Immigration has been in the news a lot recently, along with many strong claims about how it harms workers. This article reviews what research by economists says about how immigration affects workers. This requires first getting past common misconceptions that pervade press accounts and public policy debates about immigration, some of which even claim to come from economics. Unfortunately, these misconceptions usually lead to exactly the wrong policy conclusions about immigration—policies that tend to make the United States worse off. This is why it is important have the right economic model of immigration. This article first covers two common “wrong” models of immigration, before explaining the “right” model. The right model is confirmed by a large body of empirical evidence, which will be described here as well.

A frequent starting point for concern about immigration in public discussion is the large number of immigrants in the United States. There are currently 42 million immigrants in the country, and they make up almost 17 percent of workers, a historic high. This is often compared to another large number—the number of unemployed. It is not hard to find policy briefs and news articles with titles like “All Employment Growth Since 2000 Went to Immigrants” (Zeigler and Camerota 2014) and “Illegal Immigrants Outnumber Unemployed Americans” (Meyer 2015).

What is the point of such comparisons? Such articles usually do not lay out an explicit reason, but the desired implication is nevertheless clear: If we got rid of immigrants, jobs would open up for native-born workers. But why would that be? Implicitly, the authors of such articles assume—or want the reader to presume—that there are a fixed number of jobs available. That brings me to Wrong Model 1.

Wrong Model 1: Fixed Number of Jobs

The reasoning behind comparing the number of immigrants to the number of unemployed is that there is a supposedly fixed pool of jobs, so that every immigrant who has a job is taking a job away from a native-born worker. This is patently false. This faulty reasoning may originate from a kind of small-scale thinking: people might imagine an immigrant beating out a native-born worker for a specific job opening. However, this reasoning does not scale up to the level of a whole economy. Indeed, economists have argued against this idea for a very long time—though apparently not very successfully. Economist David Schloss termed it the “lump of labor fallacy” and thoroughly refuted it in 1892. It is a wrongheaded idea that just refuses to die.

At a basic level, the number of jobs in the United States is far from fixed. In fact, the number of jobs in the United States has more than doubled in the past 50 years, as Figure 1 shows. That is not to say it is going up at every moment. There are ups and downs, as Figure 1 also shows. During recessions job growth may stagnate for a while. Periods of slow growth, like the past decade, are when the economy starts to feel zero sum, and when fallacious lump of labor thinking tends to emerge in public policy discussions.

There is a large body of empirical research that directly examines the extent to which immigrants “take jobs” from natives. These studies ask: “Per immigrant who comes in, how many natives lose their job?” This research finds basically the opposite of the popular conception: not only do immigrants not take jobs from the native-born; if anything, they slightly create jobs for natives.1 To put it differently, it seems that slightly more than one job is created for each immigrant arrival.

Why would this be? A key reason is that immigrants do not just come to the United States and extract money out of the economy. Rather, by virtue of being here, they generate consumer demand. Immigrants demand and buy all the things they need to live—housing, food, clothing, and so on—and as a result they generate demand for new workers.2 On top of this, immigrants tend to specialize in jobs that enhance demand for native-born workers by making the latter more productive. They also raise product diversity through both supply and demand channels. For example, you will probably not be too surprised to learn that immigration increases local restaurant diversity (Mazzolari and Neumark 2012). The net effect of the combination of these forces is that immigrants end up creating more jobs than they take.

In sum, the net effect of immigration on jobs is exactly the opposite of common misconceptions. Thus, getting rid of immigrants would not open up jobs for natives; it would most likely destroy them.

Wrong Model 2: More Workers by Itself Means Lower Wages (Fixed Capital Stock)

What about wages? If you add more workers, don’t wages have to go down? Isn’t that the basic economics of supply and demand?

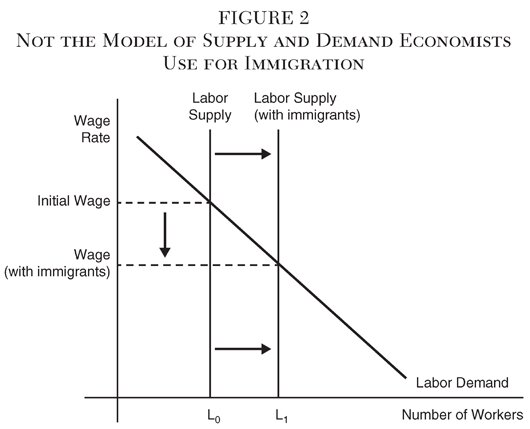

Many of us have seen a picture like Figure 2, in which the y-axis represents the wage, the x-axis represents the number of workers, and there is some downward sloping relationship between them captured by a line called “labor demand.” Where this line comes from and why it is downward sloping is not usually explained. I will do so below. It turns out to be based on a very doubtful assumption.

Figure 2 has another line, labor supply, which can be upward sloping, but is simpler to represent as a vertical line that shows the number of workers. The wage in a market economy is the intersection of supply and demand. So when you add workers due to immigration the wage has to fall to equilibrate the economy, right? A prominent economist once pleaded, “The labor demand curve is downward sloping,” and used this picture to calculate the wage impact of immigration (Borjas 2003). Furthermore, the advocacy organization Negative Population Growth Inc.—a name that usefully reveals its ideological bias—took this economist’s numbers further and calculated that immigration lowers all of our incomes by $2,470 a year, a claim the Washington Examiner uncritically reported (Bedard 2016). If true, this would mean that immigration was doing tremendous harm to America. But it is not. At best, Negative Population Growth Inc. misused the economist’s numbers.

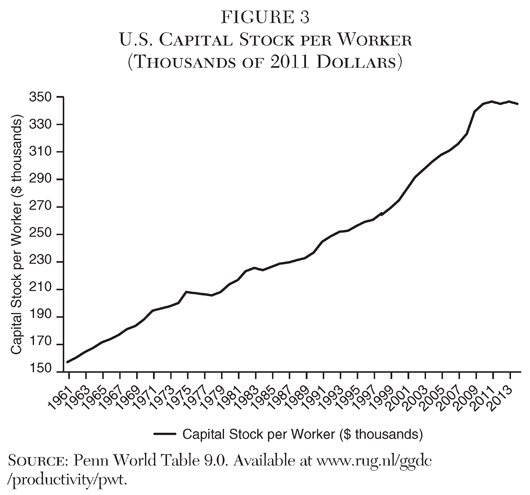

The fallacy underlying the prediction that more workers must lead to lower wages is the assumption that the capital stock is fixed. In this context, what economists mean by “capital” is all of the productive inputs in the economy besides workers. That includes, for example, office space and machinery, including the computers that help us increase our output. Capital is very important: economists estimate that it is responsible for about one-third of GDP.

The “downward sloping demand curve,” which supposedly governs the relationship between the number of workers and wages, turns out to derive entirely from the assumption that the stock of capital is fixed. As the story goes, immigration “dilutes” the capital available to each worker, lowering worker productivity and therefore wages. In this counterfactual world, a new immigrant arrival would have to share a computer and an office with an existing worker—since no computers or offices could be added—and as a result, an existing worker would be made less productive by a factor proportional to capital’s share in the economy.

Economists do not use this model for immigration because it is not accurate to model the capital stock as fixed. Figure 3 shows that the capital stock, in per worker terms, more than doubled in the past 50 years. After an immigrant arrives, some enterprising investor (it could be the immigrant himself) will realize the immigrant would be much more productive with his own office and computer, so there is a return on investment available for supplying the capital goods. Immigration generates a very large return to expanding capital and, as a result, investors rush in, and capital dilution doesn’t actually happen. While economists like to describe the labor market in terms of supply and demand, in the long run the overall demand for workers is horizontal because capital freely adjusts (its supply is “elastic”). This implies there is no wage impact from a pure increase in the number of workers.

I should not gloss over the wiggle words, “in the long run,” which economists often get ridiculed for saying (most famously John Maynard Keynes’s quip, “In the long run, we’re all dead”). It is worth emphasizing that with regard to immigration, the long run is essentially immediate. This is because, on an annual basis, immigrant inflows are very small compared to the size of the U.S. workforce, at less than 0.5 percent. For context, this is no larger than the increase in the workforce that comes from native-born workers. So if U.S. capital stocks adjust to native population growth effectively, as is the prevailing view, then they can also adjust quickly and fully to immigrant arrivals, and so wage impacts are minimal. Remember that $2,470 calculation? Well, that comes from assuming that all the immigrants in the economy came yesterday and the capital stock did not adjust at all, which is absurd. Immigrants have actually trickled in over the past 50 years or so, which gave the economy plenty of time to adjust.

The Right Model: Immigration Affects Workers When It Affects the Skill Mix

It is not that immigration can never affect native-born wages. But it has the potential to impact wages not when it just raises the absolute number of workers (which is why the two models presented above are wrong), but rather when it affects the relative numbers of different kinds of workers. Workers only compete with other workers who have similar skills. Immigrants who, say, tend to work as construction laborers do not drive down the wages of lawyers or economists (or pundits at anti-immigration think tanks, for that matter). In fact, workers with different skills often complement, rather than compete with one another; they make each other more productive. For example, adding a secretary to handle paperwork might free a doctor to spend more time with her patients.

More formally, immigration affects the wages of one type of worker when it affects the ratio of the number of that type of worker to other types of workers. To simplify, imagine there are exactly two different kinds of workers, skilled, and unskilled, with S and U representing the numbers of each. Although it is an oversimplification, it turns out to do a pretty good job of capturing immigration’s impact on the U.S. economy. In particular, the U.S. labor market seems to have roughly two kinds of jobs: jobs for college graduates and jobs for noncollege graduates.

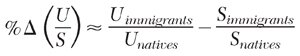

In this simple setup, what matters is how much immigration affects the ratio of unskilled to skilled (or skilled to unskilled). There is a fairly simple formula for that, shown here:

How much immigration proportionately increases the U/S ratio is given by the ratio of unskilled immigrants to unskilled natives,

, minus the same ratio for skilled immigrants and natives, . The way to think of each of these two ratios is how much immigration contributes to the growth in the numbers of that type of worker, for example, = %ΔU. Consider some examples.Suppose that all immigrants were unskilled. Then the first ratio would be large, the second ratio would be zero, so the formula says that immigration increases the ratio of unskilled to skilled workers. The opposite would be true if all immigrants were skilled.

There is another example that turns out to be highly relevant in practice: if these ratios were each roughly the same, so that immigration grows the unskilled workforce by the roughly same amount as it grows the skilled workforce. Then the difference in ratios would be zero, and there would be no potential for immigration to impact wages. We refer to this as a “skill balanced inflow”—that is, immigration replicates the skills of the existing workforce, and just enlarges the scale of the overall economy. The arguments presented earlier described how the economy can adjust to a pure increase in the scale of the workforce without any loss of wages or jobs for natives.

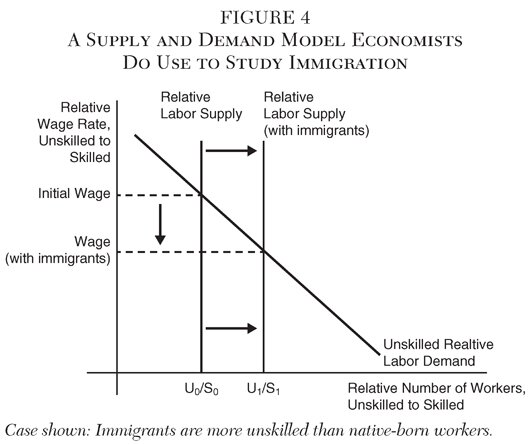

More generally, if we multiply this difference in ratios by the slope of a so-called relative demand curve, as shown in Figure 4, then we get the relative wage impact of immigration. Figure 4 looks exactly the same as Figure 2, except that the x-axis now represents the ratio of unskilled to skilled workers, rather than the absolute number of workers, and the y-axis shows the relative wage. The rightward shift in the labor supply depicted comes from the difference in ratios formula shown earlier, so the graph displayed is for immigrants who are disproportionately unskilled.

Figure 4 reveals that calling Figure 2 the “wrong” model is not at all a rejection of the supply and demand framework in the study of immigration; Figure 4 is also a supply and demand framework. To study immigration, however, we need a richer model than the one presented in Figure 2. We need a model with more than one kind of worker, and which does not impose the erroneous assumption that the capital stock is fixed.

So how much does U.S. immigration actually affect wages? To find out, let us look at these two skill ratios,

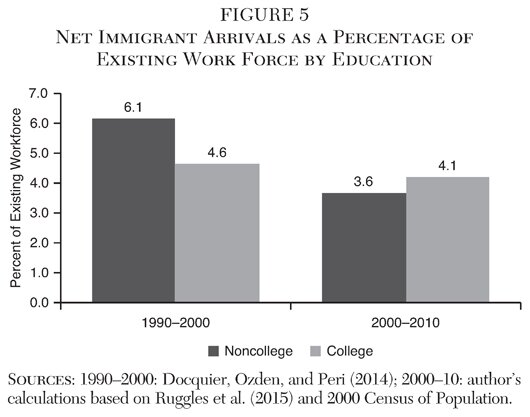

and .Figure 5 presents the ratios for unskilled (noncollege) and skilled (college) separately for two different decades. It shows that immigration increased the size of the unskilled workforce by around 6 percent in the 1990s and 4 percent in the 2000s. By itself, this would have the potential to push down unskilled wages a lot. However, that is not the end of the story, because not all immigrants are unskilled; many are highly educated. Indeed, immigration increased the size of the skilled workforce by almost the same amount—around 5 percent in the 1990s and 4 percent in the 2000s, which roughly balances out the unskilled arrivals. Another way to put it: the wrong models of immigration tend to focus on the absolute height of the bars in Figure 5. The right model focuses instead on the difference in the height of the bars. This difference is small, around 1 percent per decade. In terms of Figure 4, the shift in the relative labor supply generated by immigration is too small to have much of an impact on wages.3

Furthermore, even this model is oversimplified. Although college/noncollege is an important dividing line in the U.S. labor market, there are more subtle differences in the skills of immigrants and natives that matter as well. Immigrants tend to be at the extremes of the education distribution—either very highly or very lowly educated. Immigrants tend to be younger, and they tend to specialize in jobs that do not require strong English skills. The net effect of these differences is to push basically all of the negative impacts of immigration onto the immigrants themselves. Ottaviano and Peri (2012) have developed a richer model with many different skill categories, building on Borjas (2003). Adding up the effect of all the different changes in relative skill supplies generated by immigration, Ottaviano and Peri find that almost all native-born workers see wage increases, not decreases, as a result of immigration.

Finally, the economy has other ways of adjusting to immigration that are not modeled here, which have the effect of flattening out the relative demand curve in Figure 4, further mitigating any wage impacts. This includes the development of new technologies (Acemoglu 2007) and, again, the adjustment of the capital stock (Lewis 2011).

Conclusion

This article describes two commonly used but wrong models and one right model of the impact of immigration on workers. Both wrong models were wrong in the same way—they focus on immigration’s impact on the absolute number of workers rather than on the relative numbers of different kinds of workers. Wrong Model 1—perhaps the most commonly cited in public policy discussions of immigration—is based on the fallacy that there is a fixed number of jobs, so that every immigrant who has a job means that one fewer native-born worker has a job. The evidence suggests the opposite may be true: Immigrants add jobs, in part by raising consumer demand. So getting rid of immigrants, such as by deporting unauthorized workers, would most likely destroy jobs and raise native unemployment.

Wrong Model 2 is based on the fallacy that the capital stock is fixed. This is the basis of an overly simplistic supply and demand model that is sometimes incorrectly referred to as a basic economics “prediction” that adding more workers always means lowering wages. In practice, capital adjusts and there is no wage harm just from adding workers.

In the right model, immigration can only affect the labor market—positively or negatively—when it affects the relative numbers of different kinds of workers. In practice, immigration has almost no potential to do harm because U.S. immigration is basically balanced on the most important skill margin. There are also enough differences between the skills of immigrants and natives that most native-born workers’ wages end up going up. Almost all Americans workers are better off with immigration than without.

References

Acemoglu, D. (2007) “Equilibrium Bias of Technology.” Econometrica 75 (5): 1371–1409.

Bedard, P. (2016) “Immigration Cuts Salaries of Americans $2,470 a Year.” Washington Examiner (March 8).

Borjas, G. (2003) “The Labor Demand Curve Is Downward Sloping: Reexamining the Impact of Immigration on the Labor Market.” Quarerly Journal of Economics 118 (4): 1335–74.

Docquier, F.; Ozden, C.; and Peri, G. (2014) “The Labour Market Effects of Immigration and Emigration in OECD Countries.” Economic Journal 124 (579): 1106–45.

Hong, G., and McLaren, J. (2016) “Are Immigrants a Shot in the Arm for the Local Economy?” Unpublished manuscript, University of Virginia (June 22).

Lewis, E. (2011) “Immigration, Skill Mix, and Capital-Skill Complementarity.” Quarterly Journal of Economics 126 (2): 1029–69.

Mazzolari, F., and Neumark, D. (2012) “Immigration and Product Diversity.” Journal of Population Economics 25 (3): 1107–37.

Meyer, A. (2015) “Illegal Immigrants Outnumber Unemployed Americans.” Washington Free Beacon (July 27).

Ottaviano, G., and Peri, G. (2012) “Rethinking the Effects of Immigration on Wages.” Journal of the European Economic Association 10 (1): 152–97.

Peri, G., and Sparber, C. (2011) “Assessing Inherent Model Bias: An Application to Native Displacement in Response to Immigration.” Journal of Urban Economics 69 (1): 82–91.

Ruggles, S.; Genadek, K.; Goeken, R.; Grover, J.; and Sobek, M. (2015) Integrated Public Use Microdata Series: Version 6.0 [dataset]. University of Minnesota. Available at www.ipums.org.

Schloss, D. (1892) Methods of Industrial Remuneration. New York: G. P. Putnam’s Sons.

Zeigler, K. and Camerota, S. (2014) “All Employment Growth since 2000 Went to Immigrants.” Center for Immigration Studies Backgrounder (June). Available at www.cis.org/all-employment-growth-since-2000-went-to-immigrants.

Notes:

1Hong and McLaren (2016) find a strong overall job creation effect of immigration. Most of the literature does not examine immigration’s overall impact, but the impact within a skill category. Nevertheless, it finds insignificant displacement to weak job creation effects. Peri and Sparber (2011) is an informative review.

2 This differs from international trade, to which immigration is often compared.

3 Recall that to obtain the relative wage impact, you multiply this number by the slope of the relative demand curve. Estimates are that the slope of the relative demand curve is less than 1, and probably less than one-half.