Congress should

• phase out student aid programs, including grants, loans, and tax incentives;

• end the singular focus on for-profit colleges for censure; and

• reject proposals to incentivize more state spending on colleges.

In Universities in the Marketplace, former Harvard president Derek Bok observes, "Universities share one characteristic with compulsive gamblers and exiled royalty: there is never enough money to satisfy their desires." This chapter explores the harmful effects of federal involvement in higher education, especially distortions wrought by feeding colleges' insatiable financial cravings. When considered in conjunction with the Tenth Amendment dictum that "the powers not delegated to the United States by the Constitution ... are reserved to the States respectively, or to the people," the message is clear: the federal government should withdraw from higher education.

Student Debt and Financial Aid: Where Are We Now?

The Great Recession brought with it a new focus on student debt and the price of college, issues made especially visible by three things: (1) in 2010, total student loan debt surpassed total credit card debt for the first time; (2) the 2011 Occupy Wall Street protests focused to a significant extent on college costs; and (3) in 2012, total student debt broke the psychologically huge $1 trillion mark. As a result, we have seen significant attention paid to the cost of college and to proposals by major presidential candidates that the federal government incentivize states to spend more on their institutions of higher learning and make tuition either debt free or totally free.

This attention has come in the midst of significant expansions and reforms in federal student aid programs. For the past several decades, the federal government has been the primary provider of aid to students, through grants, loans, work study, and tax incentives for higher education expenditures. Since 2007, that role has grown significantly larger. The Bush and Obama administrations and Congress raised the maximum Pell Grant and expanded the percentage of students eligible for it, increased the maximum amounts available through loans, offered loan forgiveness for people who work for government or eligible nonprofit entities, introduced income-based repayment that caps payments at 10 or 15 percent of adjusted gross income and forgives remaining debt after 20 or 25 years, and cut interest rates on student loans.

Washington also changed how it finances loans, eliminating the "guaranteed" loan program in which borrowers obtained loans from ostensibly private lenders, but the federal government essentially guaranteed lenders a profit with the backing of federal dollars. That program was replaced with lending direct from the federal treasury. Finally, the Obama administration proposed creating a federal database on outcomes for every institution enrolling students with federal aid — almost every college — and eventually rating schools using measures such as graduation and loan-repayment rates. Facing major opposition from schools and policymakers over the rating idea, the administration eventually created the "College Scorecard," which enables users to find outcomes for first-time, full-time students 10 years after they enrolled at — but did not necessarily graduate from — a school.

Federal Aid: Seems Good, Is Probably Bad

A growing body of empirical literature strongly suggests that much federal financial aid does not translate into greater affordability for students. Instead, it has such unintended effects as these: institutions replacing their own aid dollars, state legislators decreasing direct subsidies, and just plain tuition inflation. In 1987, Secretary of Education William Bennett famously surmised that federal aid was encouraging tuition inflation. In a New York Times op-ed titled "Our Greedy Colleges," he wrote that "federal student aid policies do not cause college price inflation, but there is little doubt that they help make it possible." Essentially, when we give people money to pay for something, we give the providers the incentive to raise their prices.

Colleges are revenue maximizers. They can always think of something they could do with more money: start new programs, pay employees more, avoid cost-saving changes such as eliminating underutilized programs, build new fitness facilities or even a water park. Even economists Robert Archibald and David Feldman, who largely disagree with the "Bennett Hypothesis," tacitly concede this point in their book Why Does College Cost So Much? They argue that anything that might constrain colleges would at least appear to compromise "quality," which they seem to define as supplying everything someone might say is good, including not just small classes, but also "research or public service" and limited adjunct professors.

Top Five College Water Parks

1. University of Missouri "Tiger Grotto": According to the Mizzou website, "The Grotto will transform your dullest day into a vacation, with our resort quality facilities and atmosphere that will unwind you, even with the most stressful of schedules. The Grotto features a zero-depth pool entry with a high-powered vortex, lazy river and waterfall. Our hot tub, sauna and steam room will help you loosen up after a hard workout."

2. Texas Tech "Student Leisure Pool": According to Texas Tech's website, this is "the largest leisure pool on a college campus in the United States." It features, among other things, a 645-foot long, lazy river and a 25-person hot tub.

3. University of Alabama: According to the school's "University Recreation" webpage, the outdoor pool facility features, among other things, a "current channel," "spray features," a "tanning shelf," a "water slide," and a "bubble bench."

4. Missouri State: The school's pool features LED lights that change color at night, a 16-seat spa and sauna near the pool, and a 20-yard zip line.

5. Louisiana State University (under construction): The $84 million aquatics facility will feature a 536-foot lighted lazy river in the shape of "LSU," two "bubbler lounges," and a 21,000-square-foot sun deck made of "broom finished concrete with sand blasted etching of tiger stripes."

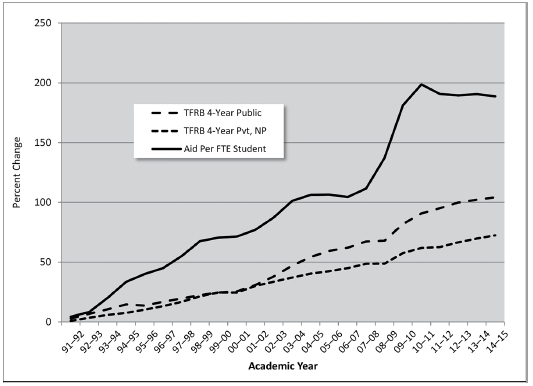

Figure 48.1

Percent Change in Aid per Full-Time-Equivalent Undergraduate Student and Published Tuition, Fees, and Room and Board Charges Since the 1990–91 Academic Year, Inflation Adjusted

SOURCE: College Board, Trends in College Pricing 2015, Table 2, http://trends.collegeboard.org/college-pricing/figures-tables/tuition-and-fees-and-room-and-board-over-time-1, and Trends in Student Aid 2015, Table 3, http://trends.collegeboard.org/student-aid/figures-tables/average-aid-student-over-time-postsecondary-undergraduate-graduate.

NOTE: TFRB = tuition, fees, and room and board; NP = nonprofit; FTE = full-time equivalent.

Figure 48.1 illustrates that over roughly the last quarter century, inflation-adjusted aid per full-time-equivalent student has increased at a remarkable rate, nearly tripling. That increase has almost certainly abetted the doubling of inflation-adjusted tuition, fees, and room and board charges at public four-year institutions, as well as the roughly 75 percent increase in prices at four-year private schools. Of course, aid is not the only factor in college pricing. Skeptics of the Bennett Hypothesis often blame cuts in direct state and local subsidies to colleges as the primary culprit behind rising prices. But those cuts do not meaningfully affect private institutions, which receive very little in direct state and local subsidization. Plus, public institutions have actually seen an increase in total state and local funding since 1990. Where there has been an appreciable funding reduction is on a per-pupil basis, but that is primarily a consequence not of tight-fisted states, but of enrollment increasing from 7.8 million to 11.1 million full-time-equivalent students between 1990 and 2015.

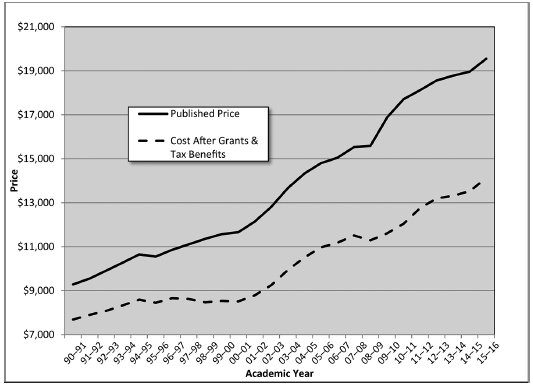

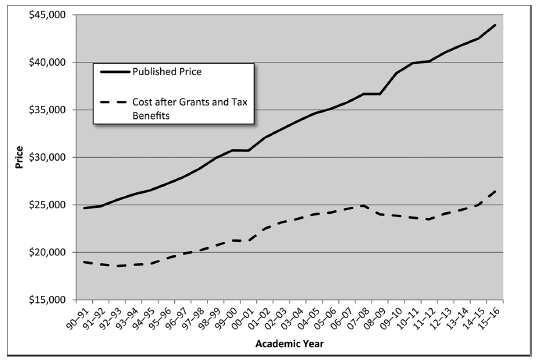

The effect of aid on what students actually pay, as opposed to the "sticker price" they are ostensibly charged, is partially illustrated in Figures 48.2 (public institutions) and 48.3 (private institutions). The illustration is only "partial" because the figures exclude student loans, which — at least in theory — must be paid back. In practice, student loans are cheap because of government subsidization, and they are often eligible for some level of forgiveness. They are also awarded to many people who almost certainly would be unable to get such loans on the private market, for both financial and academic reasons. They truly are aid. Of course, they also enable students to pay what schools want to charge, the central point of the Bennett Hypothesis. That said, even looking only at prices — before tax benefits and grants (including institutional dollars) — we see the effect of aid. At public four-year institutions, while the inflation-adjusted sticker price of tuition, fees, and room and board rose 110 percent between 1990 and 2015, net prices rose only 84 percent. At private, four-year institutions, published prices grew 78 percent, but net prices rose only 39 percent. Loans helped cover the remaining difference.

Figure 48.2

Published Tuition, Fees, and Room and Board Charges (In-State) vs. Net Cost after Grants and Tax Benefits, Public Four-Year Institutions, in 2015 Dollars

SOURCE: College Board, Trends in College Pricing 2015, Table 7, https://trends.collegeboard.org/college-pricing/figures-tables/average-net-price-over-time-full-time-students-sector.

Figure 48.3

Published Tuition, Fees, and Room and Board Charges vs. Net Cost after Grants and Tax Benefits, Private Four-Year Institutions, in 2015 Dollars

SOURCE: Source: College Board, Trends in College Pricing 2015, Table 7, https://trends.collegeboard.org/college-pricing/figures-tables/average-net-price-over-time-full-time-students-sector.

Federal aid clearly enables colleges to ramp up their prices. It also likely gooses student demand for programs and amenities increasingly removed from academic necessity, including gourmet food, deluxe housing, lots of recreational and entertainment programming, and even on-campus water parks! Indeed, researchers Brian Jacob, Brian McCall, and Kevin Stange found that for all but the top academic performers, students put more emphasis on schools' amenities than their academic offerings. That means many colleges may well be locked into an amenities "arms race" fueled, at least in part, by subsidies that incentivize students to demand lots of extras.

Perhaps this state of affairs would be tolerable if the higher education system performed magnificently, clearly imparting lots of new, crucial knowledge and skills. But much evidence suggests it does not.

First, roughly half of all students who enter college never finish. Many of those who do not finish have received aid despite being unprepared for college-level work. Thus, they often have debt but no degree with which to increase their earnings and repay what they owe. Indeed, small debtors comprise the biggest chunk of loan defaulters. The students with heftier debt levels have often gotten undergraduate degrees and gone on to graduate schools and usually earn enough to comfortably pay off their loans.

That said, even many who do finish college have difficulty finding work that requires their degree. According to a 2014 report from the Federal Reserve Bank of New York, approximately one out of every three bachelor's degree holders is in a job not requiring the credential. Meanwhile, the surfeit of degree holders is apparently leading to "credential inflation." According to research by the human resources firm Burning Glass Technologies, many job advertisements call for a degree even though the people currently occupying those positions typically do not have one, and the desired skills are not college level. Finally, while the wage premium for having a degree versus just completing high school is quite large — perhaps as much as $1 million over one's lifetime — earnings for people with at least an undergraduate degree have been essentially stagnant for roughly the last two decades.

At least people are learning a lot more, right? Perhaps not, at least according to the incomplete measures we have. Research by Richard Arum and Josipa Roksa indicates that college students reported spending 40 hours per week on academic pursuits in the early 1960s, but just 27 hours in 2011. Time spent studying declined from 25 hours per week in 1961 to 20 hours in 1980 and 13 hours in 2003. The National Assessment of Adult Literacy determined that, in 1992, about 40 percent of adults whose highest degree was a bachelor's were proficient in reading prose, but by 2003 — the only other year the assessment was administered — only 31 percent were proficient. Among people with advanced degrees, prose proficiency dropped from 51 percent to 41 percent. To a large extent, a degree seems to serve as a signal of someone's basic attributes — maybe general intelligence and ability to complete a long-term task — but does not necessarily indicate someone has obtained valuable skills. Still, employers can easily demand a degree because someone else is usually paying.

The U.S. System: Don't Make It Worse

As problematic as American higher education is, it works much better than either our elementary and secondary system, or most other countries' postsecondary systems. American universities dominate world rankings; the United States is the top destination for students pursuing studies outside of their home countries; and we have by far the greatest number of top scholars, including Nobel Prize winners. Why? Because as wasteful and distorting as aid to students is, it is far better to attach money to students and give institutions autonomy to govern and shape themselves than to have the government operate the schools and fund them directly. We want a system that can supply varied types of education and that allows students and schools to respond quickly to changing needs in the workforce. Freedom is much better suited to those goals than top-down control.

Of course, American higher education is far from perfect in that regard. Public colleges and universities receive heavy direct subsidies from state and local governments that render them significantly insulated from the pressures of student demands. And private, nonprofit schools often have big endowments or other sources of funds accumulated through tax-favored donations. For-profit colleges and, to a lesser extent, community colleges have often been the most responsive to changing workforce demands.

What that tells us is, first, Congress should not enact legislation that would offer federal funding to states in exchange for greatly increased subsidies to public colleges and lower or zero tuition. Although such legislation would reduce sticker prices and debt, it would render higher education even less efficient than the current system. And, of course, it would come with a hefty taxpayer price tag.

Second, Congress should cease the outsized assault we have seen on for-profit institutions over the last several years. Students who attend for-profit schools do tend to have relatively high loan default levels, and they do not earn as much as graduates of four-year public and private, nonprofit schools. But for-profits work with the students with the greatest challenges — older, poorer, more likely to have families and full-time jobs — even compared with community colleges. Moreover, for-profits tend to be relatively quick to expand or create new programs when demand arises and to scale down or end programs when demand subsides. In other words, they are best at responding to changing market demands. Nevertheless, like all sectors of higher education, they have inflated prices, big noncompletion problems, and too much debt default — due, in large part, to the artificial incentives created by student aid.

Removing the Federal Government from Higher Education

James Madison wrote in Federalist No. 45, "The powers delegated by the proposed Constitution to the federal government are few and defined... . [They] will be exercised principally on external objects, as war, peace, negotiation, and foreign commerce." Since the Constitution grants the federal government no role in higher education, Washington may only be involved in ways that support legitimate federal concerns. That essentially means maintaining the Senior Reserve Officers' Training Corps, service academies, and national defense–related research. Otherwise the federal government should withdraw from higher education.

Washington cannot, however, withdraw immediately. Abruptly ending federal student aid, especially, would leave millions of students scrambling for funds and would overwhelm private lenders, schools, and charitable organizations that have made plans based on expected levels of federal involvement. What follows is an overview of a six-year plan to withdraw the federal government from higher education:

• Two years: End direct federal aid to institutions. With the exceptions of Howard University and Gallaudet University, both of which are in the District of Columbia, colleges do not typically receive direct federal subsidies of major size. If schools are to be directly subsidized, state or local governments should do it. Also, federal tax incentives, which are heavily skewed to the well-to-do — such as 529 plans, Coverdell Education Savings Accounts, and Lifetime Learning Credits — should end, though existing savings should receive the tax treatment promised when the money was deposited.

• Four years: Phase out "unsubsidized" federal loans, which are loans available without regard to financial need. There is little justification for supplying loans to people who could otherwise afford to pay for college. The maximum available loan should be reduced in equal increments over four years, to a complete phaseout.

• Six years: Eliminate all federal student aid programs. Each year after the enactment of the federal phaseout, the maximum Pell Grant should be reduced in equal increments. Similarly, maximum "subsidized" loan sizes should be reduced in equal increments.

Conclusion

The federal presence in higher education is ultimately self-defeating, fueling artificially higher prices, incentivizing overconsumption, and making it harder and more expensive for people to access the education they need. The solution is not to incentivize greater direct subsidies for the ivory tower, but to eliminate the subsidies we already have. That will help transform the currently bloated, teetering ivory tower into manageably sized educational options accessible to everyone who needs them.

Suggested Readings

Arum, Richard, and Josipa Roksa. Academically Adrift: Limited Learning on College Campuses. Chicago: University of Chicago Press, 2011.

Fried, Vance. "Federal Higher Education Policy and the Profitable Nonprofits." Cato Institute Policy Analysis no. 678, June 15, 2011.

Jacob, Brian, Brian McCall, and Kevin M. Stange. "College as Country Club: Do Colleges Cater to Students' Preferences for Consumption?" National Bureau of Economic Research Working Paper no. 18745, January 2013.

McCluskey, Neal P. "How Much Ivory Does This Tower Need? What We Spend on, and Get from, Higher Education." Cato Institute Policy Analysis no. 686, October 27, 2011.

---. "The Newly Updated Help-that-Hurts List." SeeThruEdu, January 7, 2016.

Pierce, Kate. "College, Country Club or Prison." Forbes, July 29, 2014.

Vedder, Richard. Going Broke by Degree: Why College Costs Too Much. Washington: American Enterprise Institute, 2004.