Congress should

• consolidate current welfare and anti-poverty programs;

• transition from in-kind benefits to cash grants;

• reform the earned income tax credit;

• shift programs to states with as few strings as possible; and

• emphasize metrics of success, rather than funding or enrollment.

Although the exact number fluctuates from year to year, the federal government funds more than 100 separate anti-poverty programs. Some 70 of these provide cash or in-kind benefits to individuals, while the remainder target specific groups or disadvantaged neighborhoods or communities.

There are eight different health care programs, administered by five separate agencies within the Department of Health and Human Services. Six cabinet departments and five independent agencies oversee 27 cash or general-assistance programs. All together, seven different cabinet agencies and six independent agencies administer at least one anti-poverty program. And those are just the programs specifically aimed at poverty. That doesn't include more universal social welfare programs or social insurance programs such as unemployment insurance, Medicare, or Social Security.

Altogether, the federal government spent more than $680 billion in 2014 (the last year for which compete data are available). State and local governments added about $300 billion in additional funding. Thus, government at all levels is spending roughly $1 trillion per year to fight poverty. Stretching back to 1965, when President Lyndon Johnson first declared "war on poverty," anti-poverty spending has totaled more than $23 trillion.

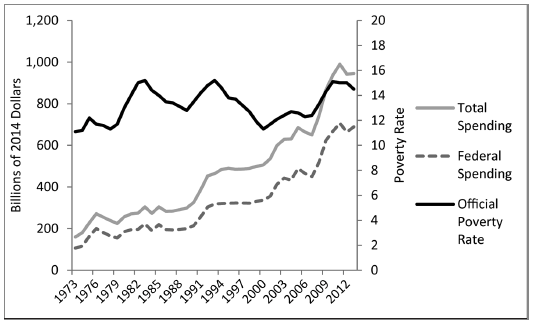

Figure 41.1

Poverty Rate vs. Welfare Spending, 1973–2014

SOURCE: Bernadette D. Proctor, Jessica L. Semega, and Melissa K. Kollar, "Income and Poverty in the United States: 2015," United States Census Bureau, September 2016; Michael Tanner, "Pros and Cons of a Guaranteed National Income," Cato Institute Policy Analysis no. 773, May 12, 2015.

Yet the results of all this spending have been disappointing. Using the traditional Census Bureau definition of poverty, we have seen virtually no improvement in poverty rates since 1965. As shown in Figure 41.1, the only appreciable decline since the mid-1970s occurred in the 1990s, a time of state experimentation with tightening welfare eligibility, culminating in the passage of national welfare reform (the Personal Responsibility and Work Responsibility Act of 1996).

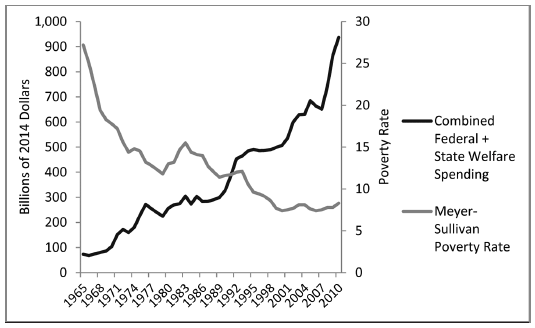

Most observers agree that the traditional poverty measure is badly flawed — for example, it does not count taxes or the value of in-kind benefits. But even more accurate alternative poverty measures show few gains since the mid-1970s. At the very least, marginal increases in spending appear to yield little marginal decrease in poverty or lead to any meaningful improvements in upward economic mobility. For example, a study by Bruce Meyer and James Sullivan found that the majority of improvements in a more accurate poverty measure occurred prior to 1972. Less than a third of the improvement has taken place in the past four decades, despite massive increases in expenditures during that time (Figure 41.2).

Figure 41.2

Meyer-Sullivan Poverty Rate vs. Combined Welfare Spending

SOURCE: Michael Tanner, "Pros and Cons of a Guaranteed National Income," Cato Institute Policy Analysis no. 773, May 12, 2015.

Perhaps apocryphally, Einstein is reputed to have defined insanity as doing the same thing over and over and expecting different results. Clearly, what we are doing now is not working. But much of the debate over poverty remains remarkably sterile and frozen in time. Arguing over whether we should increase or decrease spending on food stamps by another billion will do little to change the underlying dynamics of a failed system.

Many of the changes that would be most effective in reducing poverty will have to take place outside the welfare system. They include reforming the criminal justice and school systems, as well as reducing taxes and regulations to increase the availability of jobs. Those reforms are discussed elsewhere in this volume. Still, there are a number of steps that Congress can take immediately to reform our welfare system.

Simplify and Consolidate

The magnitude of the current welfare system, with its multitude of overlapping programs — often with contradictory eligibility requirements, differing rules, mixed oversight, and divided management — is a bureaucratic nightmare. The complexity and lack of transparency make it difficult to measure whether or not programs are accomplishing their goals. Many existing programs have become little more than fiefs for special interests, providing a bureaucratic roadblock to reform. And, while the overhead and administrative costs for most programs are modest, generally under 5 percent, the costs do add up.

Moreover, the sheer number of programs works to suck more people into the welfare system, increasing both cost and enrollment (dependency), without necessarily targeting those efforts to the people most in need. As a result, many of the people receiving benefits are not necessarily poor, while many legitimately poor people do not receive assistance.

Some households in or near poverty that do receive assistance and participate in multiple programs can face marginal effective tax rates that are counterproductive (see Figure 41.3): they are so high that they can act as poverty traps, deterring work effort or putting a low ceiling on how much these families can increase their standard of living. In those cases, the majority of each additional dollar earned is clawed back through higher taxes or reduced benefits.

Participants in the current welfare system can find it both demeaning and difficult to navigate. Those applying for benefits must deal with multiple forms, often-conflicting eligibility standards, and intrusive program administrators. Andrea Louise Campbell, an MIT professor, described the struggles of her disabled sister-in-law in her book Trapped in America's Safety Net. The professor notes that she found the welfare maze "incredibly complex and confusing." For more typical applicants with far less education and fewer coping skills, the process must be daunting indeed.

Figure 41.3

Marginal Effective Tax Rates by Family Income, 2016

SOURCE: Congressional Budget Office, "Effective Marginal Tax Rates for Low- and Moderate-Income Workers in 2016," November 19, 2015.

Receipt of benefits, therefore, often becomes a question, not of need, but of ability to game the system. Those groups and constituencies best able to maneuver through the bureaucracy are most likely to collect benefits — often multiple benefits; similarly situated individuals, or even those with greater need, who lack such skills are often left out.

There is no legitimate reason to continue to fund multiple programs that essentially do the same thing. Therefore, Congress should consolidate programs with similar functions, such as nutrition, health care, education, and so on.

Provide Cash, Not In-Kind Benefits

The vast majority of welfare benefits today are provided not in cash but rather as "in-kind" benefits. Indeed, direct cash assistance programs, including refundable tax credits, made up roughly 21 percent of federal assistance in 2015, down from roughly 29 percent a decade ago. In-kind programs — such as food stamps, housing assistance, and Medicaid — provide the poor with assistance, but only for specific purposes. In most cases, the payments are made directly to providers. The person being helped never even sees the money.

The emphasis on in-kind benefits effectively infantilizes the poor. Poor people are not expected to budget or choose among competing priorities the way people who are not on welfare are expected to. Rather, in-kind benefits substitute the government's choices, values, and priorities for those of the poor.

Virtually all programs go even further in limiting the use of benefits to government-approved purchases. For example, the Special Supplemental Nutrition Program for Women, Infants, and Children (often called "WIC") can only be used to purchase certain foods determined by government regulation. Food stamps use is being restricted to stores that stock a certain level of healthy food products, often eliminating the eligibility of small neighborhood stores. Even with cash programs like Temporary Assistance for Needy Families, state lawmakers have enacted a host of restrictions around things like the locations where electronic benefit transfer (EBT) cards may be used to access automated teller machines (ATMs).

While it is reasonable for taxpayers, who are ultimately paying for these benefits, to seek accountability for how the funds are used, this paternalism may be both unnecessary and, worse, self-defeating. Shouldn't the poor decide for themselves how much of their income should be allocated to rent or food or education or transportation? Perhaps they may even choose to save more or invest in learning new skills that will help them earn more in the future. You can't expect people to behave responsibly if they are never given any responsibility.

Some might argue that the poor can't be trusted with money. We are told they will blow it on booze, drugs, or whatever. But that attitude is too often based on erroneous and racially biased stereotypes. There is little evidence to suggest the poor misuse their resources. For example, studies from states that drug-test welfare recipients, including Florida, suggest that the use of drugs is no higher among welfare recipients than among the general population. In fact, numerous studies have shown that even when welfare recipients are given totally unrestricted cash, they do not increase their expenditure on "temptation goods" like tobacco or alcohol.

Giving the poor responsibility for managing their own lives means giving them more choices and opportunities. That, in turn, would help break up geographic concentrations of poverty that can isolate the poor from the rest of society and reinforce the worst aspects of the poverty culture. The current welfare system not only stigmatizes the poor, increasing their isolation, but pushes them into narrowly concentrated neighborhoods clustered around subsidized housing because the system relies on providers who are willing to accept government benefits (e.g., landlords willing to take Section 8 vouchers). Those neighborhoods offer poor schools, few jobs, high crime rates, and a lack of role models. Cash would allow the poor to escape those neighborhoods the same way vouchers and tax credits allow children to escape bad schools.

And, by taking the money away from the special interests that support the welfare industry, it would break up the coalitions that inevitably push for greater spending. (For example, increased food stamp spending is inevitably backed by a coalition of liberal Democrats and farm state Republicans.)

Having consolidated welfare programs as suggested above, Congress should therefore transform as many of those programs as possible to cash grants provided directly to the poor.

Reform the Earned Income Tax Credit

One program that does provide cash directly to the poor is the earned income tax credit (EITC). Moreover, the EITC is specifically designed as a wage supplement. The EITC is tied directly to work and offsets the high marginal tax rate that many poor people encounter when they leave welfare for work. The evidence suggests that the EITC increases work effort. In particular, single mothers have seen significant labor-force gains due to the EITC.

Studies also suggest that the EITC has been more successful than other welfare programs in actually reducing poverty. The Census Bureau suggests that the poverty rate would be 2.5 percent higher in the absence of the EITC and other refundable tax credits. In fact, as measured by the additional outlays needed to lift 1 million people out of poverty (using the supplemental poverty measure), refundable tax credits such as the EITC are clearly more cost effective than other types of welfare programs.

However, as the EITC has grown, problems with the program have become more apparent. First, because the EITC focuses on families, the benefit level for childless workers is small and phases out quickly. The maximum credit available to a childless worker was only $506 in 2016, and all benefits phase out before earned income hits $14,880 (for comparison's sake, the maximum credit for a single parent with one child was $3,373). Childless workers under age 25 are not allowed to claim the EITC at all. As a result, childless adults accounted for only 3 percent of all EITC funding.

Second, as the Tax Policy Center notes, "the EITC imposes significant marriage penalties on some families. If a single parent receiving the EITC marries, the addition of the spouse's income may reduce or eliminate the credit." In some cases, if a single mother eligible for the EITC marries someone with enough earnings to bring them just above the eligibility threshold, then the entire household will no longer receive anything from EITC; if the couple decided to cohabitate and remain unmarried, then they could continue to receive some credit.

Because the credit is mostly determined by the number of children in a family, the maximum credit is the same for a single parent as it is for a married couple with the same number of children. For example, for a married couple with two children, the maximum credit is $5,572 — the same as for a single filer with two children.

It is also useful to look at the breakeven points, the earned income level at which EITC benefits are exhausted. For the same two-child household, the breakeven point for a single parent is $44,648, and for married parents it is only a little higher at $50,198. In essence, the single parent can continue to receive benefits at higher income levels relative to the poverty level than can married couples; and the credit is more generous since the benefits are being distributed among the three people, rather than four, in the household.

Third, as a refundable tax credit, the EITC is paid annually, in the manner of a tax refund. While such a lump-sum payment can certainly help many low-income families, it still leaves those families relying on low wages throughout much of the year. That is, in its current form the EITC represents an income supplement, but not a wage supplement.

Therefore, Congress should reform the EITC to turn it into a pure wage supplement. Benefits should be available to childless adults and should not rise with the number of children in a family. Payments should arrive monthly rather than in an annual lump sum. Any additional cost due to expansion should be paid for by reductions in other welfare programs.

Use the Laboratories of Democracy

Given the failure of more than 50 years of federal welfare policy to significantly reduce poverty or increase economic mobility, it should be apparent that the federal government does not know best. Nor have we demonstrated that we know enough about exactly how to reduce poverty to impose a one-size-fits-all policy everywhere in the country. Five decades of failure should have taught us to be modest.

Wherever possible, therefore, Congress should shift both the funding and operational authority for welfare and other anti-poverty programs to the 50 states. The "laboratories of democracy," as Justice Louis Brandeis described, should be the primary focus of anti-poverty efforts, not an afterthought. That means more than simply giving states the authority to tinker with programs as they exist today. It means federal funding, even in block grant form, should not be accompanied by a large number of federal strings. Instead, states should be given control over broad categories of funding, with the ability to shift funds freely between programs — at their discretion but within a framework in which their efforts are rigorously evaluated and they are held accountable for achieving results. Some states, for instance, may wish to emphasize job training or public service jobs. Others may feel that education provides the biggest bang for the buck. In some states, housing may be a priority; in others, the need for nutrition assistance may be greater. Some states may wish to impose strict eligibility requirements, while others may choose to experiment with unconditional benefits, even a universal basic income.

Moreover, states that have successfully reduced poverty while also reducing the number of people on the welfare rolls, for instance, should be allowed to shift funds to other priorities entirely, such as education or transportation. Success should be rewarded. At the same time, states that fail to achieve results, after accounting for factors beyond their control, should have their funding reduced, with any shortfall made up from state funds. Failure should not be subsidized.

Good and bad examples of block granting can be seen in competing 2016 proposals by House Speaker Paul Ryan (R-WI) and Sen. Marco Rubio (R-FL). In the past, Ryan has proposed giving states a block grant in lieu of 11 current welfare programs. Unfortunately, Ryan's proposal also includes a host of strings, severely limiting the ways in which states may use the money. Rubio authored a better approach: he has called for replacing most current federal welfare programs with a single state-run "Flex Fund," under which states could provide benefits the way they want. Rubio's proposal specifically urges states to replace in-kind programs with cash benefits, although he would leave the final decision up to the states. In fact, the Rubio proposal imposes few mandates on how the states use the money. For example, while Rubio notes the importance of work requirements as a condition for receiving assistance, he would allow states to decide whether or not to impose such restrictions.

Create Standards and Metrics of Success

The lack of federal strings should not mean a lack of accountability. Too often, the federal government defines success in anti-poverty programs by looking at the inputs, such as how many people are enrolled or how much is spent, instead of measuring the effectiveness of the programs and whether they actually help the participants in their pursuit of the American dream. Anecdotes and good intentions are no substitute for evidence. Therefore, designing better outcome measures is central to the goal of making the welfare system more effective in helping people transition out of the programs and avoid becoming mired in long-term poverty.

In some programs, states have been able to utilize exemptions, credits, and other maneuvers to dilute the effectiveness of work requirements; those states end up putting fewer people on the path toward the meaningful work they need to provide for their families. In the applicable programs, shifting from a focus on caseloads to outcome measures that focus on job placements and job retention would incentivize states to help participants move into work and get to the point they no longer need those programs.

Another aspect of refining the metrics used to evaluate implementation and administration in the states is to improve the enforcement mechanisms and better align incentives between states and the federal government. Because of the financing structure of some programs, states have an incentive to shift people to programs that are federally funded and little incentive to improve program performance for jointly funded programs in which financing is based on caseload. Congress should establish a framework that rewards states for effectively helping people transition out of the programs and penalizes them when they fall short of established program goals. Such a framework would encourage states to improve performance and reduce inefficiencies, which would save resources and better serve program recipients.

The tangled web of ineffective programs that make up the current system fails everyone involved: the programs are a waste of taxpayer dollars, and they impose real human costs on participants in the form of material hardship, unrealized potential, and dreams deferred. Without mechanisms in place to better determine whether programs are meeting their goals, more money will be channeled to efforts that could end up being unsuccessful or even counterproductive.

This problem is not confined to welfare programs. One report from the Government Accountability Office found that less than two-fifths of managers throughout the federal government reported that their programs had been evaluated in the last five years. Thoroughly evaluating these programs would help policymakers and researchers determine which programs are effectively meeting their goals. With that information, finite funding could flow to higher-quality programs while those that do not have a meaningful impact could be deemphasized. Evaluations would also help policymakers better understand the unintended adverse consequences that the current structure of the welfare system can sometimes create, such as trapping participant families in poverty.

Using rigorous evaluation and research to guide policy would allow the welfare system to adopt best practices and phase out ineffective programs. Programs that fail to deliver results would no longer continue to be funded year after year without regard for outcomes. In a framework in which states have more flexibility to innovate and tailor their anti-poverty programs to their specific populations, understanding which programs have seen positive results would be even more important.

To date, the War on Poverty has placed intentions above results, and the people most harmed by its failures are the programs' intended beneficiaries. Reforming the welfare system to better align incentives for different levels of government and the participants involved, establishing clearly defined outcome measures that ensure these programs help put people on the path to self-sufficient prosperity, and shifting to a more evidence-based approach will lead to a more effective, responsive system.

Suggested Readings

Harvey, Phil, and Lisa Conyers. The Human Cost of Welfare: How the System Hurts the People It's Supposed to Help. Santa Barbara, CA: Praeger, 2016.

Hughes, Charles. "CBO: Tangled Web of Welfare Programs Creates High Tax Rates on Participants." Cato at Liberty, November 20, 2015.

Tanner, Michael. The Poverty of Welfare: Helping Others in a Civil Society. Washington: Cato Institute, 2003.

---. "The Pros and Cons of a Guaranteed National Income." Cato Institute Policy Analysis no. 773, May 12, 2015.

---. "Twenty Years after Welfare Reform: The Welfare System Remains in Place." Library of Law and Liberty, May 2, 2016.

Tanner, Michael, and Charles Hughes. "War on Poverty Turns 50: Are We Winning Yet?" Cato Institute Policy Analysis no. 761, October 20, 2014.

---. "The Work versus Welfare Trade-Off: 2013." Cato Institute White Paper, August 19, 2013.