Congress should

• recognize that the U.S. economy has experienced a downward shift in the long-term rate of growth, with the pace of growth one-half to two-thirds that of the 20th century;

• understand the huge impact of the growth slowdown: if current growth rates persist, a person born in 2000 will spend her retirement years in an economy half as big as it would have been if 20th-century growth rates had been maintained;

• recognize that reversing the growth slowdown should be a top priority across the political spectrum, as disagreements about how to divide the economic pie are subordinate to the common interest in a larger pie;

• understand that policy changes can have a significant positive effect on the long-term rate of growth; and

• seek out pro-growth reforms that attract support across the political spectrum, so that the common interest in higher growth is not a casualty of partisan polarization.

The 21st century has witnessed a major downward shift in the trajectory of U.S. economic growth. From 1900 to 2000, real (i.e., inflation adjusted) gross domestic product (GDP) per capita rose at an average annual rate of 2.1 percent. The long-term growth path remained remarkably steady even in the face of massive macroeconomic fluctuations. For example, over the 20 years from 1929 to 1949 — a period that encompassed the twin convulsions of the Great Depression and World War II — the average growth rate clocked in at 2 percent per year, right on trend.

In contrast, from 2000 to 2015, annual growth in real GDP has averaged only 1 percent — half the rate of 20th-century growth. At the center of this story is the Great Recession of 2007–2009 and its aftermath. Between the fourth quarter of 2007 and the second quarter of 2009, U.S. GDP shrank by 4.2 percent — the sharpest decline since the Great Depression. Normally in U.S. economic history, severe recessions are followed by vigorous recoveries, but not this time. Instead, the economy experienced its weakest expansion since World War II. As of October 2013, 70 months after the recession began, real GDP had grown only 5.3 percent. In contrast, after the prior six recessions, real GDP growth averaged a robust 20 percent over the same period of time.

For most Americans, the economy has been performing even worse than these aggregate numbers suggest. With the rise in income inequality, the benefits of growth in terms of rising incomes are now skewed toward the upper reaches of the socioeconomic scale. As a result, most Americans have been experiencing not just a slowing rate of improvement, but stagnation and even decline. Real median household income (family income for Americans in the exact center of the income distribution) was 7 percent lower in 2014 than it was in 2000. Using different adjustments for inflation, it is possible to massage those figures to make them look slightly less bleak. It is impossible to massage them into looking good.

The "New Normal" of Slow Growth

Unfortunately, the economy's sluggishness is likely to persist. At a Cato Institute conference in December 2014, two of the nation's leading experts on productivity growth presented long-term growth projections for the U.S. economy. Dale Jorgenson of Harvard University projected annual growth in aggregate real GDP of 1.75 percent, while John Fernald of the Federal Reserve Bank of San Francisco projected a slightly faster growth rate of 2.1 percent. After taking account of likely population growth, Jorgenson's projection puts annual growth in real GDP per capita at below 1 percent, while Fernald's comes in under 1.4 percent. In other words, in Fernald's more optimistic scenario, growth in the years to come will be more than a third off its 20th-century pace, while in Jorgenson's scenario, the long-term growth rate has been cut in half.

The reasons for Jorgenson and Fernald's pessimism have nothing to do with any recent events — neither lingering effects from the severe recession nor problems with policies enacted in its wake. Rather, both recognize the impact of deep-seated factors that once propelled growth but that now have shifted in an unfavorable direction.

To understand what's going on, let's break down measured economic growth into the constituent elements tracked by conventional growth accounting: (1) growth in labor participation, or annual hours worked per capita; (2) growth in labor quality, or the skill level of the workforce; (3) growth in capital deepening, or the amount of physical capital invested per worker; and (4) growth in so-called total factor productivity, or output per unit of quality-adjusted labor and capital.

Over the course of the 20th century, these various components fluctuated in their contributions to overall growth. The fluctuations, however, tended to offset each other, so that the long-term trend line of growth overall remained stable. In the 21st century, however, this pattern of offsetting fluctuations has come to a halt as all growth components have fallen off simultaneously.

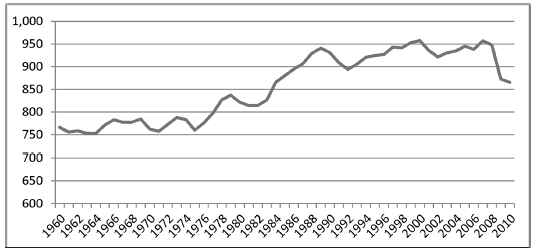

One way to get faster growth is for more people to work or for people to work longer hours. Between the mid-1960s and 2000, average annual hours worked per capita surged from under 800 to above 950, powered by rising labor force participation among women and the influx of baby boomers into the work force. Since 2000, however, the labor force participation rate for both men and women has been in steep decline: from its overall peak of 67.3 percent in early 2000, it has dropped all the way to 62.7 percent as of June 2016, the lowest rate since 1978 (Figure 6.1). With labor hours shrinking, output per worker hour (otherwise known as labor productivity) has to rise just to keep the economy from shrinking. Accordingly, hours worked per capita has gone from providing a strong tailwind for growth to now resisting growth with a stiff headwind.

Figure 6.1

Average Annual Hours Worked per Capita

SOURCE: Data from 1900–2005 come from Valerie Ramey, http://www.econ.ucsd.edu/~vramey/research.html. Data from 2006–2010 are a recreation of Ramey's methods using Current Population Survey civilian hours plus Ramey's military figures divided by the U.S. Census's annual population figures.

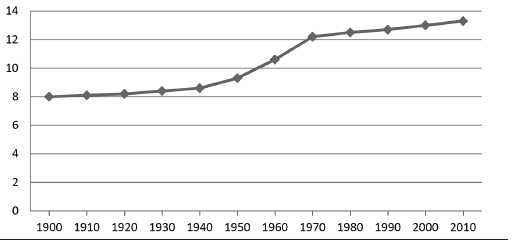

While the quantity of labor supplied is an important factor in determining output, so is the quality of labor. Since workers with higher skills and more experience produce more output in a given hour than do their less skilled, more junior colleagues, boosting the skill level of the workforce is an important way to create economic growth. Over the course of the 20th century, huge investments in mass schooling — first at the secondary level, then at the postsecondary level — led to a much more highly skilled workforce. Harvard economists Claudia Goldin and Lawrence Katz estimate that rising educational attainment accounted for about 15 percent of total growth over the period 1915–2005. But the rate of increase in years of schooling per worker has slowed dramatically in recent decades: the pace of improvement between 1980 and 2005 was less than half that during the period between 1960 and 1980 (Figure 6.2). And looking ahead, the educational level of the workforce is expected to plateau. Another important source of growth has therefore petered out.

Figure 6.2

Average Years of Schooling

SOURCE: 1900–1939: "120 Years of American Education: A Statistical Portrait" found at http://0-nces.ed.gov.opac.acc.msmc.edu/pubs93/93442.pdf. 1940–1990: Current Population Survey of the BLS Table A-1. 2000–2010: UNDP, http://hdrstats.undp.org/en/indicators/103006.html.

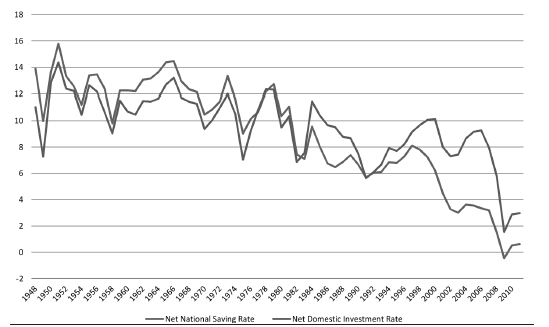

An additional source of growth is investment: workers with more and better tools are able to produce more. Unfortunately, net national investment (investment net of depreciation charges) as a percentage of net national product has been falling for decades, dragged down by the more widely reported drop in the national savings rate (Figure 6.3). There is therefore no current basis for expecting a surge in investment to counteract the unfavorable trends regarding hours worked and educational attainment.

Figure 6.3

Saving and Investment Shares

SOURCE: Jagadeesh Gokhale, Cato Institute.

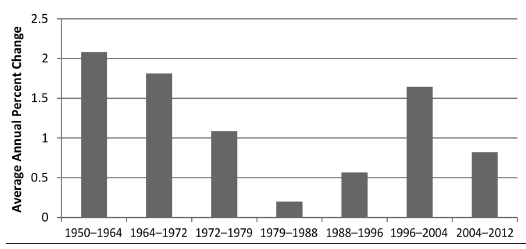

In the case of labor hours, worker skills, and investment, growth is created by adding more inputs. If you increase inputs with more hours worked, more training, and more equipment, then you will produce more output. The final source of growth, innovation, involves figuring out how to get more output from a given set of inputs — either through inventing new products or by developing more efficient production processes. Economists' best measure of innovation is known as total factor productivity (TFP) growth: the increase in output from a given unit of labor and capital. From 1996 to 2004, TFP growth surged after a long slump that began in the 1970s; since 2004, however, TFP growth has returned to the low rates of decades past (Figure 6.4). Admittedly, shifts in the rate of TFP growth are unpredictable, so it is possible that another round of rapid growth is just around the corner. But at present, no signs of such a turnaround are visible.

Figure 6.4

Total Factor Productivity

SOURCE: 1871–1950: Robert Gordon's 1999 "U. S. Economic Growth Since 1870: One Big Wave." 1950–2011: The Bureau of Labor Statistics, "MFP Tables: Historical multifactor productivity measures (SIC 1948–87 linked to NAICS 1987–2011)," Nonfarm Tables, June 2013, http://www.bls.gov/mfp/.

In the 21st century, the U.S. economy has thus experienced simultaneous weakening in all four components of economic growth. This does not mean that slow growth is inevitable from here on out: the current trends are not set in stone. Nevertheless, it is difficult to avoid the conclusion that the conditions for growth are less favorable than they used to be.

The Stakes Are High — for Left and Right Alike

The long-term implications of a 50 percent drop in the growth rate are huge. With real GDP per capita rising 2 percent a year, output per capita doubles in around 35 years. With the growth rate cut to 1 percent, doubling takes 70 years. Accordingly, if 21st-century growth rates persist, a person born in 2000 will spend her old age in an economy only half as rich as it would have been if 20th-century growth rates could have been extended.

Conservatives and libertarians should require little convincing that more economic output is generally something to be desired, and that therefore the prospect of a prolonged growth slump is a matter of serious concern. Progressives may be more skeptical. In particular, they might object that, because of income inequality, all the extra output created by higher growth wouldn't translate into commensurate income gains for most Americans.

That's an understandable concern, but disappointment with the pace of median income growth will hardly be assuaged by a slowdown in the economy's overall expansion. In the era of rising inequality and falling median wage growth that began in the 1970s, there has been only one period of strong growth in real earnings: the late 1990s, when GDP and productivity growth were surging as well. Thus, even in an age of income inequality, faster growth redounds to the benefit of average workers. Indeed, in the current circumstances, it appears that only strong growth can stave off stagnation or disappointingly sluggish growth in workers' pay.

Many progressives might argue that, even with faster growth, the gains from economic growth are no longer shared widely enough. More redistribution, they contend, is needed to correct the imbalance. Libertarians and conservatives can be counted on to dispute the point, but that is an argument for another day. For present purposes, it suffices to point out that slow growth will make it all but impossible to fund any more generous provision for the less well-off.

Because of the aging U.S. population and rising health care spending, entitlement spending on the elderly figures to put the squeeze on everything else the federal government does. According to the Congressional Budget Office, spending on Social Security and the major federal health care programs is projected to balloon to 14 percent of GDP by 2039, double the 7 percent average over the past 40 years. Meanwhile, spending on everything besides interest payments would fall to 7 percent of GDP, well below the 11 percent 40-year average — indeed, a smaller share of GDP than at any time since the late 1930s. And even with this hit to the relative size of nonentitlement spending, by 2039, federal debt as a share of GDP is projected to hit the all-time historical peak of 106 percent (set back in 1946 at the end of World War II). It will continue upward from there. To put it mildly, this is not a fiscal environment that augurs well for big new federal social programs.

Alas, we cannot simply grow our way out of this predicament. Yes, higher growth directly inflates the denominator of the debt-to-GDP ratio; but it also leads to increased spending under entitlement programs and thus works indirectly to boost the numerator as well. Nevertheless, faster growth does mean a considerably larger economy over the longer term and, consequently, more resources available for funding income transfers than would otherwise be the case.

Consequently, progressives and libertarians should be united on the desirability of higher growth. They may have different ideas about what to do with the extra money, but both sides have a stake in getting the chance to fight it out.

In addition to economic reasons for favoring higher growth regardless of ideology, there are also important political reasons. Indeed, in our present situation, the political stakes have assumed an urgency that swamps any calculations of mere dollars and cents. The health of American democracy and the basic character of American society are now on the line. As Harvard economist Benjamin Friedman documented in The Moral Consequences of Economic Growth, a prosperous, growing economy promotes the democratic virtues of tolerance and openness. When incomes and living standards are rising generally, the welfare of other groups is less likely to be perceived as a threat to one's own. But when the economy stagnates, gains for some necessarily mean losses for others. In this zero-sum environment, the ugly, defensive reactions of bigotry, xenophobia, and belligerent nationalism gain traction.

With the recent rise of authoritarian populism here in the United States, as well as in countries across Europe, the broader, political implications of the growth rate are no longer a matter of merely theoretical concern. Fundamental American ideals are under active assault, and all who still hold to those ideals, regardless of their position on the political spectrum, need to recognize the role that the growth slowdown is playing in strengthening the other side. Reviving economic growth is perhaps the most potent means at our disposal to counter and defeat this illiberal challenge to the country's founding principles.

Reversing the Growth Slowdown

Can anything be done to stir the economy out of its current doldrums? The heartening answer is yes, absolutely. Current trends in labor participation, labor quality, investment, and innovation point to a permanent reduction in the U.S. economy's long-term growth path, but those trends do not exist in a vacuum. They are situated in the larger context of the nation's laws and economic policies, which combine to shape the incentives of individuals and firms along countless different margins. If you change those laws and policies, then you can change those incentives; change those incentives, and you can change the economic trends.

The fact is — and it's hard to imagine who would disagree — that American public policy is far from optimal when it comes to facilitating economic growth. Look at the factors that shape each component of growth and you will find laws and policies that push in the wrong direction: laws and policies that discourage participation in the labor force, frustrate accumulation of human capital, deter productive investment, and inhibit innovation or block its diffusion throughout the economy. In the circumstances, this is good news: it means that there is wide room for improving public policy, and consequently wide room for improving economic performance.

To explore the wide variety of possible pro-growth reforms, the Cato Institute hosted a special online forum during late 2014, in which 51 of the nation's top economists and policy experts were asked to identify one or two policy changes that could trigger faster economic growth, whether temporarily through a one-time change in the level of output or indefinitely through accelerating the growth rate. The proposed reforms covered a long list of policy domains: tax policy; budget policy; education and training policy; health care financing policy; financial regulation; monetary policy; health, safety, and environmental regulation; regulations on starting a business; trade policy; immigration policy; intellectual property law; land use regulation; and even foreign policy. In addition, some of the contributors have advocated what might be called "meta policy" changes — that is, reforms to the policymaking process rather than specific substantive changes to rules or programs.

While everyone might agree on the need to change public policy, finding agreement on what particular changes to make is considerably trickier. After all, American politics today is characterized by deep ideological divisions and intense partisan polarization over government's proper role in the economy. There are many fronts in the political conflicts of recent years: the trajectory and composition of federal spending, the level and structure of taxation, health care policy, regulation of the financial sector, immigration, climate change, and environmental regulation more generally. All involve policy issues with important implications for the level of output or the permanent rate of growth. On these questions, and many others besides, the respective sides are miles apart when it comes to the proper direction of policy change. Yes, there is a shared interest in continued healthy economic growth that transcends the left-right divide. But agreement on ends need not translate into agreement on means, and in the present case, there is disagreement aplenty.

Under current political conditions, the most promising path forward is to identify policy ideas that are not already the subject of high-profile, politically polarized debate. America's growth slowdown is a new problem, and policy responses that address that problem are more likely to gain traction if they are not recycled ideas originally put forward to address other problems. And if a policy idea is already clearly associated with either the left or the right, in today's highly contentious environment, it is all but guaranteed that the other side will fight tooth and nail against it. That makes progress of any kind difficult in the absence of large congressional majorities and unified partisan control of the White House and Congress.

The good news is that, notwithstanding the extent of polarization, it is still possible to construct an ambitious and highly promising agenda of pro-growth reforms that steers largely clear of the red-versus-blue divide. Chapter 7 explains how.

Suggested Readings

Friedman, Benjamin. The Moral Consequences of Economic Growth. New York: Vintage Books, 2006.

Lindsey, Brink. "Why Growth Is Getting Harder." Cato Institute Policy Analysis no. 737, October 18, 2013.

---. "Low-Hanging Fruit Guarded by Dragons: Reforming Regressive Regulation to Boost U.S. Economic Growth." Cato Institute White Paper, June 22, 2015.

Lindsey, Brink, ed. Reviving Economic Growth: Policy Proposals from 51 Leading Experts. Washington: Cato Institute, 2015.

---. Understanding the Growth Slowdown. Washington: Cato Institute, 2015.