32. Cutting Federal Spending

Congress should

• cut federal spending from 21 percent of gross domestic product to less than 18 percent to balance the budget and begin paying down the debt;

• terminate damaging programs, such as farm subsidies and corporate welfare;

• privatize activities that can be funded in the marketplace, such as postal services, passenger rail, electric utilities, and air traffic control;

• phase out aid-to-state programs, including those for education, housing, transportation, and welfare;

• cut traditional Social Security benefits and replace them with private retirement accounts;

• move to a Medicare system based on individual savings, competition, and choice;

• convert Medicaid to a block grant and cap spending growth; and

• repeal the Affordable Care Act.

Federal government spending is rising, deficits are chronic, and accumulated debt is reaching dangerous levels. Growing spending and debt are undermining economic growth and may push the nation into a financial crisis in coming years. The solution to these problems is to downsize every federal department by cutting the most harmful and unneeded programs. This chapter proposes specific cuts that would balance the budget and reduce projected spending by almost one-quarter within a decade.

Over recent decades, the federal government has expanded into many areas that should be left to state and local governments, businesses, charities, and individuals. That expansion is sucking the life out of the private economy and creating a top-down bureaucratic society that is alien to American traditions.

Federal spending cuts would revive growth by shifting resources from lower-valued government activities to higher-valued private ones. Cuts would also enhance civil liberties by dispersing power away from Washington. And cuts would help reduce the number of costly regulations that are imposed as part of spending programs.

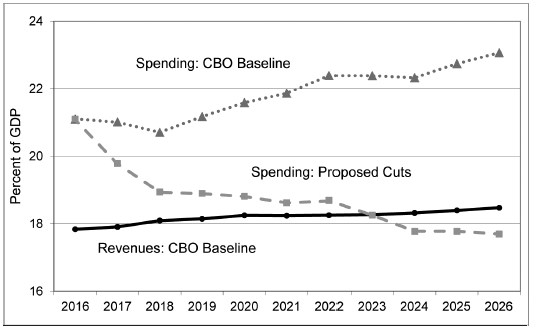

The Congressional Budget Office (CBO) projects that federal spending will rise from 21.1 percent of gross domestic product (GDP) this year to 23.1 percent by 2026 under current law. Over the same period, tax revenues will rise more modestly, reaching 18.5 percent of GDP in 2026. As a consequence, rising spending will produce increasingly large deficits.

Policymakers should change course. They should cut spending and eliminate deficits. The plan presented here would balance the budget over time and generate growing surpluses. Spending would be reduced to 17.7 percent of GDP by 2026, or almost one-quarter less than the CBO projection for that year.

Some economists claim that cutting government spending would hurt the economy, but that notion is based on faulty Keynesian theories. In fact, spending cuts would shift resources from often mismanaged and damaging government programs to more productive private activities, thus increasing overall GDP. Markets have mechanisms to allocate resources to high-value activities, but the government has no such capabilities.

It is true that private businesses make many mistakes, but entrepreneurs and competition are constantly fixing them. By contrast, federal agencies follow failed and obsolete approaches decade after decade. That is why moving resources out of the government would be a net gain for the overall economy.

Policymakers should not think of spending cuts as a necessary evil to reduce deficits. Rather, the federal government's fiscal mess is an opportunity to implement reforms that would spur growth and expand freedom. The plan proposed here includes a menu of possible spending reforms. These and other reforms are discussed further at DownsizingGovernment.org.

Spending Cut Overview

The starting point for a spending cut plan is the CBO's baseline budget projections. Figure 32.1 shows CBO projections from August 2016 for revenues (solid line) and spending (dotted line) as a percentage of GDP. The gap between the two lines is the federal deficit, which is expected to grow steadily without reforms.

Figure 32.1

Projected Federal Revenues and Spending, Percentage of GDP

SOURCE: Author's calculations.

The dashed line shows projected spending under the reform plan proposed here. Under the plan, spending would decline from 21.1 percent of GDP in 2016 to 17.7 percent by 2026. The deficit would be eliminated by 2023, and growing surpluses would be generated after that. Spending cuts would be phased in over 10 years and would total $1.5 trillion annually by 2026, including reduced interest costs.

Falling spending and deficits would create budget room for tax reforms. One reform would be to repeal the tax increases under the 2010 Affordable Care Act. Another reform would be to slash the federal corporate tax rate from 35 percent to 15 percent to match the federal rate in our largest trading partner, Canada. Such a cut would spur stronger growth, boost worker wages as businesses increased investment, and lose little revenue over the long term.

Spending Cut Details

Tables 32.1 and 32.2 list proposed cuts to reduce federal spending to 17.7 percent of GDP by 2026. Table 32.1 shows cuts for health care and Social Security. Those reforms would be implemented right away, but the value of savings would grow over time. The figures shown are the estimated annual savings by 2026, generally based on CBO projections.

Table 32.1

Proposed Federal Budget Cuts: Health Care and Social Security

| Agency and Activity | Annual Savings $billions, 2026 |

| Health Care | |

| Repeal Affordable Care Act exchange subsidies | 103 |

| Repeal Affordable Care Act Medicaid expansion | 122 |

| Block grant Medicaid and grow at 2% | 128 |

| Increase Medicare premiums | 63 |

| Increase Medicare cost sharing | 20 |

| Cut Medicare improper payments by 50% | 78 |

| Cut non-Medicaid state health grants by 50% | 47 |

| Total cuts | 561 |

| Social Security Administration | |

| Price index initial Social Security benefits | 39 |

| Raise the normal retirement age for Social Security | 10 |

| Cut Social Security Disability Insurance by 25% | 54 |

| Cut Supplemental Security Income by 25% | 18 |

| Total cuts | 121 |

| Total annual spending cuts in 2026 | $682 |

SOURCE: Author's calculations.

Table 32.2 shows cuts to programs other than health care and Social Security. These cuts would be valued at $458 billion in 2016, but the plan assumes that they would be phased in one-tenth each year over the next decade.

The reforms listed in Tables 32.1 and 32.2 are deeper than the savings from "duplication" and "waste" often mentioned by policymakers. We should cut hundreds of billions of dollars of "meat" from federal departments, not just the obvious "fat." If the activities that are cut are useful to society, then state governments or private groups should fund them, and they would be more efficient doing so than the federal government.

Table 32.2

Proposed Federal Budget Cuts Discretionary Programs and Other Entitlements

| Agency and Activity | Annual Savings $billions, 2016 |

| Department of Agriculture | |

| End farm subsidies | 29.3 |

| Cut food subsidies by 50% | 53.5 |

| End rural subsidies | 6.5 |

| Total cuts | 89.3 |

| Department of Commerce | |

| End telecom subsidies | 0.6 |

| End economic development subsidies | 0.4 |

| Total cuts | 1.0 |

| Department of Defense | |

| End overseas contingency operations | 59.0 |

| Total cuts | 59.0 |

| Department of Education | |

| End K-12 education grants | 25.3 |

| End all other programs | 53.8 |

| Total cuts (terminate the department) | 79.1 |

| Department of Energy | |

| End subsidies for renewables | 2.2 |

| End fossil/nuclear/electricity subsidies | 1.9 |

| Privatize power marketing administrations | 0.8 |

| Total cuts | 4.9 |

| Department of Homeland Security | |

| Privatize TSA airport screening | 4.9 |

| Devolve FEMA activities to the states | 16.6 |

| Total cuts | 21.5 |

| Department of Housing and Urban Development | |

| End rental assistance | 30.5 |

| End community development subsidies | 11.0 |

| End public housing subsidies | 5.8 |

| Total cuts (terminate the department) | 47.3 |

| Department of the Interior | |

| Reduce net outlays by 50% through spending cuts, privatization, and user charges | 7.0 |

| Total cuts | 7.0 |

| Department of Justice | |

| End state/local grants | 6.7 |

| Total cuts | 6.7 |

| Department of Labor | |

| End employment and training services | 3.6 |

| End Job Corps | 1.6 |

| End trade adjustment assistance | 0.8 |

| End Community Service for Seniors | 0.4 |

| Total cuts | 6.4 |

| Department of Transportation | |

| Cut highway/transit grants to balance trust fund | 12.0 |

| Privatize air traffic control (federal fund savings) | 2.1 |

| Privatize Amtrak and end rail subsidies | 3.6 |

| Total cuts | 17.7 |

| Department of the Treasury | |

| Cut earned income tax credit by 50% | 30.7 |

| End refundable part of child tax credit | 21.6 |

| End refundable part of Am. Opp. Tax Credit | 4.4 |

| Total cuts | 56.7 |

| Other Savings | |

| Cut foreign aid by 50% | 8.0 |

| Cut federal civilian compensation costs by 10% | 32.9 |

| Privatize the Army Corps of Engineers (Civil Works) | 6.7 |

| Privatize the Tennessee Valley Authority | 0.5 |

| Privatize the U.S. Postal Service | n/a |

| Repeal Davis-Bacon labor rules | 9.0 |

| End EPA state/local grants | 4.1 |

| Total cuts | 61.2 |

| Total annual spending cuts | $457.8 |

SOURCE: Author's calculations.

The proposed cuts to subsidies, aid to the states, military spending, and entitlement programs are discussed below. The final section discusses the privatization of federal activities. Further analyses of these and other cuts are at DownsizingGovernment.org.

Subsidies to Individuals and Businesses

The federal government funds about 2,300 subsidy programs, more than twice as many as in the 1980s, according to my analysis of the Catalog of Federal Domestic Assistance. The scope of federal activities has expanded in recent decades along with the size of the federal budget. The federal government subsidizes farming, health care, school lunches, rural utilities, the energy industry, rental housing, aviation, passenger rail, public broadcasting, job training, foreign aid, urban transit, and many other activities.

Each subsidy causes damage to the economy through the required taxation. And each subsidy generates a bureaucracy, spawns lobby groups, and encourages even more people to demand government handouts. Individuals, businesses, and nonprofit groups that become hooked on federal subsidies essentially become tools of the state. They lose their independence, have less incentive to work and innovate, and shy away from criticizing the government.

Table 32.2 includes cuts to subsidies in agriculture, commerce, energy, housing, foreign aid, and other activities. Those cuts would not eliminate all of the unjustified subsidies in the budget, but they would be a good start. Government subsidies are like an addictive drug, undermining America's traditions of individual reliance, voluntary charity, and entrepreneurialism.

Aid to the States

Under the Constitution, the federal government was assigned specific limited powers, and most government functions were left to the states. Unfortunately, policymakers and the courts have mainly discarded constitutional federalism in recent decades. Through "grants-in-aid" Congress has undertaken many activities that were traditionally reserved to state and local governments. Grant programs are subsidies that are combined with federal regulatory controls to micromanage state and local activities. Federal aid to the states totals about $700 billion a year and is distributed through more than 1,100 separate programs.

The theory behind grants-in-aid is that the federal government can operate programs in the national interest to efficiently solve local problems. However, the aid system does not work that way in practice. Most federal politicians are preoccupied by the competitive scramble to maximize subsidies for their states, and they generally ignore program efficiency and overall budget limitations.

Furthermore, federal aid stimulates overspending by state governments and creates a web of complex federal regulations that undermine state innovation. At all levels of the aid system, the focus is on spending and regulatory compliance, not on delivering quality public services. The aid system destroys government accountability because each level of government blames the other levels when programs fail. It is a triumph of expenditure without responsibility.

The grants-in-aid system is a roundabout funding system for state and local activities. It serves no important economic purpose, and it should be eliminated. Tables 32.1 and 32.2 include cuts to state grants for education, health care, highways, justice, transit, and other activities. There is no reason why such activities should not be funded by state and local governments or the private sector.

Military Spending

Cato Institute defense experts Christopher Preble and Benjamin Friedman have proposed numerous cuts to U.S. military spending (see Chapter 68). They argue that the United States would be better off taking a wait-and-see approach to distant threats, while letting friendly nations bear more of the costs of their own defenses. They note that U.S. policymakers support many extraneous missions for the military aside from the basic role of defending the nation.

As such, the military budget should be cut in a prudent fashion as part of an overall plan to downsize the government and balance the budget. The plan proposed here assumes that spending on overseas contingency operations — which will be $59 billion in 2016 — would be reduced to zero over time.

Medicare, Medicaid, and Social Security

The projected growth in Medicare, Medicaid, and Social Security is the main cause of America's looming fiscal crisis. Budget experts generally agree on the need to restructure these programs, and Table 32.1 includes a variety of reforms.

Policymakers should repeal the 2010 Affordable Care Act. That would reduce spending on Medicaid and end spending on the exchange subsidies. In addition, policymakers should convert Medicaid from an open-ended matching grant to a block grant, while giving state governments more program flexibility. That was the successful approach used for welfare reform in 1996, which encouraged state innovation.

Table 32.1 includes modest Medicare changes based on CBO estimates. Reforms include increasing deductibles and increasing premiums for Part B to cover 35 percent of the program's costs. It also assumes that the Medicare improper payment rate would be cut in half to 6 percent.

However, larger Medicare reforms are needed than just these cuts. Cato scholars have proposed moving to a system based on individual vouchers, personal savings, and consumer choice for elderly health care (see Chapter 38). Such a reform would create incentives for patients to become more discriminating consumers of health services and providers to improve system quality and reduce costs.

For Social Security, initial benefits should be indexed to prices rather than wages to slow the program's growth. The plan also includes a CBO option to modestly raise the normal retirement age. In addition, the fraud-plagued Social Security Disability Insurance and Supplemental Security Income programs would be trimmed 25 percent compared with current spending projections.

In addition to these reforms, Social Security should be transitioned to a system of private accounts, as discussed in Chapter 40. Private accounts would increase fairness, boost personal financial security, and improve work incentives by partly converting payroll taxes into contributions to accounts that are personally owned.

Privatization

A privatization revolution has swept the world since the 1980s. Following Britain's lead, governments in more than 100 countries have transferred thousands of state-owned businesses to the private sector. More than $3 trillion of railroads, energy companies, postal services, airports, and other businesses have been privatized.

Privatization helps spur economic growth. It allows entrepreneurs and markets to reduce costs, improve service quality, and increase innovation. It also benefits the environment by reducing the wasteful use of resources.

Despite the global success of privatization, reforms have largely bypassed our own federal government. Many activities that have been privatized abroad remain in government hands in this country. U.S. policymakers should learn from foreign privatization and enact proven reforms here.

Table 32.2 includes the privatization of Amtrak, the air traffic control system, airport screening, electric utilities, the Army Corps of Engineers, and the U.S. Postal Service. Such reforms would reduce budget deficits and improve management, as described in related chapters and at DownsizingGovernment.org.

Conclusions

CBO's long-term baseline projections show that federal spending and debt will rise continuously in coming years as a share of GDP, which will undermine economic growth and cause a serious financial crisis at some point. The sooner that policymakers tackle major spending reforms, the better to avoid accumulating even more debt. Leaders of numerous other nations have pursued vigorous cost cutting when their spending and debt started getting out of control. There is no reason why our political leaders cannot do the same.

Suggested Readings

Cato Institute. www.DownsizingGovernment.org.

Congressional Budget Office. "Options for Reducing the Deficit: 2015 to 2024." November 20, 2014.

---. "The 2016 Long-Term Budget Outlook." July 12, 2016.

---. "An Update to the Budget and Economic Outlook: 2016 to 2026." August 23, 2016.

Edwards, Chris. "Fiscal Federalism." DownsizingGovernment.org, Cato Institute, June 2013.

---. "Options for Federal Privatization and Reform Lessons from Abroad." Cato Institute Policy Analysis no. 794, June 28, 2016.

---. "Washington's Largest Monument: Government Debt." Cato Institute Tax & Budget Bulletin no. 71, September 8, 2015.

---. "Why the Federal Government Fails," Cato Institute Policy Analysis no. 777, July 27, 2015.

General Services Administration. Catalog of Federal Domestic Assistance. Washington: Government Printing Office, various editions.