State governments should

• eliminate licensing of medical professionals or, as a preliminary step, recognize licenses issued by other states;

• eliminate “corporate practice of medicine” and “certificate of need” laws; and

• direct courts to enforce private contracts in which patients and providers agree upon alternative medical malpractice liability rules.

Congress should

• eliminate states’ ability to use licensing laws as a barrier to entry by medical professionals licensed by other states;

• eliminate the U.S. Food and Drug Administration or, at a minimum, eliminate the FDA’s authority to regulate drug efficacy, and allow other entities to certify safety and efficacy; and

• reject federal medical malpractice reforms.

By any measure, the United States spends more on medical care than any other nation. Health expenditures exceeded $10,000 per person in 2016, for a total of $3.6 trillion. Health care accounts for more than 18 percent of the U.S. economy. The problem with U.S. health care is not how much Americans spend, however. The problem is how little they get in return.

The U.S. health care sector has produced countless innovations that make health care better, more affordable, and more secure. These and further innovations should be exploding across the U.S. health care sector — making primary care more affordable for vulnerable patients such as low-income single mothers and their children, making health insurance more secure for patients with expensive illnesses, and driving high-cost and low-quality providers and insurers out of business. Instead, Americans are suffering under a ridiculously cruel system of high and hidden costs, low-quality and inconvenient care, and shaky health insurance — because government protects high-cost, low-quality providers who would never survive in a market system.

Health care is a special area of the economy, where the right policies can save lives and the wrong policies can do extraordinary and irreversible harm. This chapter provides an introduction to the successes and failures of the U.S. health care sector. It and subsequent chapters then offer reforms that state and federal officials must enact to make health care work for all Americans, particularly the most vulnerable.

Government Control, Government Failure

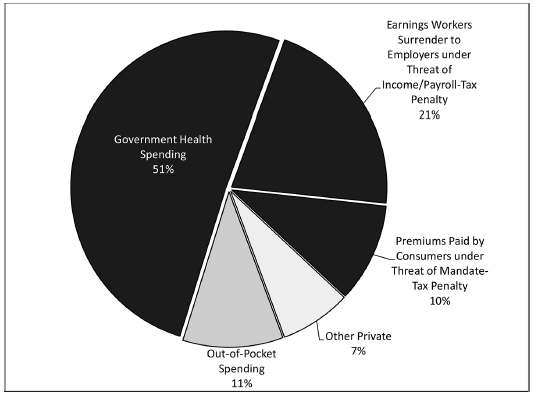

Contrary to popular belief, the U.S. health care sector is no more a free market than other nations' health systems. In the United States, government directly or indirectly controls more than 80 percent of health spending (Figure 35.1). It controls 51 percent ($1.7 trillion in 2016) directly by taxing that money away from the people who earned it. It controls another 21 percent ($707 billion) by penalizing workers unless they surrender control over those earnings to their employers and let their employers choose their health plans. Government effectively controls the 10 percent of U.S. health spending that consumers pay toward private health insurance premiums ($345 billion) by penalizing consumers if they don't purchase a government-designed health plan. At best, consumers control just 10 percent ($350 billion) of U.S. health spending. Yet even that is an overestimate, since patients spend much of this money under terms dictated by government and employers.

Government further dictates what goods and services consumers may purchase, who may provide them, and what the prices will be. These interventions have reduced the quality of care, increased its cost, and made health insurance less secure.

Government Failure: An Epidemic of Low-Quality Care

The United States produces more new medical treatments and diagnostic tools than any other nation. Those innovations go on to improve health outcomes around the world. Open-ended health care subsidies and other government policies may play a role in this success. Even so, Americans suffer from an epidemic of low-quality care.

Figure 35.1

Government Control of Spending on Health Care

SOURCE: U.S. Centers for Medicare & Medicaid Services, Table 16 National Health Expenditures by Type of Sponsor (2016), https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/NationalHealthExpendData/Downloads/Proj2015Tables.zip.

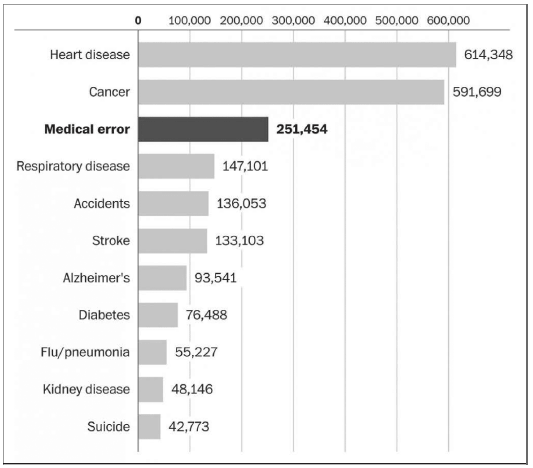

Researchers at Johns Hopkins University estimate that preventable medical errors cause 250,000 deaths annually, or roughly 1 out of every 10 deaths in the United States (Figure 35.2). That means preventable medical errors are the third-leading cause of death, after heart disease and cancer, and the cause of far more annual deaths than firearms (34,000) or a lack of health insurance (45,000 under the highest estimates).

Other examples demonstrate the poor quality of U.S. health care as well. For instance, researchers estimate that fewer than half of all medical interventions have reliable evidence demonstrating their effectiveness. Some estimate the share to be as low as 15 percent. Another example is from the U.S. Food and Drug Administration (FDA): the agency prevents terminally ill patients who have exhausted all approved therapies from accessing promising new treatments. In addition, the health care sector is behind other sectors in providing basic conveniences available in other sectors, like electronic scheduling, records, and communications.

Figure 35.2

Causes of Death in the United States

SOURCE: Washington Post, https://www.washingtonpost.com/news/to-your-health/wp/2016/05/03/researchers-medical-errors-now-third-leading-cause-of-death-in-united-states/, based on data from National Center for Health Statistics and British Medical Journal.

Government Failure: Health Care Costs

Health care prices are high and continue to climb faster than incomes or the overall economy. A typical family health insurance plan, for example, costs $18,142 — nearly a third of median family income ($56,516). Prices for medical services are unnecessarily high and opaque as well.

Countless government interventions increase medical prices and wasteful health care spending. Clinician licensing laws, the tax preference for employer-sponsored insurance, and government health care programs like Medicare, Medicaid, and the State Children's Health Insurance Program all discourage patients from scrutinizing the costs and benefits of the services they receive, encourage providers to raise prices, encourage providers to deliver unnecessary services, and discourage transparent pricing.

On average, only 10 cents out of every dollar Americans spend on health care comes directly from the patient. Patients thus have little to no incentive to scrutinize whether the care they receive is worth the cost, or to demand lower prices. The result is health care prices that are higher than they would be in a market system and unnecessary services that account for an estimated one-third of total spending.

Government Failure: Insecure Access

Thanks to various government interventions, Americans routinely lose their health insurance for no good reason. Americans can lose coverage when they quit their jobs, get laid off, get fired, or become too sick to work; when their employer goes out of business, stops offering health benefits, switches health plans, or changes how much it pays for their benefits; when they divorce or a spouse dies; when they turn 19, or 26, or 65; when they become disabled; when they get arrested; when their income falls, or when their income rises; when their insurer offers coverage attractive to the sick; and when courts or elections reduce or end the taxpayer subsidies propping up their plan. Compounding the insecurity, Americans can lose access to their doctors and other providers because they lose their health plan, because government regulations punish insurers who offer comprehensive coverage, and when courts or elections intervene.

Even when Americans maintain consistent coverage, government erodes their access to care. With the implementation of the Affordable Care Act, the federal government now imposes "community rating" price controls on every health insurance plan in the United States. Community rating forces insurers to offer narrower provider networks and less coverage by punishing carriers who provide attractive coverage to the sick. Government literally creates a race to the bottom in health insurance.

A Market System: Better, More Affordable, More Secure Health Care

It does not have to be this way. Though far from a free market, the U.S. health care sector provides evidence that a market system can deliver better, more affordable, and more secure health care than alternative systems. In corners of the U.S. health care sector where market forces have had room to breathe, they have produced remarkable innovations that protect the most vulnerable patients. These innovations save lives, reduce the burden of disease, get the right medicine to the right patient, reduce medical errors, and make health care easier.

Market Innovation: Prepaid Group Plans

Markets have developed innovative health plans that solve seemingly intractable problems. Unlike most health insurance, prepaid group health plans like Kaiser Permanente and Group Health Cooperative excel on many dimensions of quality where American health care suffers. They provide coordinated care with a single point of payment and accountability. They operate under incentives that encourage them to conduct comparative-effectiveness research and to use that research to guide clinical decisionmaking. They use medical teams to coordinate care. They encourage providers to make medical care safer by making the providers bear the financial costs of medical errors. They offer conveniences like electronic communications, scheduling, and medical records that are ubiquitous in other consumer industries. They even have the capacity to certify and monitor the safety and efficacy of drugs and medical devices in a way that respects the right of patients to choose their own course of treatment.

Integrated, prepaid group plans make health insurance and medical care more affordable. They create incentives to avoid wasteful and harmful care. They also make greater use of midlevel clinicians (e.g., nurse practitioners and physician assistants), who can deliver many services at a lower cost than physicians.

Market Innovation: Affordable Primary Care

Integrated health systems are not the only way market innovations reduce the cost of health care. Innovations in laser-eye surgery, for example, have caused prices to fall even as the quality of those services improves. Other examples include retail clinics, such as CVS's MinuteClinic, that make greater use of nurse practitioners and other midlevel clinicians — much like prepaid group plans — thus reducing prices for primary care visits by an estimated 30 percent.

The growth of ambulatory surgical centers and specialty hospitals provides more evidence that innovations are driving the cost of those services below the prices Medicare sets. Conversely, their growth means Medicare is keeping prices for those services higher than they would be in a market system.

Market Innovation: Reverse Deductibles

Markets have developed insurance features that drive down the prices of common procedures by thousands or even tens of thousands of dollars. One such innovation in insurance design, called "reverse deductibles," makes patients more cost conscious. With reverse deductibles, insurers offer to pay health care providers a fixed amount per procedure, leaving their enrollees to pay 100 percent of the cost of the service above the fixed amount. When consumers face 100 percent of the marginal cost of services, they are much more likely to demand lower prices and switch to lower-cost providers.

In California, reverse deductibles caused prices for colonoscopies to fall by an average of 21 percent, or $360; for knee arthroscopy, more than $1,000 (18 percent); for shoulder arthroscopy, $1,336 (17 percent); and for hip and knee replacements, an average of $9,000 (26 percent). At hospitals that had been charging the most, they caused joint-replacement prices to fall by $16,000 (37 percent).

Market Innovation: Secure Health Insurance

Markets have developed innovative health-insurance products that make access to care more secure and save consumers potentially thousands of dollars. Voluntary health insurance is itself a market innovation. It harnesses the self-interest of policyholders and carriers to provide a sustainable system of subsidies to patients with expensive conditions. After that, markets kept innovating, offering greater protections to the sick and vulnerable.

The federal government's tax preference for employer-sponsored insurance diverts more than 80 percent of Americans with private insurance into employer-sponsored plans, where sick patients can see their premiums skyrocket if they divorce or leave their jobs. By contrast, the individual market that covers the remaining consumers developed protections such as "renewal guarantees" that allow patients with expensive conditions like diabetes, heart disease, or cancer to keep purchasing insurance at standard rates. Guaranteed-renewal health insurance swept the market years before the federal government required that all individual-market policies carry this feature.

Markets developed a further innovation known as "preexisting conditions insurance." This revolutionary product allows uninsured patients who develop expensive conditions to purchase health insurance at standard rates. Premiums for preexisting conditions insurance cost one-fifth the premium for the underlying health insurance policy. That's an 80 percent discount that would save the typical enrollee thousands of dollars. In 2008 and 2009, insurance regulators approved this product for sale in 25 states.

When Congress passed the Patient Protection and Affordable Care Act (ACA) of 2010, markets were close to offering health insurance products with a total-satisfaction guarantee that frees sick patients to fire their insurance companies and choose from other carriers who would compete for their business. The ACA destroyed guaranteed-renewal insurance, preexisting conditions insurance, and any further health insurance innovations.

Government Regulations Cost Lives

The government has kept these and other innovations from making health care better and more affordable for the most vulnerable patients. One example is integrated, prepaid group plans, which markets developed more than 70 years ago. The government has been blocking them — and the cost and quality improvements they offer — for even longer by way of almost countless interventions. Many states enacted laws directly prohibiting prepaid group plans. More broadly, government licensing of clinicians and insurers inhibits prepaid group plans.

Government harms consumers by tilting the playing field in favor of certain ways of organizing and financing health care. The federal government's tax preference for employer-sponsored health insurance and government entitlement programs steer providers and patients away from prepaid group plans and toward fee-for-service payment and nonintegrated providers. Government policies not only inhibit prepaid group plans, which create incentives to reduce medical errors, but Medicare, Medicaid, and the tax preference for employer-sponsored health insurance literally punish providers who save lives by reducing medical errors. These interventions mandate or encourage fee-for-service payment systems where providers receive payment both for the medical error that injures the patient and for the follow-up care to treat that injury. Such payment systems pay providers less when they invest resources in preventing medical errors. In addition, the federal government grants itself a monopoly over certification of the safety and efficacy of new drugs and devices, which denies prepaid group plans yet another competitive advantage. Even where such plans have broken through these barriers, mostly on the West Coast, consumers are still not free to choose them. Federal and state tax laws penalize workers who choose health plans other than those their employer offers.

Day after day, Americans suffer the consequences of a century of mounting government failures. American health care is worse, more dangerous, more expensive, and less secure than a market system would deliver. Helping the most vulnerable patients requires more than repealing "Obamacare." It requires repealing all the barriers government places in the way of better, more affordable, more secure health care. It requires replacing America's dysfunctional government-run health care system with a market system.

Making health care better, more affordable, and more secure requires policymakers to do two things. First, they must return control over the $3.6 trillion America spends on health care to the patients that sector exists to serve — and eventually, leave that money with the workers who earned it. Like all government subsidies and tax preferences, those that separate Americans from their health care dollars inhibit innovation and create wasteful incentives. Second, policymakers must remove regulatory barriers to innovations that could bring better, more secure health care within reach of the most vulnerable patients.

Eliminate Government Licensing of Medical Professionals

Markets make medical care more affordable in large part by allowing less-trained clinicians, such as nurse practitioners and physician assistants, to perform tasks that were once performed only by highly trained physicians, whose services are more expensive. As Harvard Business School professor Clayton Christensen and his colleagues explain, "Many of the most powerful innovations that disrupted other industries did so by enabling a larger population of less-skilled people to do in a more convenient, less-expensive setting things that historically could be performed only by expensive specialists in centralized, inconvenient locations." State licensing of clinicians inhibits that market process.

To practice medicine in a state, physicians, nurse practitioners, physician assistants, and other clinicians must obtain a license from that state. Each state specifies the minimum requirements for each type of license and the tasks each license allows clinicians to perform. That list of tasks is called the clinician's "scope of practice."

Somewhat counterintuitively, groups representing various types of clinicians are constantly lobbying state governments to make these regulations more restrictive, by increasing the minimum requirements to obtain a given license or by limiting scopes of practice. The stated purpose is always to increase the quality of care. But the evidence does not support such claims. For example, when physician groups argue to restrict the scope of practice of nurse practitioners, they argue that a broader scope of practice would threaten patient safety. Yet study after study has shown midlevel clinicians provide a level of quality equal to that of physicians performing the same services. As the American Medical Association, the nation's largest lobbying group representing physicians, grudgingly admitted:

More than 50 journal articles and reports comparing physician and nonphysician services have been reviewed… . These studies almost uniformly conclude that in the particular instances studied, a nonphysician clinician in defined circumstances can provide an acceptable level of care.

Moreover, licensing does little to discipline clinicians who actually harm patients. A study by the consumer watchdog Public Citizen found that between 1990 and 2005, “only 33.26 percent of doctors who made 10 or more malpractice payments were disciplined by their state board — meaning two-thirds of doctors in this group of egregious repeat offenders were not disciplined at all.”

A more plausible explanation than concern for patient welfare is that physicians are trying to protect their incomes. For many services, nurse practitioners and other midlevel clinicians are substitutes for physicians and provide those services at a much lower cost. As noted above, a primary-care visit can cost 30 percent less at a nurse-practitioner-staffed retail clinic than at a physician’s office. When state governments restrict the scopes of practice of midlevel clinicians, or require them to work under a physician’s supervision, it increases demand for physicians and increases physician incomes.

Licensing also enables midlevel clinicians to do the same. Nurse practitioners, for example, compete not only with physicians, but also with physician assistants, registered nurses, and other nurse practitioners. As a result, established nurse practitioners often lobby state governments to restrict entry into their profession (e.g., by imposing greater education requirements on new nurse practitioners) and to restrict the supply of substitutes for nurse practitioners (e.g., by imposing narrower scopes of practice on physician assistants and registered nurses). Each type of regulation increases incomes for existing nurse practitioners. Unfortunately, they also reduce the quality and increase the cost of medical care.

From a static perspective, licensing may do nothing to improve the quality of health care patients receive. Economists generally agree that although licensing increases the quality of medical services actually delivered, it also reduces the quantity of services delivered. But clinician licensing may actually be reducing the quality of care by inhibiting higher-quality forms of health care delivery. As noted earlier, prepaid group plans face unique incentives to make medical care and health insurance more affordable by making greater use of midlevel clinicians. By preventing midlevel clinicians from providing services they are competent to perform, licensing deprives such plans of a key competitive advantage. Licensing further inhibits such plans from spreading to additional states by requiring them to develop different work flows that conform to each state’s ever-changing scope-of-practice rules for midlevel clinicians. Physicians have consciously used licensing to block competition from integrated delivery systems and prepaid health plans, because such delivery systems allow physicians less autonomy and are generally less remunerative.

Reform: Repeal Medical Licensing

Mere tinkering cannot fix the problems inherent in medical licensing. Whether the licensing authority is a legislature or regulatory agency — state or federal — there is no way to insulate it from influence by those whose incomes hang in the balance. Even if there were no threat of the regulated professions capturing the agency’s power and enriching themselves at the expense of consumers, government is inherently unable to strike the proper balance between access and safety for millions of patients across billions of medical encounters. Such an authority would inevitably restrict access to care and block innovations that make medicine better, more affordable, and more secure. Medical licensing adds little if anything to the protections that medical malpractice liability and market forces already offer patients. State governments should eliminate it.

Many things would not change. Hospitals, health plans, and other organizations would continue to rely on board certification, private credentialing organizations, and their own internal processes to evaluate the competence of clinicians. Courts would continue to hold health care organizations and individual clinicians accountable for harm caused by negligence.

What would change is that providers would seek innovative ways to use midlevel clinicians to bring quality care within reach of more low-income Americans. Demand for private credentialing and the desire to protect brand names and reputations would do even more to safeguard patients from incompetent providers. Greater competition between different delivery and payment systems would drive the medical marketplace toward providing better health care to more Americans at a much lower cost.

Interim Reform: Stop Licensing from Blocking Interstate Commerce

If it is politically infeasible to eliminate medical licensing, policymakers can stop licensing laws from acting as a barrier to entry by clinicians licensed by other states. States should enact “good Samaritan” laws like those enacted in Tennessee, Illinois, Connecticut, and Missouri. Volunteer groups such as Remote Area Medical have had to turn away patients or cancel free clinics in California, Florida, and Georgia because those states’ licensing laws did not allow clinicians licensed by other states to give away free care. “Before Georgia told us to stop,” said Remote Area Medical founder Stan Brock, “we used to go down to southern Georgia and work with the Lions Club there treating patients.” Missouri finally changed its laws after they prevented visiting optometrists from giving away free eyeglasses to residents devastated by a tornado that struck Joplin, Missouri. Visiting clinicians would still be liable for malpractice under the laws of the patient’s state, or the contractual liability rules the patient and clinicians agree to honor (see below).

Licensing laws also create a barrier to interstate “telemedicine.” In effect, they deny patients access to top specialists around the country and force patients to settle for whatever specialists happen to be licensed in their state. States can give rural and other patients access to top specialists by recognizing the licenses of telemedicine providers licensed by other states, or by redefining the location of care from the location of the patient to the location of the provider, where the provider already holds a license.

States could use such laws as a step toward recognizing all clinician licenses issued by other states. Congress could also use its power under the Commerce Clause to require states to recognize medical licenses issued by other states or, in a more narrow fashion, to recognize the licenses of clinicians providing charitable care or to redefine the location of care to be that of the clinician.

Medical Facilities

Another way markets might make medical care better, cheaper, and safer is through rigorous competition among medical facilities, including retail and other clinics, physician offices, urgent care clinics, ambulatory surgical centers, specialty hospitals, and general hospitals. State laws that require government approval of new medical facilities are a leading barrier to competition between medical facilities.

Many states impose laws requiring hospitals, nursing homes, and even physician offices to obtain a “certificate of need” (CON) from a state planning agency before opening a new facility or investing in new equipment. The rationale is that by restraining the supply of hospital beds, the government could restrain medical spending. In 1976, the federal government mandated CON planning nationwide.

CON laws failed to slow the growth of medical spending. In a survey of the empirical literature on CON laws, health economist Michael Morrisey writes that those studies “find virtually no cost-containment effects… . If anything, CON programs tended to increase costs.” The failure of CON laws to achieve their stated aims led the federal government to lift its CON-planning mandate in 1987 and led many states to eliminate their laws also. Yet other states have maintained and even expanded their CON requirements.

Nor do they appear to have increased the quality of care. Examining cost and outcomes data for coronary artery bypass grafts, economists Vivian Ho and Meei-Hsiang Ku-Goto found, “CON regulations … may not be justified in terms of either improving quality or controlling cost growth.” Physician-economist Daniel Polsky and colleagues found laws imposing CON on home-health agencies have “negligible” effects on quality or costs.

Incumbent-Veto Laws

Perhaps because CON laws have done nothing to contain spending, they have been a boon for incumbent health care providers. CON laws protect existing health care facilities from competition. Morrisey explains:

A reasonably large body of evidence suggests that CON has been used to the benefit of existing hospitals. Prices and costs were higher in the presence of CON, investor-owned hospitals were less likely to enter the market, multihospital systems were less likely to be formed, and hospitals were less likely to be managed under for-profit contract… . The continued existence of CON and, indeed, its reintroduction and expansion despite overwhelming evidence of its ineffectiveness as a cost-control device suggest that something other than the public interest is being sought. The provider self-interest view is worthy of examination.

Indeed, when new entrants apply for certificates of need, incumbent hospitals and other providers object the loudest. Law professor Sallyanne Payton and physician Rhoda M. Powsner explain that although the stated rationale of CON laws is to reduce health care spending, this claim “has diverted attention from the actual economic and political imperatives that led to and presently sustain certificate-of-need regulation. To attribute CON legislation to [cost-reduction] is to mistake a convenient theoretical justification for an actual motivation.”

Reform: Repeal Incumbent-Veto Laws

CON laws increase health care costs without improving quality. They deny patients the benefits of new forms of health care delivery. There is no justification for them, and no place in a market economy for Soviet-style economic planning. States should eliminate CON laws immediately. State officials concerned about runaway health expenditures should reduce or eliminate the government subsidies that fuel such spending. (See Chapters 4 and 39.)

Pharmaceutical Regulation

In response to drug-related poisonings that killed over 100 children, Congress enacted the Food, Drugs, and Cosmetics Act of 1938. The act requires pharmaceutical manufacturers to demonstrate to the federal government that their products are safe. Originally, if the federal government did not reject the application within 180 days, the firm could proceed to market its product.

Another drug-related tragedy occurred when pregnant women taking the tranquilizer thalidomide gave birth to children with severe deformities. Thalidomide victims numbered over 10,000 worldwide. Relatively few were in the United States, as the FDA had not yet approved thalidomide for marketing. Congress nevertheless responded to this tragedy by enacting the 1962 amendments to the Food, Drugs, and Cosmetics Act. Since then, firms have had to prove to the FDA’s satisfaction that their products are efficacious for the indication for which approval is sought and to obtain an affirmative approval from the FDA before marketing a new drug. Congress subsequently imposed similar regulations on new medical devices.

Table 35.1

FDA’s Information Problem

| FDA Decision | Helpful Drug | Harmful Drug |

| Approve | Patients benefit. | Patients suffer. Patients and the public can trace injury to FDA officials. |

| Delay/reject | Patients suffer. Patients and the public cannot trace injury to FDA officials. |

Patients benefit. |

NOTE: FDA — Food and Drug Administration.

You Can’t Fix the FDA

The FDA faces an inherent information problem that inevitably leads to unnecessary patient suffering and death. Massachusetts Institute of Technology economist Ernst Berndt and colleagues describe the fundamental tension confronting the FDA or any organization certifying the safety and effectiveness of new products: “A central tradeoff facing the FDA involves balancing its two goals — protecting public health by assuring the safety and efficacy of drugs, and advancing the public health by helping to secure and speed access to new innovations.”

There are two ways the FDA helps patients, and two ways it can harm them. It helps patients when it approves beneficial drugs and blocks harmful drugs. It harms patients when it approves harmful drugs (a “Type I error”) and delays or rejects the approval of beneficial drugs (a “Type II error”). The tradeoff between Type I and Type II errors — that is, between the number of harmful drugs the FDA approves and the number of beneficial drugs it delays or rejects — is unavoidable. Reducing the number of harmful drugs approved (Type I errors) requires higher standards of evidence, more testing, more time, and more expense — all of which harm other patients, because those requirements necessarily increase the number of beneficial drugs that the FDA delays or rejects, or that drug manufacturers never develop (Type II errors). Conversely, reducing the number of beneficial drugs delayed or rejected (Type II errors) requires lowering those barriers to market entry, which inevitably leads to the approval of more harmful drugs (Type I errors).

Both Type I and Type II errors can cause suffering and death. As Table 35.1 illustrates, however, there is a very important difference between the two from the FDA’s perspective. The political system penalizes FDA officials when a patient dies from a harmful drug the officials approved, but it far less often penalizes them when a patient dies because they delayed or blocked a beneficial drug.

• Type I errors bring swift and certain retribution down on agency officials because the victims are easily identifiable. When an FDA-approved drug injures or kills patients (Type I error), patients and the public can trace those injuries to the FDA’s decision. The victims, their loved ones, the media, and Congress can discipline FDA officials for approving a harmful product. FDA officials know Type I errors lead to congressional hearings, public disgrace, and possibly even the end of their careers.

• In contrast, FDA officials typically face no consequences for Type II errors. Delaying or blocking beneficial drugs harms patients no less than approving unsafe drugs. But victims of Type II errors are much harder to identify, because it appears that the disease, not the FDA, killed them. Typically, neither the victims, nor their loved ones, nor FDA officials can identify which patients an unapproved but beneficial drug might have helped. The patients and their families may never have heard of the drug. Indeed, the high cost of winning FDA approval can deter companies from even developing new, potentially beneficial, drugs. Since it is typically impossible to trace the suffering and death of these patients to the actions of FDA officials, it is impossible to hold those officials accountable for this type of harm.

This fundamental information asymmetry means the political system can only discipline FDA officials when their decisions cause patients to suffer or die from Type I errors; it cannot discipline FDA officials when their decisions cause patients to suffer and die from Type II errors. Dr. Henry Miller, a former FDA official, describes how this information asymmetry affects the decisions of FDA officials:

In the early 1980s, when I headed the team at the FDA that was reviewing the [new drug application] for recombinant human insulin, the first drug made with gene-splicing techniques, we were ready to recommend approval a mere four months after the application was submitted (at a time when the average time for [new drug application] review was more than two and a half years)… . My supervisor refused to sign off on the approval — even though he agreed that the data provided compelling evidence of the drug’s safety and effectiveness. “If anything goes wrong,” he argued, “think how bad it will look that we approved the drug so quickly.”… The supervisor was more concerned with not looking bad in case of an unforeseen mishap than with getting an important new product to patients who needed it.

This information problem leads FDA officials to support policies that increase morbidity and mortality. Suppose FDA officials were considering a new regulation that would prevent an estimated 1,000 deaths by blocking harmful drugs but would slow down the approval of new drugs such that 10,000 patients would die while waiting for life-extending drugs that otherwise would have been approved. Such a regulation would result in 9,000 additional deaths. FDA officials would nevertheless approve and implement it. In a perverse way, that decision makes sense. If FDA officials do not adopt the regulation, Congress and the public will hold them accountable for letting 1,000 patients die. If they do adopt it, Congress and the public will not — cannot — hold them accountable for letting 10,000 people die.

Every effort to quantify the costs and benefits of FDA regulation supports the conclusion that the FDA values some lives more than others. Tulane University economist Mary K. Olson estimates that when additional revenue from user fees enabled the FDA to review drugs more quickly, the health benefits of quicker access to new drugs were roughly 12 times greater that the costs from additional adverse drug reactions. In other words, the FDA was inflicting 12 times as much harm on patients through Type II errors as it was sparing patients by avoiding Type I errors.

University of Chicago economist Tomas Philipson and colleagues found that quicker reviews brought significant health benefits, but “did not, in fact, have any effect on drug safety.” This finding implies the FDA will inflict additional deaths due to Type II errors even if doing so produces no reduction in deaths due to Type I errors. (Indeed, despite such research, many in Congress have sought to give the FDA additional powers to reduce Type I errors.)

A Better Way of Certifying and Monitoring Drugs and Medical Devices

Little is to be gained from minor FDA reforms such as adjusting user fees. The FDA’s information problem guarantees that the agency will always value some lives more than others and tolerate unnecessary suffering and death. Fortunately, there is a voluntary, market-based alternative that does not suffer from the FDA’s information problem and that respects the right of patients to make their own medical decisions.

Nobel prize–winning economist Gary Becker advocated eliminating the FDA’s efficacy standard and returning the FDA to the status quo ante 1962, when the FDA had the power only to block drugs it believed to be unsafe. That would be worth doing. The evidence strongly suggests that eliminating the efficacy standard would reduce so much morbidity and mortality by reducing Type II errors that those gains would swamp the increase in Type I errors. The problem, of course, is the increase in Type I errors. So long as there exists a government agency whose purpose is to protect patients from harmful drugs, then agency officials, the public, and Congress will always respond to Type I errors by trying to increase the barriers to new drugs. If enough Type I errors subsequently occurred, then Congress would likely reinstate the efficacy standard, even if doing so would cost lives. Congress or the FDA could also eliminate any gains by increasing the amount of testing required to establish safety. Such will always be the incentives of politicians or a government agency charged with ensuring drug safety and efficacy.

Congress would do better to eliminate any role for the FDA in certifying the safety and efficacy of drugs. Economist Sam Peltzman argues that even the safety requirement delivers more harm than benefit. Another Nobel prize–winning economist, Milton Friedman, proposed eliminating the FDA entirely.

Eliminating the efficacy standard would increase patient demand for private certification of safety and efficacy, which currently exists only informally. (Economist J. Howard Beales III found that the U.S. Pharmacopeia Drug Information certified newly discovered uses of approved drugs — so-called “off-label uses” — an average of two and one-half years sooner than the FDA.) The threat of liability for harmful products would create powerful incentives for pharmaceutical manufacturers to conduct appropriate testing and seek private certification.

In a market system, health plans like Kaiser Permanente and Group Health Cooperative could provide safety and efficacy certification, which the FDA now monopolizes. Integrated, prepaid group plans are uniquely capable of performing these functions. Prepaid group plans already lead the industry in effectiveness research and the use of electronic medical records, which are essential to tracking accurately a drug’s effects on patients. When the FDA wanted to determine whether the pain reliever Vioxx was causing heart attacks, the agency could not conduct that research itself. It turned to Kaiser Permanente of Northern and Southern California.

Prepaid group plans internalize the costs of wasteful and harmful care and would therefore face strong incentives not to approve unsafe or ineffective drugs. At the same time, different plans would cater to different risk preferences by applying different approval requirements. Each plan’s reputation for quality (and ability to attract enrollees) would depend on the perceived value of its seal of approval.

Health plans like Kaiser Permanente and Group Health Cooperative could do the FDA’s job better than the FDA. Congress prohibits the FDA from considering cost-effectiveness as a criterion for approval. In contrast, prepaid group plans face financial incentives to ensure that their enrollees receive maximum value for their money. They could condition their seal of approval on whether a drug provides benefits that are worth the cost. The FDA’s ability to monitor a drug ends after approval. Prepaid group plans could continue to monitor safety and efficacy post-approval and could more quickly detect adverse drug reactions.

Perhaps most important, market-based certification would save more lives by striking a better balance between Type I and Type II errors. Unlike the FDA, private health plans could not block drugs from the market. Market-based certification respects the freedom of doctors and patients to make treatment decisions according to individual circumstances. It also provides them with information more quickly than government certification. Patients within or outside of such plans would rely on whichever plan’s seal of approval fit their own risk preferences.

The first step toward reforming the regulation of drugs and medical devices may be to eliminate the barriers that Congress and state legislatures have erected to integrated, prepaid group plans. (See above, and Chapters 36, 37, and 38.) Concurrently, Congress could allow alternative ways of certifying the safety and efficacy of medical products by granting marketing approval to products approved by other countries’ regulatory bodies. The next step would be to eliminate either the efficacy standard or the FDA entirely. Either would save lives, on balance, because patients would get quicker access to more beneficial new drugs. While patients would also have quicker access to harmful drugs, two factors make that unfortunate effect tolerable. First, more patients would benefit — more patients would live — thanks to greater innovation and quicker access to helpful drugs than would suffer as a result of harmful drugs. Second, eliminating either the efficacy standard or the FDA itself would lead to greater skepticism of new drugs by doctors and patients. Finally, innovations by prepaid group plans and others would more quickly detect and stop adverse drug reactions.

Medical Liability Reform

The right to sue health care providers for medical malpractice is an important tool for protecting patients from injury due to negligent care. Patients typically have little information about the quality of care. To the extent the medical malpractice “system” imposes the costs of negligent care on providers, it aligns the incentives of providers with those of patients.

Nevertheless, many people complain — with some justification — that the medical malpractice liability system in the United States performs poorly. Research suggests malpractice liability does little to discourage negligent care, that only a small fraction of patients injured by provider negligence actually recover damages from providers, and that many who do recover are not victims of negligence. Many specialists (neurosurgeons and obstetricians, to name two) report that they cannot afford the rising cost of medical liability insurance. Duke University professor Christopher Conover estimated that in 2002, the U.S. medical liability system cost Americans $81 billion more than it produced in benefits. Physicians and other providers — who have seen often-dramatic increases in malpractice insurance premiums — have intermittently declared the medical liability system to be in “crisis” for over 30 years.

This “crisis” has spawned numerous proposals to reform medical malpractice liability rules, including a nationwide cap on noneconomic damages similar to the $250,000 cap California imposes. Other proposals include legislative limits on contingency fees for plaintiffs’ attorneys; “no-fault” compensation systems for medical injuries, such as the limited programs adopted in Florida and Virginia; alternative forms of dispute resolution, such as arbitration and special medical courts; the English rule of costs; and reform of the collateral source rule.

Each of these reforms would leave some patients better off — typically by reducing prices for medical care — at the cost of leaving other patients worse off. So-called “loser pays” reforms often reallocate the costs of frivolous lawsuits to the correct party. However, that rule deters less affluent patients from seeking legal redress for legitimate grievances. A cap on noneconomic damages would reduce health care costs for noninjured patients, but at the expense of leaving some injured patients with uncompensated losses. Limits on contingency fees would reduce costs for noninjured patients, but at the cost of denying compensation to injured patients whose cases plaintiffs’ attorneys deem too expensive to pursue. Perhaps most important, any reduction in provider liability potentially jeopardizes patient safety by reducing the incentives for providers to avoid negligent care.

Many Republicans want Congress to enact a nationwide set of limits on malpractice liability. As discussed in Chapter 15, the U.S. Constitution does not authorize Congress to impose substantive rules of tort law on the states. Though the federal government may enact technical procedural changes to tort law, state legislatures are the proper venue for correcting excesses in their civil justice systems. The fact that medical professionals can avoid states with inhospitable civil justice systems gives them significant leverage when advocating state-level medical liability reforms and gives states incentives to enact such reforms. Indeed, many states have.

Yet state-imposed medical malpractice reforms share two flaws with federally imposed rules. As noted earlier, imposing one set of limits on the right to sue for medical malpractice on all patients and providers will help some patients but hurt others. Codifying those rules makes removing harmful ones extremely difficult.

A more patient-friendly and liberty-enhancing approach would allow patients and providers to write their own medical malpractice reforms into legally enforceable contracts. For cases of ordinary negligence, patients could choose the level of protection they desire, rather than have a uniform level of protection (and the resulting price) imposed on them by the government. Providers could offer discounts to patients who agree to limits on compensation in the event of an injury. Patients who don’t agree could pay the nondiscounted price or seek a better deal from another provider. Insurance companies could facilitate such contracts on behalf of their enrollees. Those companies would have strong incentives to ensure that such contracts provide adequate protection; otherwise, the insurers could face higher claims from injured patients who could not collect the full extent of their damages. Regular tort rules would continue to apply in cases where patients and providers did not contract around them, where patients were subject to duress, or where providers were guilty of intentional wrongdoing or reckless behavior.

Freedom of contract would make medical care more affordable to many low-income patients. It would also enhance quality competition. Providers who know they are less likely to injure patients could offer more expansive malpractice protections or equivalent malpractice protections at a lower cost. Low-quality providers would not be able to do the same and would face strong financial incentives to improve their processes of care.

Such contracts are not possible today because courts have invalidated them as “contracts of adhesion” or “against public policy.” The refusal to honor those contracts restricts the freedom of adults to make mutually beneficial exchanges that hurt no one else. It also increases the cost of providing medical care to the poor, which has undoubtedly reduced their access to care. To remedy this costly restriction on liberty, courts should abandon their current policy and enforce contractual limitations on the right to sue for medical malpractice. If courts refuse, state legislatures should require them to do so. Economist Richard Thaler and law professor Cass Sunstein write:

In our view, state lawmakers should think seriously about increasing freedom of contract in the domain of medical malpractice, if only to see whether such experiments would reduce the cost of health care without decreasing its quality. Increasing contractual freedom won’t solve the health care crisis. But it might well help — and in this domain every little bit of help counts.

As noted earlier, the medical malpractice system does a poor job of providing relief to injured patients, preventing frivolous lawsuits, or discouraging negligence. The remedies for these shortcomings are not obvious. A dynamic marketplace that allows parties to experiment with — and abandon — different malpractice rules is the quickest and surest way to find those solutions.

Conclusion

Sixty years ago, before Congress enacted the Affordable Care Act, State Children’s Health Insurance Program, or even Medicare and Medicaid, Milton Friedman made a prediction — if the government stopped interfering in the market for medical care, markets would develop the very innovations that central planners are now struggling to create:

Suppose that anyone had been free to practice medicine without restriction except for legal and financial responsibility for any harm done to others through fraud and negligence. I conjecture that the whole development of medicine would have been different. The present market for medical care, hampered as it has been, gives some hints of what the difference would have been. Group practice in conjunction with hospitals would have grown enormously. Instead of individual practice plus large institutional hospitals conducted by governments or eleemosynary institutions, there might have developed medical partnerships or corporations — medical teams. These would have provided central diagnostic and treatment facilities, including hospital facilities. Some presumably would have been prepaid, combining in one package present hospital insurance, health insurance, and group medical practice. Others would have charged separate fees for separate services. And of course, most might have used both methods of payment.

These medical teams — department stores of medicine, if you will — would be intermediaries between the patients and the physician. Being long-lived and immobile, they would have a great interest in establishing a reputation for reliability and quality. For the same reason, consumers would get to know their reputation. They would have the specialized skill to judge the quality of physicians; indeed, they would be the agent of the consumer in doing so, as the department store is now for many a product. In addition, they could organize medical care efficiently, combining medical men of different degrees of skill and training, using technicians with limited training for tasks for which they were suited, and reserving highly skilled and competent specialists for the tasks they alone could perform. The reader can add further flourishes for himself, drawing in part, as I have done, on what now goes on at the leading medical clinics.

Since then, state and federal governments have unfortunately and dramatically increased government’s footprint in the health care sector, making these innovations seem more elusive than ever. Reformers who want better health care for the most vulnerable patients should consider the reforms in this and subsequent chapters.

Suggested Readings

Abelson, Reed. “UnitedHealth to Insure the Right to Insurance.” New York Times, December 2, 2008.

Arrow, Kenneth J. “Uncertainty and the Welfare Economics of Medical Care.” American Economic Review 53, no. 5 (1963): 941–73.

Cannon, Michael F. “Ascertaining Costs and Benefits of Colonoscopy More Difficult than the Procedure Itself.” JAMA Internal Medicine 176, no. 8 (2016): 1055–56.

—. “A Better Way to Generate and Use Comparative-Effectiveness Research.” Cato Institute Policy Analysis no. 632, February 6, 2009.

—. “Health Care’s Future Is So Bright, I Gotta Wear Shades.” Willamette Law Review 51, no. 4 (Summer 2015): 559–71.

—. “Reforming Medical Malpractice Liability through Contract.” Cato Institute Working Paper no. 3, November 12, 2010.

—. “Yes, Mr. President: A Free Market Can Fix Health Care.” Cato Institute Policy Analysis no. 650, October 21, 2009.

Cannon, Michael F., and Michael D. Tanner. Healthy Competition: What’s Holding Back Health Care and How to Free It. Washington: Cato Institute, 2007.

Christensen, Clayton M., Richard Bohmer, and John Kenagy. “Will Disruptive Innovations Cure Health Care?” Harvard Business Review (September-October 2000).

Cochrane, John H. “Health-Status Insurance: How Markets Can Provide Health Security.” Cato Institute Policy Analysis no. 633, February 18, 2009.

Conover, Christopher J. “Health Care Regulation: A $169 Billion Hidden Tax.” Cato Institute Policy Analysis no. 527, October 4, 2004.

Epstein, Richard A. “Medical Malpractice: The Case for Contract.” American Bar Foundation Research Journal 87, no. 1 (1976).

Friedman, Milton. “Occupational Licensure.” Chap. 9 in Capitalism and Freedom. Chicago, IL: University of Chicago Press, 1962.

Morrisey, Michael. “State Health Care Reform: Protecting the Provider.” In American Health Care: Government, Market Processes, and the Public Interest, edited by Roger Feldman. New Brunswick, NJ: Transaction, 2000.

Olson, Mary K. “Are Novel Drugs More Risky for Patients than Less Novel Drugs?” Journal of Health Economics 23, no. 6 (2004).

—. Regulation and the Natural Progress of Opulence. Washington: AEI Press, 2005.

Philipson, Tomas J., Ernst R. Berndt, Adrian H. B. Gottschalk, and Matthew W. Strobeck. “Assessing the Safety and Efficacy of the FDA: The Case of the Prescription Drug User Fee Acts.” National Bureau of Economic Research Working Paper no. 11724, October 2005.

Robinson, James C. “Comparison Shopping for Knee Surgery.” The Wall Street Journal, October 27, 2013.

Starr, Paul. The Social Transformation of American Medicine. New York: Basic Books, 1984.

Svorny, Shirley. “Could Mandatory Caps on Medical Malpractice Damages Harm Consumers?” Cato Institute Policy Analysis no. 685, October 20, 2011.

—. “Medical Licensing: An Obstacle to Affordable, Quality Care.” Cato Institute Policy Analysis no. 621, September 17, 2008.

Thaler, Richard H., and Cass R. Sunstein. “Should Patients Be Forced to Buy Lottery Tickets?” Chap. 14 in Nudge: Improving Decisions about Health, Wealth, and Happiness. New Haven, CT: Yale University Press, 2008.

Whitman, Glen. “WHO’s Fooling Who? The World Health Organization’s Problematic Ranking of Health Care Systems.” Cato Institute Briefing Paper no. 101, February 28, 2008.

Whitman, Glen, and Raymond Raad. “Bending the Productivity Curve: Why America Leads the World in Medical Innovation.” Cato Institute Policy Analysis no. 654, November 18, 2009.