Congress should

31. Averting National Bankruptcy

• raise the age of eligibility for Medicare and Social Security;

• phase in higher deductibles and copayments for Medicare, Medicaid, and Obamacare; and

• freeze Social Security benefits per capita at the current (inflation-adjusted) value.

The United States debt is on an unsustainable path; that is, the United States is in (extreme) fiscal imbalance. In particular, the four main entitlement programs (Medicare, Medicaid, Obamacare, and Social Security) are collectively growing far faster than any plausible path for gross domestic product (GDP). Congress should curtail these programs to avoid fiscal Armageddon.

Background

The United States faces a challenging fiscal future. According to projections from the Congressional Budget Office (CBO), the debt-to-GDP ratio will hit at least 181 percent by 2090 and continue to climb unless the nation adjusts its tax and spending policies. If no policy changes occur and the debt ratio continues on its projected path for an extended period, the United States will eventually face rising interest rates on its debt, an even steeper debt path, and a fiscal crisis. This outcome is not inevitable; the United States likely has decades to adjust its policies. Few dispute, however, that unless the CBO's projections are substantially too pessimistic, the United States needs major adjustments in spending or tax policies to avoid fiscal meltdown.

Despite widespread agreement that spending or tax policies must change, however, appropriate adjustments have so far not occurred. Indeed, many recent policy changes have worsened the U.S. fiscal situation. These include the creation of Medicare Part D ($65 billion in 2014); new subsidies under the Affordable Care Act, often called Obamacare ($13.7 billion in 2014); the expansion of Medicaid under Obamacare (from $250.9 billion in 2009 to $301.5 billion in 2014); higher defense spending (from $348.46 billion in 2002 to $603.46 billion in 2014); increased spending on veterans' benefits and services (from $70.4 billion in 2006 to $161.2 billion in 2014); and greater spending on energy programs (average annual spending rose from $0.52 billion over 1998–2002 to $11.43 billion over 2010–2014). Politicians across the spectrum, moreover, propose additional spending all the time.

"Fiscal imbalance" is the excess of what we expect to spend, including repayment of our debt, over what government expects to receive in revenue. A plausible explanation for America's failure to address its fiscal imbalance is a belief that "this time is no different," since earlier alarms have not ended in fiscal meltdown. In the 1980s, for example, the government experienced a large buildup of federal debt due to President Ronald Reagan's tax cuts and increases in military spending. Concern arose over the spiraling debt, causing congressional budget showdowns during President Bill Clinton's first term. But, ultimately, no serious fiscal crisis ensued.

In 2011, fears of a U.S. government default arose during the debt-ceiling crisis. Disagreements between members of Congress resulted in a political stalemate, massive public apprehension, and a one-notch downgrade of the U.S. credit rating. Just before the deadline, however, the Budget Control Act was signed into law, raising the debt ceiling by more than $2.1 trillion and staving off the threat of immediate default. A similar crisis loomed in 2013 when Congress's inability to rein in the federal deficit almost triggered a "fiscal cliff" — a series of deep, automatic cuts to federal spending. Once again, with only hours to spare, lawmakers reached a compromise and averted larger economic consequences. Overall, the past 30 years reveal a clear trend: time and time again, alarm erupts over the rising federal debt level, but full fiscal meltdown never materializes. Thus, many people dismiss claims that U.S. fiscal balance is a calamity in waiting, believing "this time is no different."

In truth, this time is different. Although fiscal meltdown is not imminent, the nation's fiscal situation has been deteriorating since the mid-1960s, is far worse than ever before, and will get worse as time passes and no adjustments occur. This view follows from looking not just at current deficits and the current value of the debt; these are incomplete measures of the government's fiscal situation because they account only for past expenditure relative to tax revenue. The true impact of existing expenditure and tax policies depends as well on the projected paths of future expenditure and tax revenues. The standard measure of the overall fiscal situation is known as fiscal imbalance, which adds up (in a way that adjusts for interest rates) all future expenditures, minus future tax revenues, plus the explicit debt.

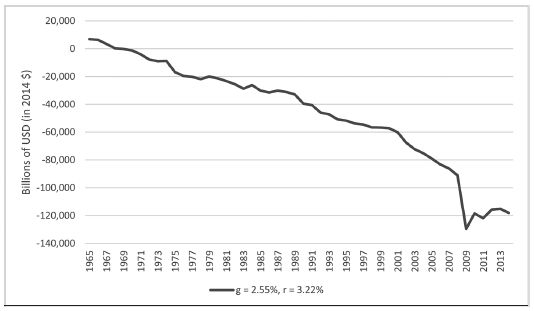

Figure 31.1 presents estimates of U.S. fiscal imbalance for the period 1965–2014. Imbalance has risen enormously from roughly zero in 1965 to $118 trillion in 2014, which is roughly seven times current GDP.

The reason for the persistent decline in fiscal balance is that the composition of federal expenditure has shifted markedly since 1965, especially from defense spending to mandatory health and retirement spending — that is, entitlements. Defense spending has declined relative to GDP over the post-WWII period; this spending could increase in the future but is unlikely to grow without bound. Entitlement spending, however, not only consumes a large fraction of the federal budget, it is also likely to grow faster than GDP, indefinitely, under current law. This excess growth reflects the increasing share of the population collecting benefits relative to younger people paying taxes, as well as the impact of subsidized health insurance on health care cost inflation. Thus, CBO forecasts that health and retirement spending will increase substantially faster than GDP going forward.

Figure 31.1

Projected Fiscal Imbalance, 1965–2014

NOTE: The estimates assume an average annual GDP growth rate (g) of 2.55 percent and real interest rate (r) of 3.22 percent, which reflect median growth and average interest rates over the past 40 years.

SOURCE: Jeffrey Miron, U.S. Fiscal Imbalance over Time: This Time Is Different. Washington: Cato Institute, 2016.

In principle, the United States has three options for restoring fiscal balance: faster economic growth, higher taxes, or slower expenditure growth. In practice, only slower growth of entitlement spending can make a significant difference. Even if economic growth achieved its highest historical levels, that would not alter imbalance materially. Similarly, even if taxes were raised substantially above their postwar average — and had no adverse effect on growth — fiscal imbalance would still be large.

That leaves expenditure cuts as the only viable way to significantly reduce fiscal imbalance. And the cuts must target entitlements, since those programs are large and are the ones growing relative to GDP. The crucial difference between expenditure cuts and tax hikes is that the former could plausibly increase growth, by reducing distortions in health and retirement decisions, while the latter would almost certainly reduce growth, making imbalance worse. Thus, cutting the growth of federal health and retirement expenditure is a win-win. Congress has three main options for cutting entitlements and averting bankruptcy.

Raise the Eligibility Age for Social Security and Medicare

The original justification for Social Security and Medicare was to help citizens who could no longer care for themselves. When Congress created Social Security in 1935, life expectancy was 63 and the age of eligibility was 65, so Social Security was insurance against "living too long." Similarly, when Congress adopted Medicare in 1965, life expectancy was about 70 and the age of eligibility was again 65, so most beneficiaries expected only a few years of subsidized health care. Today's average life expectancy, however, has reached nearly 79. Social Security's age of "normal retirement" has increased by only two years since 1965, and Medicare's is still 65. Unsurprisingly, the total number of Social Security beneficiaries has skyrocketed; 25 million Americans received Social Security benefits in 1970, compared with 60 million in 2015.

Thus, as life expectancy has steadily increased, and health conditional on age has improved, Social Security and Medicare have evolved from helping only those in serious need to also providing income support and subsidized health insurance, over decades, for middle- and upper-income households. Simultaneously, the fraction of the population receiving benefits has grown relative to the fraction paying taxes, making these programs fiscally unsustainable. Thus, under current parameters, both programs have grown far beyond their original intent and have become unaffordable.

Congress should raise the age of eligibility in both programs, by at least enough to offset the increase in life expectancy since creation of the programs. The higher ages could be phased in gradually, for example, by six months every year for some number of years, with the higher age affecting only those below some cutoff, such as age 50. Thus, the higher eligibility ages would not affect those already receiving benefits or even those within 15 years of (current) eligibility. Congress should also index the eligibility age to future increases in life expectancy; this would avoid future expansions of Social Security and Medicare relative to the size of the economy.

Increase Deductibles and Copayments for Medicare, Obamacare, and Medicaid

Standard economics explains that people demand health insurance to protect themselves financially in the case of major illnesses or accidents, not to cover routine expenditures such as for checkups, medications, and other moderate and predictable outlays. This implies that economically efficient health insurance should have substantial deductibles.

Standard economics also suggests that economically efficient health insurance should come with significant copays. Insurance can generate excessive health expenditure because the insured do not pay the costs of their care (a phenomenon known as moral hazard). One remedy is deductibles; a second is copays, the portion of health expenditure paid by the insured person, after the deductible has been met. Copays do not fully balance the costs of care against the benefits, but they nudge health care decisions in the right direction while still reducing the risk of large outlays for the insured.

Thus, Congress should modify Medicare, Obamacare, and Medicaid to incorporate significantly higher deductibles and copays. The appropriate adjustments differ across programs, but increases of at least 50 to 100 percent, or more, make sense in many cases. For example, the yearly deductible for Medicare Part A is only $1,288 and for most Part B benefits, only $166. Obamacare caps yearly out-of-pocket spending for deductibles and copays at $6,850 for self-only coverage and $13,700 for family coverage. Medicaid charges minimal copays for those below 150 percent of the federal poverty level.

Freeze (Real) Social Security Benefits

Under current policy, the level of Social Security benefits that an individual receives is a function of that individual's earnings history. In market economies, wages tend to rise with worker productivity (which in turn reflects technological progress); so as an economy experiences productivity growth, real wages rise. Thus, the inflation-adjusted level of Social Security benefits grows along with the economy's increase in overall productivity. Indeed, over the past four decades, the average annual Social Security benefit (in real terms) has more than doubled, from $7,200 per recipient in 1970 to $14,900 in 2015 (constant 2015 dollars).

Assuming Social Security exists to prevent poverty, the ongoing increase in benefit levels is excessive. Instead, society should determine a level of benefits that allows those without other income to attain some modest standard of living; Congress should keep that level in place over time.

Congress should therefore freeze the level of real benefits at its current value; this amounts to indexing the level of new benefits to price rather than wage inflation. Under this approach, Social Security expenditure would grow far more slowly than under the current system because it would only reflect increases in the population age 65 and over, rather than also increasing with productivity.

Suggested Readings

Gokhale, Jagadeesh. "Spending Beyond Our Means: How We Are Bankrupting Future Generations." Cato Institute White Paper, February 13, 2013.

Miron, Jeffrey. "Curtailing Subsidies for Health Insurance." In Reviving Economic Growth, edited by Brink Lindsey. Washington: Cato Institute, 2015.

---. Fiscal Imbalance: A Primer. Washington: Cato Institute, 2015.

---. U.S. Fiscal Imbalance over Time: This Time Is Different, Washington: Cato Institute, 2016.