises (1912) and Hayek (1931), the ample provision of low-cost liquidity for banks and (indirectly) to companies creates negative incentives, which are reminiscent of the soft budget constraints of the Central and Eastern European planned economies before 1990 (Kornai 1986). At that time, inefficient enterprises were granted unconditional loans by the state-controlled banking sector to prevent unemployment. The state banks’ losses were covered by the money printing press. Inflation was suppressed by price controls. The result was a lack of efficiency gains and innovation, shortages in the supply of goods and services, and growing dissatisfaction among the population.

Acharya et al. (2016) find that in southern Europe undercapitalized banks extend loans to enterprises with low returns below interest rates charged on enterprises with high returns. So-called zombie lending, which became possible thanks to credit provision by the ECB at eased collateral requirements, allows southern European enterprises with low efficiency to keep alive. Storz et al. (2017) show that between 2010 and 2014 weak banks allowed zombie firms to survive and further increase debt, whereas healthy firms reduced their credit exposure.

Thus, the precrisis private-sector and postcrisis public-sector credit provision of northern European countries to southern Europe can be regarded as a substutitute for the transfers of wealth being engineered by the depreciations of the southern European currencies prior to the (qualification period for the) euro. From the perspective of German export enterprises, the credit provision has prevented a collapse of demand for German products from the southern euro area countries. The access of northern European enterprises to southern European markets is maintained, with the four freedoms of the EU remaining unchallenged.

Implications for Political Stability in Europe

However, the “transfer-based” new equilibrium in the EMU is less stable than the pre-euro “depreciation-based” equilibrium, because the change in the monetary order in Germany has undermined productivity gains. Pre-euro, the productivity gains in Germany and northern Europe were large enough to increase real wages in northern Europe and to provide reasonable amounts of direct and indirect transfers to other member states of the EU. As GDP per capita in all parts of Europe increased, the European political system was stable, also allowing the EU to finance and expand common European institutions.

Postcrisis, with productivity gains in Germany and some smaller neighboring countries converging toward zero, redistribution has become a zero-sum game. What is to be transferred from northern to southern Europe has to be taken away from the northern European populations in the form of real wage austerity, public expenditure cuts, growing tax burdens, or declining quality of public goods.27 Erhard’s maxim that one can only distribute a national product that has been produced beforehand seems to be forgotten.

Erhard’s insight that a market economy generates a fair real wage,28 seems to have become increasingly overruled in both parts of the EMU. Growing inequality promotes a lingering dissatisfaction among the populations in both northern and southern Europe.29 Erhard (1958: 216) had remarked: “A bureaucratically manipulated Europe, breeding reciprocal mistrust rather than a sense of community, apparently materialistic in its whole attitude, will bring in its train more dangers than benefits for Europe.” In both southern and northern Europe, the support for the traditional political parties is fading (Müller and Schnabl 2018).

That is why the return to the values promoted by Eucken (1952) and Erhard (1958) is recommended. Just as the stable German mark was the backbone of the German economic miracle, a stability-oriented European monetary policy is today the prerequisite for economic and political stability in Europe. Only if the ultra-loose monetary policy is reversed, and thereby the breeding ground of new financial crises is contained, can growth and real wages be stabilized and further negative distribution effects avoided. This reversal would safeguard the valuable achievements of the 1948 German currency and economic reform and the European integration process.

References

Abelshauser, W. (1975) Wirtschaft in Westdeutschland 1945–1948. Stuttgart: Deutsche Verlags-Anstalt.

Acharya, V.; Eisert, T.; Eufinger, C.; and Hirsch, C. (2016) “Whatever It Takes: The Real Effects of Unconventional Monetary Policy.” SAFE Working Paper No. 152.

Bénassy-Quéré, A. et al. (2018) “Reconciling Risk Sharing with Market Discipline: A Constructive Approach to Euro Area Reform.” Center for Economic Policy Research, Policy Insights 91 (January).

Balassa, B. (1961) The Theory of Economic Integration. Homewood, Ill.: Irvin.

Blank, T. (1967) “Vom Ahlener Programm zu den Düsseldorfer Leitsätzen — Zur Dogmengeschichte der CDU: Festgabe für Franz Etzel.” In A. Müller-Armack (ed.), Wirtschaft und Finanzpolitik im Zeichen der sozialen Marktwirtschaft, 42. Stuttgart: Seewald.

Böhm, F. (1950) Wirtschaftsordnung und Staatsverfassung. Tübingen: Mohr.

Borio, C.; Kharroubi, E.; Upper, C.; and Zampolli, F. (2016) “Labour Reallocation and Productivity Dynamics: Financial Causes, Real Consequences.” BIS Working Paper No. 534.

Borio, C.; Gambarcorta, L.; and Hofmann, B. (2017) “The Influence of Monetary Policy on Bank Profitability.” International Finance 20 (1): 48–63.

Buchheim, C. (1998) “Die Errichtung der Bank deutscher Länder und die Währungsreform in Westdeutschland.” In Deutsche Bundesbank (ed.), Fünfzig Jahre Deutsche Mark, 92–138. München: Deutsche Bundesbank.

Burda, M., and Seele, S. (2016) “No Role for the Hartz Reforms? Demand and Supply Factors in the German Labor Market, 1993–2014.” SFB 649 Discussion Paper No. 2016–010.

Cardarelli, R., and Lusinyan, L. (2015) “U.S. Total Factor Productivity Slowdown: Evidence from the U.S. States.” IMF Working Paper No. 15/116. Washington: International Monetary Fund.

De Grauwe, P. (2012) The Economics of Monetary Union, 9th ed. Oxford, Oxford University Press.

Draghi, M. (2012) “Speech at the Global Investment Conference,” London, July 26. https://www.ecb.europa.eu/press/key/date/2012/html/sp120726.en.html.

Duarte, P. (2018) “Monetary Policy, Economic Privileges and Development: Ordoliberal Lessons for the EMU.” Mimeo.

Erhard, L. (1958) Prosperity through Competition. London: Thames and Hudson.

Eucken, W. (1952) Grundsätze der Wirtschaftspolitik. Zürich: Mohr und Polygraphischer Verlag.

Freytag, A., and Schnabl, G. (2017) “Monetary Policy Crisis Management as a Threat to Economic Order.” Credit and Capital Markets 50 (2): 151–69.

Gerstenberger, J., and Schnabl, G. (2017) “The Impact of Japanese Monetary Policy Crisis Management on the Japanese Banking Sector.” CESifo Working Paper No. 6440.

Gertler, P., and Hofmann, B. (2016) “Monetary Facts Revisited.” BIS Working Paper No. 566.

Golder, M. (2016) “Far Right Parties in Europe.” Annual Review of Political Science 19; 477–97.

Gopinath, G.; Kalemli-Ozcan, S.; Karabarbounis, L.; and Villegas-Sanchez, C. (2017) “Capital Allocation and Productivity in South Europe.” Quarterly Journal of Economics 132 (4): 1915–67.

Hayek, F. A. (1931) Prices and Production. Reprint. New York: Augustus M. Kelly.

__________ (1968) “Competition as a Discovery Procedure.” In F.A. Hayek (1978) New Studies in Philosophy, Politics, Economics and the History of Ideas, 179–90. Chicago: University of Chicago Press.

Hoffmann, A., and Schnabl, G. (2016) “The Adverse Effects of Unconventional Monetary Policy.” Cato Journal 36 (3): 449–84.

Hughes, M. (1999) Shouldering the Burdens of Defeat: West Germany and the Reconstruction of Social Justice. Chapel Hill: University of North Carolina Press.

Kayser, S. (2018) “Mögliche Fusion Deutscher Bank und Commerzbank. Es wäre eine Hochzeit aus Angst vor dem Tod.” Spiegel (September 9).

Kindleberger, C. (1973) The World Depresssion 1929–1939. Berkeley: University of California Press.

Kornai, J. (1986) “The Soft Budget Constraint.” Kyklos 39 (1): 3–30.

Laubach, T., and Williams, J. (2015) “Measuring the Natural Rate of Interest Redux.” Federal Reserve Bank of San Francisco, Working Paper No. 2015–16.

Mayer, T.; Meyer, D.; Schnabl, G.; and Vaubel, R. (2018) “Der Euro darf nicht in die Haftungsunion führen.” Frankfurter Allgemeine Zeitung (May 22): 19.

Mises, L. von (1912) Theorie des Geldes und der Umlaufsmittel. München: Duncker & Humblot.

Müller, S., and Schnabl, G. (2018) “The Brexit as a Forerunner: Monetary Policy: Economic Order and Divergence Forces in the European Union.” CESifo Working Paper No. 6938.

Müller-Armack, A. (1947) Wirtschaftslenkung und Marktwirtschaft. Verlag für Wirtschaft und Sozialpolitik, Hamburg.

__________ (1956) “Soziale Marktwirtschaft.” In E. Beckerath and C. Bente (eds.) Handwörterbuch der Sozialwissenschaften: zugleich Neuauflage des Handwörterbuch der Staatswissenschaften. Band 9, 390. Stuttgart: Fischer.

Rhonheimer, M. (2017) “Ludwig Erhards Konzept der Sozialen Marktwirtschaft und Seine Wettbewerbstheoretischen Grund-lagen.” Journal for Markets and Ethics 5 (2): 83–106.

Riet, A. van (2018) “Twenty Years of ECB Monetary Policy: A Keynesian and Austrian Perspective.” Mimeo.

Ritschl, A. (2005) “Der späte Fluch des Dritten Reichs: Pfadabhängigkeit in der Entstehung der Bundesdeutschen Wirtschaftsordnung.” Perspektiven der Wirtschaftspolitik 6 (2): 151–70.

__________ (2016) “Soziale Marktwirtschaft in der Praxis.” In W. Abelshauser (ed.), Das Bundeswirtschaftsministerium in der Ära der Sozialen Marktwirtschaft. Berlin: De Gruyter.

Schnabl, G. (2018) “The Failure of ECB Monetary Policy from a Mises/Hayek Perspective.” In A. Godart–van der Kroon and P. Vonlanthen (eds.) Banking and Monetary Policy from the Perspective of Austrian Economics, 127–52. Berlin: Springer.

Schumpeter, J. A. ([1911] 1934) The Theory of Economic Development. Cambridge, Mass.: Harvard University Press.

Sinn, H.-W. (2018) “The ECB’s Fiscal Policy.” NBER Working Paper No. 24613.

Storz, M.; Kötter, M.; Setzer, R.; and Westphal, A. (2017) “Do We Want These Two to Tango? On Zombie Firms and Stressed Banks in Europe.” ECB Working Paper No. 2104.

Woodford, M. (2003) Interest and Prices: Foundations of a Theory of Monetary Policy. Princeton, N.J.: Princeton University Press.

1 The quote is attributed to Ludwig Erhard. Ritschl (2005) argues that the transformation of the economic order was less pronounced than suggested by Erhard (1958). Important characteristics of the prewar and war economic system prevailed.

2 Erhard (1958: 13) cites Jacques Rueff and André Piettre as follows: “The black market suddenly disappeared. Shop windows were full of goods; factory chimneys were smoking; and the streets swarmed with lorries. Everywhere the noise of the new buildings going up replaced the deathly silence of the ruins. If the state of recovery was a surprise, its swiftness was even more so. In all sectors of economic life it began as the clocks struck on the day of currency reform.”

3 The law against restraints on competition did not correspond to the pure form of full competition, because it allowed for “rationalization cartels” (Rhonheimer 2017: 96–97).

4 Ordoliberalism is a German concept for a market economy. The state creates a regulatory framework for free economic action. The resulting competition generates prosperity. Undesirable developments such as high inequality and environmental pollution are corrected by the state. See also the constitutive and regulative principles of Eucken (1952). Other important representatives are Franz Böhm and Leonard Miksch.

5 Rhonheimer (2017: 89–94) points out that the concept of competition of Eucken (1952) and Erhard (1958) was different. Eucken (1952) and Böhm (1950) saw the ideal in many small companies with equal starting positions, and with entrepreneurs running their own companies. Erhard, on the other hand, as a practitioner, realized that this theoretical concept was unrealistic and inefficient. He regarded the coexistence of large, medium-sized, and small companies as ideal.

6 “With the currency reform, the veil which had made all calculation impossible had been torn off the economy; behind lay pseudo-employment” (Erhard 1958: 88).

7 “The yardstick and criterion of what is good or bad in economic policy are not dogmas or the points of view of pressure groups, but exclusively the human being, the consumer, the people. Economic policy can only be regarded as good if and as long as it is regarded simply as useful and welcomed by the individual” (Erhard 1958: 100–1).

8 Abelshauser (1975) contradicts the notion that postwar high growth was created by the new economic framework, but rather attributes the high growth to the postwar reconstruction. This is in contradiction to the fact that economic conditions in East Germany evolved fundamentally different.

9 Paraphrased by Erhard (1958: 85).

10 The German hyperinflation of the 1920s had highlighted the unfair distributional effects of inflation. It eroded the middle class, which led to increasing political instability.

11 The distinction between functional and institutional integration dates back to Balassa (1961). The distinguishing feature is the different degree of willingness to renounce economic sovereignty. Both areas of integration are interconnected because the integration of markets necessitates the establishment of institutions that regulate the process of integration.

12 On the competitive depreciations of the 1930s, see Kindleberger (1973).

13 As a result, the productivity gains generated by the Hartz IV reforms in Germany were consumed abroad.

14 The counter position is that the bond purchases of the ECB are not equivalent to government financing as long as the bonds are bought from secondary markets and not directly from governments.

15 The ECB buys the bonds of all euro countries except Greece according to the capital key, with the shares of the national central banks in the ECB’s capital being weighted according to the share of the respective member states in the total population and gross domestic product of the European Union.

16 The concept of the natural interest rate by Hayek (1931) is different from the natural interest rate by Woodford (2003), where the natural interest rate is the inflation-neutral interest rate, which has gradually declined since the 1990s (see Laubach and Williams 2015). For details see Schnabl (2018).

17 Since the mid-1980s, monetary expansions have increasingly been reflected in financial rather than goods markets (Hoffmann and Schnabl 2016). Gertler and Hofmann (2016) show that the relationship between the money supply (monetary base) and consumer price inflation became increasingly difficult to trace. Whereas central banks gradually cut interest rates toward zero and gradually expanded their balance sheets far beyond real GDP growth, inflation rates fell to historically low levels.

18 Schumpeter (1911) calls this a cleansing effect. On the role of the interest rate for reallocation of resources during a recession see also Borio et al. (2016).

19 Also, Erhard (1958: 91–92) had doubted that a central bank–financed credit expansion could generate growth and prosperity.

20 Under the Bretton-Woods-System, the German mark tended to be under appreciation pressure due to current account surpluses. In 1969 the mark was revalued by 9 percent against the dollar.

21 One qualification criterion for the euro was to keep the exchange rate within the band of the European Monetary System for at least two years without major tensions and without depreciating the central parity.

22 See Gerstenberger and Schnabl (2017) concerning the implications for the Japanese banking sector.

23 For details, see www.ecb.europa.eu/mopo/implement/omt/html/index.en.html#cspp.

24 The German minister of finance Scholz advocated a merger between Deutsche Bank and Commerzbank to create a very large German bank (Kayser 2018). Previously, the by then–minister of economic affairs Zypries had cheered the takeover of Air Berlin by Lufthansa to crown a national airline champion. Leading politicians such as Annegret Kramp-Karrenbauer and Peter Altmaier praise a new industrial policy to protect and promote German corporations.

25 “The calculation never works out — but the crisis deepens” (Erhard 1958: 135). “What can be protected and secured artifically by cartels are, at best, unproductive jobs, with the resulting danger that the whole national economy will cease to progress” (Erhard 1958: 136).

26 Cardarelli and Lusinyan (2015) show a similar development for the United States.

27 Meanwhile, there are daily press reports in Germany about a declining quality of public goods, for instance, streets, highways, railway transport, defense, child care, health care, schooling, and data transfer networks.

28 “This increase in economic efficiency is by no means an end in itself. The facts of the case of the social market economy can only be regarded as completely fulfilled when, in keeping with growing productivity, prices are lowered, thus making increases in real wages possible.” (Erhard 1958: 158).

29 Albeit, in the public perception real wage pressure and growing inequality are attributed to globalization (Golder 2016), both factors can be attributed to monetary policy (see Duarte 2018).