State legislators should

• avoid creating special tax treatment for health insurance or medical care; and

• eliminate existing tax preferences for health insurance and medical care while reducing the overall tax burden.

Congress should

• oppose refundable tax credits or other tax preferences or new categories of government spending;

• replace all existing health-related tax preferences with a tax preference for large health savings accounts; and subsequently

• adopt a new tax system that eliminates tax preferences for medical care and any other forms of consumption and reduces tax rates.

Markets are not free simply because we call them “private.” Government can exert as much control over the private sector as the public sector, simply by ordering private individuals and firms to apply their resources toward the government’s goals rather than their own.

Many presume the U.S. health care sector to be a market system because the private sector plays a greater role than in other advanced countries. The fact that the health care sector is more “private” and less “public” than in other nations tells us little about whether the United States has a market system. What matters — what determines real as opposed to nominal ownership, and whether a market is free or unfree — is who controls the nation’s medical resources.

One of the most far-reaching and damaging ways government controls health care is through tax laws. Federal and state governments exempt certain health-related uses of income from income and payroll taxes. In effect, these tax preferences mean government penalizes taxpayers who do not spend their money on the favored goods or services.

Government Penalizes Choice

The largest of these tax preferences is the exclusion of employer-sponsored health insurance from income and payroll taxes. Workers who obtain health insurance through an employer pay no income or payroll tax on the money the employer pays toward the premium, even though that “contribution” is income to them. Under so-called “Section 125” plans, many workers pay no tax on the portion of the premium they pay, either. As a result of the exclusion, federal and state tax codes effectively penalize workers who choose not to enroll in an employer-sponsored health plan; they pay higher taxes than workers who do. In 2016, the revenue loss to the federal government from the exclusion was $342 billion — five and a half times the size of the mortgage-interest deduction. That figure also represents an implicit threat: if employers stop offering coverage or workers stop enrolling in employer plans, workers would effectively have to pay a $342 billion penalty to the federal government.

A worker’s health insurance premium and marginal tax rate determine the value of the tax exclusion, and the concomitant tax penalty it creates, for that worker. In 2015, the average family premium for job-based coverage was roughly $17,000. A worker’s overall marginal tax rate can reach as high as 50 percent or more because it is the sum of her marginal payroll tax rate for Social Security and Medicare (up to 15.3 percent), her marginal federal income tax rate (up to 39.6 percent), and her marginal state income tax rate (up to 13.3 percent).

As a result, the federal tax code effectively penalizes workers thousands of dollars if they choose a health plan other than what their employer offers. After taxes, such workers can end up paying twice as much for less coverage. For 70 years, this hefty penalty has discouraged many workers from seeking insurance on the “individual” market. It is the principal reason more than 80 percent of Americans who have private health insurance get it through an employer.

Featured Project

Making Health Savings Accounts Work for Everyone

Health savings accounts, or HSAs, are tax‐free accounts that let workers control their health care dollars without penalty. Taxpayers with high‐deductible health plans can put money in an HSA, then either save those funds or use them to pay out‐of‐pocket medical expenses, all tax‐free.

At present, health savings accounts free only a small share of workers to control only a small share of those earnings. Congress can restore health care rights and improve health care by making health savings accounts work for everyone.

The Exclusion Is a Form of Government Control, Not a Tax Cut

All targeted tax preferences reduce tax liability for those who engage in the preferred behavior — and therefore create an effective penalty on those who do not. The tax exclusion for employer-sponsored health insurance is even worse. It reduces tax liability only for workers who surrender control over an even larger share of their earnings, and their choice of health plan, to their employer. Equivalently, it threatens workers with a tax penalty of thousands of dollars unless they surrender control over even more money to their employer.

The average employer "contribution" to family coverage is $13,000. Though it may seem counterintuitive, a survey of health economists found 91 percent of them agree that even though the employer writes that $13,000 check to an insurance company, the money comes out of the pockets of workers, not employers. The reason the "employer contribution" actually comes from workers is that employers take the money out of other forms of worker compensation. If employers weren't providing health benefits, they could not keep that money for themselves. Competition for labor from other employers would force them to give that money to workers in the form of higher cash wages or other benefits.

The exclusion can reduce a worker's tax liability by thousands of dollars — but only if she surrenders control over two or more times as much to her employer and lets her employer choose her health plan. If she does not, she pays thousands of dollars more in taxes than she otherwise would. This supposed tax cut literally penalizes workers who want to control their own money.

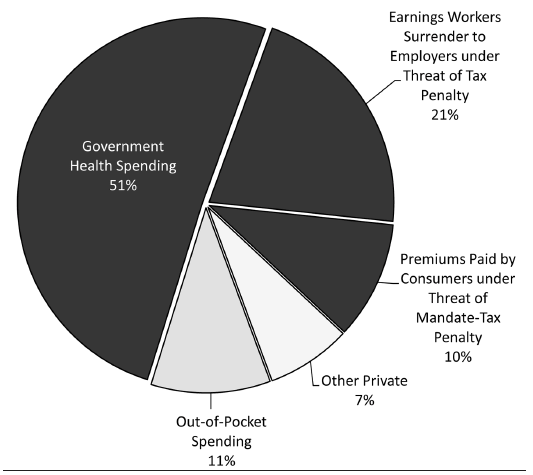

In effect, the tax preference for employer-sponsored insurance gives government control over $707 billion (21 percent) of the $3.6 trillion sloshing around America's health care sector (Figure 37.1). Federal and state tax laws penalize workers unless they surrender control over those earnings to an employer and enroll in coverage subject to government price controls and other regulations.

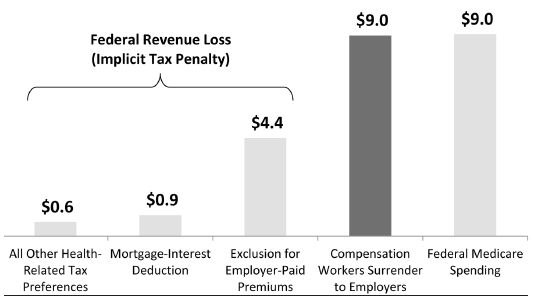

All told, this supposed tax "break" is comparable to the federal Medicare program (see Chapter 38) in terms of how many health care dollars it allows government to control (Figure 37.2).

The employer-sponsored insurance system — which covers 60 percent of Americans and has dominated the market since the 1940s — has more in common with a government program than a market system. In a market system, workers control their health care dollars and choose their own health plan. Under a government program, the government taxes them and uses their money to provide health insurance. Under the tax exclusion, government penalizes workers unless they surrender their health care dollars and choice of health plan to a third party. The United States does not have, and never has had, a private or market-based health insurance system.

Figure 37.1

Sources of Health Care Spending

SOURCE: U.S. Centers for Medicare & Medicaid Services, Table 16 — National Health Expenditures, by Type of Sponsor (2016).

Employer-Sponsored Health Insurance Is Lousy Insurance

The tax exclusion has increased the cost and reduced the quality of health insurance in many ways. First, the exclusion increases health insurance premiums. Though workers pay for their job-based coverage through lower wages, that cost is not salient to them. They feel like they are spending someone else's money. The resulting lack of cost-consciousness causes workers to demand more health insurance than they would if they controlled their own health care dollars. It puts upward pressure on health insurance premiums, which persistently rise faster than wages.

Figure 37.2

Government Control of Health Spending: Tax Exclusion for Employer Coverage vs. Medicare, 2016–2025 (trillions of dollars)

Second, the exclusion increases health care prices. With that additional coverage, workers are — again — insulated from the cost of medical care. This second-order lack of cost-consciousness encourages workers to consume health care that provides little or no benefit and may even harm them. The added demand for medical care puts upward pressure on prices.

Third, the exclusion encourages wasteful and harmful care. Economist Alain Enthoven estimates that "less than 5 percent of the insured workforce can both choose a health plan and reap the full savings from choosing economically." So, when employers try to contain premiums with health plan features that discourage low-value care, such as cost sharing or managed care rules, workers revolt. Duke University professor Christopher Conover estimates the cost of all that additional care exceeded the benefits by $106 billion in 2002 — a hidden tax that is no doubt larger today. The exclusion therefore contributes to estimates that as much as one-third of U.S. health spending is pure waste that does nothing to improve health.

Fourth, the exclusion reduces the quality of coverage by limiting workers' choice of plans. Because of the higher administrative costs of offering multiple plans, 83 percent of employers offer just one, and only 3 percent offer more than two. Even when employees have a choice, the choice is typically between two plans from the same carrier. Economists Mark Pauly, Allison Percy, and Bradley Herring estimate the lack of choice alone imposes costs on workers of somewhere between 5 and 10 percent of premiums.

Fifth, the exclusion reduces the quality of care by inhibiting competition from entities that could potentially offer higher-value ways of financing and delivering health care. Enthoven argues that the exclusion holds back prepaid group practices like Kaiser Permanente, which have shown great promise in providing high-value care at a reasonable cost. Many workers may prefer such plans. The exclusion nevertheless prevents many employers from offering them. Prepaid group plans offer lower premiums in part by providing coverage only through limited networks of doctors and facilities. The exclusion obscures those savings such that they are not salient to workers. Workers therefore resist such plans, which seem to them like nothing but a cut in their compensation (see also Chapter 35).

Worst of all, the exclusion coerces workers into purchasing inherently lousy health insurance. A market system provides long-term protection against the cost of preexisting conditions for those with health insurance and even for the uninsured. As noted in Chapter 35, employer-sponsored insurance disappears when workers move, quit their jobs, get laid off, get fired, or become too sick to work; when their employer goes out of business, stops offering health benefits, or switches health plans; when they divorce or a spouse dies; or when they age off a parent's plan.

Prior to the Patient Protection and Affordable Care Act of 2010 (ACA), workers who lost their employer-based coverage after developing a preexisting condition often could not obtain coverage. Economists Mark Pauly and Robert Lieberthal found that tying health insurance to employment doubled the risk that workers in smaller firms with high-cost medical conditions will end up uninsured, relative to high-cost patients with individual-market coverage. Under the ACA, they still cannot obtain quality coverage. As discussed in Chapter 41, the ACA forces insurers to offer coverage that is increasingly unattractive to the sick and blocks innovations that would make health insurance more affordable and secure.

Employer-sponsored insurance creates the same sort of race to the bottom. Even before the ACA, federal law forbade employer plans to charge enrollees risk-based premiums. Government price controls based on "community rating" punish employers who offer coverage that is attractive to the sick, just as they punish insurers who do so. The adverse selection they create can explain at least part of the gradual erosion in the number of workers covered by, and the comprehensiveness of, employer-sponsored plans.

A market system provides health insurance that stays with the policyholder from job to job and provides long-term protection against preexisting conditions. Federal and state governments penalized that type of insurance for decades, then effectively outlawed it.

The Affordable Care Act: More Taxes and Penalties

The ACA layered even more taxes, tax penalties, regulations, and government subsidies on top of those that had already been reducing the quality of health care while increasing its cost. Most notably, the ACA imposes community rating on all health insurance plans that were not already subject to such price controls. As explained in Chapter 36, the ACA has forced a race to the bottom in health insurance.

The ACA imposes additional taxes and penalties that further tighten the government's control over Americans' health care decisions — whether and where Americans purchase health insurance, and what kind of coverage they purchase. The ACA imposes an individual mandate that penalizes nearly all Americans who fail to purchase a government-defined health plan. If employers fail to provide a minimum level of coverage to employees, the ACA penalizes them $2,000 per worker. If an employer does not hide enough of the cost of that coverage in the form of foregone wages, the ACA penalizes the employer $3,000 per worker. The ACA imposes the penalties on employers, but ultimately they fall on workers themselves. The penalties even harm workers who comply. Economist Casey Mulligan estimates that even if firms comply, this "employer mandate" will depress wages by 1.3 percent for high-skilled workers, and by 3 percent for low-skilled workers.

The ACA imposes a 40-percent "Cadillac tax" on the portion of employer-sponsored health plan premiums that exceed $10,200 for self-only coverage and $27,500 for family coverage. (Thresholds rise each year with inflation.) The ACA originally specified the Cadillac tax would take effect in 2018, but Congress has since delayed its imposition until 2020. By 2028, an estimated 41 percent of small firms and 68 percent of large firms will have premiums that exceed the thresholds and will therefore be subject to the Cadillac tax. Again, even though the ACA levies this tax on employers, workers will ultimately bear the cost.

The ACA offers refundable "premium-assistance tax credits" to taxpayers who purchase coverage through an ACA exchange and have household incomes between 100 percent and 400 percent of the poverty level ($24,300 to $97,200 for a family of four). The ACA's tax credits are not actually tax cuts. Taxpayers pay the same amount to the IRS that they would if these credits did not exist. The ACA just directs the IRS to send the taxpayer's "tax credit" to the taxpayer's insurance company. Moreover, the ACA's tax credits are 94 percent government spending. Taxpayers who receive (if that's the right word) the ACA's tax credits pay only enough in income taxes to offset 6 percent of the funds the IRS sends to their insurance companies on their behalf. The remaining 94 percent comes from other taxpayers.

In sum, with the ACA, tax laws now penalize workers thousands of dollars if they don't surrender control over a signification portion of their earnings to an employer, and again if they surrender control over too little of their earnings. Tax laws further penalize workers if their employer doesn't offer coverage, doesn't offer enough coverage, or offers too much coverage. If their employer doesn't offer coverage, tax laws penalize workers again if they don't obtain coverage, or enough coverage, on their own. One consequence of all these penalties is that the definitions of what coverage taxpayers must purchase to avoid the penalties are enough to give government control over every aspect of "private" health insurance.

Reforming Health Care via the Tax Code

Like government subsidies, targeted tax preferences create waste and inhibit innovation. They encourage taxpayers to spend money on low-value items. They reward producers who provide that which the government favors — and those who lobby for more favors — rather than producers who create something better.

Ideally, government would offer no special tax breaks for health-related expenditures. The purpose of taxes should be solely to raise revenue for government. If the government must impose a tax, it should distort how individuals cast their "dollar votes" as little as possible. Creating special tax breaks for certain types of behavior — and thereby imposing concomitant tax penalties on other behaviors — is just one more illegitimate (yet pervasive) tool governments use to control free people. If politicians want to subsidize an item like medical care, they should raise general taxes and spend the revenue on that item.

Therefore, the ultimate goal of tax-based health care reform should be to eliminate all tax breaks for health-related uses of income, and to tax medical consumption like any other consumption. Consumers should choose for themselves whether, where, and how much health insurance and medical care to purchase. Those decisions should reflect the values of each individual, not the values of special-interest groups and politicians who worm special favors into the tax code.

Eliminating tax breaks can be problematic both in principle and for political reasons. All else equal, eliminating a targeted tax preference brings more revenue into government coffers. If that indirectly causes government spending to rise, then eliminating a targeted tax break can increase government's claim on economic resources. (If instead the added revenue reduces government debt, then it merely shifts the burden of government spending from future taxpayers to current taxpayers.) Eliminating the tax break for employer-sponsored insurance would raise taxes on most U.S. workers by requiring them to pay payroll and income taxes on the value of their health insurance premiums. Workers are therefore likely to resist reforms that merely eliminate health-related tax breaks.

A more sensible approach would eliminate those tax breaks and also reduce payroll and income tax rates to a point where the overall amount of revenue raised remains constant or even falls. Even if overall tax revenues remained unchanged, some individuals would pay less in taxes and others would pay more. The latter group — typically those with the most expensive employer-sponsored health benefits — would still resist reform. In the short term, therefore, it may be politically infeasible to eliminate health-related tax breaks completely.

As a preliminary step, Congress should enact tax reforms that reduce tax-based distortions within the health care sector and prepare consumers and the health care sector to transition to a new tax system with no health-related tax breaks. Congress took a small step in that direction by creating tax-free health savings accounts (HSAs).

Employer contributions to a worker's HSA enjoy the same preferred tax status as employer-paid insurance premiums. As a result, workers do not have to surrender those earnings to their employer to obtain the tax break, and HSAs enable workers to save money for their health care expenses tax free. Taxpayers can also make tax-preferred contributions themselves. HSA funds belong to the individual, follow her from job to job, and grow tax free. Account holders can use HSA funds to purchase qualified medical expenses, tax free, from any source.

Still, HSAs enable workers to control only a small portion of the dollars and decisions that tax laws allow employers to control. HSAs create tax parity only for the funds that account holders contribute to the HSA to cover out-of-pocket medical expenses. If workers want to purchase their own health insurance, generally they must still pay the premiums with after-tax dollars. Only consumers with insurance that meets Congress's rigid definition of a "qualified high-deductible health plan" can make tax-free HSA deposits. HSAs are small comfort to workers whose employer doesn't offer them, or who dislike the one narrow type of health plan Congress permits HSA holders to obtain.

Nevertheless, HSAs present an opportunity to enact reforms that would make health care better, more affordable, and more secure. Congress should take three steps to expand HSAs:

• increase HSA contribution limits dramatically, say, from $3,400 for individuals and $6,750 for families to $9,000 and $18,000;

• remove the requirement that HSA holders obtain a qualified high-deductible health plan, or any type of health plan; and

• allow HSA holders to purchase health insurance, of any type and from any source, tax free with HSA funds.

Replacing all existing health-related tax preferences with one tax break for large HSAs would let workers with family coverage control an average $13,000 of their income that their employer currently controls. It would reduce all tax-code distortions within the health care sector, freeing workers to choose their doctor and their health plans. It would also minimize political resistance to reform.

How Would Large HSAs Work?

For workers who receive family coverage through an employer, the average premium is $17,000 per year, of which the employer pays $13,000 and the worker pays $4,000. With large HSAs, rather than divert $13,000 from the worker's cash compensation to health benefits, the employer would add that amount to the worker's salary. The worker would then decide how much to contribute to her HSA, up to the contribution limit (e.g., $18,000). The tax code would exclude those contributions from both income and payroll taxes, just as it excludes employer-paid health premiums today. The worker could then use her HSA funds to purchase health insurance, of any type, from her employer or another source, tax free. If she likes her employer plan, she could stay put. Or she could choose a policy that stays with her family throughout life's many changes.

With large HSAs, the tax code would no longer distort Americans' decisions about whether to purchase health insurance or save for their medical expenses, where to purchase coverage, or what type of coverage to purchase. Unlike today, the worker would own every dime she spends on coverage and care and would seek out health plans and providers who deliver value for the money.

What Would Large HSAs Do?

Aside from reforming Medicare (see Chapter 38), authorizing large HSAs may be the single most important thing Congress can do to make health care better, more affordable, and more secure. In particular, it may be the single most important thing Congress can do to bring medical care within the reach of the poor.

Each year, large HSAs would shift control over some $707 billion, or 21 percent of total U.S. health care spending, from employers to the workers who earned it. That transfer of power would dramatically transform U.S. health care for the better. Large HSAs would reduce barriers to innovative insurance products. Workers could choose any health plan they like and would become cost-conscious when shopping for insurance in a way they have never been. This dynamic would eliminate the tax code's barriers to prepaid group plans and thereby bring innovations like comparative-effectiveness research, electronic medical records, and coordinated care within the reach of hundreds of millions of Americans. The change would drive down prices by encouraging the growth of retail clinics and removing barriers to reverse deductibles, which have saved consumers thousands of dollars on medical procedures (see Chapter 35). Large HSAs could change the politics of health care by making consumers more conscious of the costs of government regulation.

Large HSAs versus Other Proposals

Large HSAs have distinct advantages over other options for reforming the tax treatment of health care, including a cap on the exclusion, refundable tax credits, full deductibility for all medical spending, and a standard deduction for health insurance. Any reform that achieves tax parity between employer-sponsored health insurance and other forms of insurance (e.g., tax credits, a standard deduction) will cause a certain amount of uncertainty and anxiety. Will healthy workers stay in their employer's health plan? Will premiums for older, sicker workers who remain become unaffordable? If so, competition among employers will return to those workers the $13,000 that employers had been spending on their health benefits — and that will help. There is uncertainty, however, about when workers will get those funds.

The only tax reform that includes a mechanism to return $13,000 immediately to the vast majority of workers is the large HSA. It would therefore do more than other reforms to reduce uncertainty for workers, particularly high-risk workers, and would minimize political opposition to reform. Suppose, for example, Congress legislates that large HSAs will take effect on January 1. When January 1 arrives, the transition for most workers would be seamless. Far in advance of that date, workers would demand, and competition among employers would ensure, that employers would increase workers' annual cash wages by around $13,000 as of January 1. Workers would then decide how much of their earnings to deposit in a large HSA and would use those funds to pay their health premiums. If they wanted to stay with their employer plan, they might not even notice any change.

Large HSAs would minimize political opposition to reform by giving all affected workers a large net tax cut. With contribution limits in the neighborhood of $9,000 and $18,000, nearly all workers could exempt as much income from taxation as they did when their employers were paying their premiums. Only a small and relatively wealthy number of workers have employer-plan premiums that exceed those amounts; those few would have some income that would become subject to income and payroll taxes.

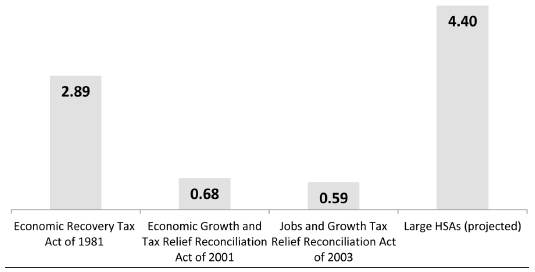

Yet, large HSAs would be an effective tax cut for all workers — even those who would end up paying more to the Internal Revenue Service. Large HSAs would give all workers ownership and control over the first $9,000 or $18,000 of their health care dollars. Returning money to the people who earned it is a tax cut. Over a 10-year period, large HSAs would return to workers $9 trillion of their earnings that current law allows employers to control. As a share of gross domestic product (GDP), that is a larger effective tax cut than the 1981 Reagan tax cuts plus the 2001 and 2003 Bush tax cuts, combined (Figure 37.3). That effective tax cut would totally swamp the relatively small additional tax liability that some high-income workers would have to pay.

Alternative tax reforms would preserve government control and are less politically feasible. Capping the exclusion — which the Cadillac tax will do if Congress ever lets it take effect — neither gives workers ownership of their health care dollars nor achieves parity between job-based and other forms of insurance.

Figure 37.3

Effective Tax Cut from Large HSAs Relative to Previous Tax Cuts: Earnings Returned to Workers as a Percentage of GDP (Four-Year Average)

SOURCE: U.S. Department of the Treasury, U.S. Centers for Medicare & Medicaid Services, and author's calculations.

Health insurance tax credits would preserve the worst features of the ACA. Replacing the exclusion with a uniform tax credit would increase taxes on many workers. Creating a tax credit only for those without access to employer-sponsored insurance (as the ACA does) would increase federal deficits. Either option would threaten to unravel employer-based plans while doing nothing to give workers immediate control of that $13,000, which workers with expensive medical needs would need to weather the changes. Making a tax credit refundable would mimic even more features of the ACA by dramatically increasing both government spending and the overall tax burden. Any refundable health insurance tax credit proposal would simply be a repackaged version of the ACA. It would increase taxes and redistribute income, penalize taxpayers who do not purchase a government-defined health plan, give government as much control over health insurance markets as the ACA does, and suppress innovation.

Full deductibility for all medical spending — as advocated by economists John Cogan, Glenn Hubbard, and Daniel Kessler — would neither give workers ownership of their earnings, nor level the playing field, nor contain the economic distortions due to health-related tax breaks.

A standard deduction for health insurance would dramatically reduce the tax code's influence over consumer decisionmaking. Yet, even that reform would suppress innovation, allow government to control health insurance markets, and do nothing to alleviate the uncertainty about what will become of workers' $13,000 when Congress levels the playing field between employment-based and other forms of insurance. Indeed, that uncertainty may be the most significant (if unacknowledged) obstacle to fundamental tax reform. If Congress attempts fundamental tax reform without first giving workers ownership of that $13,000, and giving consumers time to learn how to navigate health insurance markets, opponents will rail against it and likely succeed in killing the reform. To do so, they need only frighten a small share of the 160 million Americans with employment-based health insurance.

Endgame: Tax Neutrality for Health Care

Large HSAs would allow tax reform to proceed in two steps. First, they would give consumers control of the money that employers now spend on their behalf and would acclimate consumers to making their own health insurance decisions. Consumers are likely to appreciate the option of purchasing health insurance that doesn't disappear when they get sick and lose their jobs.

Second, large HSAs would make it far easier for Congress to transition to a flat, fair, or national sales tax. Congress could enact reform without the obstacle of consumers' anxieties about whether they will be able to keep their health insurance, or whether employers will return to them what is rightfully theirs.

Suggested Readings

Cannon, Michael F. "Health Care's Future Is So Bright, I Gotta Wear Shades." Willamette Law Review 51, no. 4 (Summer 2015): 559-71.

---. "Health Savings Accounts: Do the Critics Have a Point?" Cato Institute Policy Analysis no. 569, May 30, 2006.

---. "Large Health Savings Accounts: A Step toward Tax Neutrality for Health Care." Forum for Health Economics & Policy 11, no. 2 (2008).

Cannon, Michael F., and Michael D. Tanner. Healthy Competition: What's Holding Back Health Care and How to Free It. Washington: Cato Institute, 2007.

Cochrane, John. "Time-Consistent Health Insurance." Journal of Political Economy 103, no. 3 (1995): 445-73.

Mulligan, Casey B. Side Effects and Complications: The Economic Consequences of Health-Care Reform. Chicago, IL: University of Chicago Press, 2015.

Pauly, Mark V., and Robert D. Lieberthal. "How Risky Is Individual Health Insurance?" Health Affairs 27, no. 3 (2008).

Pauly, Mark, Allison Percy, and Bradley Herring. "Individual versus Job-Based Insurance: Weighing the Pros and Cons." Health Affairs 18, no. 6 (1999): 28-44.