The sharp increase in U.S. home prices has been one of the most remarkable economic events in recent memory. As shown in Figure 1, for example, the Case-Shiller U.S. National Home Price Index indicates that home prices in August 2021 were almost 20 percent higher than in August 2020, and most experts believe that prices will continue to rise in 2022, especially in the nation’s hottest markets. This trend has unsurprisingly sparked intense debate among pundits, academics, and policymakers about the factors driving the increase in prices and how policy can help American homebuyers weather it.

Explanations of the current home price dynamics tend to focus on a handful of demand- and supply-side considerations. Following the onset of the COVID-19 pandemic, unprecedented U.S. monetary expansion and higher interest in larger houses, especially in less densely populated areas, boosted housing demand. On the supply side, frequently discussed causes include local land-use regulations (e.g., zoning), labor shortages, and higher material costs—each of which can limit the ability of the national housing supply to keep up with surging demand.1

In this paper, we explore one potential determinant of construction material prices in the United States: trade policy. Figure 1 shows that in August 2021, construction material prices were 27 percent higher than in August of the previous year, and several analysts have highlighted how U.S. trade restrictions may have contributed to this trend. For example, Scott Lincicome shows that numerous intermediate inputs (e.g., steel nails) and finished goods (e.g., washing machines) in the housing construction sector are subject to U.S. trade protection.2 In November 2021, the Biden administration doubled “trade remedy” duties on Canadian lumber imports, despite homebuilders’ repeated requests to eliminate these and other protectionist measures that they say increase U.S. construction costs.3

Building on previous work, we used data on U.S. trade remedies—antidumping, countervailing duty (anti-subsidy), and safeguard measures—to study the effect of protectionism on construction material prices in the United States.4 Several factors make trade remedies an ideal mechanism for examining this question: First, the United States (like many countries) uses trade remedies extensively to restrict trade in intermediate inputs (i.e., goods used in the domestic production of downstream goods and services). Second, domestic producers of important construction materials (e.g., lumber) have petitioned for and won trade remedy protection in the past three decades. Third, trade remedy data make it possible to measure import protection at a monthly frequency, making the identification of causal effects less difficult.

This analysis considers the most important trade remedy beneficiary industries (at the North American Industry Classification System [NAICS] four-digit industry level) among the construction sector’s material suppliers. For each industry, we determined the share of imports subject to new trade remedies measures and then identified changes to the share that are not attributable to industry-level economic outcomes related to the construction sector (e.g., previous employment and price dynamics). Finally, we combined these identified changes in trade remedies with disaggregated input-output tables to determine the exposure of the U.S. construction sector to trade remedies restrictions won by its domestic suppliers (a.k.a. “upstream protectionism”). We used this measure to estimate the dynamic effects of upstream protectionism on U.S. construction material costs—in other words, to determine how trade remedies affect U.S. prices of key construction inputs like lumber.

We found that upstream protectionism in the United States increases domestic construction material costs. In particular, a uniform 1 percentage point increase in the share of construction material imports into the United States that are subject to new trade remedies (approximately corresponding to a 1.35 percentage point uniform import tariff) increases the domestic price of those materials by 0.9 percent after six months. These results are statistically significant and confirmed by using an alternative measure of construction material costs specific to residential construction. Therefore, U.S. protectionism has increased domestic construction costs, with potentially significant consequences for American homebuyers.

Background on U.S. Trade Remedies

Trade remedies are the most common and important means by which a national government may, consistent with its World Trade Organization (WTO) obligations, increase tariffs on an imported product above the “most favored nation” levels that the government agreed to apply generally to the imports of that product from all other WTO members. There are three types of trade remedy measures: antidumping duties, countervailing duties, and safeguards. Antidumping proceedings determine whether a foreign nation’s exporters have sold goods in the investigating government’s market at “less than fair value” (i.e., at “dumped” prices) and thereby caused “material injury” to the domestic industry making that same product. Countervailing duty proceedings determine whether foreign exporters’ goods have been unfairly subsidized by their government and are similarly injurious. Safeguards determine whether global imports of a particular good have surged and are a substantial cause of “serious injury” to the domestic industry. Antidumping actions account for the vast majority—approximately 80 to 90 percent—of all trade remedy measures imposed by WTO members.5

In the United States, the Tariff Act of 1930 permits domestic industries and labor unions to petition the government for trade remedies protection. Antidumping and countervailing duty petitions target a specific imported product within an industry and can involve one or more trading partners. Once a petition is filed, the U.S. International Trade Commission (USITC) determines whether it satisfies the relevant statutory requirements for initiating an investigation. If the investigation is initiated (as is almost always the case), the USITC conducts a preliminary investigation to determine whether imports have caused material injury to the domestic industry or retarded its establishment. If the USITC’s preliminary determination is affirmative, the U.S. Department of Commerce continues the investigation to determine whether subject imports have been dumped or subsidized and, if so, the duty rate that would need to be applied to those imports to offset the level of dumping or subsidization. The final duty rates calculated by the Commerce Department are ultimately applied to subject imports following the USITC’s final affirmative determination of material injury. Duty rates vary widely by country, exporter, and product, but they can be significant and, in many cases, prohibitive.

Safeguard investigations, which are much less common in the United States, target global imports of a certain product and are conducted entirely by the USITC. Duties may be imposed by the president (advised by the Office of the U.S. Trade Representative) following an affirmative USITC determination of a surge in those imports and serious injury therefrom.

Calculating Upstream Protectionism and Its Importance in the U.S. Construction Sector

We first determined the upstream inputs covered by U.S. trade remedy measures and their relative importance to the domestic construction sector. To do this, we constructed a monthly time series for products subject to new U.S. trade remedy investigations using the World Bank’s Temporary Trade Barriers Database.6 We recorded the number of products (at the Harmonized System [HS] six-digit level) for which an investigation began in a given month between January 1994 and December 2015. We then aggregated HS six-digit products to their corresponding NAICS four-digit industry level. We focused on trade remedy investigations rather than their outcomes (e.g., duties) since economic agents can easily anticipate the latter once an investigation begins. Duties usually result from new petitions, which provide estimates of the alleged margins of dumping or foreign government subsidization (and thus the duty rates to be applied on subject imports). Additional details are provided in Appendix 1.

Table 1 describes the U.S. trade remedy measures in industries that supply intermediate inputs to the domestic construction sector. We focused on industries that feature at least 5 percent of imports subject to new trade remedies investigations in the sample. The table ranks industries according to their importance as intermediate input suppliers to the construction sector. The most important industry affected by trade remedy measures is “architectural and structural metals manufacturing” followed by “plastics product manufacturing” and “other wood product manufacturing.” Altogether, the eight industries reported in Table 1 account for 25 percent of the U.S. construction sector’s intermediate inputs.

Columns 2–4 of Table 1 contain information about trade remedies actions in the industry at issue. Column 2 shows that the applied duty rates in these cases are substantial: the median duty rate ranges between 28 and 134 percent across industries. Columns 3 and 4 of Table 1 report, respectively, the average share of imports in the industry affected by trade remedy measures and the maximum import share for each industry. The broadest import coverage is in the “sawmills and wood preservation” industry (almost 82 percent of imports covered by trade remedies) and in the “veneer, plywood, and engineered wood product manufacturing” industry (almost 20 percent).

Methodology and Results

We next determined the effects of U.S. trade remedies (upstream protectionism) on the prices of those materials using the monthly producer price index for construction materials from the Federal Reserve Economic Data.7 A detailed description of the methodology is provided in Appendix 2. To measure upstream protectionism faced by the construction sector, we first isolated the change in trade remedy actions that was not a response to other economic factors affecting the construction sector (e.g., general economic conditions and labor market trends). We then weighted each action based on its importance to the construction sector using the data in Table 1. (Weighting is necessary because a trade remedy measure applied to a more important input will affect the price of construction materials more than the same measure in a less important industry.) Finally, we used the upstream protection measure to estimate how much an increase in U.S. trade remedies actions affected construction prices in subsequent months.

Figure 2 shows the main results, plotting the change in construction material prices in the United States following a uniform 1 percent increase in the share of imports subject to a U.S. trade remedy measure (equal to a uniform 1.35 percent tariff on imports from all eight input sectors listed in Table 1). As the figure shows, the trade remedy action caused domestic construction material prices to increase significantly up to 18 months after the measure’s implementation. It therefore confirms that U.S. restrictions on imports of construction materials increased costs for domestic builders. The results are statistically significant, with the increase in construction material prices caused by the trade remedy investigation peaking at 0.9 percent six months after initiation. Figure 2A in Appendix 2 shows the results’ confidence intervals, which widen over time.

To check our results, we used an alternative measure of material prices—the Federal Reserve’s price index of net inputs to residential construction.8 As shown in Figure 3, the results are quite similar to our main results: the initiation of a trade remedy action caused domestic prices to increase up to a year and a half after the measure’s introduction. The results are again statistically significant for the first several months (see Figure 3A in Appendix 2).

Conclusion

Tariffs imposed by the U.S. government on materials used by the domestic construction sector cause a significant increase in the cost of those goods. These results suggest that lifting trade restrictions on intermediate inputs could help dampen recent increases in U.S. construction material costs. Addressing the ultimate impact of these trade barriers on skyrocketing U.S. housing prices is beyond the scope of this paper. Nevertheless, U.S. homebuilders report that they often pass on higher material costs to homebuyers,9 and previous research notes that many homes in the United States are priced close to their construction cost,10 of which materials (e.g., lumber) are a significant part. Our results therefore suggest that U.S. trade barriers affect home prices, at least in certain areas, and that this connection is an important avenue for future analysis and research.

Appendix 1: Methodology for the Upstream Protectionism Measure

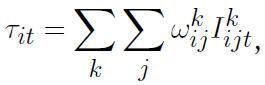

We converted the data on product-level investigations into sectoral shares of imports subject to new trade remedy investigations each month (τit). We used previous-year import data to avoid endogeneity concerns in the econometric analysis (i.e., to avoid the value/share being affected by the trade remedy measure). Using the import coverage of new trade remedies measures allowed us to account for the fact that both the number of product (HS) lines under investigation and the value of imports affected by trade remedies measures can change over time. This approach ensured that an investigation involving a single HS code with a large volume of trade (import value) was not inappropriately measured as less important than an investigation covering many HS codes with a modest amount of trade.11

Appendix 2: Methodology for Model and Results

We followed Alessandro Barattieri and Matteo Cacciatore’s method in “Self-Harming Trade Policy? Protectionism and Production Networks” and estimated the effects of protectionism on construction material prices, PtC, by using the local projection method in Oscar Jorda’s “Estimation and Inference of Impulse Responses by Local Projections.”12 The approach consisted of running a sequence of predictive regressions of PtC on a measure of upstream protectionism faced by the construction sector,  .

.

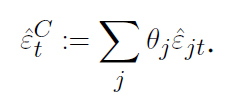

We measured PtC using the construction material price index from the Federal Reserve Economic Data.13 Concerning upstream protectionism,  , our approach follows Barattieri and Cacciatore's approach. First, we identified the variation in the share of imports subject to new trade remedies (τit) that is not an endogenous response to past, current, and expected economic outcomes. We considered the construction-sector suppliers in Table 1 and regress τit on lags of industry employment growth, the industry market-to-book ratio (a popular measure of expected returns from the finance literature), and the construction sector price index, PtC.14 We then used the estimated residuals, εit, to measure upstream protectionism in the construction sector,

, our approach follows Barattieri and Cacciatore's approach. First, we identified the variation in the share of imports subject to new trade remedies (τit) that is not an endogenous response to past, current, and expected economic outcomes. We considered the construction-sector suppliers in Table 1 and regress τit on lags of industry employment growth, the industry market-to-book ratio (a popular measure of expected returns from the finance literature), and the construction sector price index, PtC.14 We then used the estimated residuals, εit, to measure upstream protectionism in the construction sector,  . We constructed a weighted average of the identified trade policy shocks in upstream industries:

. We constructed a weighted average of the identified trade policy shocks in upstream industries:

The weight θj reflects the contribution of industry j to the construction sector’s output (i.e., the extent to which the construction sector uses industry j’s output as an intermediate input). The definition of  implies that an increase in protectionism in industry j is more important for the construction sector when the input share of sector j is higher.

implies that an increase in protectionism in industry j is more important for the construction sector when the input share of sector j is higher.

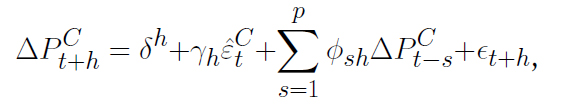

We estimated the response of prices to an increase in upstream protectionism by estimating the following predictive regressions, for h = 0, .., H:

where ϒh measured the response of the cumulative materials price change (ΔPt+hC) between time t and t+h following upstream protectionism at time t ( ). We included 12 lags of the growth rate of the construction material price index (ΔPt-sC) as a control.

). We included 12 lags of the growth rate of the construction material price index (ΔPt-sC) as a control.

Figure 2A plots the dynamics of PtC following a uniform 1 percent increase in the share of imports subject to new trade remedies in upstream sectors. The shock corresponds to imposing a 1.35 percent tariff on all imports in the eight most important trade remedy users.15 The continuous line reports the point estimate of the price response (ϒh), while the grey area plots the 90 percent confidence interval. Construction material prices increased over time, peaking six months after the shock at 0.9 percent. However, the effect is not tightly estimated since the band ranges from 0.2 percent to 1.75 percent.

As discussed in “Self-Harming Trade Policy? Protectionism and Production Networks,” possible alternative explanations exist for the price increase triggered by upstream protectionism. For example, when an intermediate input is subject to a trade remedies action, downstream producers in the construction sector may find it hard to replace and end up paying a higher price. Alternatively, producers may switch to potentially less-efficient suppliers and thus face relatively higher prices. In both cases, production costs increase in the construction sector.

To conclude, for robustness, we considered an alternative measure of material prices: the price index of net inputs to residential construction goods.16 Figure 3A shows that we obtained similar results, both qualitatively and quantitatively.

This work is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License.

be a dummy variable equal to one if imports of product j from country k in industry i are subject to a new investigation at time t. We construct the following sectoral share of imports subject to new investigations in a given month:

be a dummy variable equal to one if imports of product j from country k in industry i are subject to a new investigation at time t. We construct the following sectoral share of imports subject to new investigations in a given month: